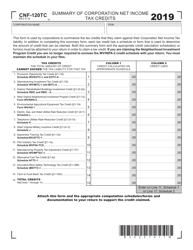

This version of the form is not currently in use and is provided for reference only. Download this version of

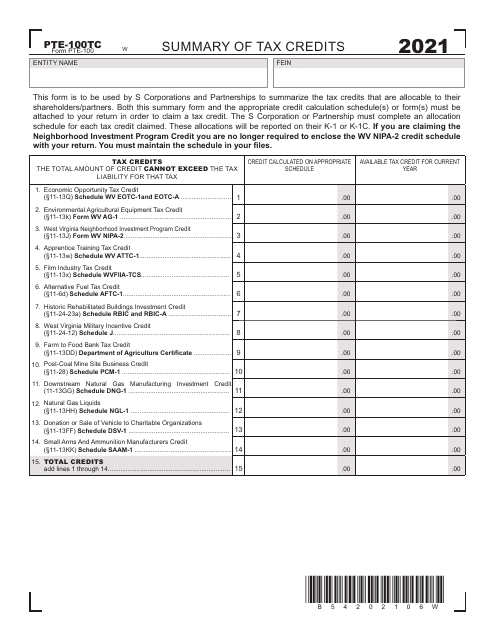

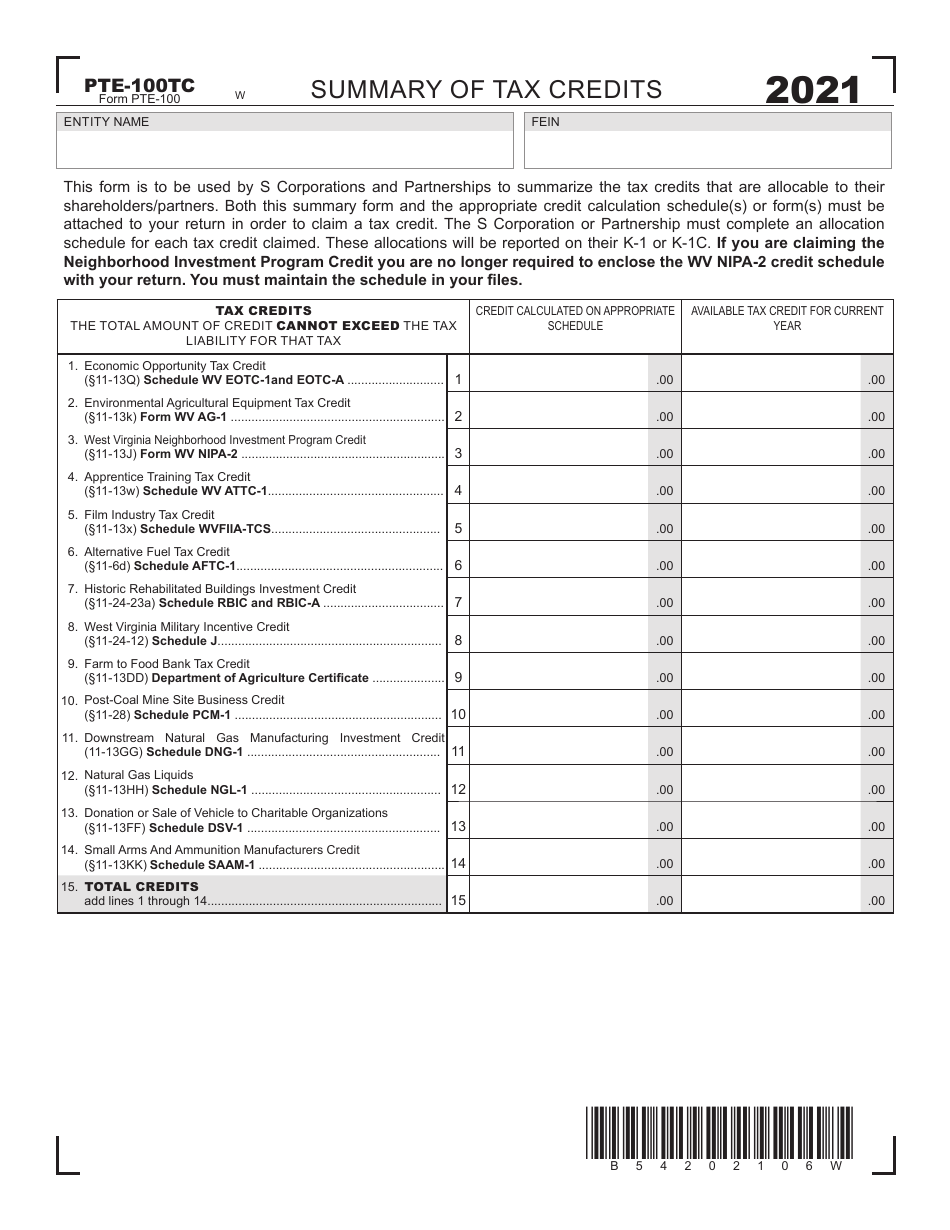

Form PTE-100TC

for the current year.

Form PTE-100TC Summary of Tax Credits - West Virginia

What Is Form PTE-100TC?

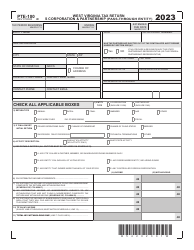

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100TC?

A: Form PTE-100TC is the Summary of Tax Credits form used in West Virginia.

Q: What is the purpose of Form PTE-100TC?

A: The purpose of Form PTE-100TC is to report tax credits in West Virginia.

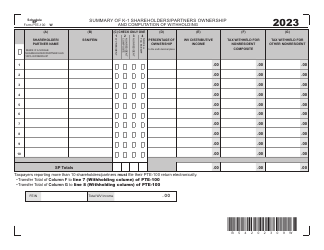

Q: Who needs to file Form PTE-100TC?

A: Partnerships and S corporations in West Virginia need to file Form PTE-100TC.

Q: What information is required on Form PTE-100TC?

A: Form PTE-100TC requires information on the partnership or S corporation, its shareholders or partners, and the tax credits being claimed.

Q: When is the deadline to file Form PTE-100TC?

A: Form PTE-100TC is due on or before the fifteenth day of the fourth month following the close of the partnership or S corporation's tax year.

Q: Are there any penalties for late filing of Form PTE-100TC?

A: Yes, there may be penalties for late filing of Form PTE-100TC. It is important to file by the deadline to avoid penalties.

Q: Can Form PTE-100TC be amended?

A: Yes, Form PTE-100TC can be amended by filing an amended Form PTE-100TC with the West Virginia State Tax Department.

Q: Do I need to include supporting documentation with Form PTE-100TC?

A: No, supporting documentation does not need to be submitted with Form PTE-100TC, but should be retained for record-keeping purposes.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100TC by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.