This version of the form is not currently in use and is provided for reference only. Download this version of

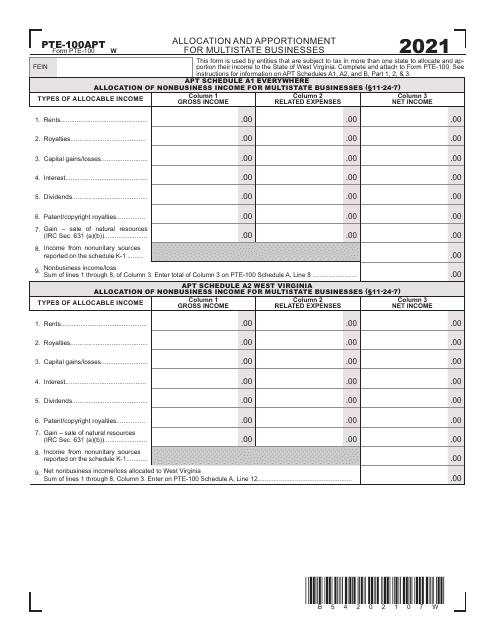

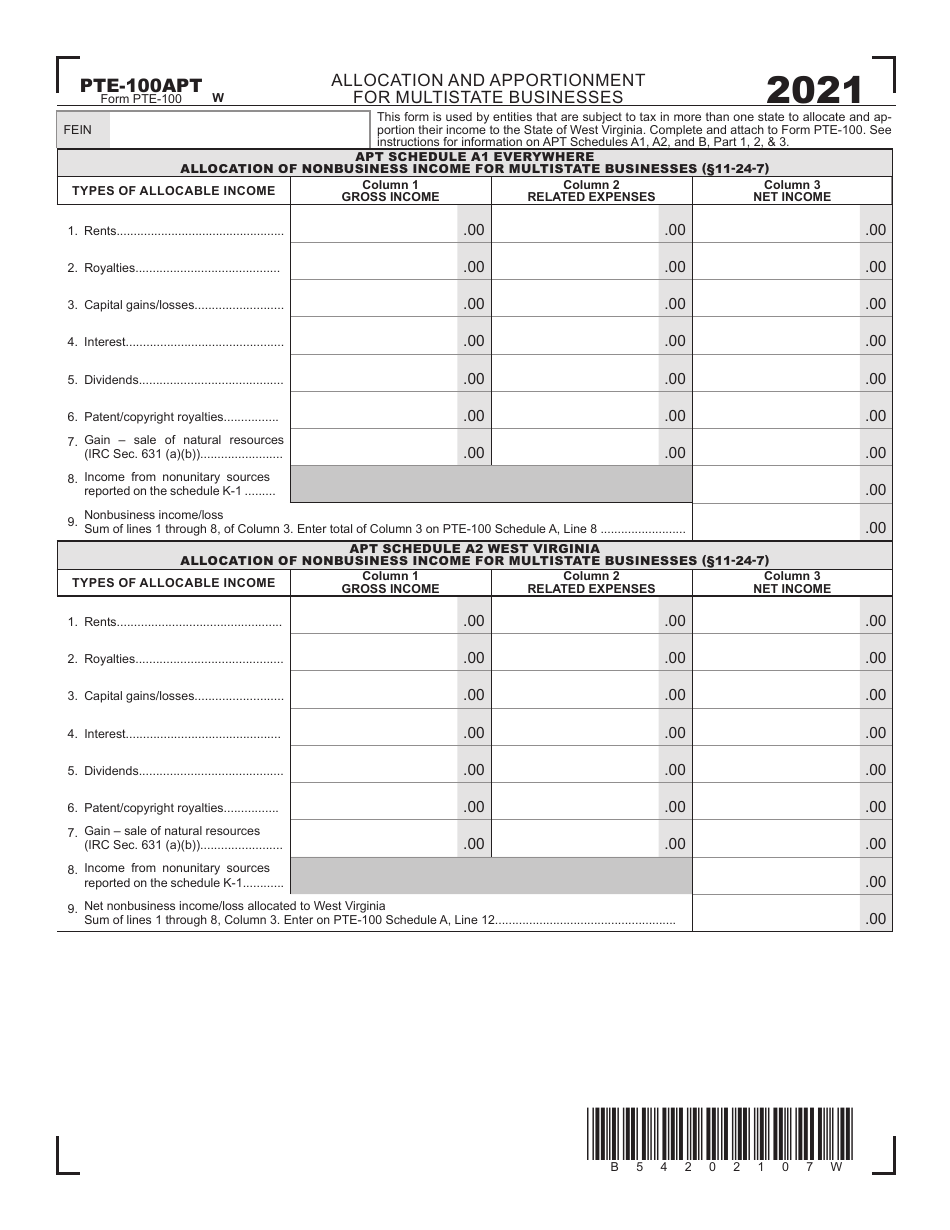

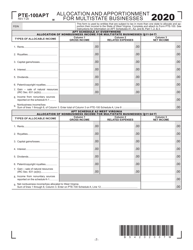

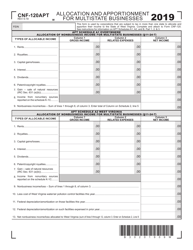

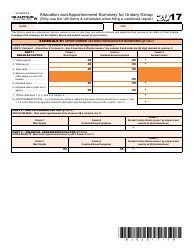

Form PTE-100APT

for the current year.

Form PTE-100APT Allocation and Apportionment for Multistate Businesses - West Virginia

What Is Form PTE-100APT?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PTE-100APT?

A: PTE-100APT is a form used for allocation and apportionment of income for multistate businesses in West Virginia.

Q: Who needs to file Form PTE-100APT?

A: Multistate businesses operating in West Virginia need to file Form PTE-100APT.

Q: What is the purpose of Form PTE-100APT?

A: The purpose of Form PTE-100APT is to calculate the portion of a multistate business's income that is attributable to West Virginia and determine the applicable tax liability.

Q: How do I fill out Form PTE-100APT?

A: Refer to the instructions provided with Form PTE-100APT for detailed guidelines on how to fill out the form.

Q: When is Form PTE-100APT due?

A: Form PTE-100APT is due on or before the 15th day of the fourth month following the close of the tax year.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100APT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.