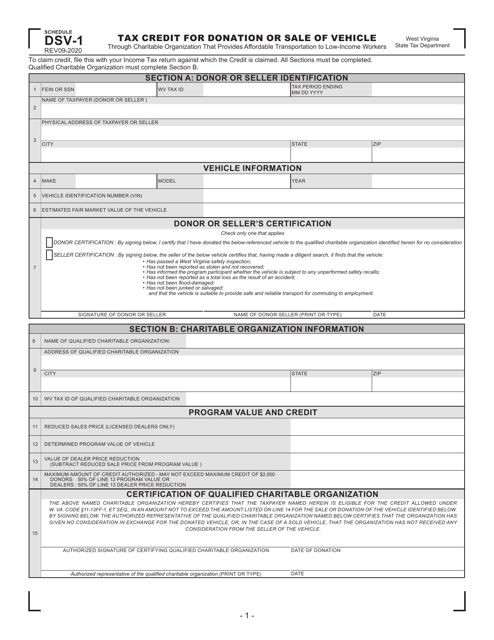

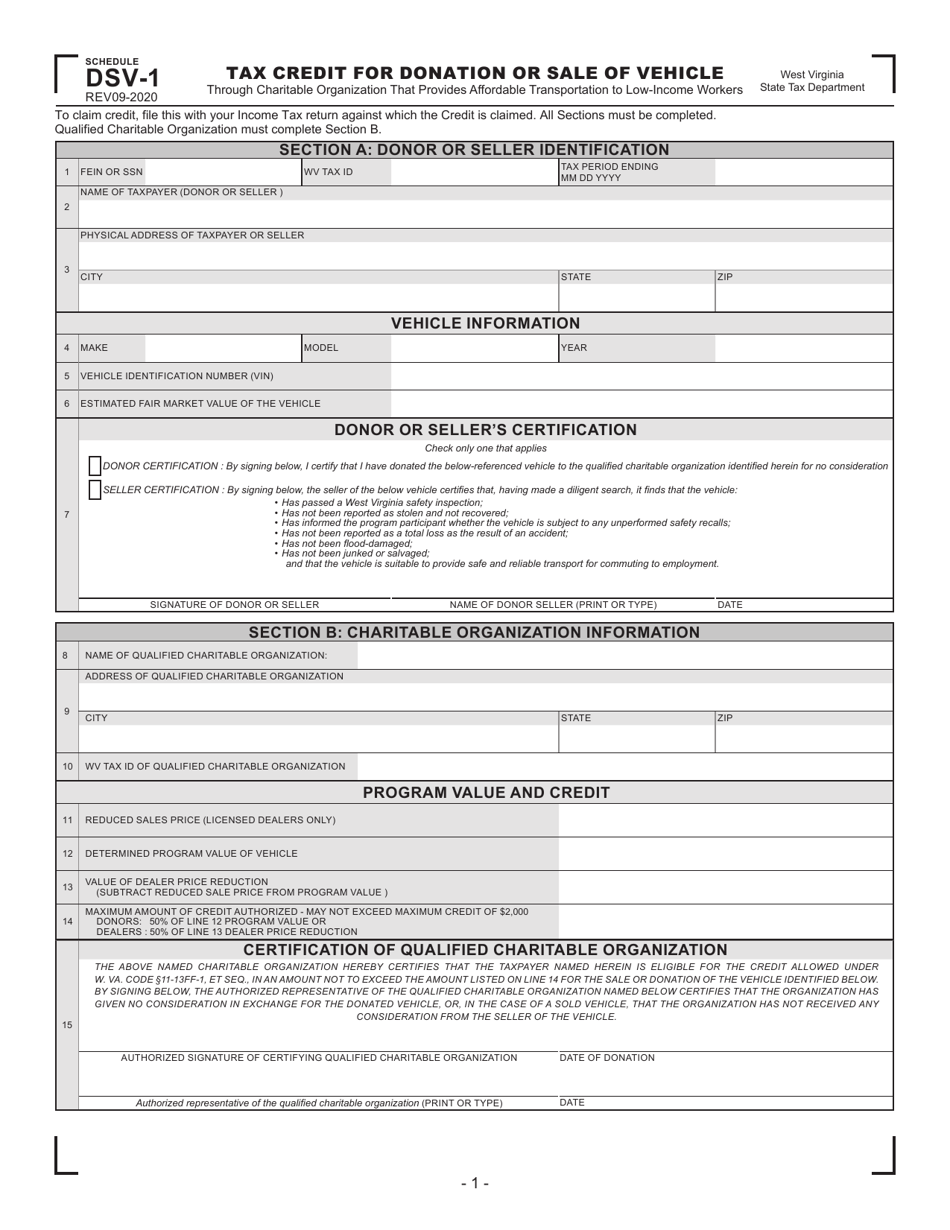

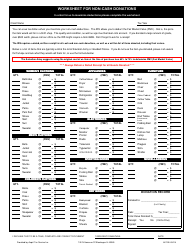

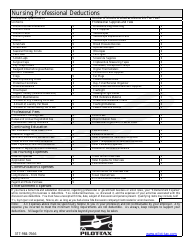

Schedule DSV-1 Tax Credit for Donation or Sale of Vehicle Through Charitable Organization That Provides Affordable Transportation to Low-Income Workers - West Virginia

What Is Schedule DSV-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

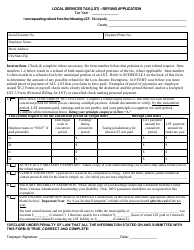

Q: What is the DSV-1 Tax Credit?

A: The DSV-1 Tax Credit is a tax credit for the donation or sale of a vehicle through a charitable organization in West Virginia.

Q: Who is eligible for the DSV-1 Tax Credit?

A: Individuals who donate or sell a vehicle to a charitable organization that provides affordable transportation to low-income workers in West Virginia are eligible for the DSV-1 Tax Credit.

Q: What is the purpose of the DSV-1 Tax Credit?

A: The purpose of the DSV-1 Tax Credit is to incentivize the donation or sale of vehicles to charitable organizations that help low-income workers in West Virginia access affordable transportation.

Q: How much is the DSV-1 Tax Credit?

A: The DSV-1 Tax Credit is equal to 50% of the fair market value of the donated or sold vehicle, up to a maximum credit of $2,000.

Q: What is the process for claiming the DSV-1 Tax Credit?

A: To claim the DSV-1 Tax Credit, you need to complete and submit Schedule DSV-1 along with your West Virginia state income tax return.

Q: Are there any restrictions on the DSV-1 Tax Credit?

A: Yes, there are some restrictions on the DSV-1 Tax Credit. The vehicle must be in good working order and have a fair market value of at least $500. Additionally, the charitable organization must meet certain criteria set by the West Virginia Tax Department.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule DSV-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.