This version of the form is not currently in use and is provided for reference only. Download this version of

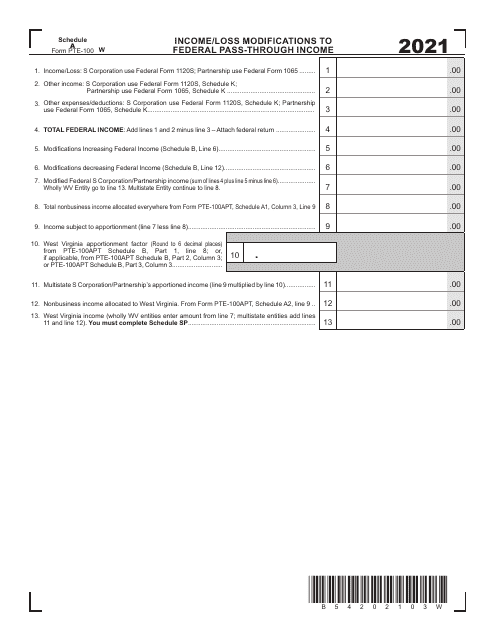

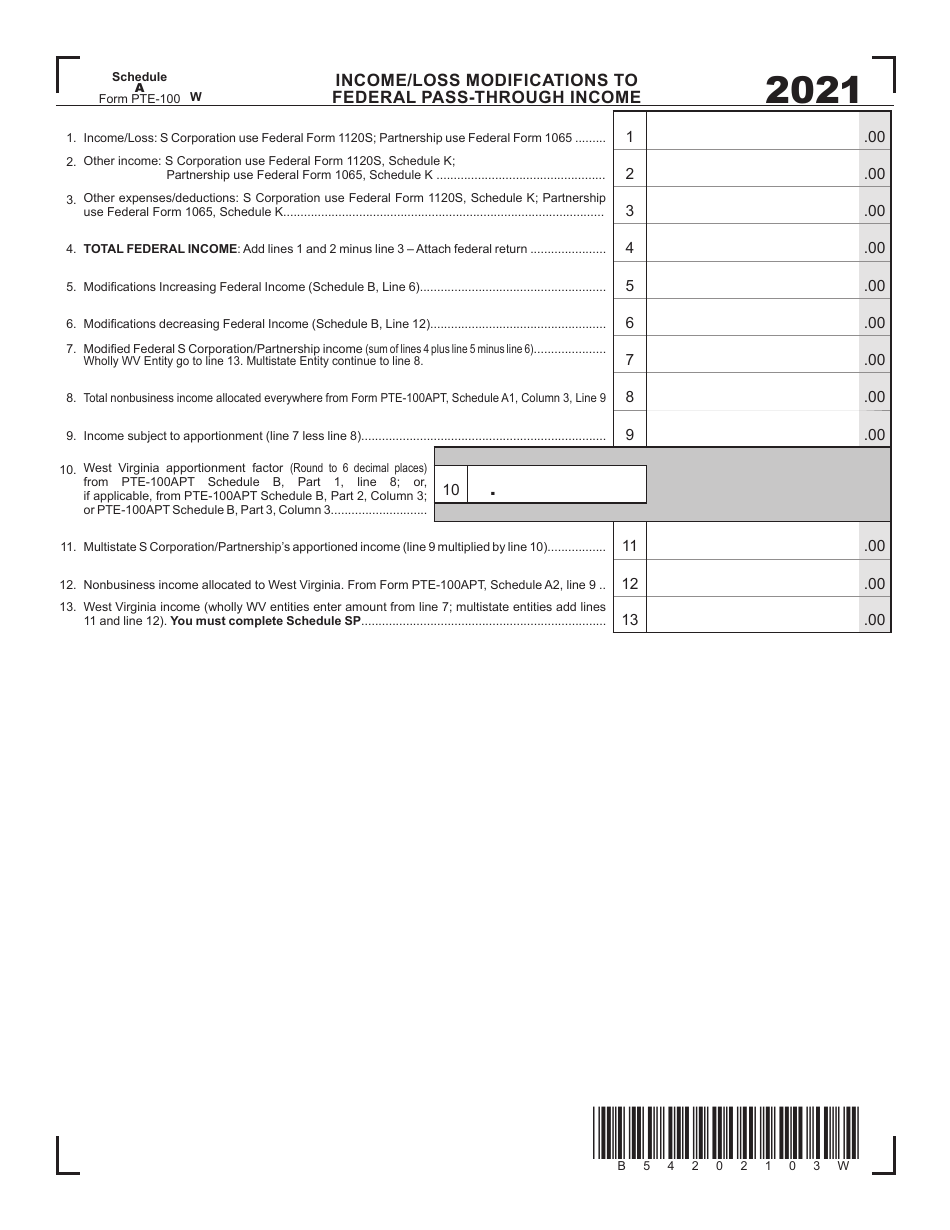

Form PTE-100 Schedule A

for the current year.

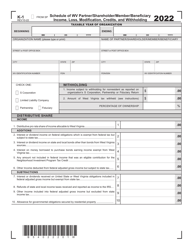

Form PTE-100 Schedule A Income / Loss Modifications to Federal Pass-Through Income - West Virginia

What Is Form PTE-100 Schedule A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100 Schedule A?

A: Form PTE-100 Schedule A is a tax form used in West Virginia to report income or loss modifications to federal pass-through income.

Q: Who should file Form PTE-100 Schedule A?

A: Individuals or entities in West Virginia with pass-through income that requires modifications to federal income should file Form PTE-100 Schedule A.

Q: What is pass-through income?

A: Pass-through income is income earned by certain entities, such as partnerships, S corporations, and limited liability companies (LLCs), that is passed through to the owners or members and reported on their individual tax returns.

Q: What are income/loss modifications?

A: Income/loss modifications are adjustments made to federal pass-through income to conform to West Virginia tax laws.

Q: Are there any deadlines for filing Form PTE-100 Schedule A?

A: Yes, Form PTE-100 Schedule A must be filed by the original due date of the West Virginia income tax return, which is usually April 15th.

Q: Is Form PTE-100 Schedule A used for both individual and business income?

A: Yes, Form PTE-100 Schedule A is used for both individual and business pass-through income in West Virginia.

Q: Do I need to attach any additional documents when filing Form PTE-100 Schedule A?

A: You may need to attach additional documentation, such as federal schedules and K-1 forms, to support the income or loss modifications reported on Form PTE-100 Schedule A.

Q: What should I do if I have questions or need help with Form PTE-100 Schedule A?

A: If you have questions or need assistance with Form PTE-100 Schedule A, contact the West Virginia State Tax Department or consult with a tax professional.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.