This version of the form is not currently in use and is provided for reference only. Download this version of

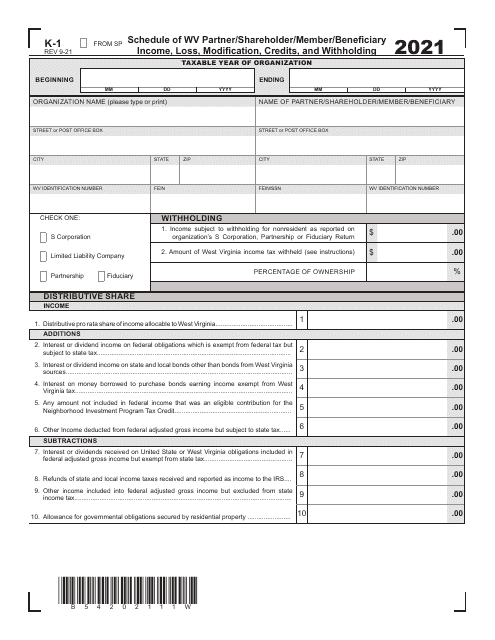

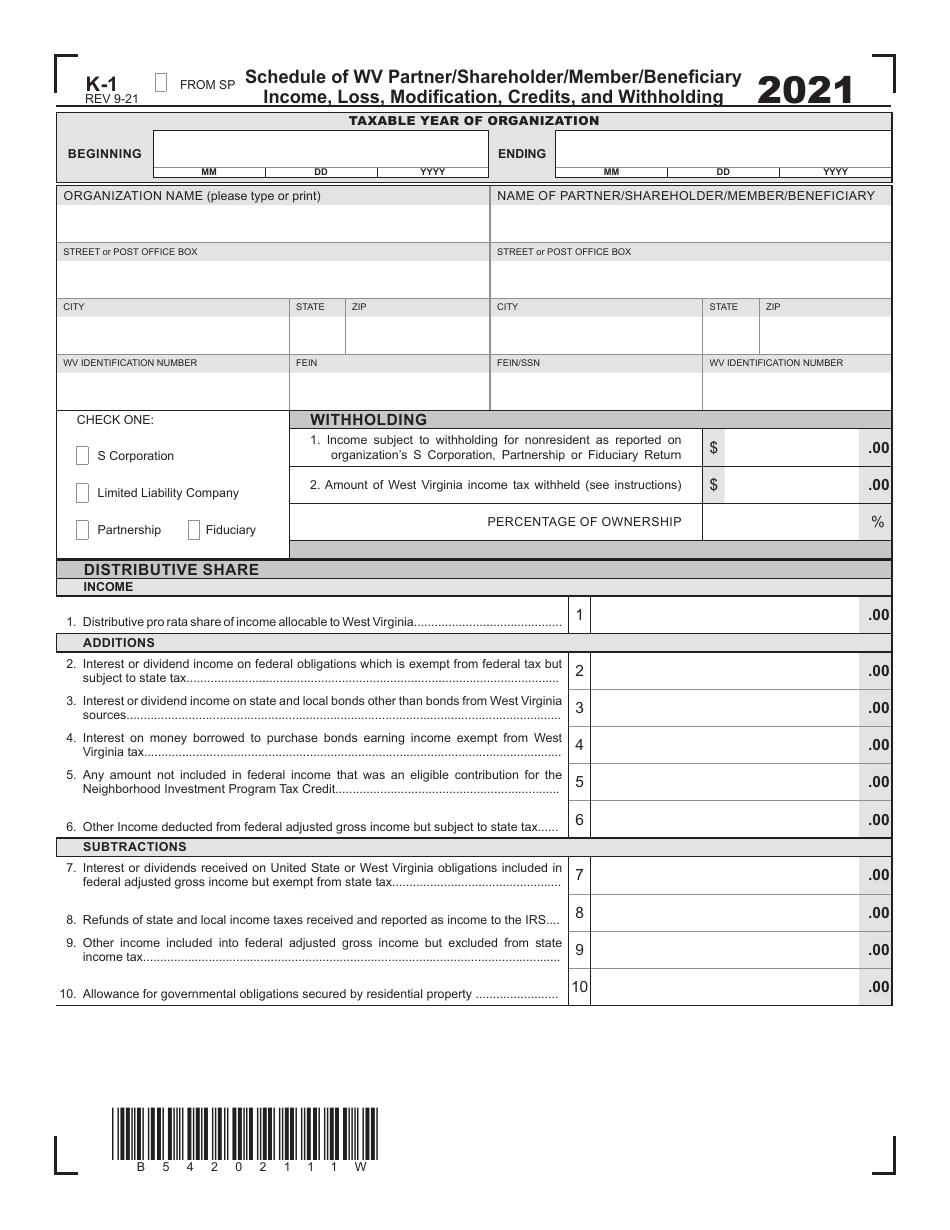

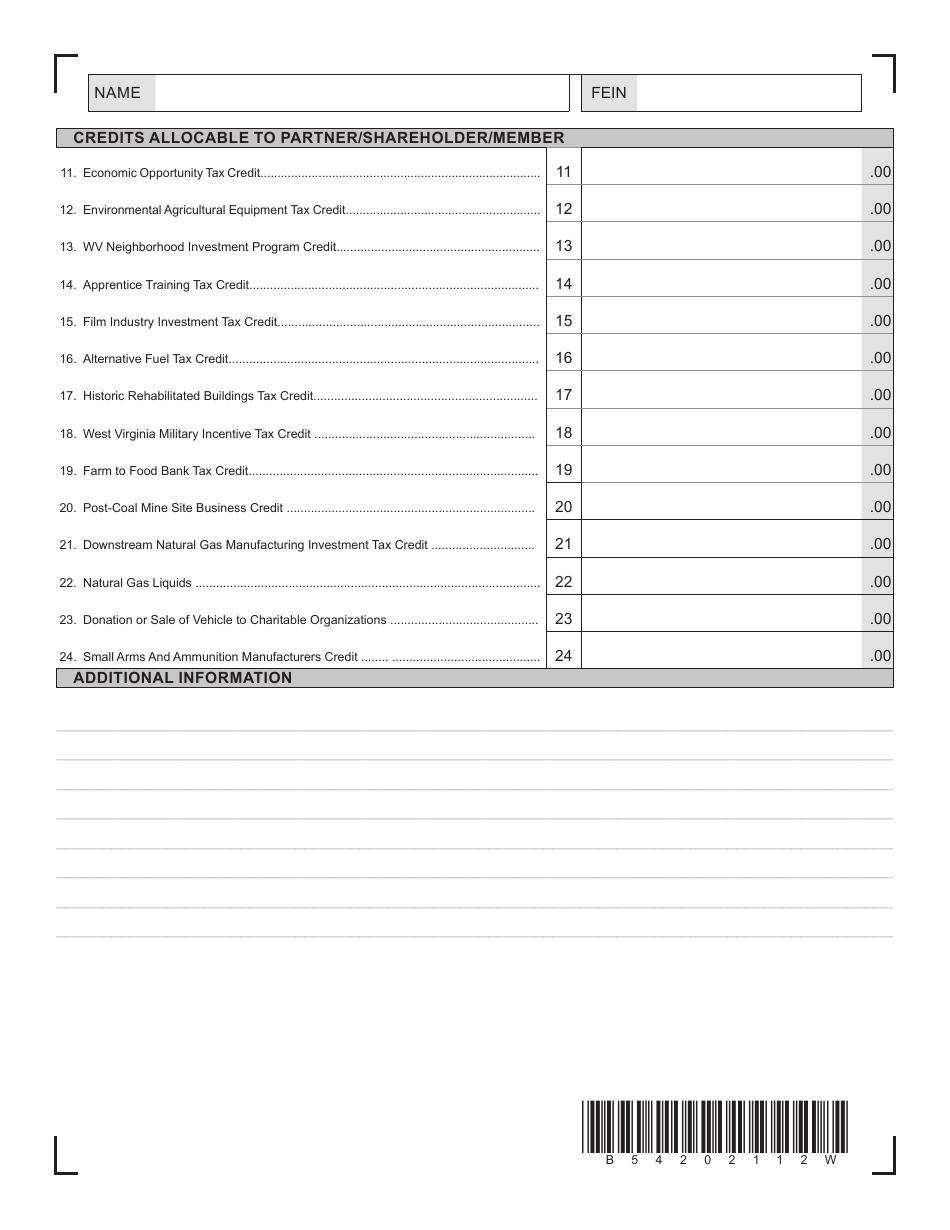

Schedule K-1

for the current year.

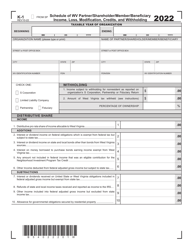

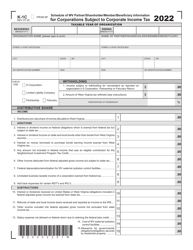

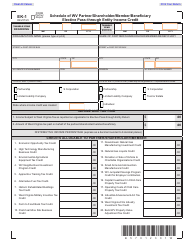

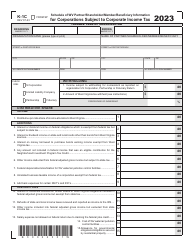

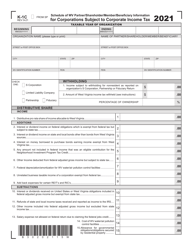

Schedule K-1 Schedule of Wv Partner / Shareholder / Member / Beneficiary Income, Loss, Modification, Credits, and Withholding - West Virginia

What Is Schedule K-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Schedule K-1?

A: Schedule K-1 is a tax form that reports the income, losses, and deductions of a partnership, S corporation, estate, or trust to its partners, shareholders, beneficiaries, or recipients.

Q: What is Schedule K-1 used for?

A: Schedule K-1 is used to report the partner's or shareholder's share of income, losses, and deductions from the entity in which they hold an interest.

Q: Who receives a Schedule K-1?

A: Partners or shareholders in a partnership, S corporation, estate, or trust receive a Schedule K-1.

Q: What information does Schedule K-1 include?

A: Schedule K-1 includes information about the partner's or shareholder's share of income, losses, deductions, and other tax-related items.

Q: What should I do with Schedule K-1?

A: You should use the information provided on Schedule K-1 to report your share of income, losses, and deductions on your personal tax return.

Q: Is Schedule K-1 the same for every state?

A: No, Schedule K-1 may vary depending on the state. The specific form mentioned in the question is for West Virginia.

Q: What is West Virginia Schedule K-1 used for?

A: West Virginia Schedule K-1 is used to report the partner's or shareholder's share of income, losses, and other tax-related items specific to West Virginia tax laws.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.