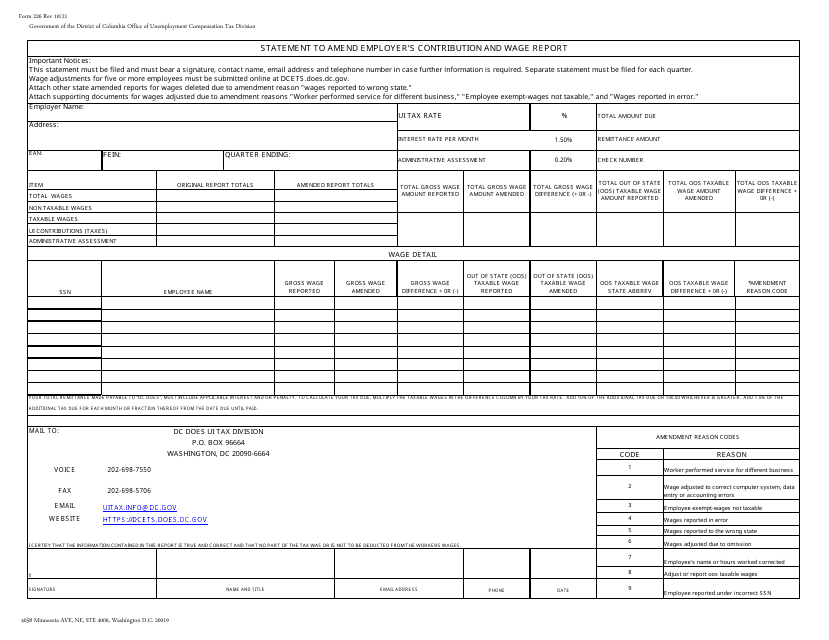

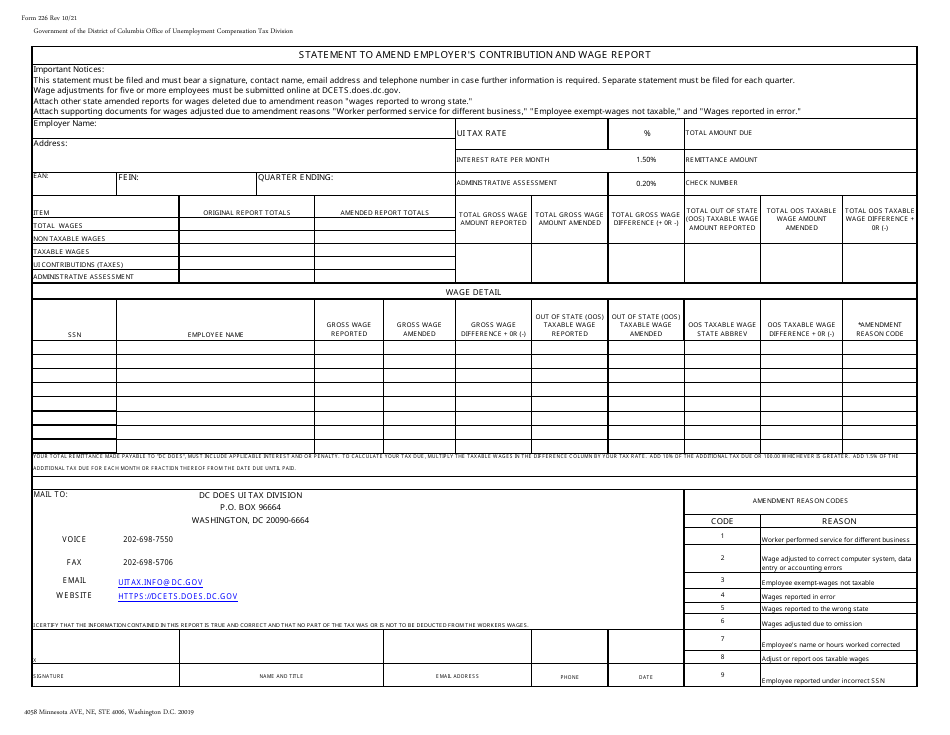

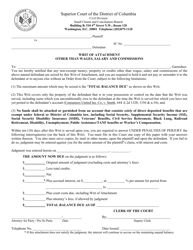

Form 226 Statement to Amend Employer's Contribution and Wage Report - Washington, D.C.

What Is Form 226?

This is a legal form that was released by the Washington DC Department of General Services - Office of Unemployment Compensation - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 226 Statement to Amend Employer's Contribution and Wage Report - Washington, D.C.?

A: Form 226 is a document used by employers in Washington, D.C. to amend their previous Employer's Contribution and Wage Report.

Q: Who needs to file Form 226?

A: Employers in Washington, D.C. who need to correct or update information on their previous Employer's Contribution and Wage Report.

Q: What information can be amended on Form 226?

A: Form 226 allows employers to make changes to their reported wages, contributions, and other relevant information.

Q: Is there a deadline for filing Form 226?

A: Yes, Form 226 must be filed within 30 days from the date of discovery of the error or omission.

Q: What happens after filing Form 226?

A: Once Form 226 is received and processed by the Washington, D.C. Office of Tax and Revenue, the necessary corrections will be made to the employer's records.

Q: Are there any penalties for not filing Form 226?

A: Failure to file Form 226 or filing it late may result in penalties and interest charges imposed by the Washington, D.C. Office of Tax and Revenue.

Q: Are there any fees associated with filing Form 226?

A: No, there are no fees associated with filing Form 226.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Washington DC Department of General Services - Office of Unemployment Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 226 by clicking the link below or browse more documents and templates provided by the Washington DC Department of General Services - Office of Unemployment Compensation.