This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

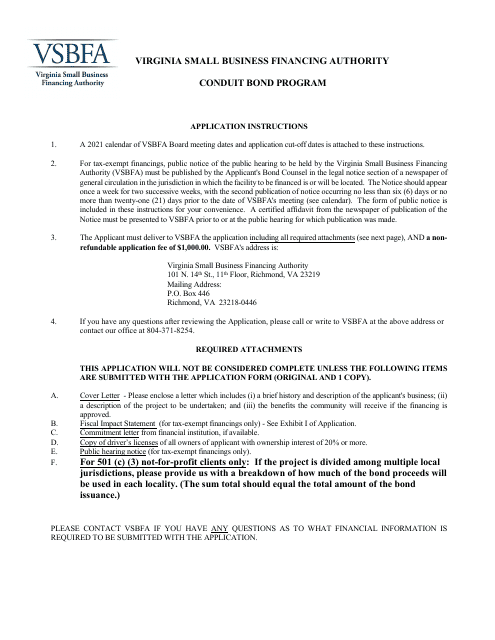

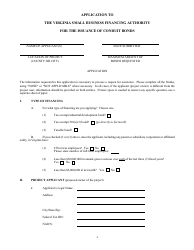

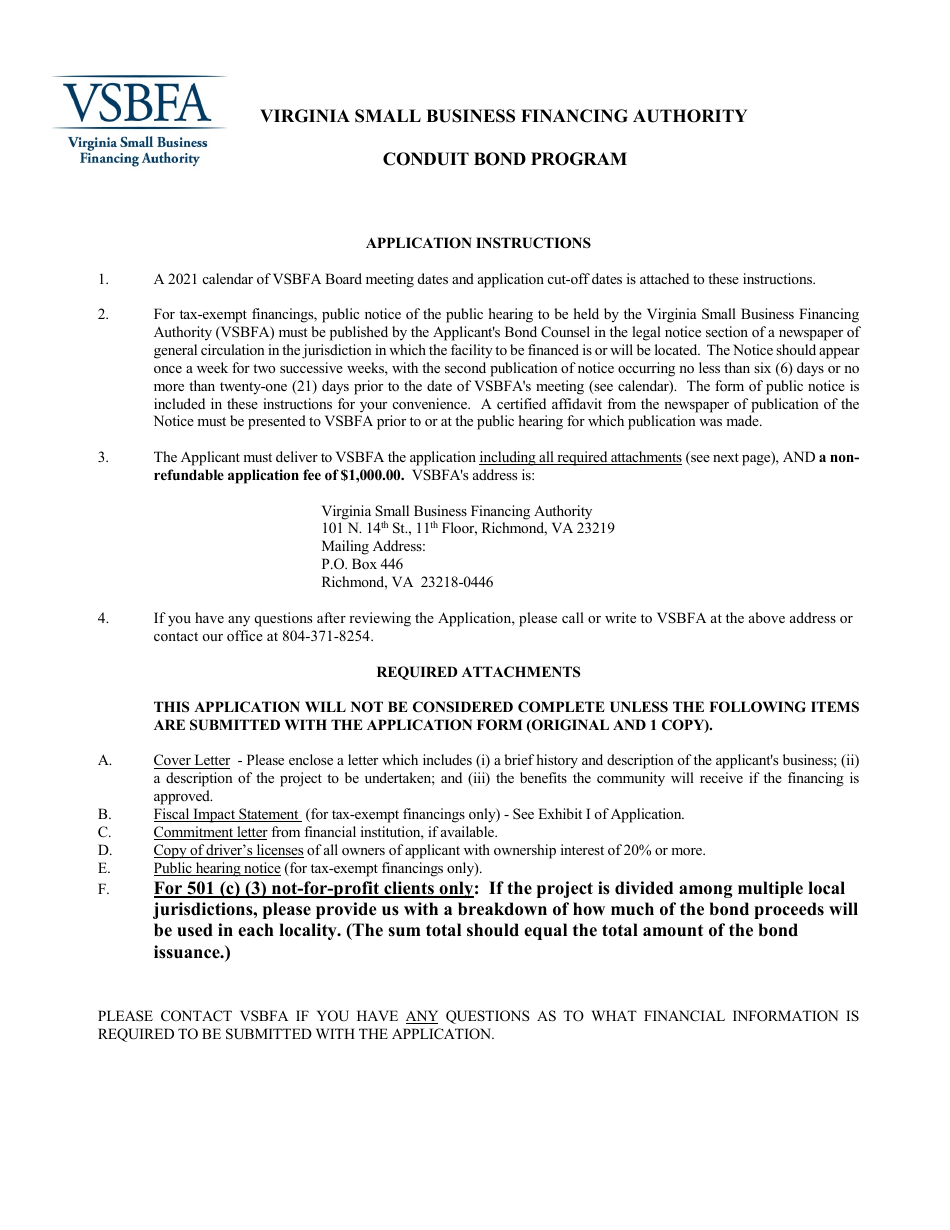

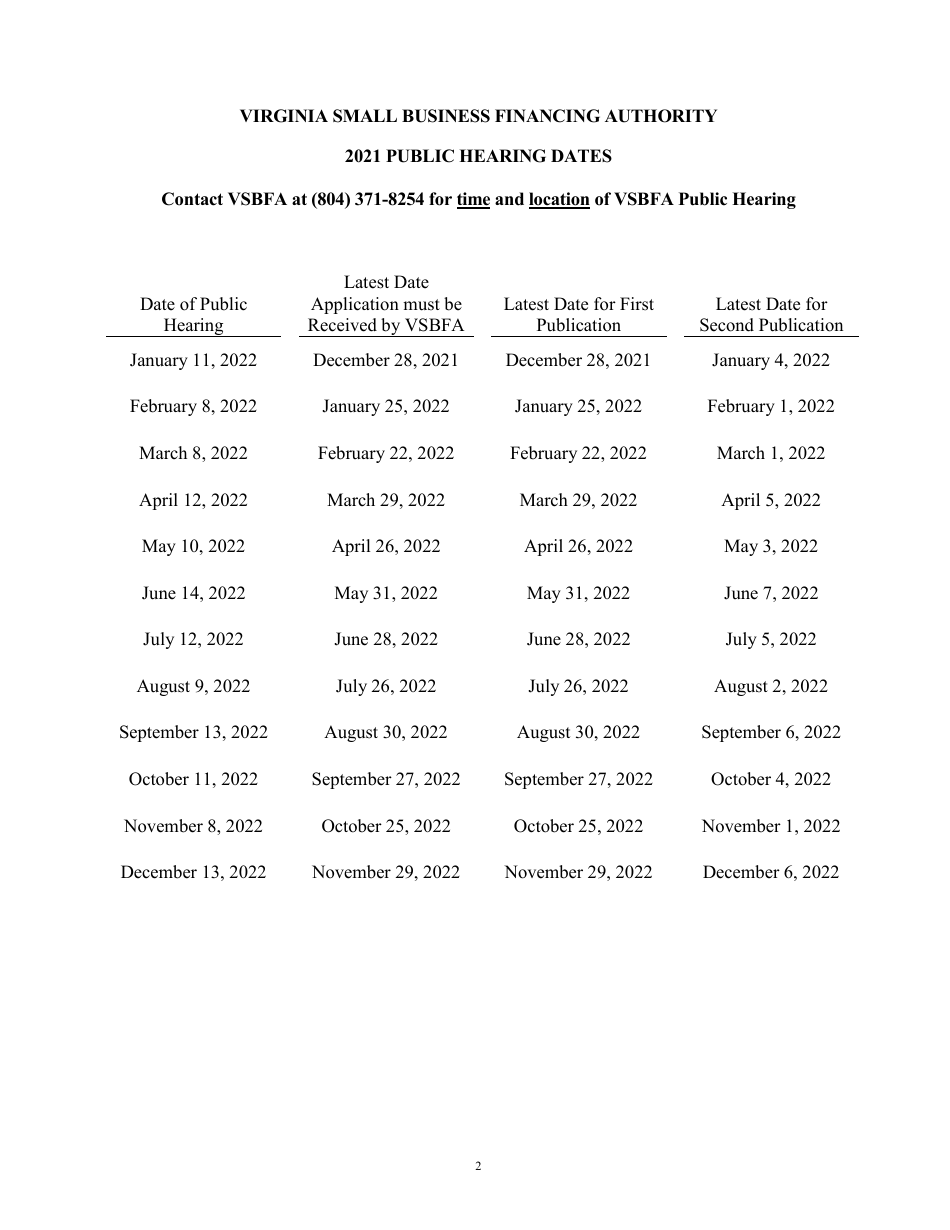

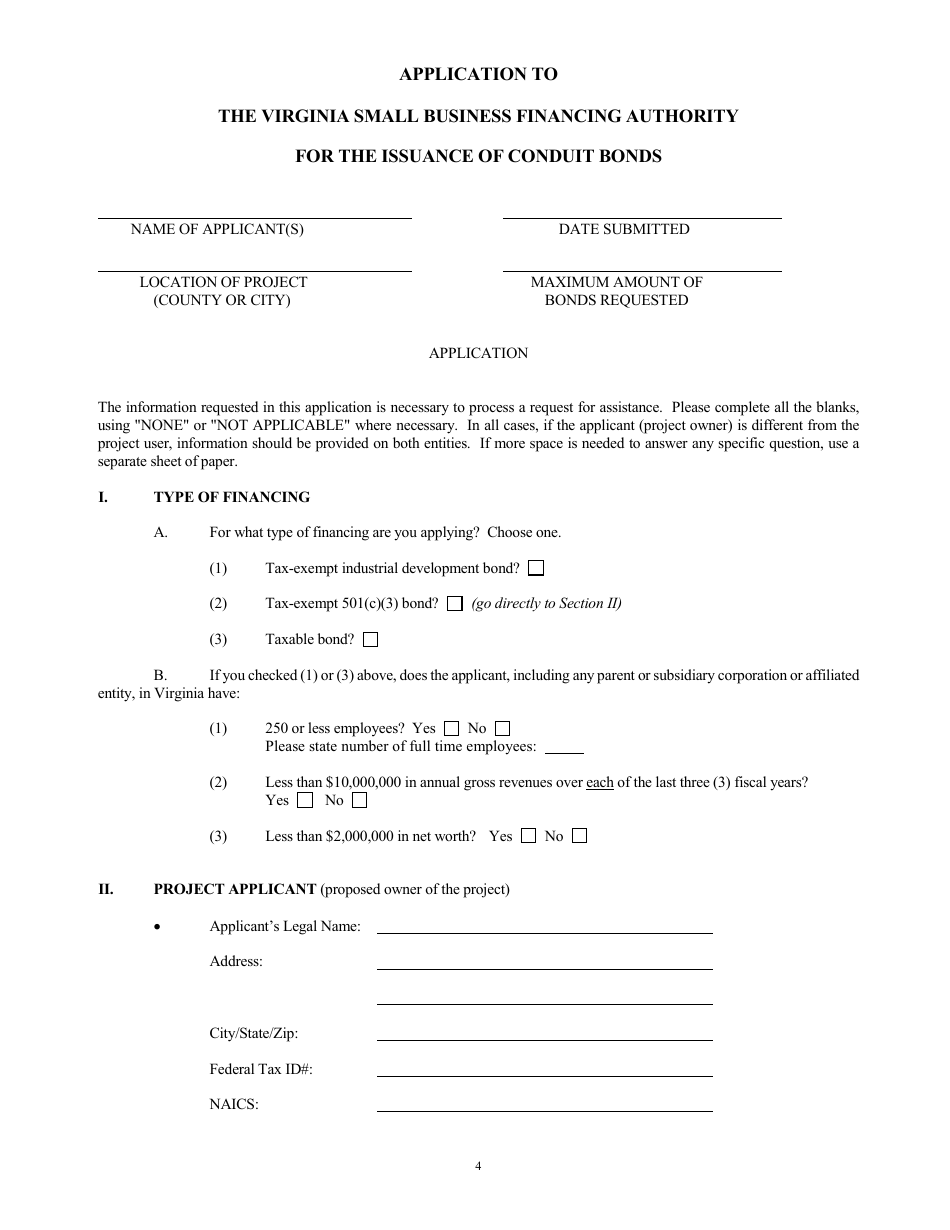

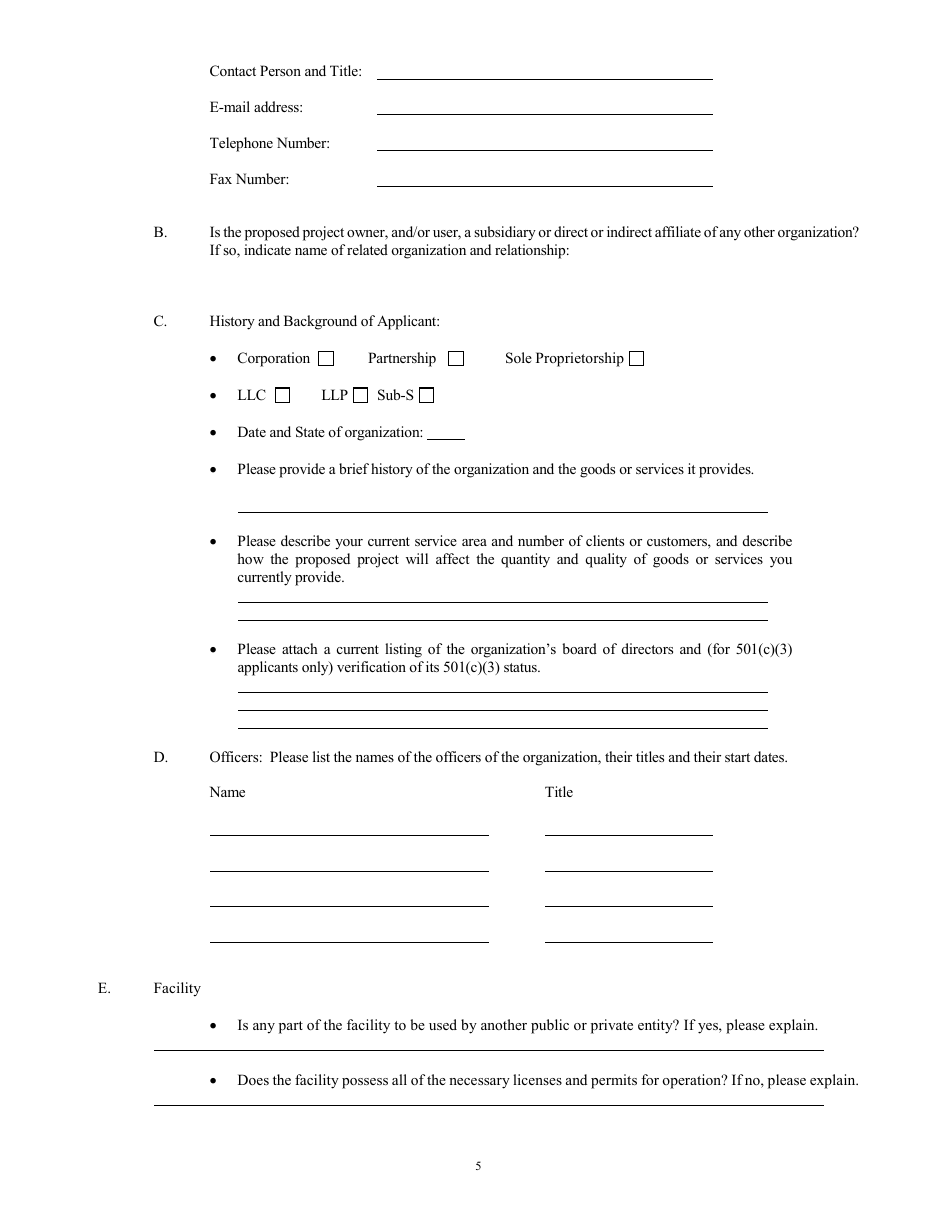

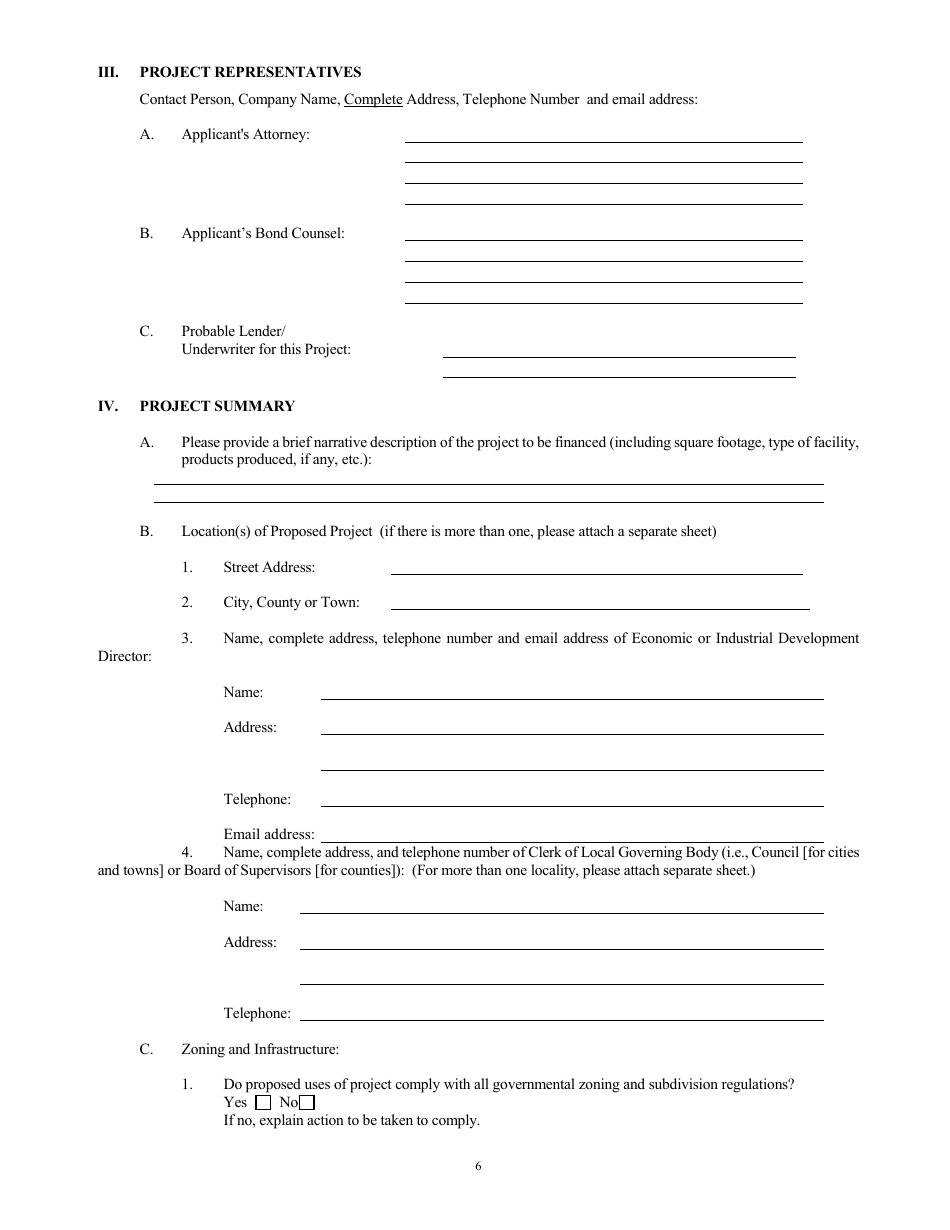

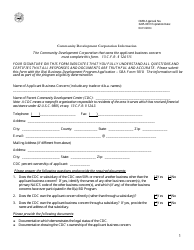

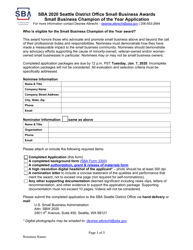

Application to the Virginia Small Business Financing Authority for the Issuance of Conduit Bonds - Virginia

Application to the Virginia Small Business Financing Authority for the Issuance of Conduit Bonds is a legal document that was released by the Virginia Department of Small Business and Supplier Diversity - a government authority operating within Virginia.

FAQ

Q: What is the Virginia Small Business Financing Authority?

A: The Virginia Small Business Financing Authority (VSBFA) is an agency that provides financing solutions to small businesses in Virginia.

Q: What are conduit bonds?

A: Conduit bonds are bonds issued by a governmental agency, such as the VSBFA, on behalf of a borrower. The borrower will use the bond proceeds for a specific project.

Q: Why would a small business apply for conduit bonds?

A: Small businesses may apply for conduit bonds to access funding at lower interest rates. The bonds can be used for various purposes, such as expansion, equipment purchases, or refinancing debt.

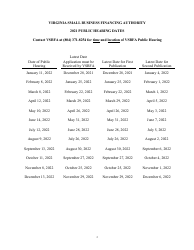

Q: How does the application process for conduit bonds work?

A: The application process for conduit bonds involves submitting a comprehensive application to the VSBFA. The VSBFA will review the application, assess the creditworthiness of the borrower, and determine the terms of the bond issuance.

Q: Are conduit bonds available only in Virginia?

A: Conduit bonds are available in many states, not just Virginia. Each state may have its own agency that offers conduit bond financing for small businesses.

Q: What are the benefits of obtaining conduit bonds for small businesses?

A: Obtaining conduit bonds can provide small businesses with access to capital at more favorable terms, such as lower interest rates and longer repayment periods. This can help businesses grow and thrive.

Q: Is there a limit to the amount of conduit bonds a small business can obtain?

A: The amount of conduit bonds a small business can obtain will depend on various factors, including its creditworthiness, the purpose of the financing, and the availability of funds through the VSBFA.

Q: What other types of financing options are available for small businesses in Virginia?

A: In addition to conduit bonds, small businesses in Virginia may have access to traditional bank loans, Small Business Administration (SBA) loans, grants, and other financing programs offered by state and local agencies.

Form Details:

- The latest edition currently provided by the Virginia Department of Small Business and Supplier Diversity;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Small Business and Supplier Diversity.