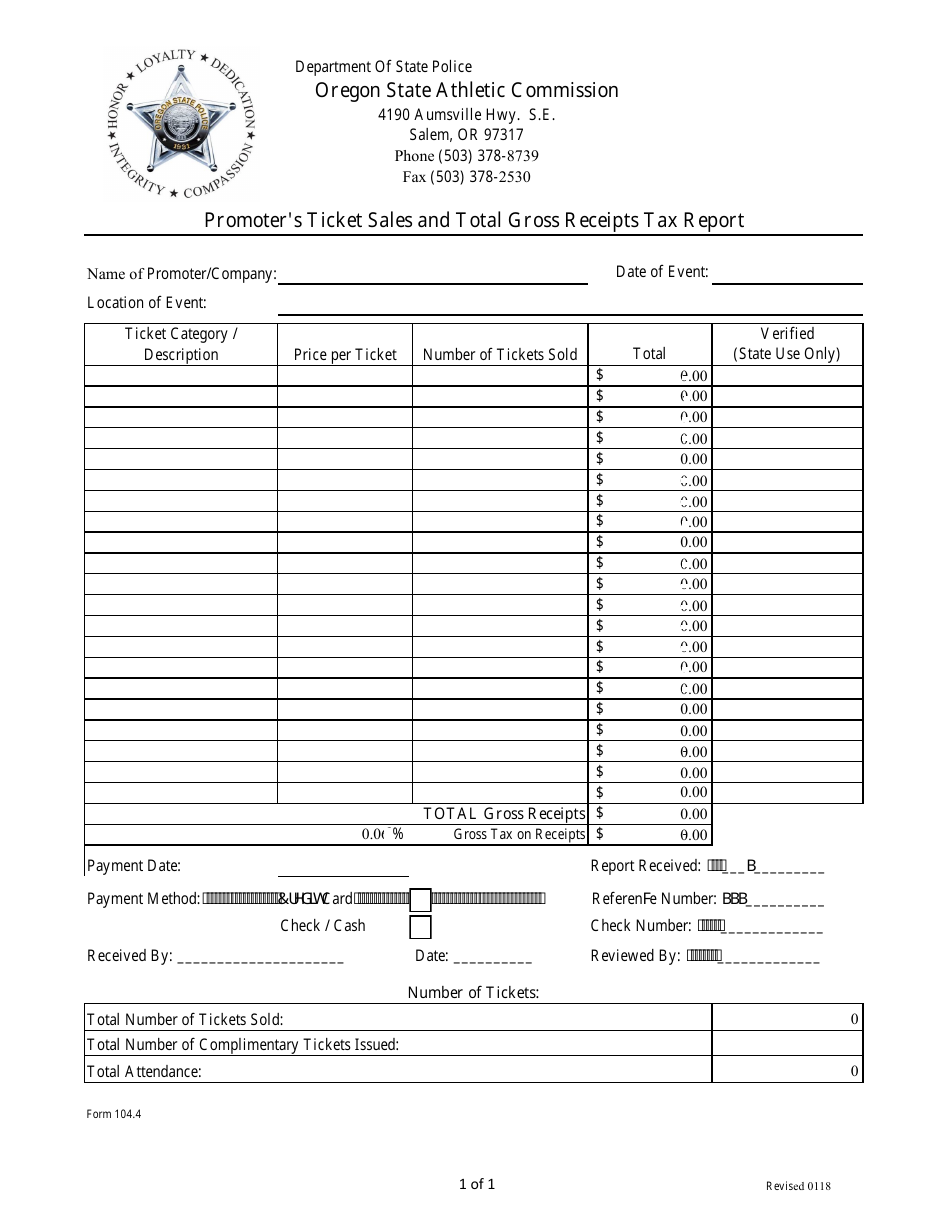

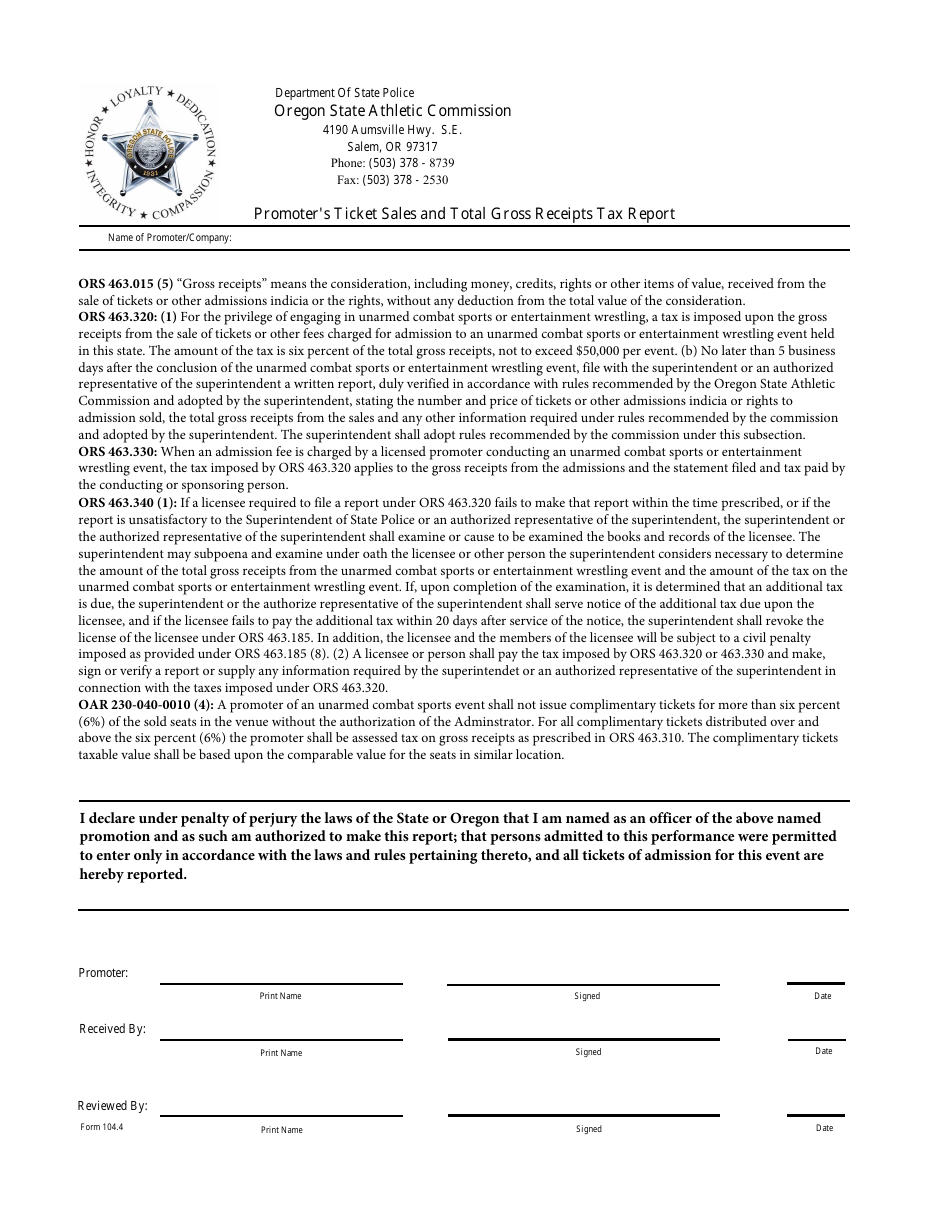

Form 104.4 Promoter's Ticket Sales and Total Gross Receipts Tax Report - Oregon

What Is Form 104.4?

This is a legal form that was released by the Oregon State Police - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 104.4?

A: Form 104.4 is a tax form used in Oregon for reporting promoter's ticket sales and total gross receipts.

Q: Who needs to file Form 104.4?

A: Promoters who sell tickets and generate gross receipts in Oregon need to file Form 104.4.

Q: What information is required on Form 104.4?

A: Form 104.4 requires information such as the event details, ticket sales, and gross receipts.

Q: When is the due date for filing Form 104.4?

A: The due date for filing Form 104.4 varies and depends on the specific event. It is advised to check the instructions or consult with the Oregon Department of Revenue.

Q: Is there any tax owed with Form 104.4?

A: Yes, promoters may be required to pay taxes on the gross receipts reported on Form 104.4.

Q: Are there any penalties for late filing of Form 104.4?

A: Yes, there may be penalties for late filing of Form 104.4. It is important to file the form on time to avoid penalties.

Q: Can I e-file Form 104.4?

A: As of now, Form 104.4 cannot be e-filed. It must be filed by mail or in person.

Q: Is Form 104.4 specific to Oregon?

A: Yes, Form 104.4 is specific to Oregon and is used for reporting promoter's ticket sales and total gross receipts in the state.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Oregon State Police;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 104.4 by clicking the link below or browse more documents and templates provided by the Oregon State Police.