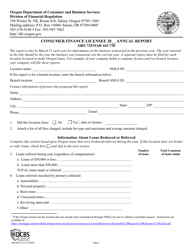

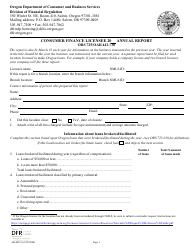

Section 10 Finance - Oregon

What Is Section 10?

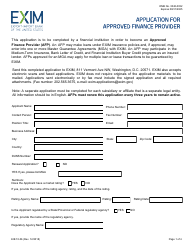

This is a legal form that was released by the Oregon Office of the State Fire Marshal - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the minimum age to apply for a credit card in Oregon?

A: 18 years old.

Q: What is the sales tax rate in Oregon?

A: Oregon does not have a sales tax.

Q: How much is the minimum wage in Oregon?

A: As of July 1, 2021, the minimum wage in Oregon is $12.75 per hour.

Q: Is Oregon a community property state?

A: No, Oregon is not a community property state.

Q: Are there any tax breaks for college tuition in Oregon?

A: Yes, Oregon offers a tax deduction for qualified higher education expenses through the Oregon College Savings Plan.

Q: What is the Oregon Retirement Savings Plan?

A: The Oregon Retirement Savings Plan is a state-sponsored program that helps workers save for retirement if their employer does not offer a retirement plan.

Q: Are inheritances taxable in Oregon?

A: No, inheritances are not subject to state inheritance tax in Oregon.

Q: What is the Oregon Health Insurance Marketplace?

A: The Oregon Health Insurance Marketplace is a state-based platform where individuals and families can compare and purchase health insurance plans.

Q: Are there any tax credits for energy-efficient home improvements in Oregon?

A: Yes, Oregon offers tax credits for certain energy-efficient home improvements, such as solar panels or energy-efficient appliances.

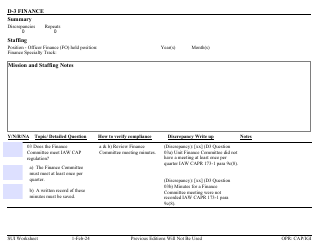

Q: What is the Oregon CAT tax?

A: The Oregon Corporate Activity Tax (CAT) is a tax on businesses with annual commercial activity of $1 million or more in Oregon.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Oregon Office of the State Fire Marshal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Section 10 by clicking the link below or browse more documents and templates provided by the Oregon Office of the State Fire Marshal.