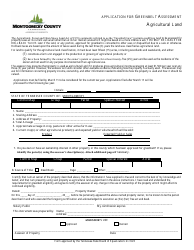

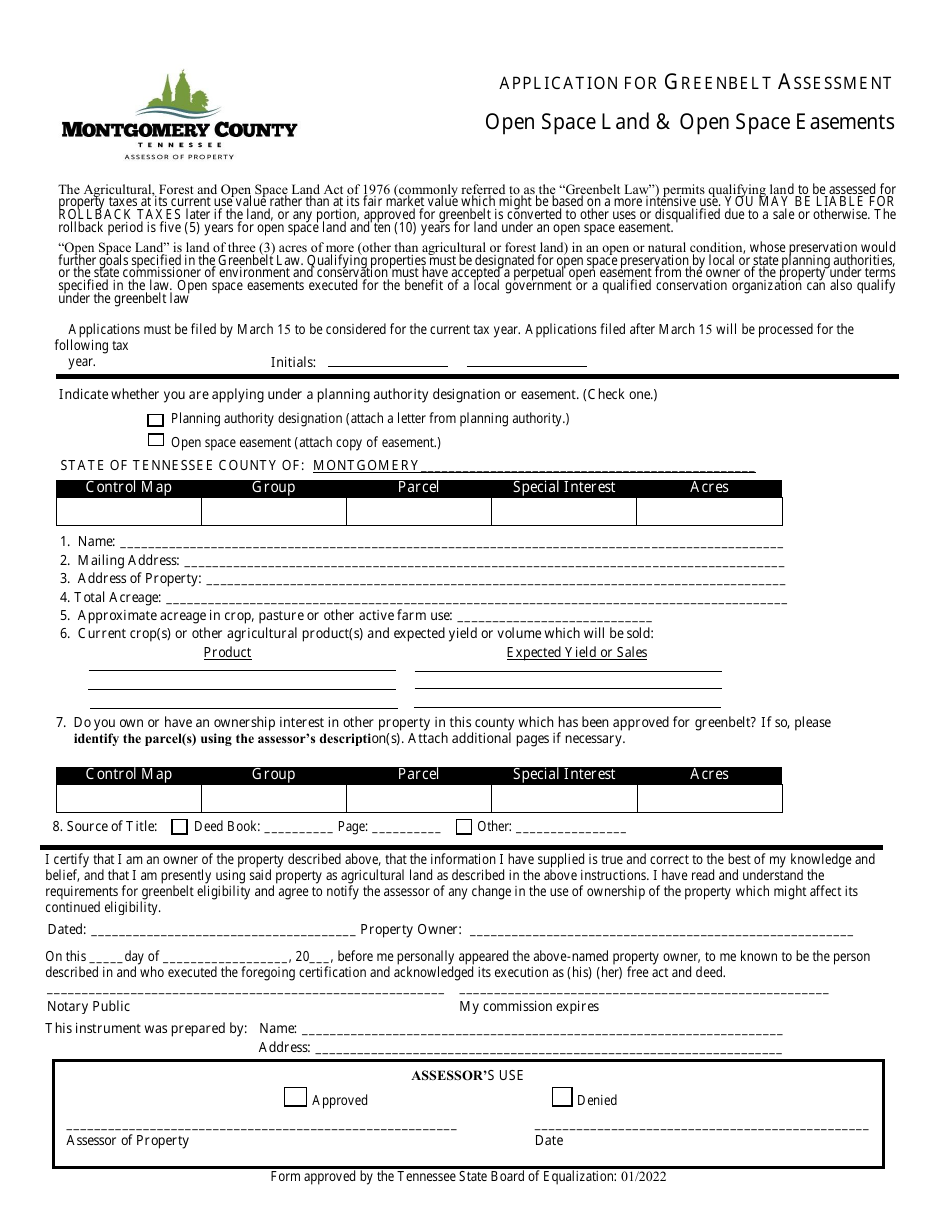

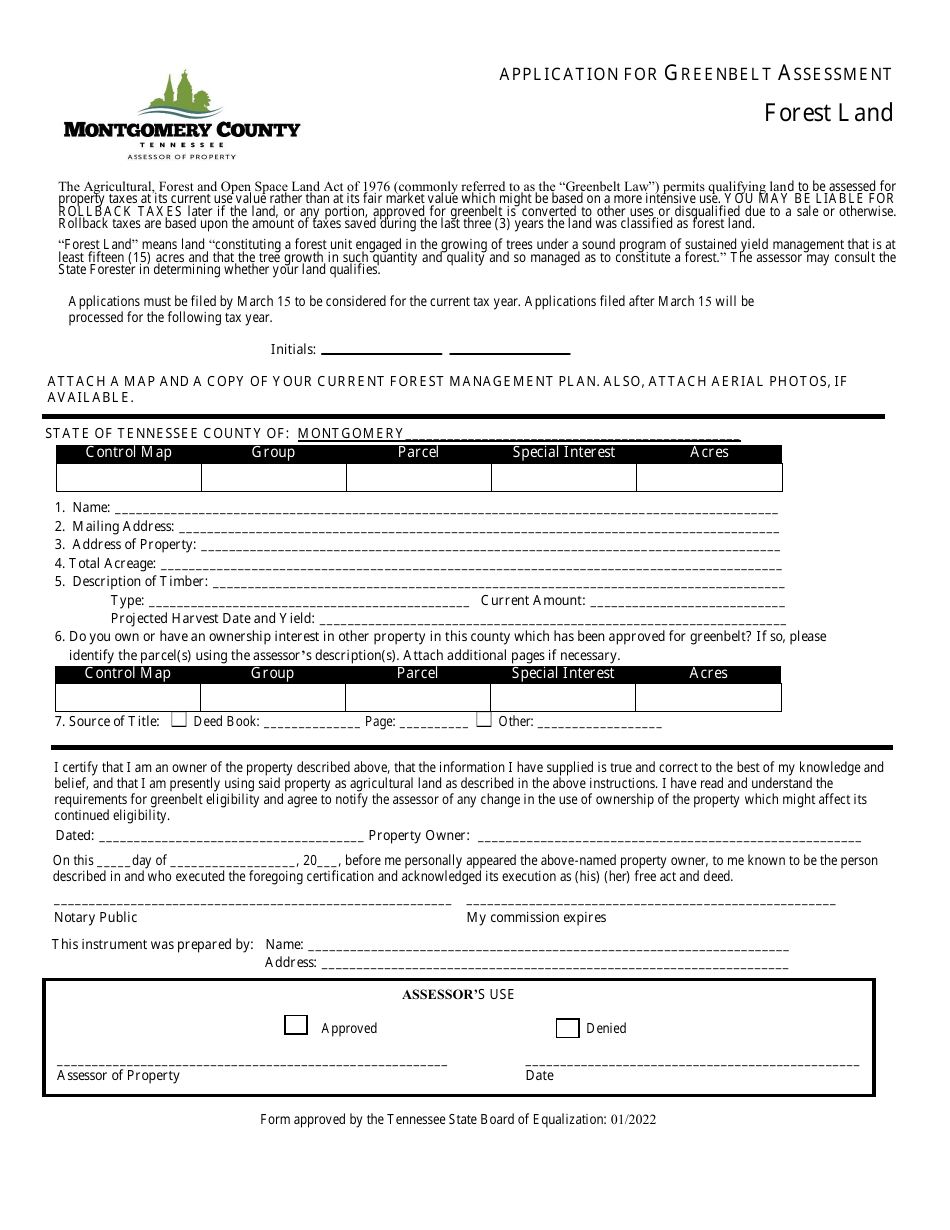

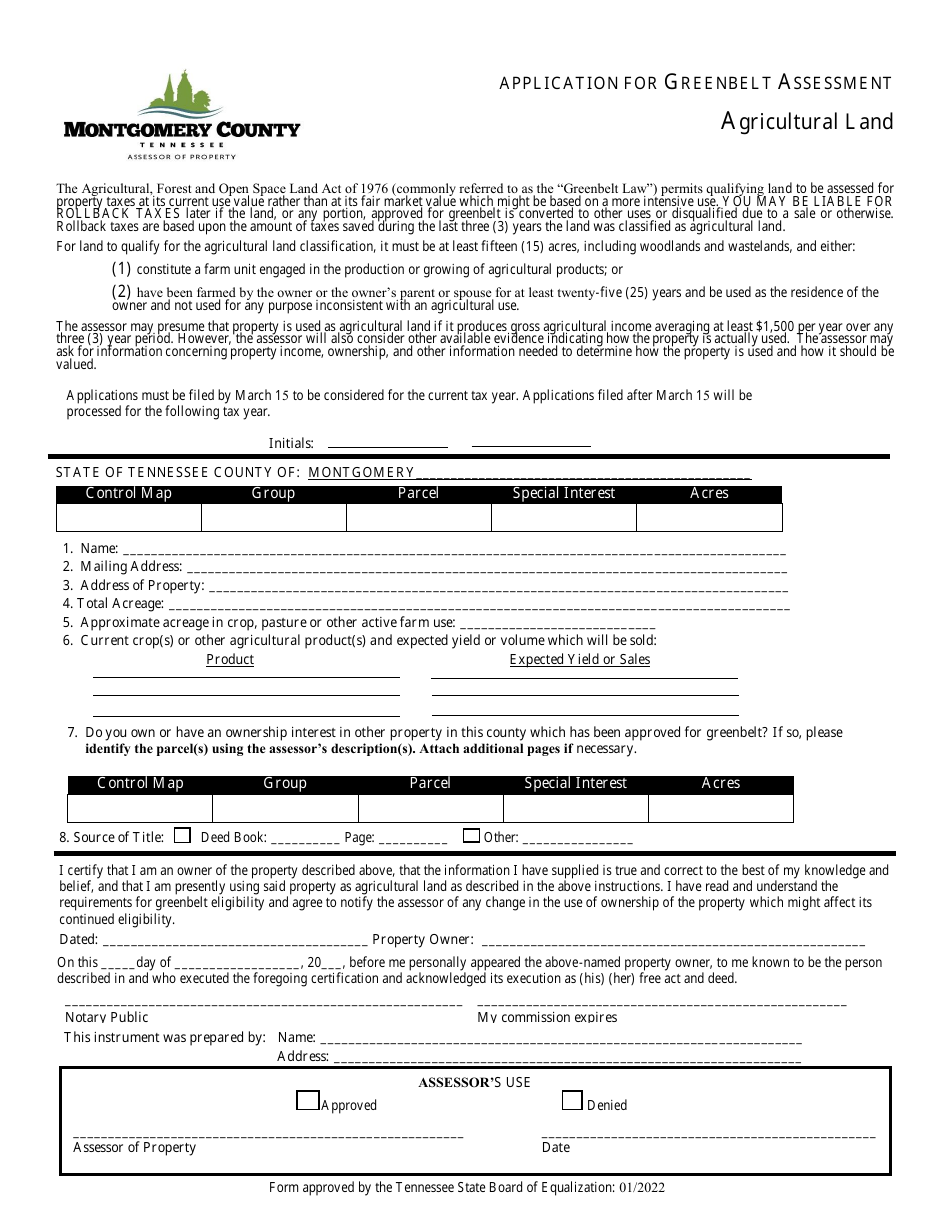

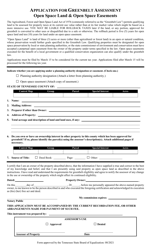

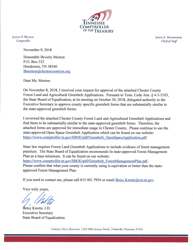

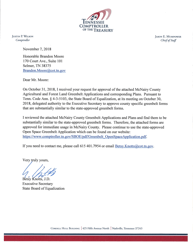

Application for Greenbelt Assessment - Tennessee

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee.

FAQ

Q: What is a Greenbelt Assessment?

A: A Greenbelt Assessment is a program that offers property tax relief for landowners who use their land primarily for agricultural, forest, or open space purposes.

Q: Who is eligible for a Greenbelt Assessment in Tennessee?

A: Landowners who meet certain criteria, such as having a minimum number of acres and meeting income requirements, may be eligible for a Greenbelt Assessment in Tennessee.

Q: What are the benefits of a Greenbelt Assessment?

A: The benefits of a Greenbelt Assessment include reduced property taxes for landowners who qualify, which can help keep the land in agricultural or open space use.

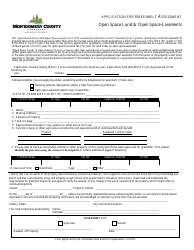

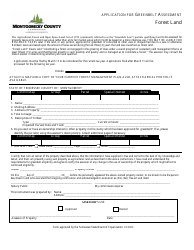

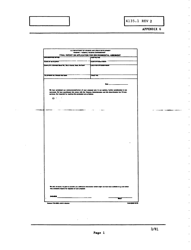

Q: How can I apply for a Greenbelt Assessment in Tennessee?

A: To apply for a Greenbelt Assessment in Tennessee, you will need to contact your local county assessor's office and complete the necessary application forms.

Q: What documents do I need to include with my Greenbelt Assessment application?

A: The specific documents required may vary by county, but typically you will need to provide proof of ownership, a completed application form, and any additional supporting documentation requested by the assessor's office.

Q: What is the deadline for applying for a Greenbelt Assessment?

A: The deadline for applying for a Greenbelt Assessment in Tennessee is typically before the end of the calendar year for the assessment to be effective for the following tax year. It is best to contact your local assessor's office to confirm the exact deadline.

Q: Can my Greenbelt Assessment be revoked?

A: Yes, a Greenbelt Assessment can be revoked if the land no longer meets the requirements for agricultural or open space use, or if the land is transferred to a new owner who does not qualify for the program.

Q: Are there any penalties for withdrawing from the Greenbelt Assessment?

A: If you withdraw from the Greenbelt Assessment program, there may be penalties, such as having to pay back taxes that would have been owed if the property had not been assessed at the reduced rate.

Q: Can I appeal a Greenbelt Assessment decision?

A: Yes, if your Greenbelt Assessment application is denied or if the assessed value of your land is higher than you believe it should be, you can typically appeal the decision with your local county board of equalization.

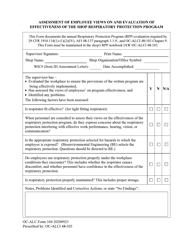

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.