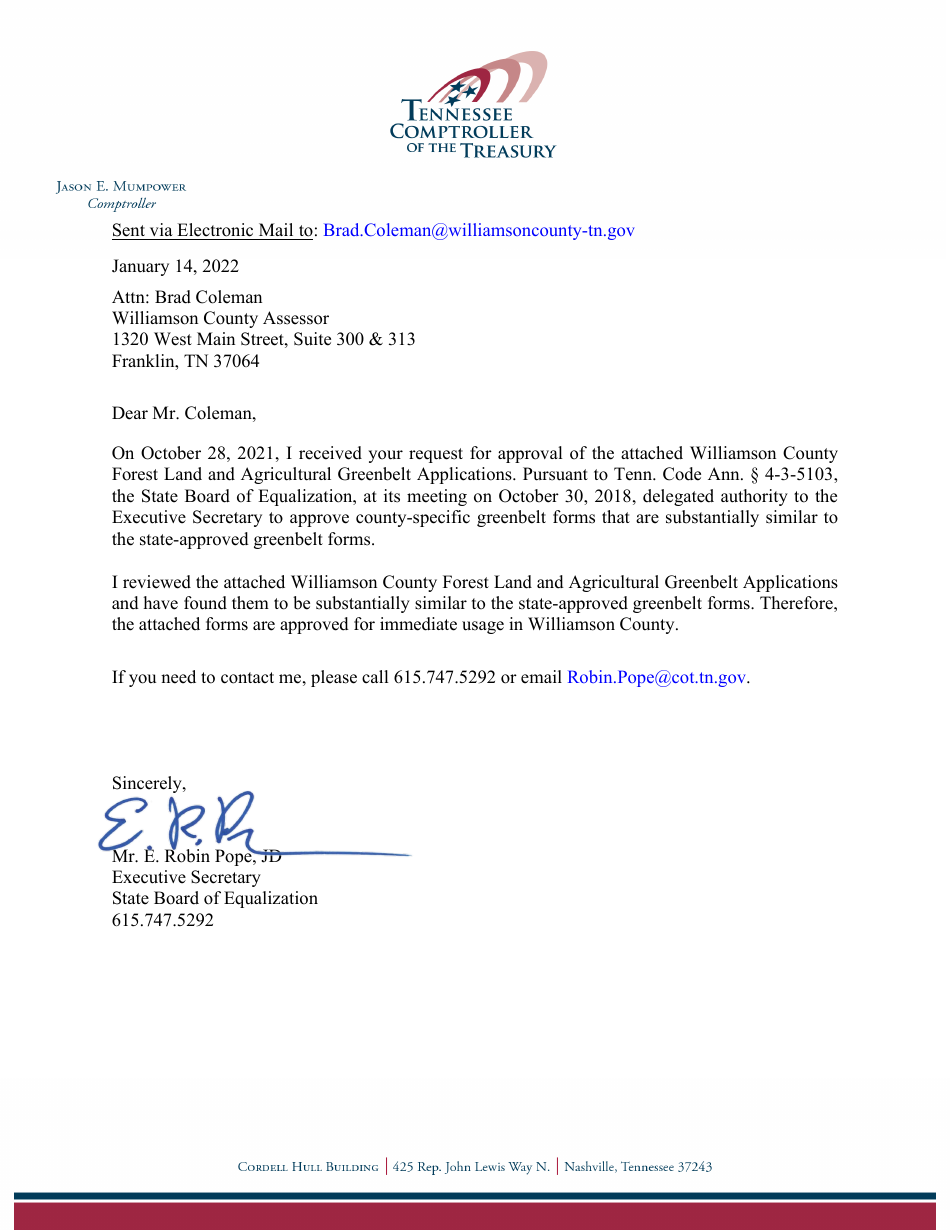

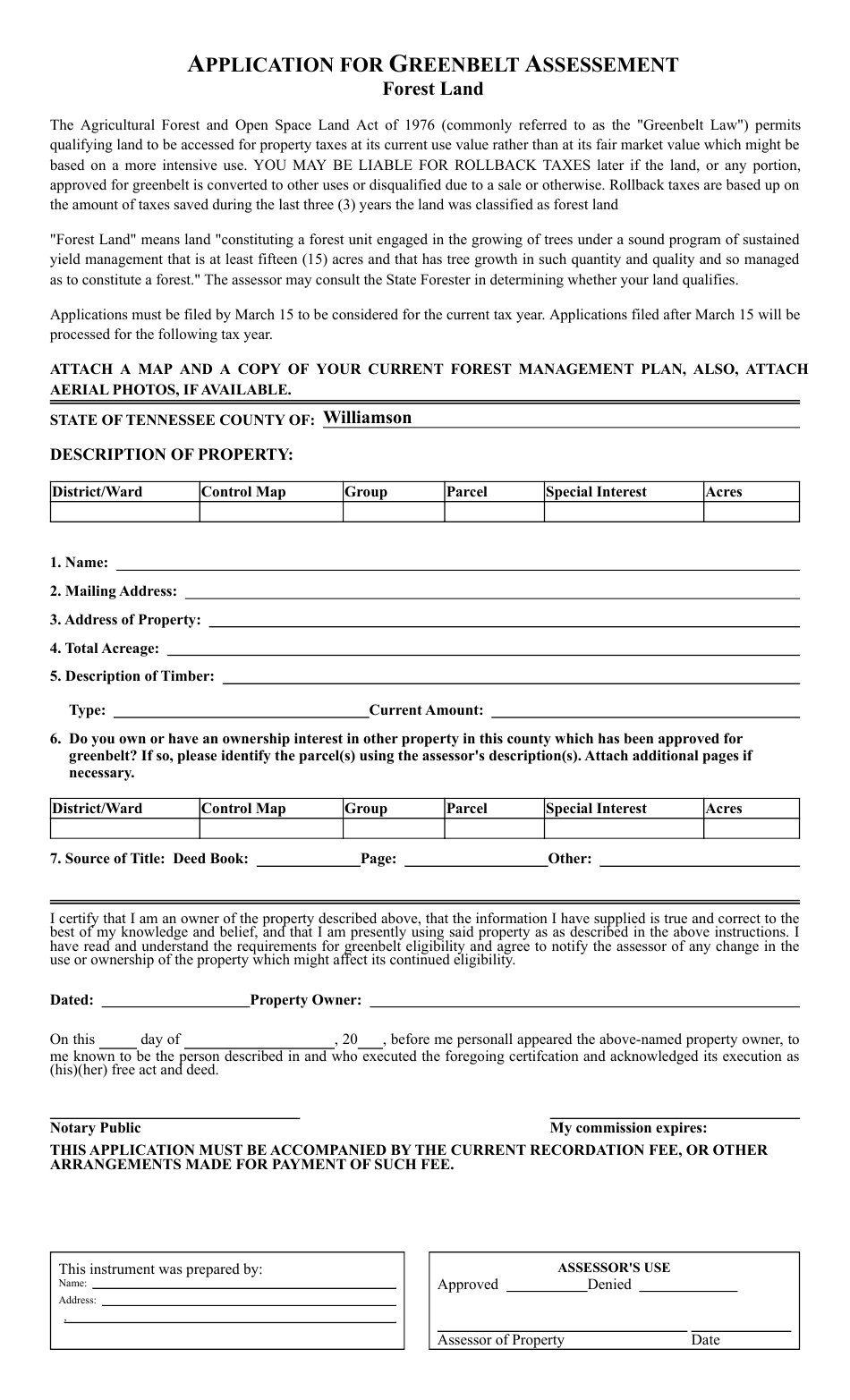

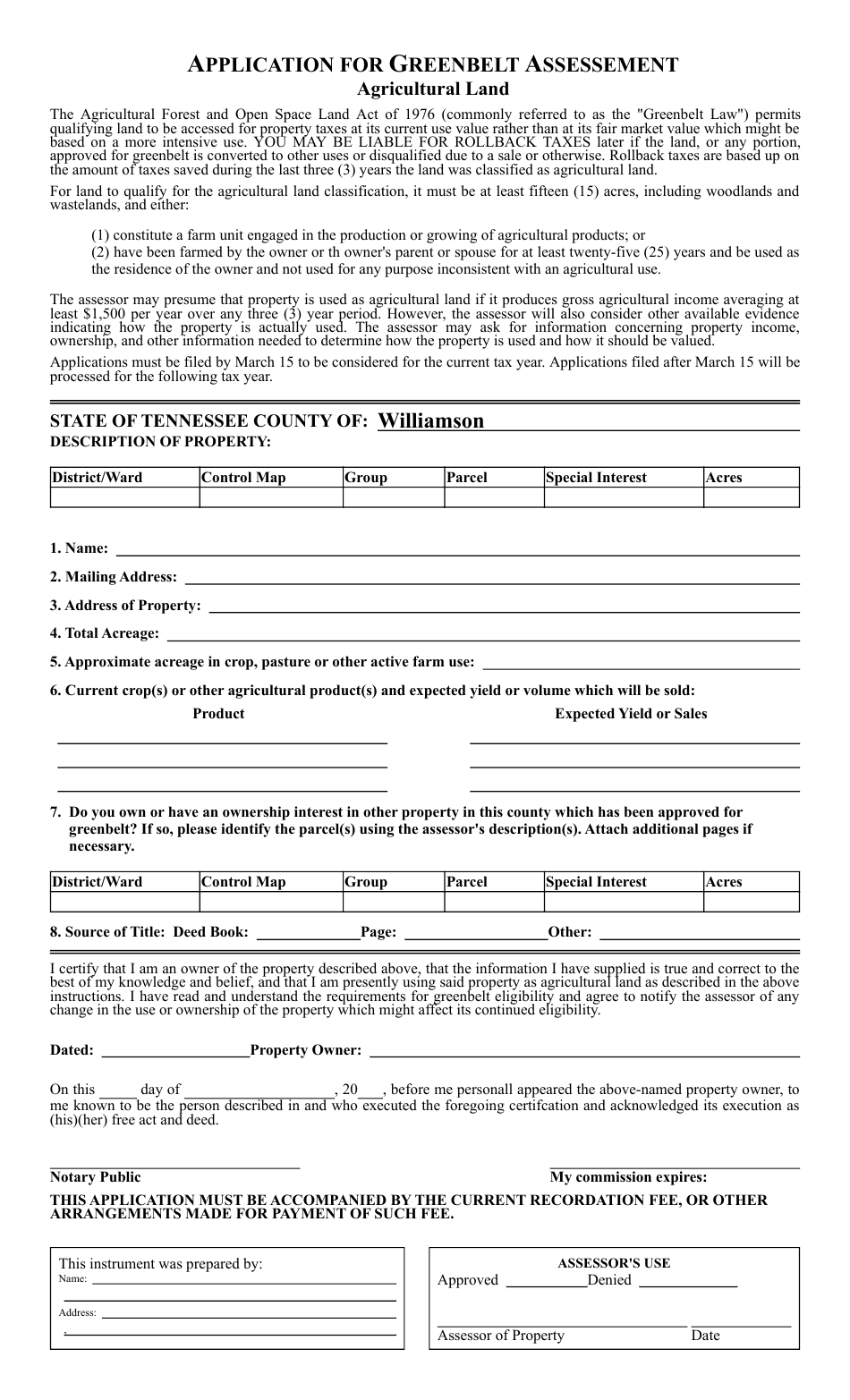

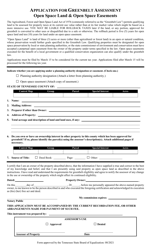

Application for Greenbelt Assessement - Tennessee

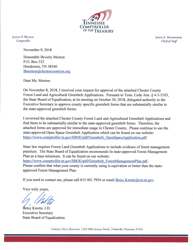

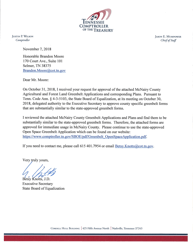

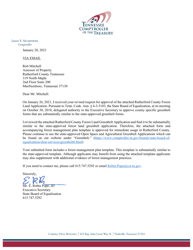

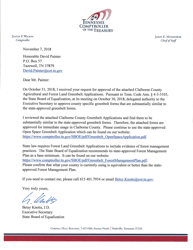

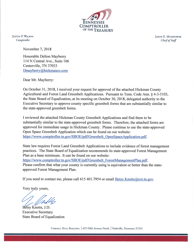

Application for Greenbelt Assessement is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee.

FAQ

Q: What is a Greenbelt assessment?

A: A Greenbelt assessment is an application process for a property tax program that provides tax savings for eligible agricultural, forest, and open space lands in Tennessee.

Q: Who is eligible for a Greenbelt assessment in Tennessee?

A: Property owners who actively use their land for agricultural, forestry, or open space purposes may be eligible for a Greenbelt assessment.

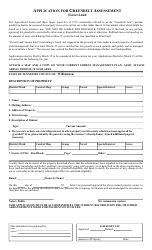

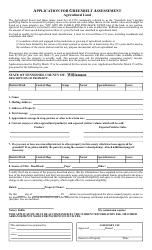

Q: How do I apply for a Greenbelt assessment in Tennessee?

A: To apply for a Greenbelt assessment, you need to contact your county's property assessor's office and fill out an application form.

Q: What are the benefits of a Greenbelt assessment in Tennessee?

A: The main benefit of a Greenbelt assessment is reduced property taxes for eligible landowners, allowing them to maintain and preserve their agricultural, forestry, or open space properties.

Q: Are there any requirements or obligations for landowners with a Greenbelt assessment in Tennessee?

A: Yes, landowners with a Greenbelt assessment are required to maintain the designated use of their land and may be subject to penalties if the land use changes.

Q: Can I apply for a Greenbelt assessment if I only have a small piece of land?

A: Yes, there is no minimum land size requirement to apply for a Greenbelt assessment in Tennessee.

Q: Is there a deadline to apply for a Greenbelt assessment in Tennessee?

A: The deadline to apply for a Greenbelt assessment varies by county, so you should contact your county's property assessor's office to find out the specific deadline.

Q: Can I appeal if my Greenbelt assessment application is denied?

A: Yes, if your Greenbelt assessment application is denied, you have the right to appeal the decision. You should contact your county's property assessor's office for more information on the appeals process.

Q: Will my Greenbelt assessment automatically renew each year?

A: No, Greenbelt assessments do not automatically renew each year. You will need to reapply for the assessment periodically, depending on your county's requirements.

Q: Are there any other tax programs available for Tennessee landowners?

A: Yes, Tennessee offers additional tax programs for landowners, such as the Agricultural, Forest, and Open Space Land Act and the Land Trust PropertyTax Credit Program. You can contact your county's property assessor's office for more information on these programs.

Form Details:

- Released on January 14, 2022;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.