This version of the form is not currently in use and is provided for reference only. Download this version of

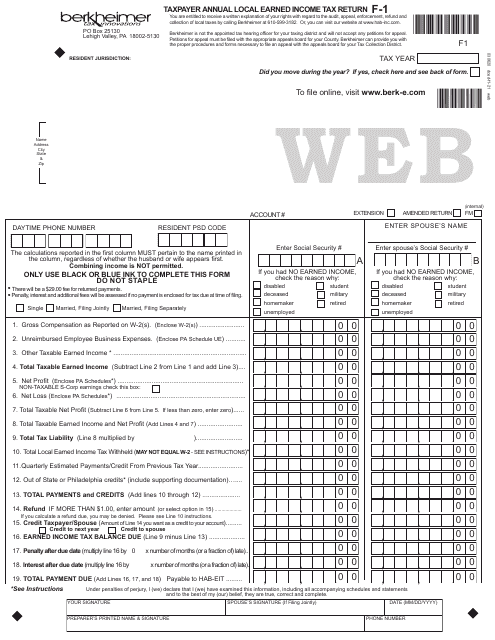

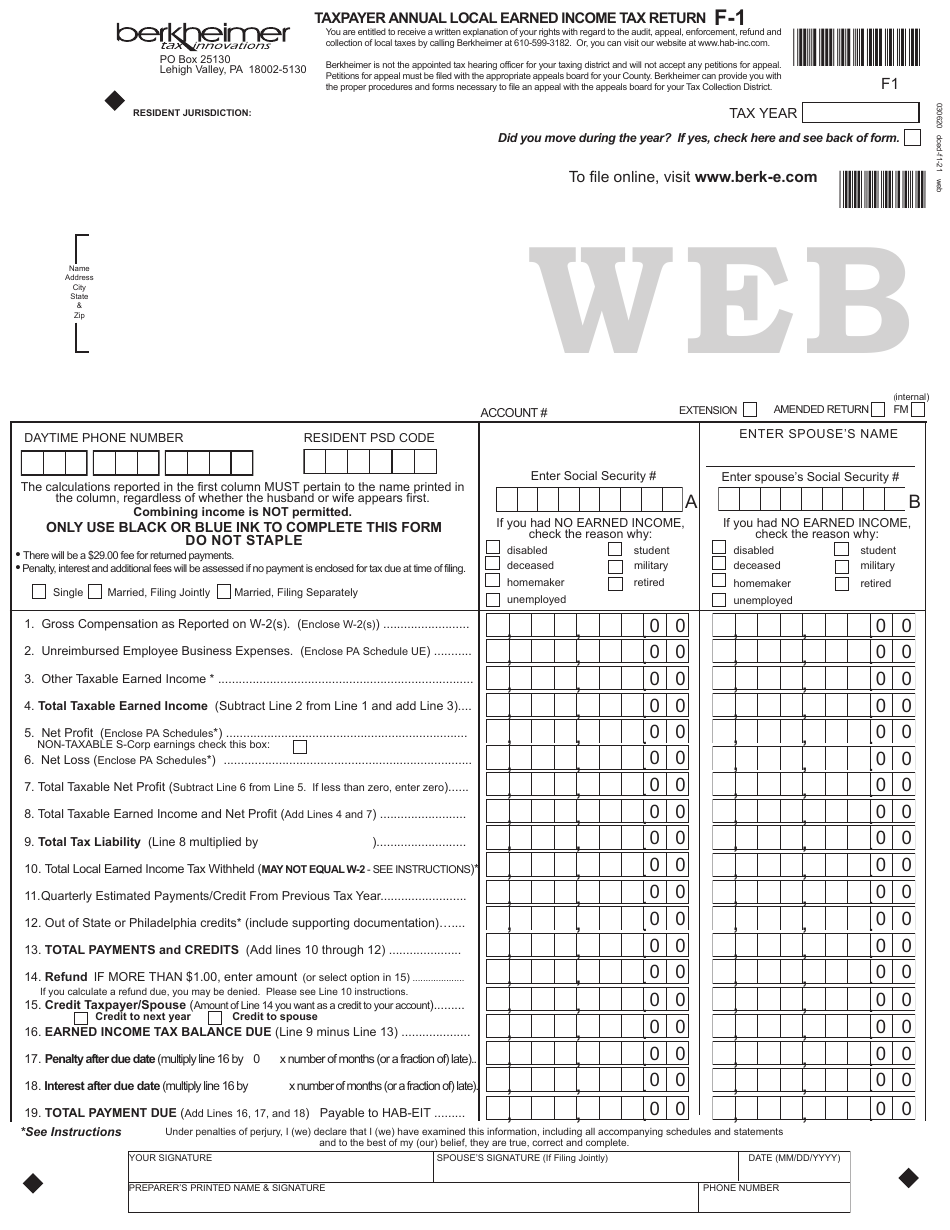

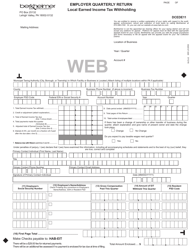

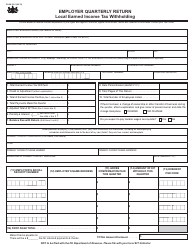

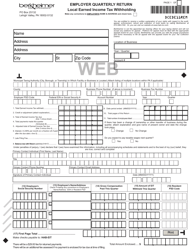

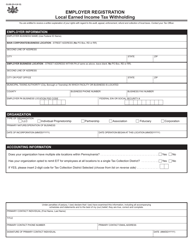

Form F-1

for the current year.

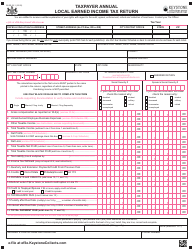

Form F-1 Taxpayer Annual Local Earned Income Tax Return - Pennsylvania

What Is Form F-1?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1?

A: Form F-1 is the Taxpayer Annual Local Earned Income Tax Return for Pennsylvania.

Q: Who needs to file Form F-1?

A: Residents of Pennsylvania who earn income in a local municipality need to file Form F-1.

Q: What is the purpose of Form F-1?

A: The purpose of Form F-1 is to report and pay local earned income taxes.

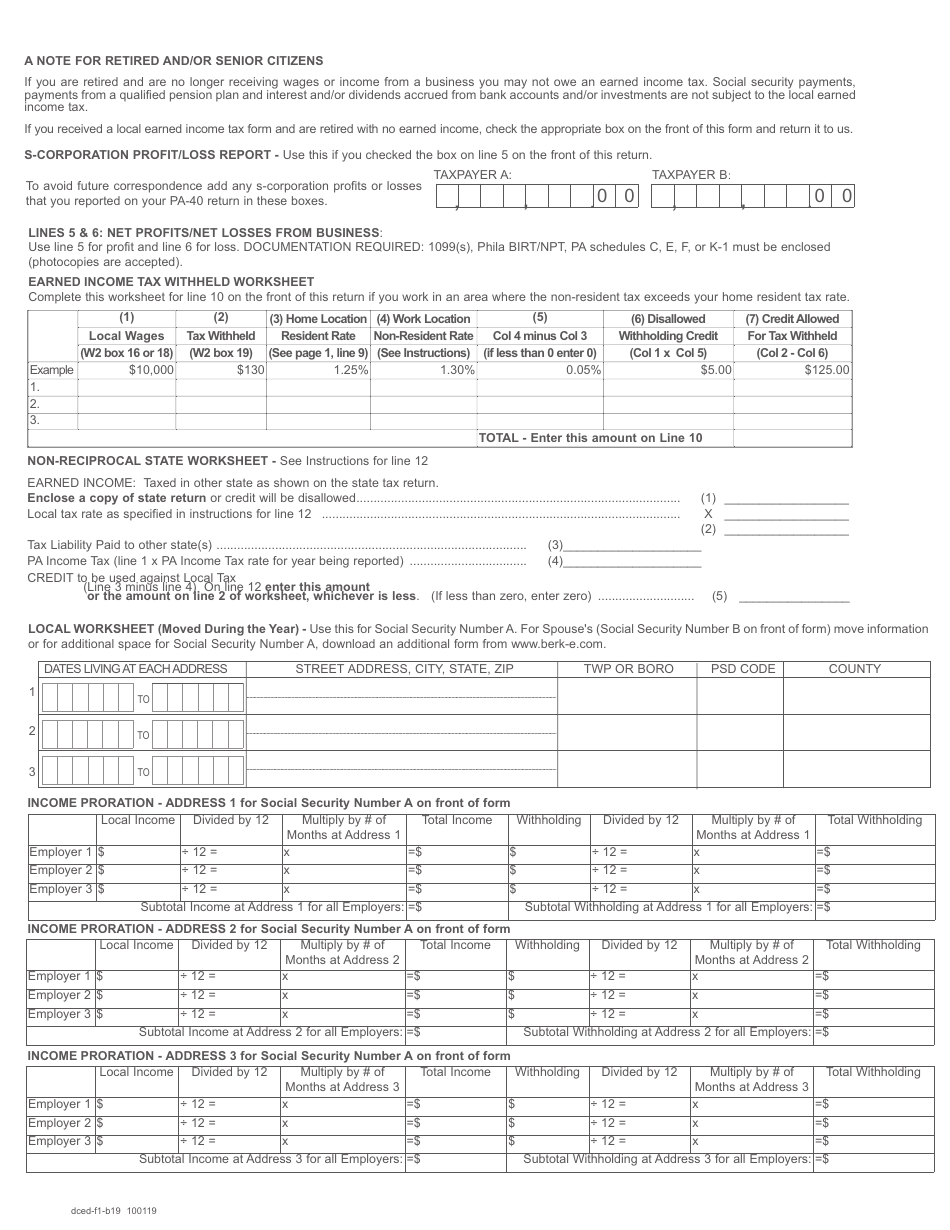

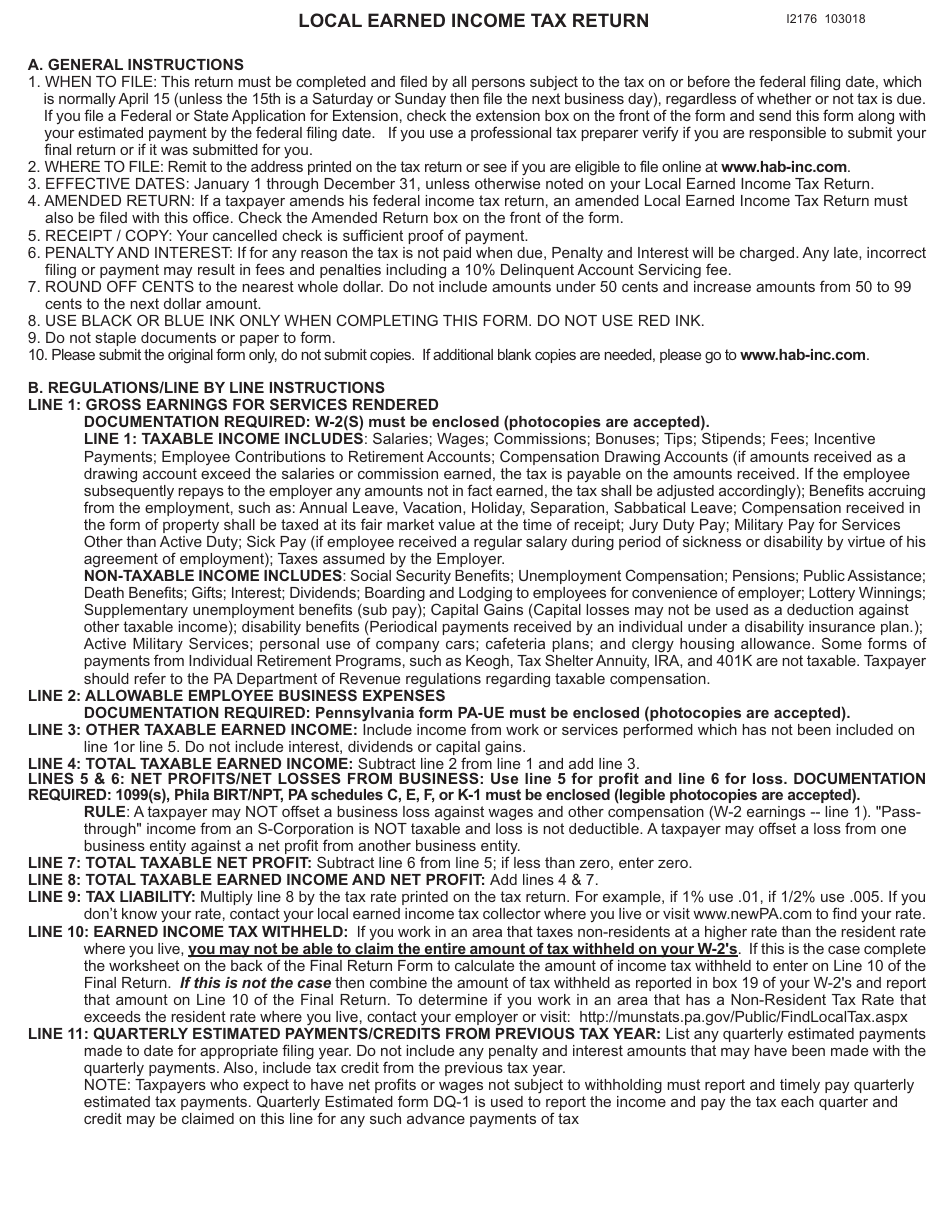

Q: What information do I need to complete Form F-1?

A: You will need information about your income, deductions, and any local taxes paid.

Q: When is the deadline to file Form F-1?

A: The deadline to file Form F-1 is April 15th of the following year.

Q: Can I file Form F-1 electronically?

A: Yes, you can file Form F-1 electronically through the Pennsylvania Department of Revenue's e-file system.

Q: What happens if I don't file Form F-1?

A: Failure to file Form F-1 may result in penalties and interest charges.

Q: Can I get an extension to file Form F-1?

A: Yes, you can request an extension to file Form F-1, but any taxes owed should still be paid by the original deadline.

Q: Are there any exemptions or deductions available on Form F-1?

A: Yes, there are exemptions and deductions available to reduce your local earned income tax liability. Consult the instructions for Form F-1 for more information.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-1 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.