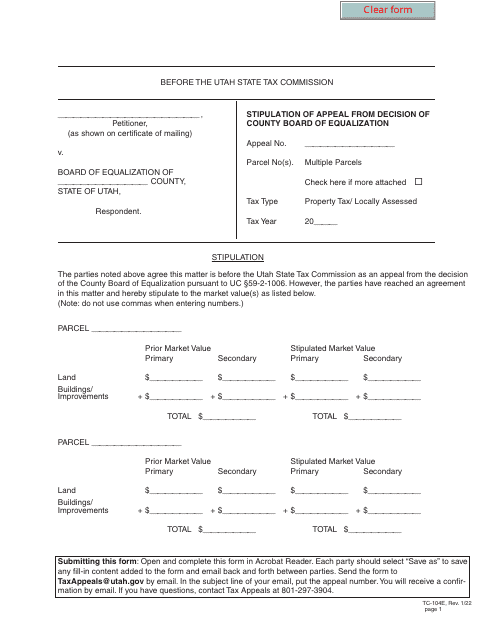

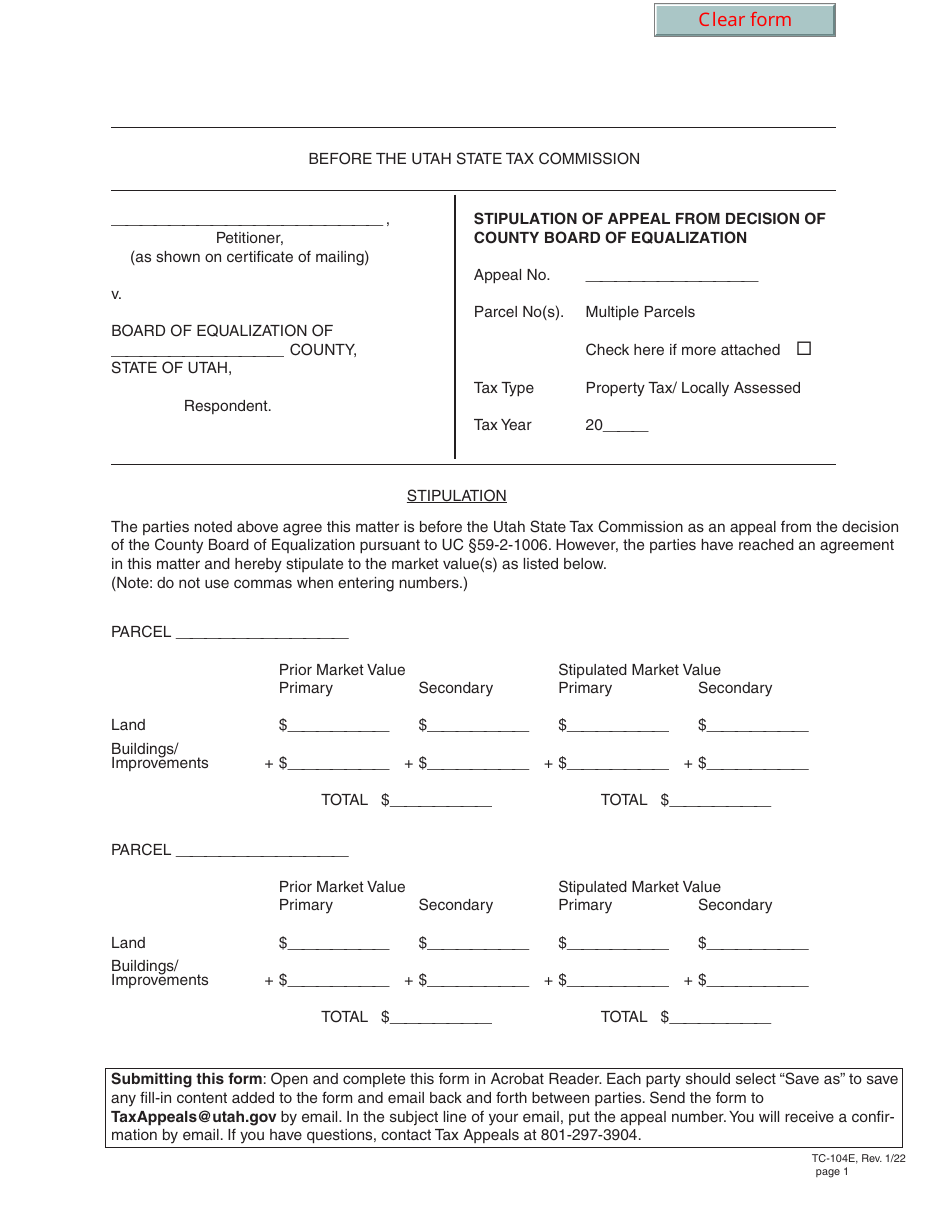

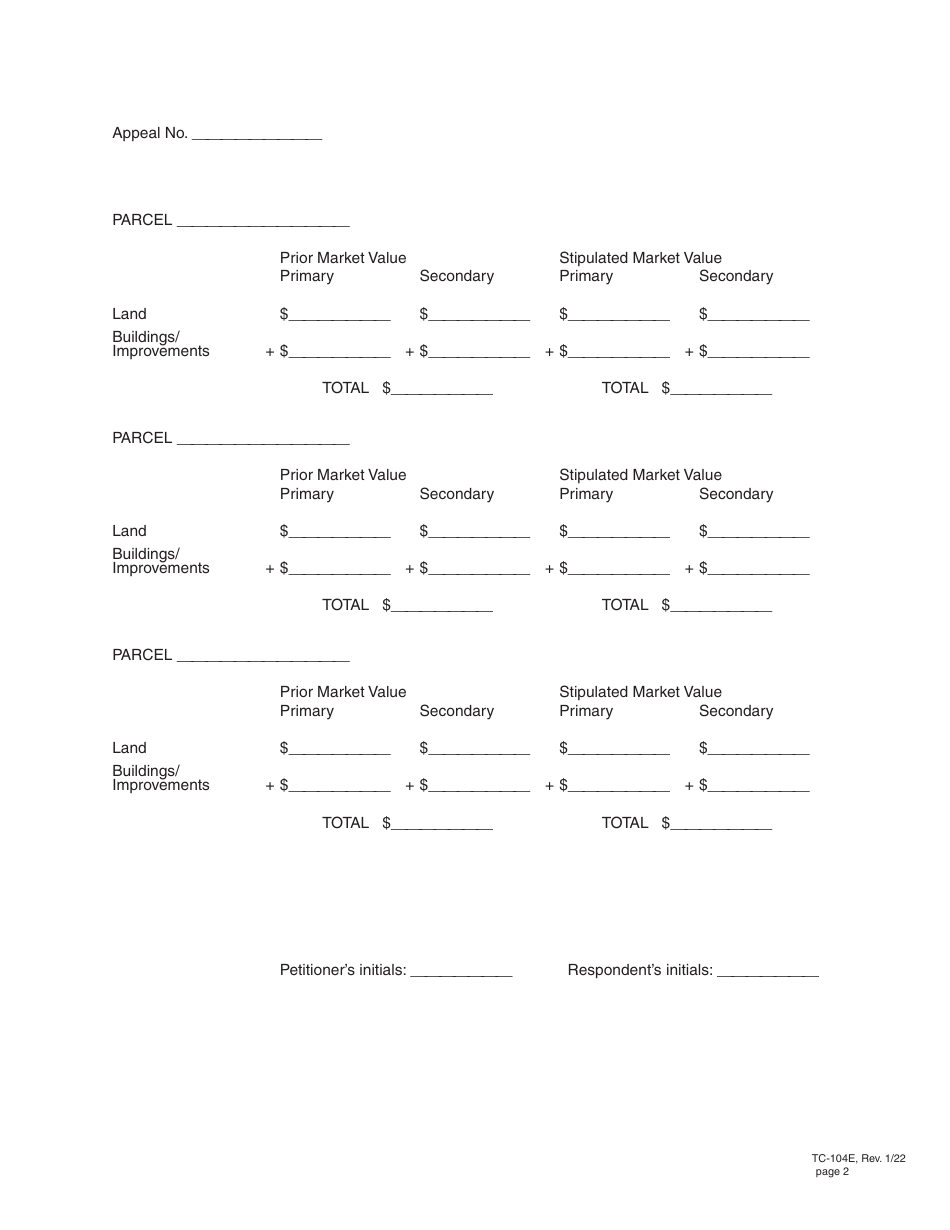

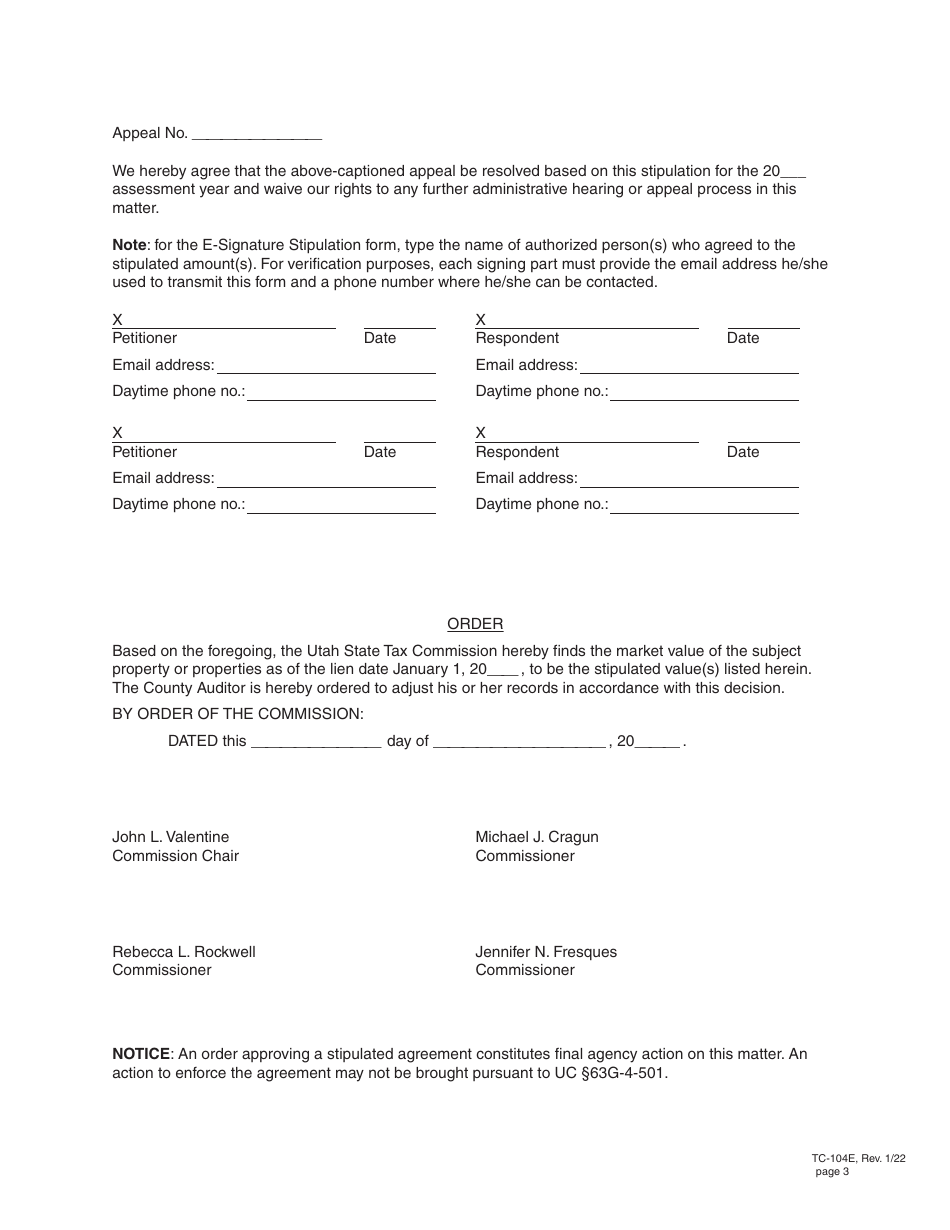

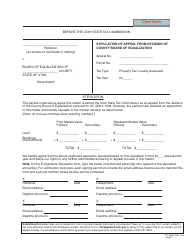

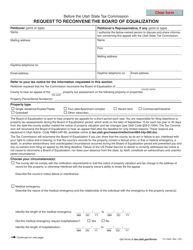

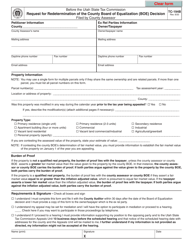

Form TC-104E MULTIPLE Stipulation of Appeal From Decision of County Board of Equalization (For Multiple Parcels) - Utah

What Is Form TC-104E MULTIPLE?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-104E?

A: Form TC-104E is a Stipulation of Appeal From Decision of County Board of Equalization form specifically for multiple parcels in Utah.

Q: When should I use Form TC-104E?

A: You should use Form TC-104E when you want to appeal the decision of the County Board of Equalization regarding multiple parcels in Utah.

Q: What is the purpose of Form TC-104E?

A: The purpose of Form TC-104E is to stipulate your appeal from the decision of the County Board of Equalization for multiple parcels in Utah.

Q: Is Form TC-104E only for appeals in Utah?

A: Yes, Form TC-104E is specifically for appeals related to multiple parcels in Utah.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-104E MULTIPLE by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.