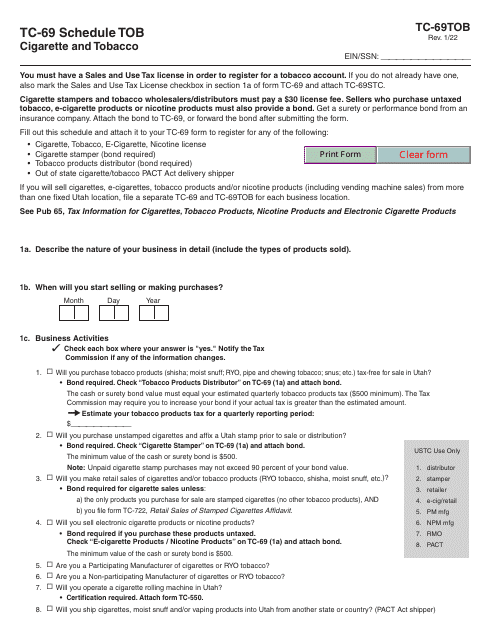

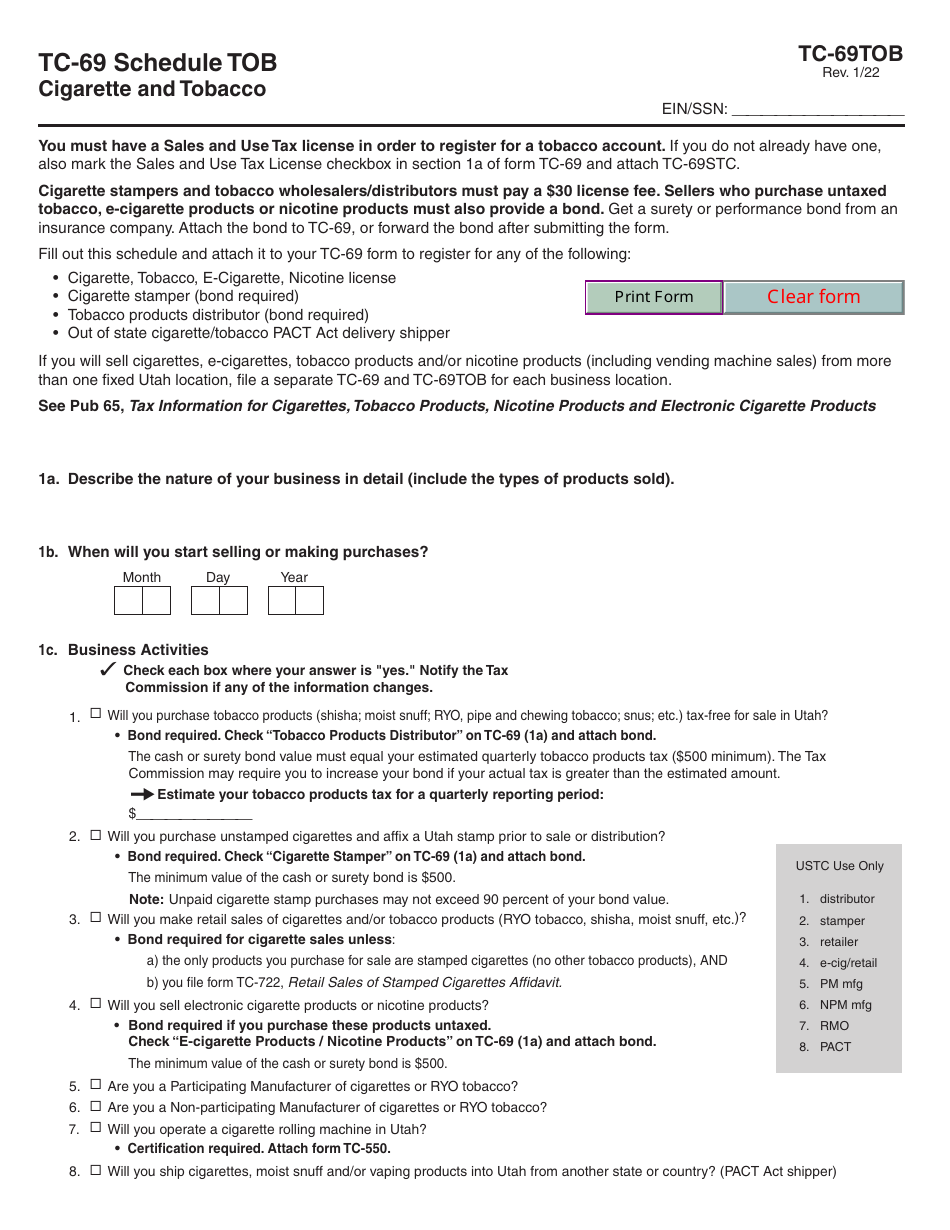

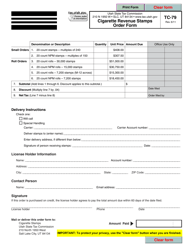

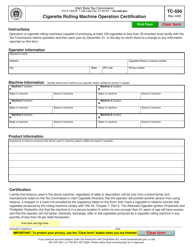

Form TC-69 Schedule TOB Cigarette and Tobacco - Utah

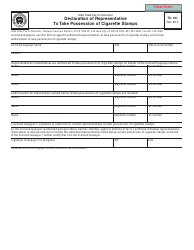

What Is Form TC-69 Schedule TOB?

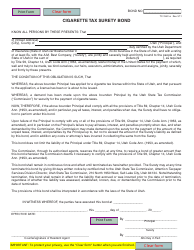

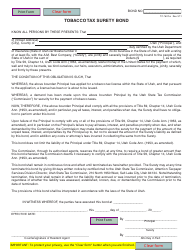

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-69, Utah State Business and Tax Registration. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-69 Schedule TOB?

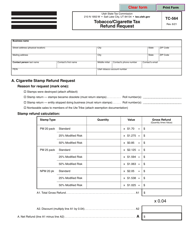

A: Form TC-69 Schedule TOB is a form used in Utah to report and pay the taxes on cigarettes and tobacco products.

Q: Who needs to file Form TC-69 Schedule TOB?

A: Any business in Utah that sells cigarettes or tobacco products needs to file Form TC-69 Schedule TOB.

Q: What information is required on Form TC-69 Schedule TOB?

A: Form TC-69 Schedule TOB requires information about the quantity and sales of cigarettes and tobacco products, as well as the taxes owed.

Q: When is Form TC-69 Schedule TOB due?

A: Form TC-69 Schedule TOB is due on or before the 22nd day of the month following the end of the reporting period.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 Schedule TOB by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.