This version of the form is not currently in use and is provided for reference only. Download this version of

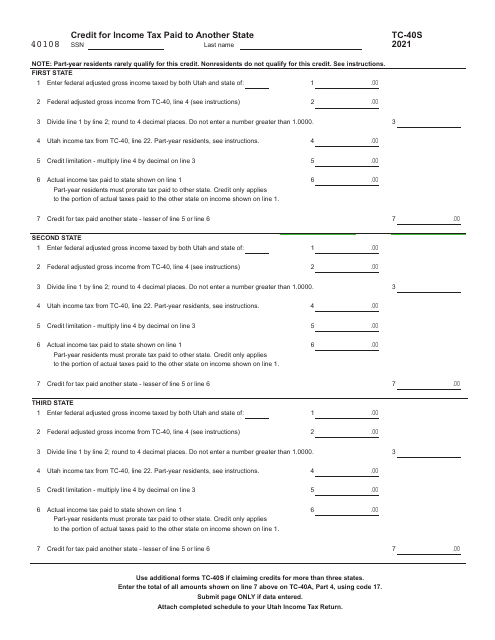

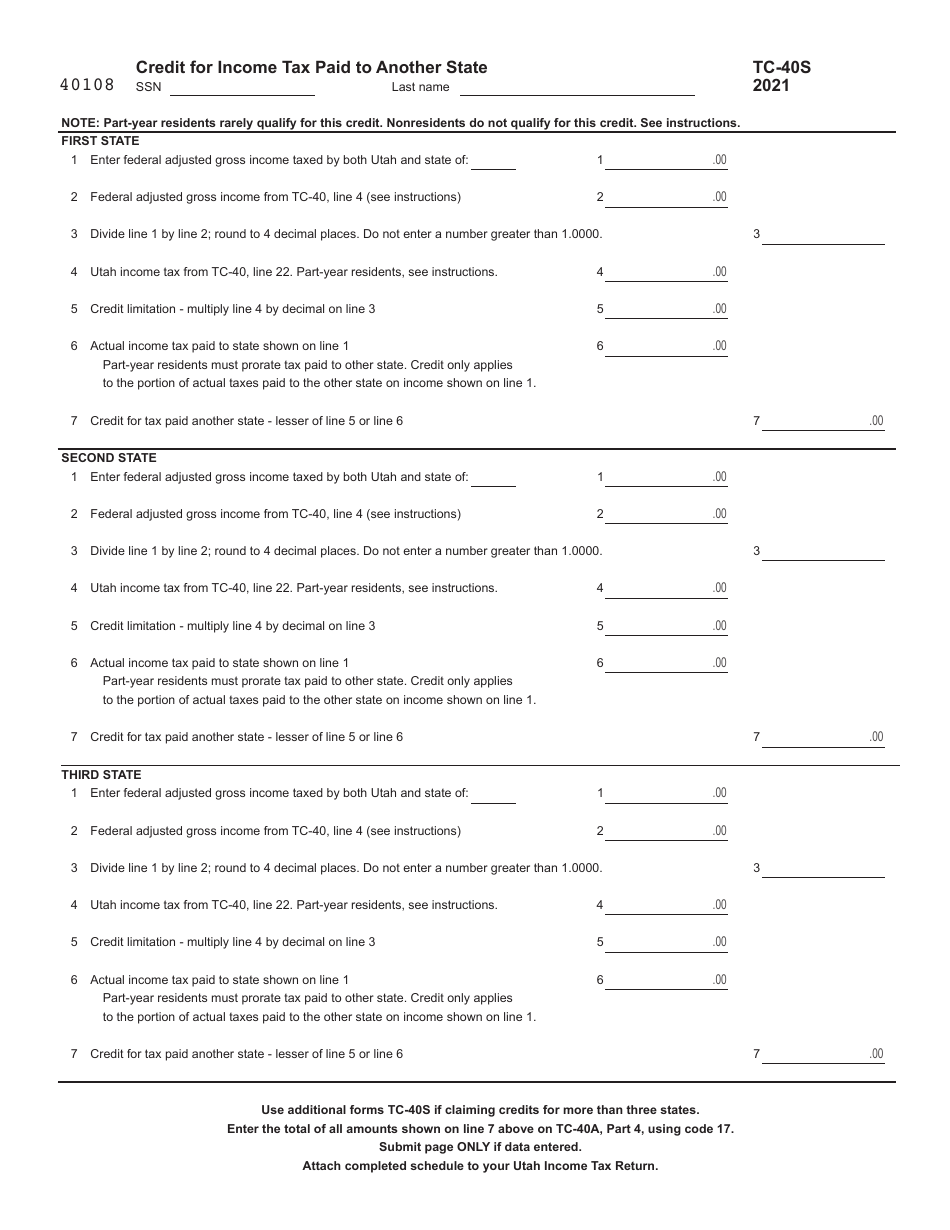

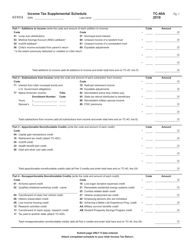

Form TC-40S

for the current year.

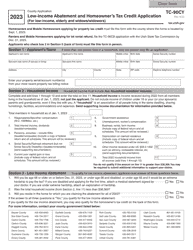

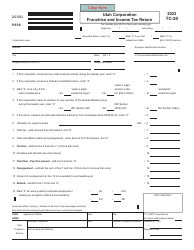

Form TC-40S Credit for Income Tax Paid to Another State - Utah

What Is Form TC-40S?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-40S?

A: Form TC-40S is a tax form used in the state of Utah.

Q: What is the purpose of Form TC-40S?

A: Form TC-40S is used to claim a credit for income tax paid to another state.

Q: Who can use Form TC-40S?

A: Form TC-40S can be used by Utah residents who have earned income in another state and have paid income tax to that state.

Q: How do I fill out Form TC-40S?

A: You will need to provide information about the income earned in the other state and the amount of income tax paid to that state.

Q: When is the deadline for filing Form TC-40S?

A: The deadline for filing Form TC-40S is the same as the deadline for filing your Utah state income tax return, which is usually April 15th.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40S by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.