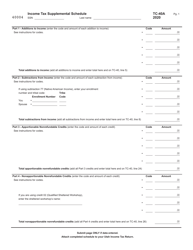

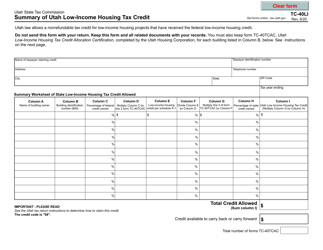

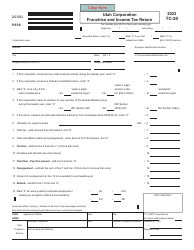

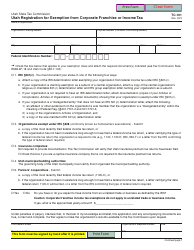

This version of the form is not currently in use and is provided for reference only. Download this version of

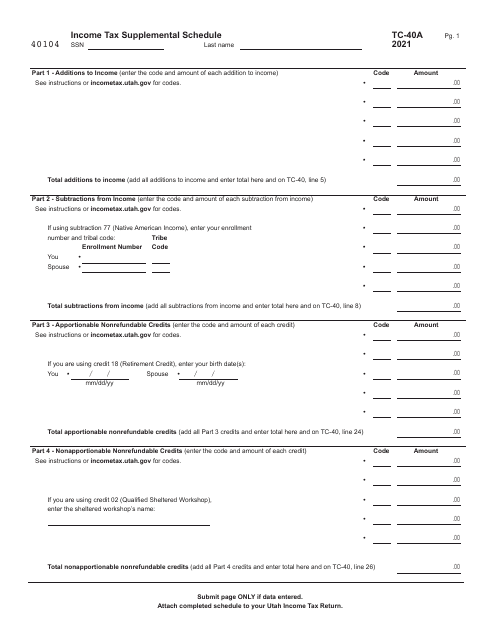

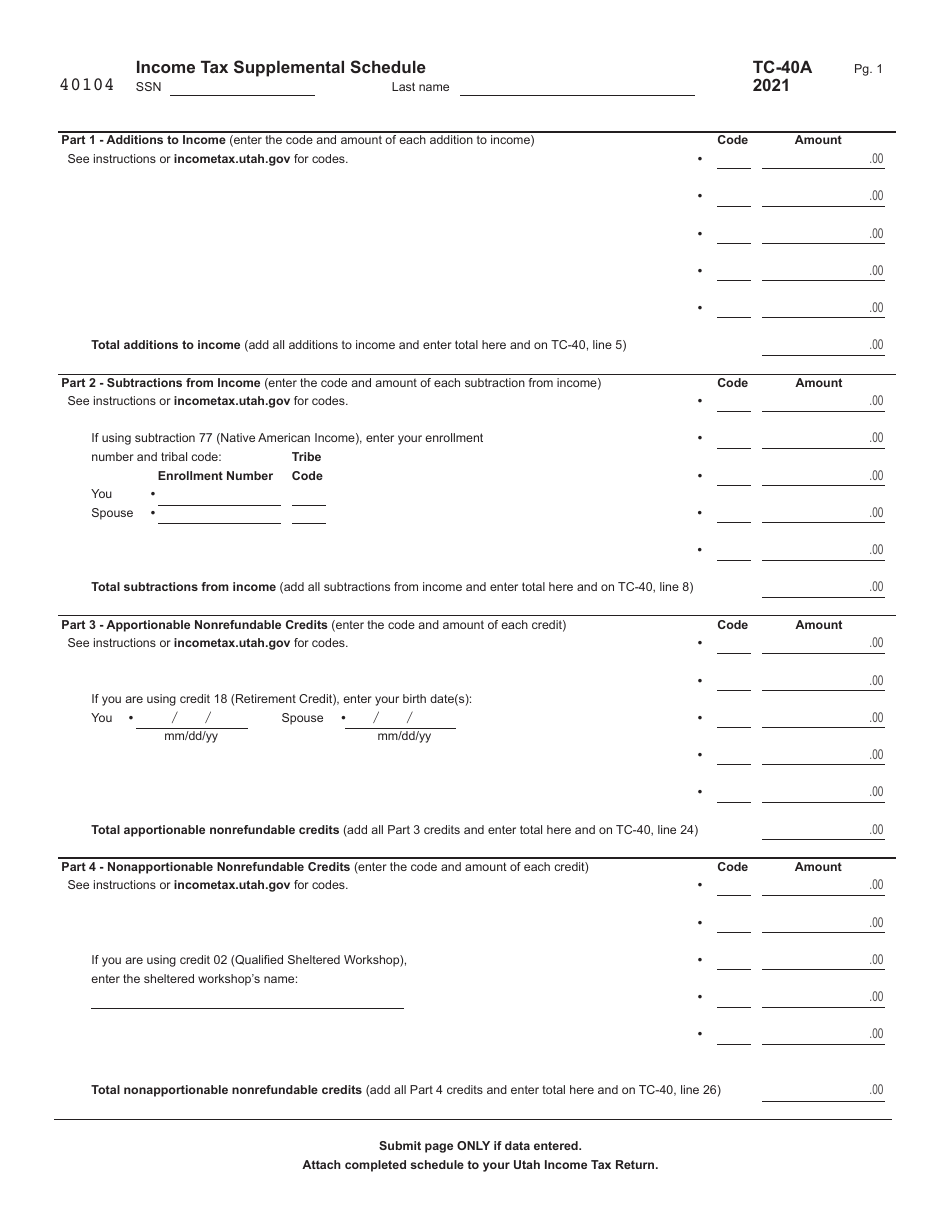

Form TC-40A

for the current year.

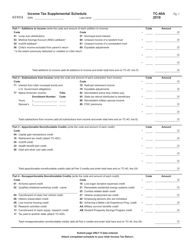

Form TC-40A Income Tax Supplemental Schedule - Utah

What Is Form TC-40A?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-40A?

A: Form TC-40A is the Income Tax Supplemental Schedule in Utah.

Q: Who needs to file Form TC-40A?

A: Individuals who need to report additional income or make adjustments to their Utah state tax return may need to file Form TC-40A.

Q: What is the purpose of Form TC-40A?

A: The purpose of Form TC-40A is to provide a supplemental schedule for reporting additional income or making adjustments to the Utah state tax return.

Q: How do I fill out Form TC-40A?

A: You will need to provide your personal information, details of the additional income or adjustments, and calculate the corresponding tax amounts.

Q: When is the deadline to file Form TC-40A?

A: The filing deadline for Form TC-40A is the same as the deadline for the Utah state tax return, which is generally April 15th.

Q: Do I need to include any supporting documents with Form TC-40A?

A: You may need to include supporting documents such as W-2 forms, 1099 forms, or other relevant tax documents, depending on the nature of the additional income or adjustments.

Q: What penalty could I face for not filing Form TC-40A?

A: If you are required to file Form TC-40A and fail to do so, you may be subject to penalties and interest on the additional tax owed.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40A by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.