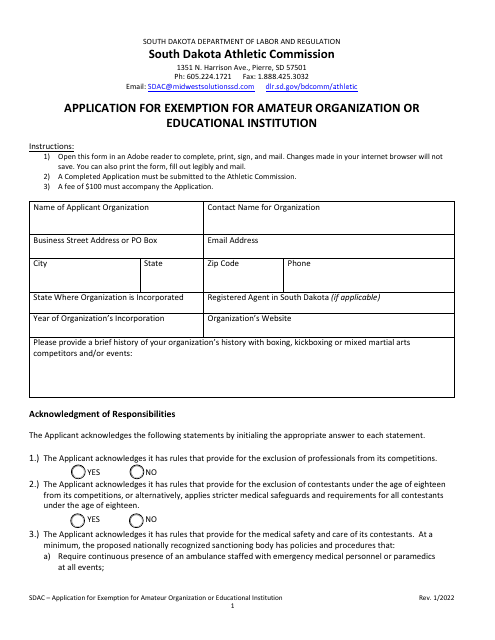

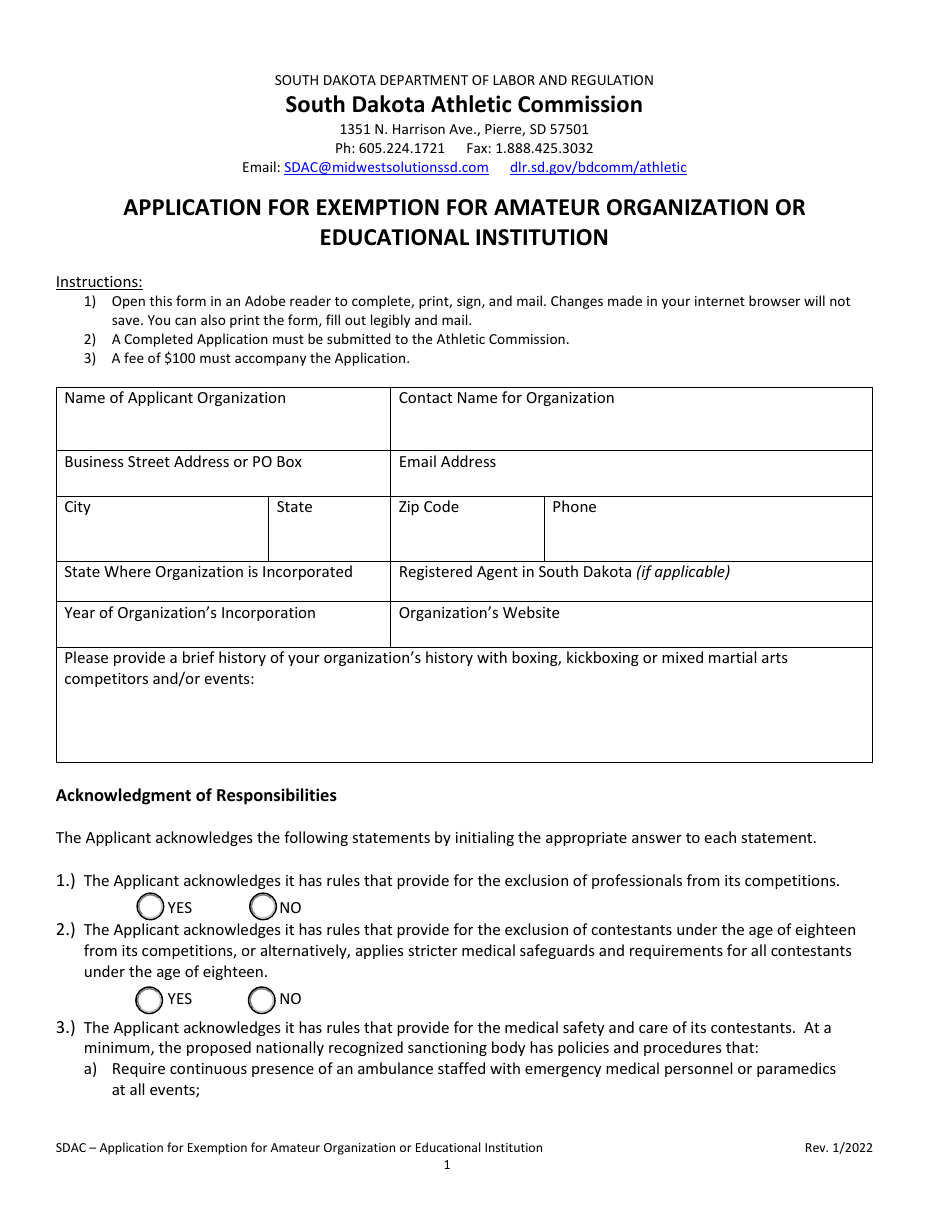

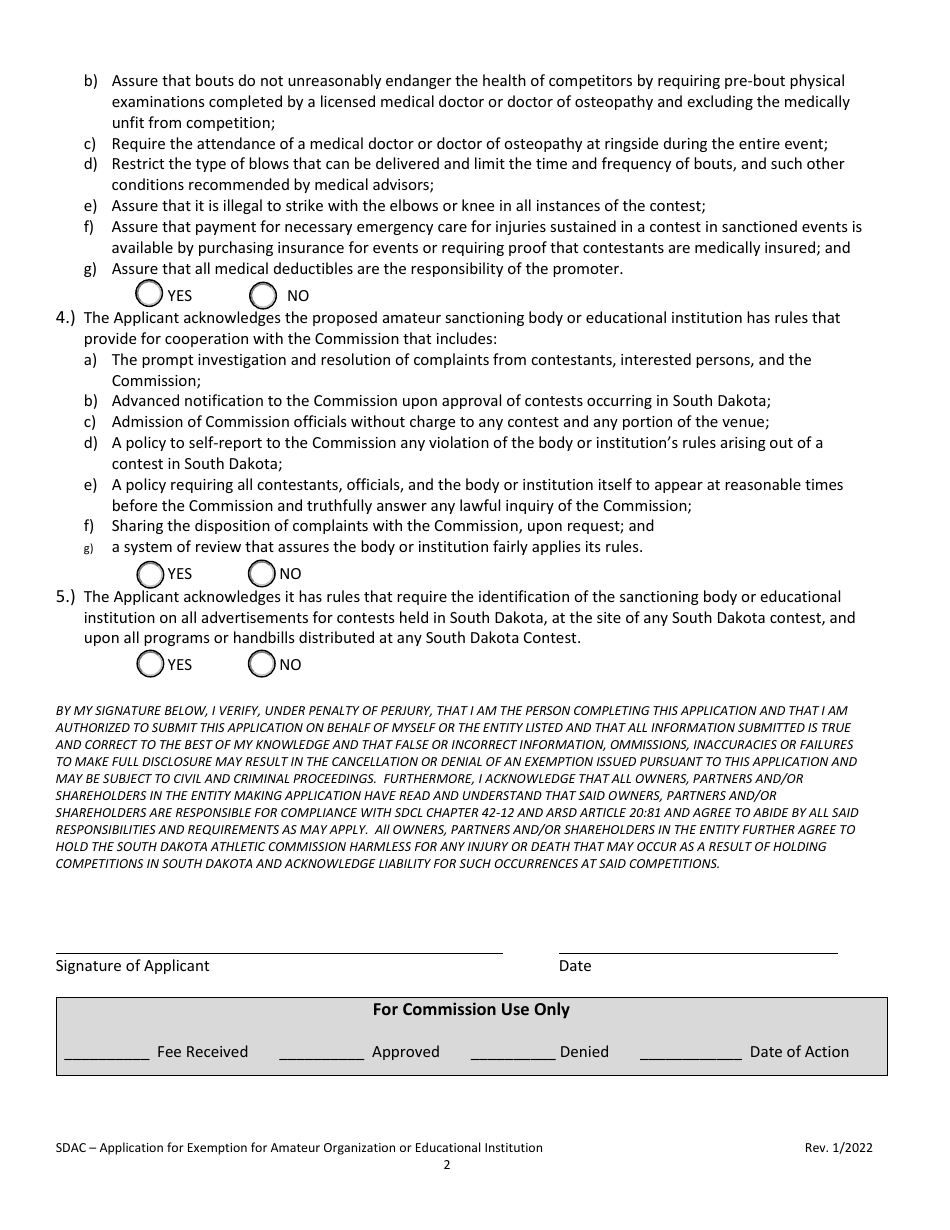

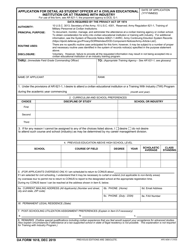

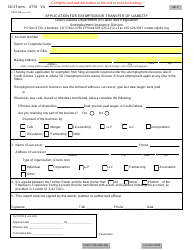

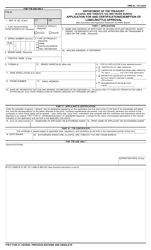

Application for Exemption for Amateur Organization or Educational Institution - South Dakota

Application for Exemption for Amateur Organization or Educational Institution is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

Q: What is an exemption for an Amateur Organization or Educational Institution?

A: An exemption for an Amateur Organization or Educational Institution is a special status granted to certain organizations or institutions that allows them to be exempt from certain taxes or fees.

Q: Who is eligible for an exemption in South Dakota?

A: Amateur organizations and educational institutions may be eligible for an exemption in South Dakota.

Q: What are the benefits of obtaining an exemption?

A: Obtaining an exemption can provide certain privileges, such as being exempt from paying certain taxes or fees.

Q: How can an organization or institution apply for an exemption?

A: To apply for an exemption, an organization or institution must complete the Application for Exemption for an Amateur Organization or Educational Institution in South Dakota.

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.