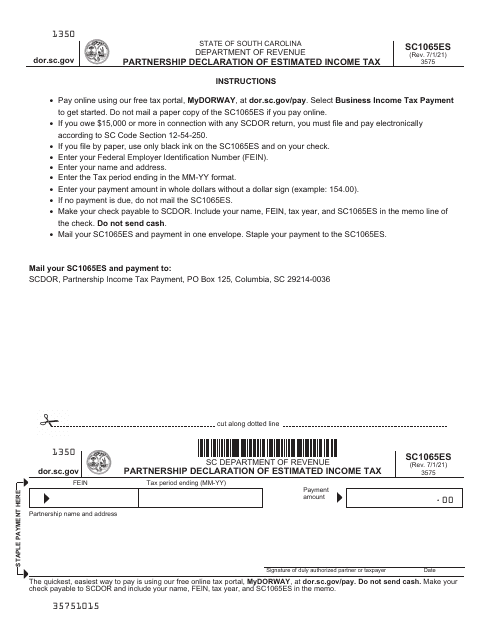

Form SC1065ES Partnership Declaration of Estimated Income Tax - South Carolina

What Is Form SC1065ES?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SC1065ES?

A: Form SC1065ES is the Partnership Declaration of Estimated Income Tax form for South Carolina.

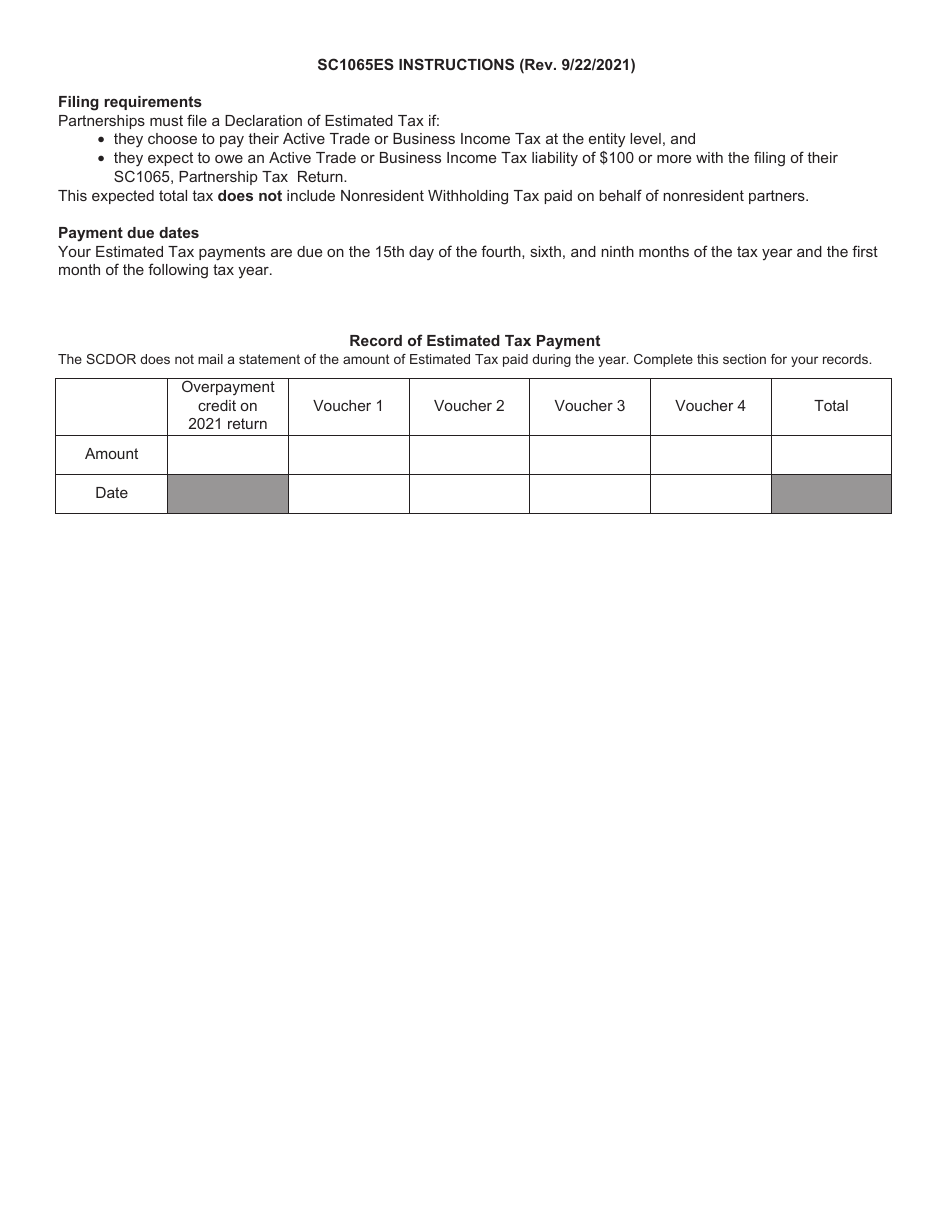

Q: Who needs to file Form SC1065ES?

A: Partnerships in South Carolina need to file Form SC1065ES.

Q: What is the purpose of Form SC1065ES?

A: Form SC1065ES is used to declare and pay estimated income tax for partnerships in South Carolina.

Q: When is Form SC1065ES due?

A: Form SC1065ES is due on or before the 15th day of the fourth month following the close of the taxable year.

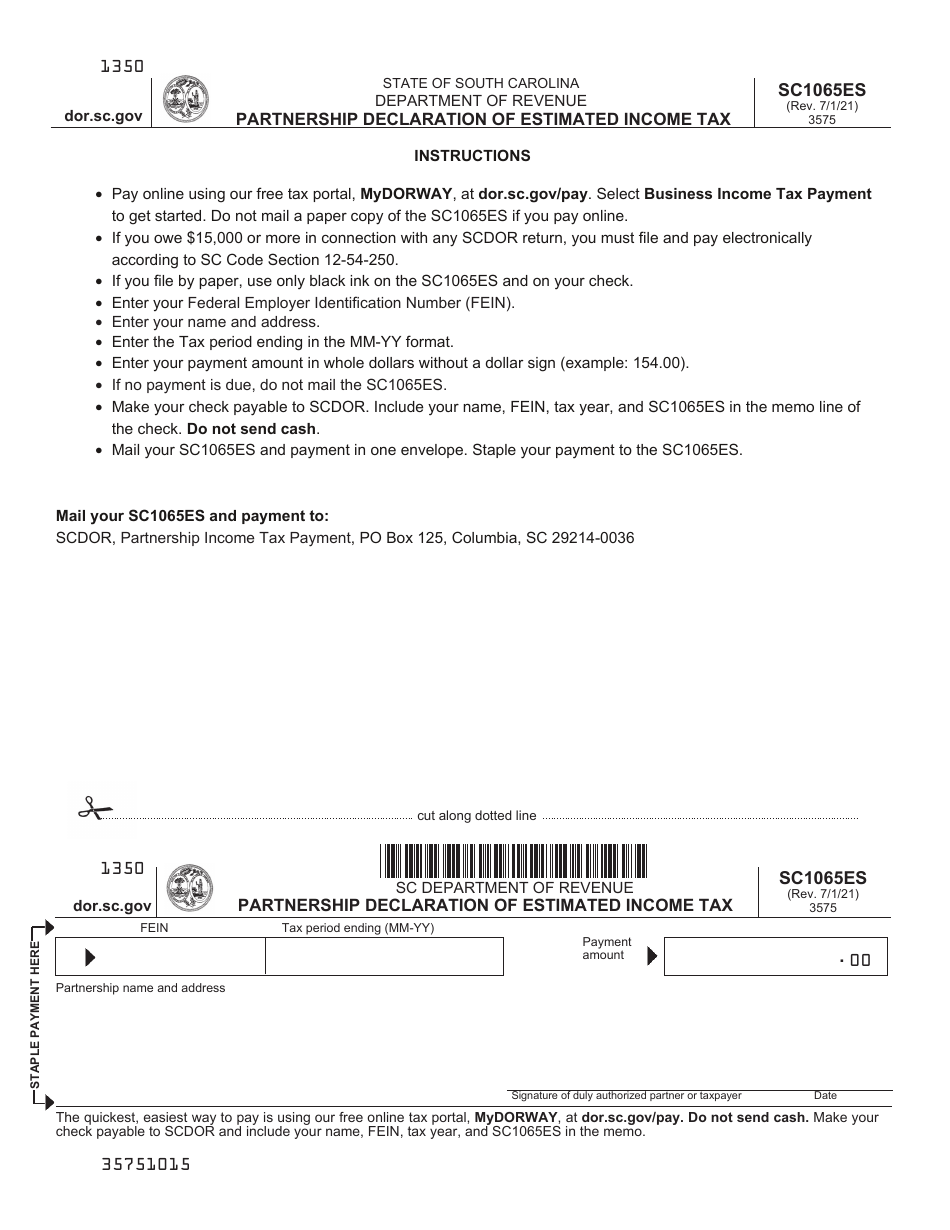

Q: What information is required on Form SC1065ES?

A: Form SC1065ES requires information such as the partnership's name, address, federal employer identification number, estimated tax due, and payment information.

Q: What happens if I don't file Form SC1065ES?

A: If you fail to file Form SC1065ES or pay the estimated tax on time, you may be subject to penalties and interest.

Q: Can I amend Form SC1065ES?

A: Yes, if you need to make changes to your estimated tax declaration, you can file an amended Form SC1065ES.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1065ES by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.