This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-435

for the current year.

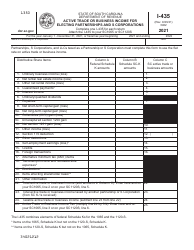

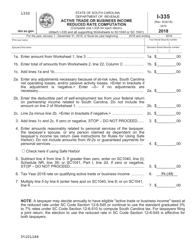

Form I-435 Active Trade or Business Income for Electing Partnerships and S Corporations - South Carolina

What Is Form I-435?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-435?

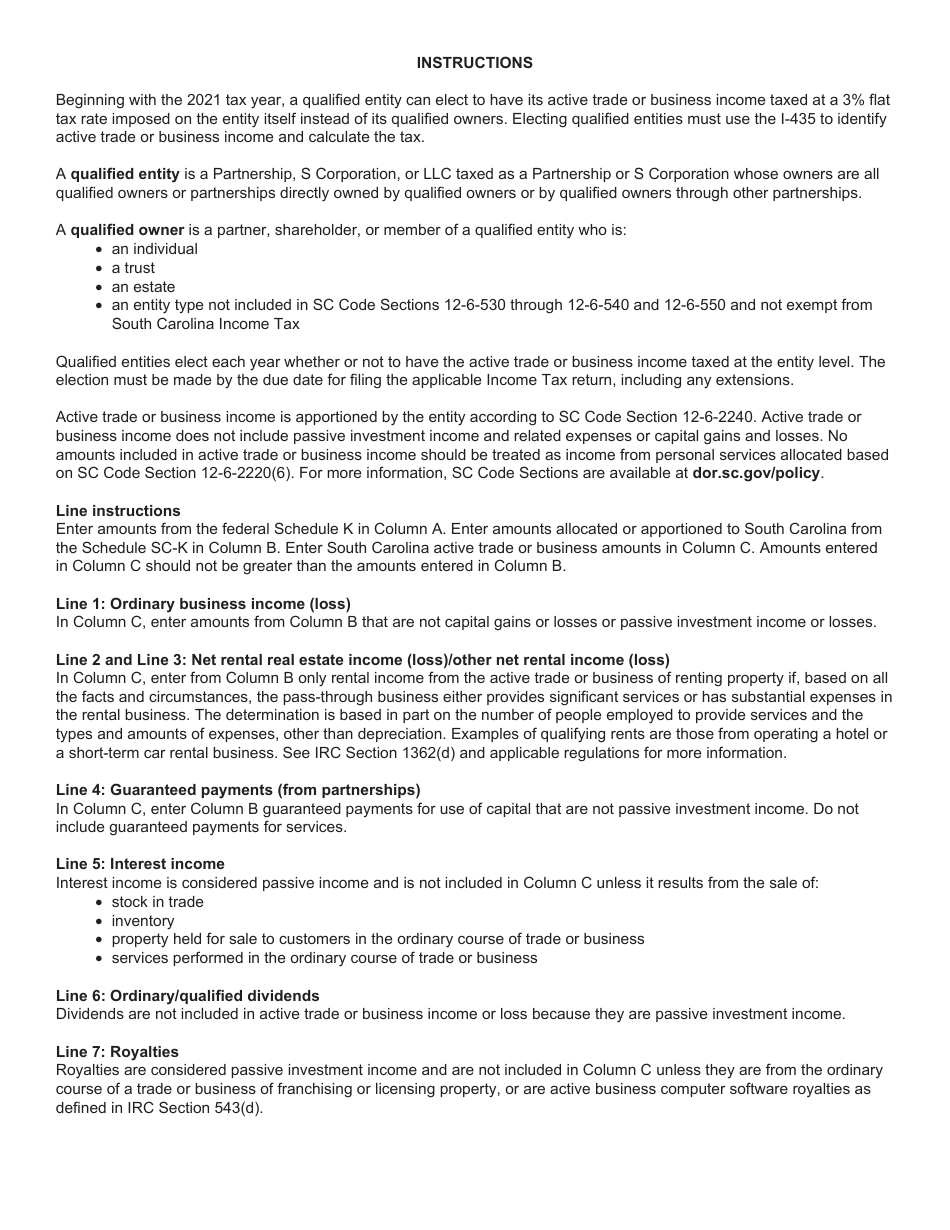

A: Form I-435 is used to report active trade or business income for electing partnerships and S corporations in South Carolina.

Q: Who needs to file Form I-435?

A: Partnerships and S corporations in South Carolina that have elected to have the income taxed at the entity level instead of the individual level need to file Form I-435.

Q: What is active trade or business income?

A: Active trade or business income refers to income generated from the regular operations of a partnership or S corporation.

Q: When is the deadline to file Form I-435?

A: Form I-435 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form I-435?

A: Yes, there are penalties for late filing of Form I-435. It is important to file the form on time to avoid these penalties.

Q: What should I do if I made an error on my Form I-435?

A: If you made an error on your Form I-435, you should file an amended Form I-435 as soon as possible to correct the error.

Form Details:

- Released on September 23, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-435 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.