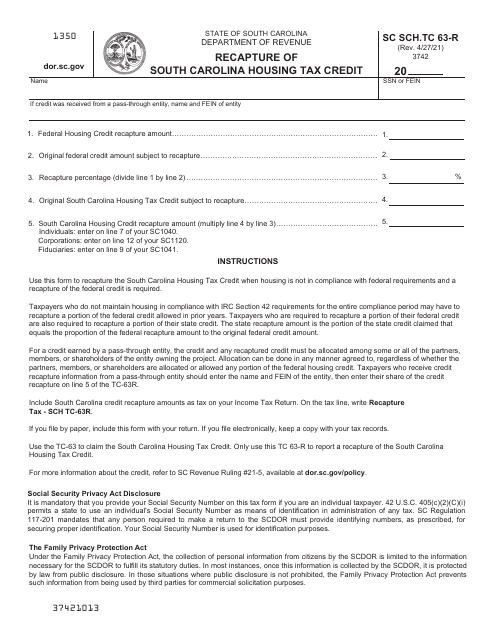

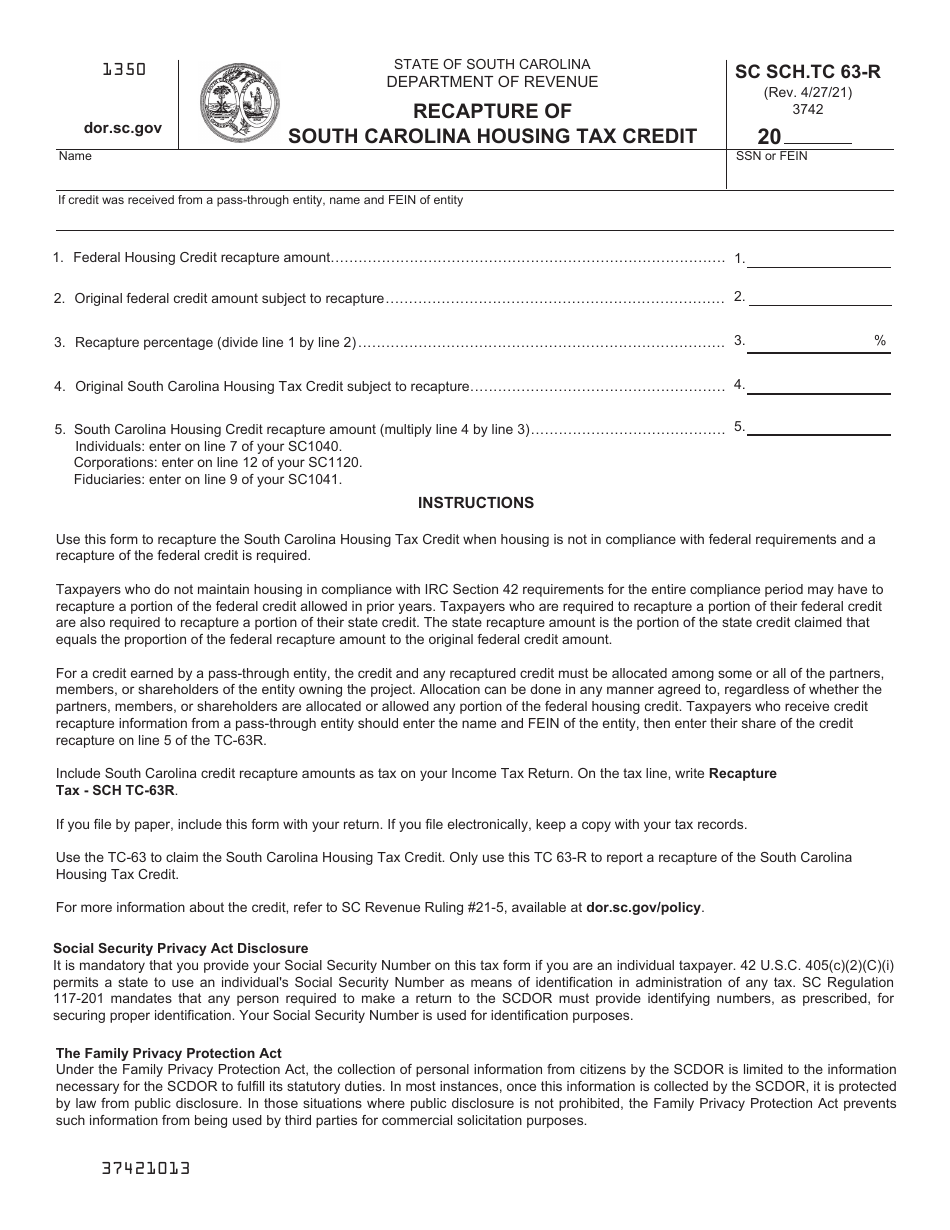

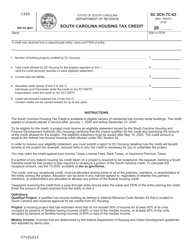

Schedule TC 63-R Recapture of South Carolina Housing Tax Credit - South Carolina

What Is Schedule TC 63-R?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC 63-R?

A: TC 63-R refers to the recapture of South Carolina Housing Tax Credit.

Q: What is the purpose of TC 63-R?

A: The purpose of TC 63-R is to recapture the South Carolina Housing Tax Credit.

Q: What does the South Carolina Housing Tax Credit refer to?

A: The South Carolina Housing Tax Credit refers to a tax credit for housing in South Carolina.

Q: What does the term 'recapture' mean in this context?

A: In this context, 'recapture' means reclaiming or taking back the tax credit.

Q: Who is responsible for the recapture of the South Carolina Housing Tax Credit?

A: The responsibility for the recapture of the South Carolina Housing Tax Credit lies with the relevant authorities in South Carolina.

Q: What is the schedule of TC 63-R?

A: The schedule of TC 63-R outlines the specific dates and deadlines for the recapture process.

Q: Is TC 63-R applicable in any other state?

A: No, TC 63-R is specific to the state of South Carolina.

Q: What happens if the South Carolina Housing Tax Credit is recaptured?

A: If the South Carolina Housing Tax Credit is recaptured, the taxpayer may be required to pay back the credit or face other penalties.

Form Details:

- Released on April 27, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule TC 63-R by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.