This version of the form is not currently in use and is provided for reference only. Download this version of

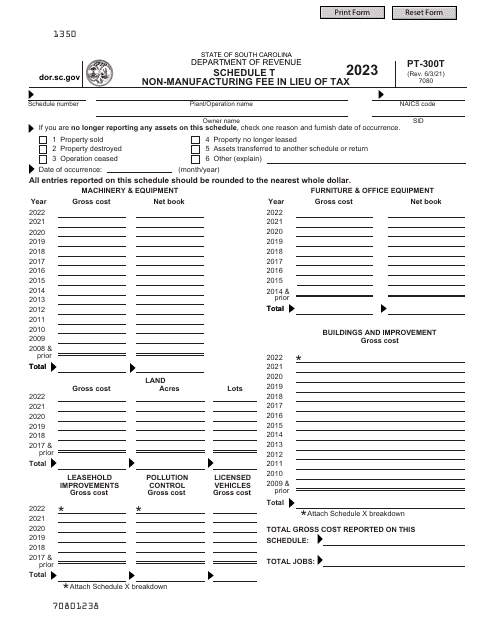

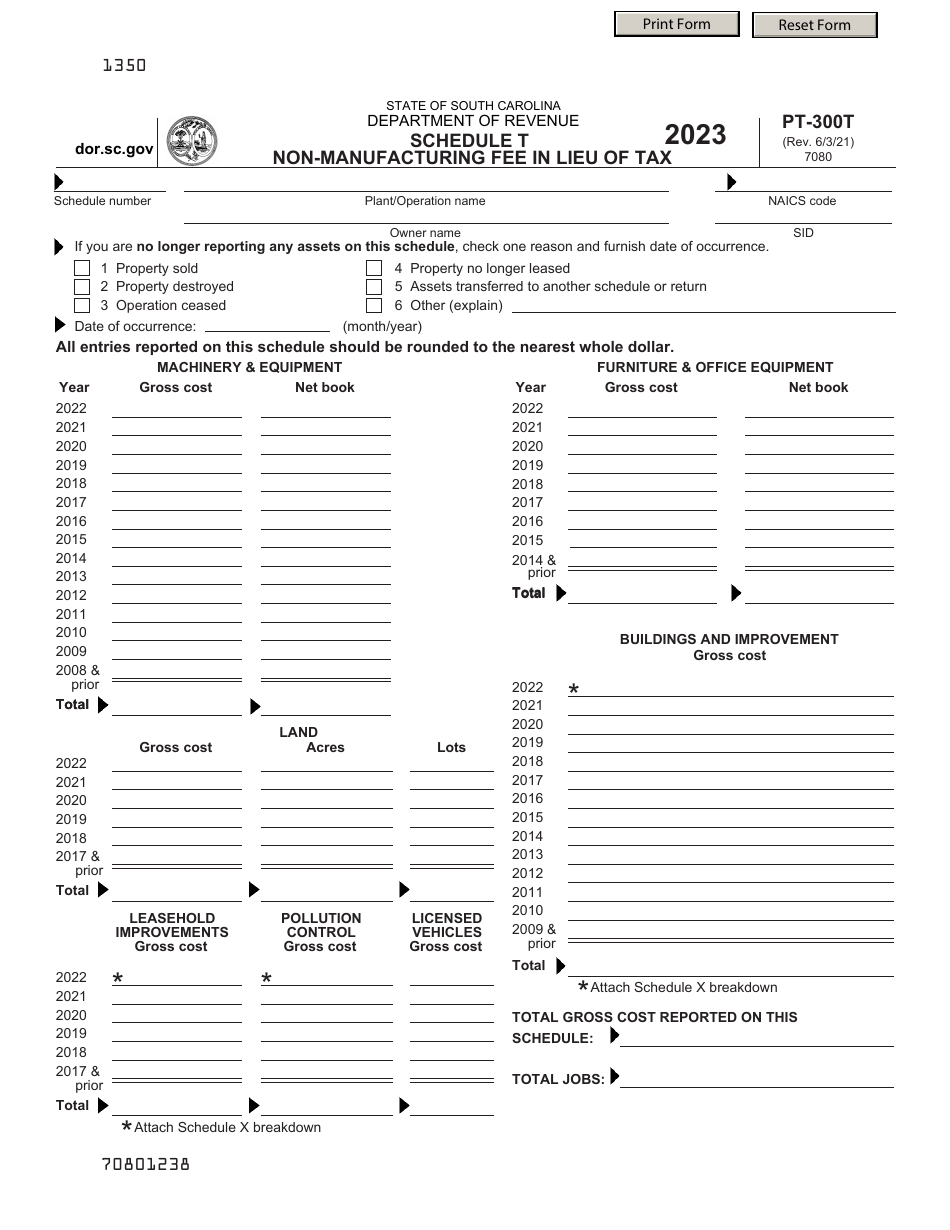

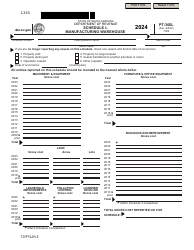

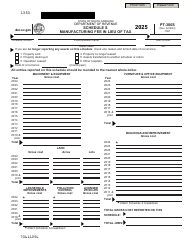

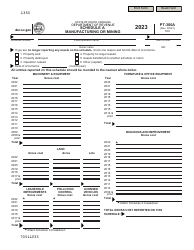

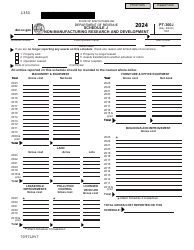

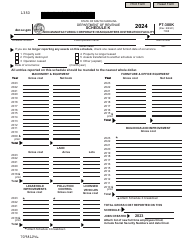

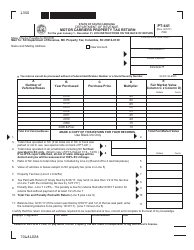

Form PT-300 Schedule T

for the current year.

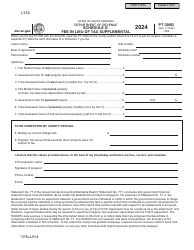

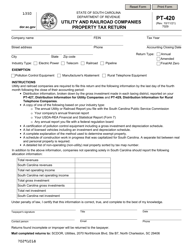

Form PT-300 Schedule T Non-manufacturing Fee in Lieu of Tax - South Carolina

What Is Form PT-300 Schedule T?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina.The document is a supplement to Form PT-300, Property Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300 Schedule T?

A: Form PT-300 Schedule T is a tax form used in South Carolina.

Q: What is the purpose of Form PT-300 Schedule T?

A: The purpose of Form PT-300 Schedule T is to calculate the non-manufacturing fee in lieu of tax.

Q: Who is required to file Form PT-300 Schedule T?

A: Certain businesses in South Carolina are required to file Form PT-300 Schedule T if they are eligible for the non-manufacturing fee in lieu of tax.

Q: What is the non-manufacturing fee in lieu of tax?

A: The non-manufacturing fee in lieu of tax is a payment made by certain businesses in South Carolina in place of traditional property taxes.

Q: How do I fill out Form PT-300 Schedule T?

A: To fill out Form PT-300 Schedule T, you will need to provide information about your business and calculate the amount of the non-manufacturing fee in lieu of tax.

Q: When is the deadline to file Form PT-300 Schedule T?

A: The deadline to file Form PT-300 Schedule T is usually the same as the deadline for filing the business's annual tax return in South Carolina.

Form Details:

- Released on June 3, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-300 Schedule T by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.