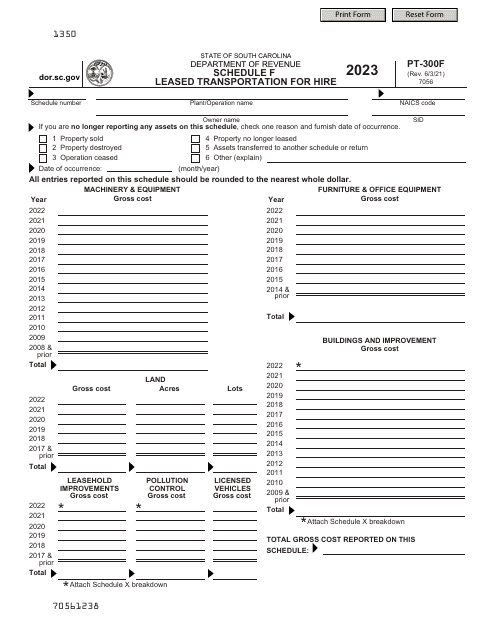

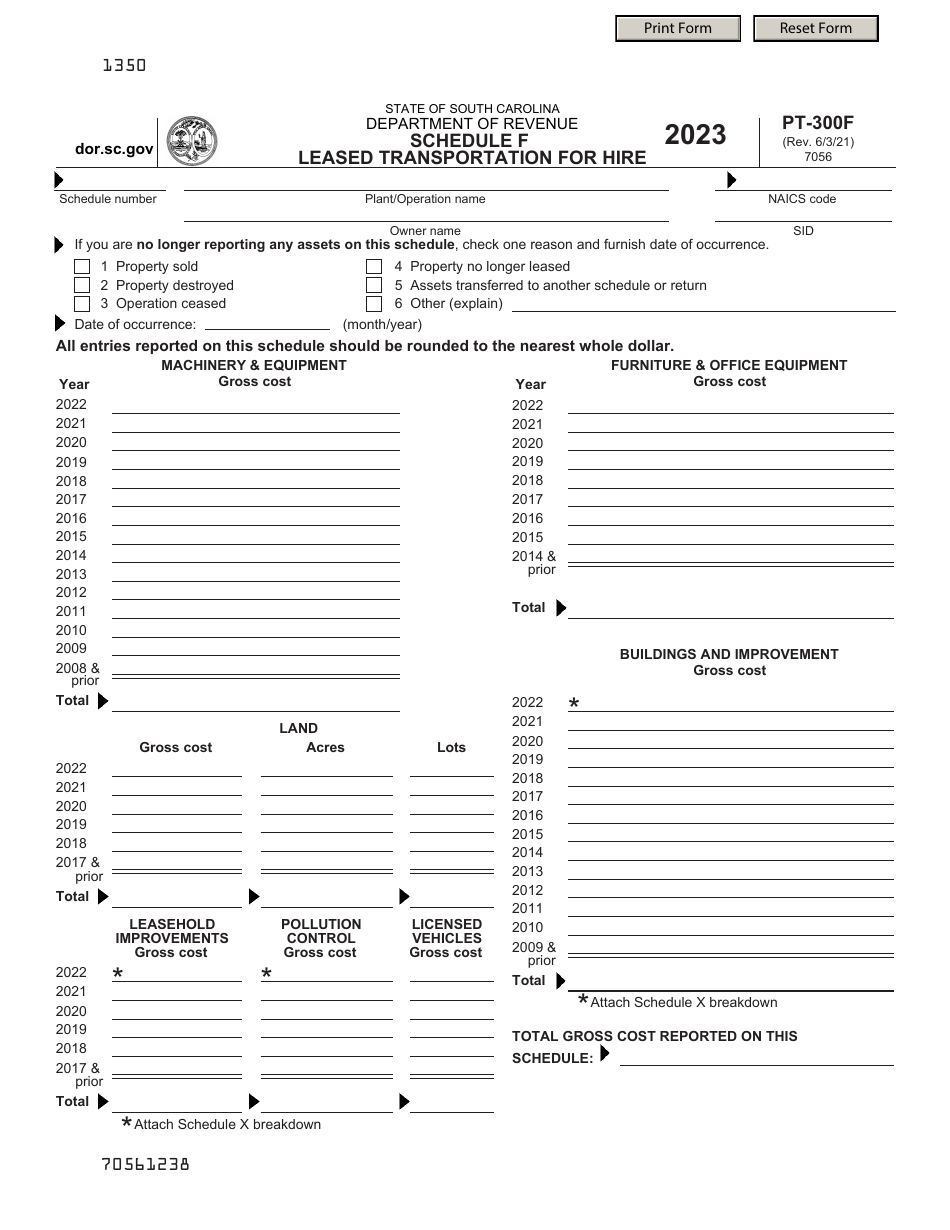

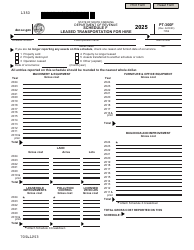

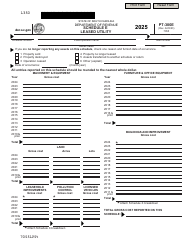

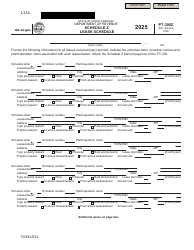

Form PT-300 Schedule F Leased Transportation for Hire - South Carolina

What Is Form PT-300 Schedule F?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina.The document is a supplement to Form PT-300, Property Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300 Schedule F?

A: Form PT-300 Schedule F is a tax form used in South Carolina for reporting leased transportation for hire.

Q: What is leased transportation for hire?

A: Leased transportation for hire refers to the renting or leasing of vehicles to transport passengers or goods for a fee.

Q: Who needs to file Form PT-300 Schedule F?

A: Anyone who leases vehicles for transportation for hire in South Carolina needs to file Form PT-300 Schedule F.

Q: What information is required on Form PT-300 Schedule F?

A: Form PT-300 Schedule F requires information about the leased vehicles, the lessee, and the amount of lease tax due.

Q: When is the deadline to file Form PT-300 Schedule F?

A: Form PT-300 Schedule F must be filed annually by January 31st of the following year.

Q: Is there a penalty for late filing of Form PT-300 Schedule F?

A: Yes, there is a penalty for late filing of Form PT-300 Schedule F. The penalty amount varies depending on the delay.

Q: Are there any exemptions or deductions available for leased transportation for hire?

A: Yes, there are certain exemptions and deductions available for leased transportation for hire in South Carolina. It is recommended to consult with a tax professional or the Department of Revenue for specific details.

Q: What should I do if I have further questions about Form PT-300 Schedule F?

A: If you have further questions about Form PT-300 Schedule F, you should contact the South Carolina Department of Revenue for assistance.

Form Details:

- Released on June 3, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-300 Schedule F by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.