This version of the form is not currently in use and is provided for reference only. Download this version of

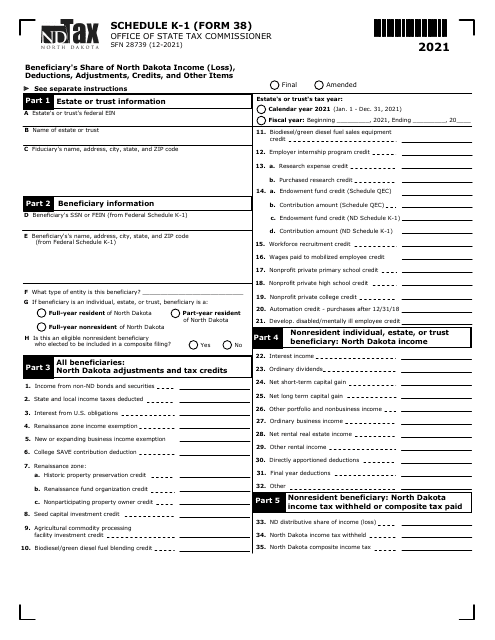

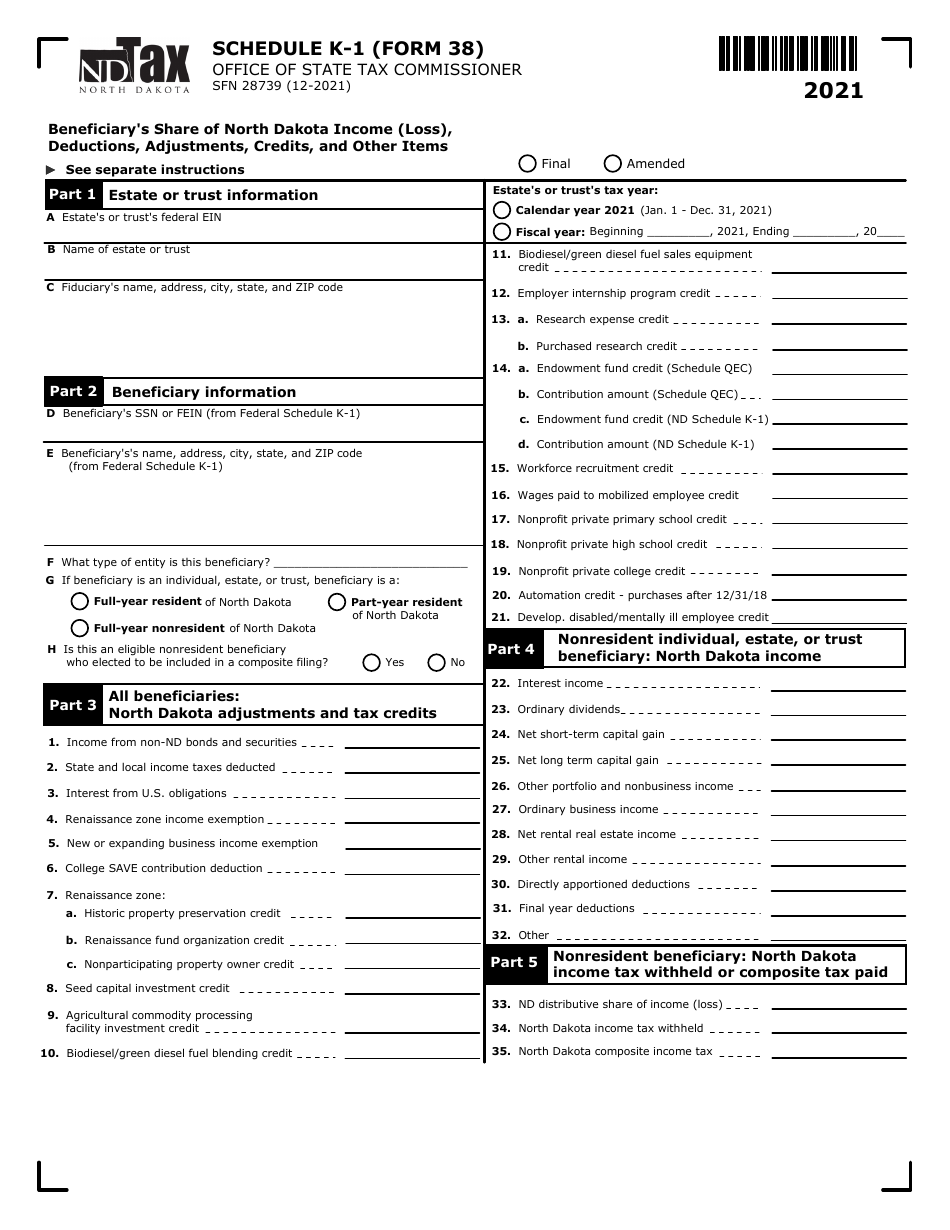

Form 38 (SFN28739) Schedule K-1

for the current year.

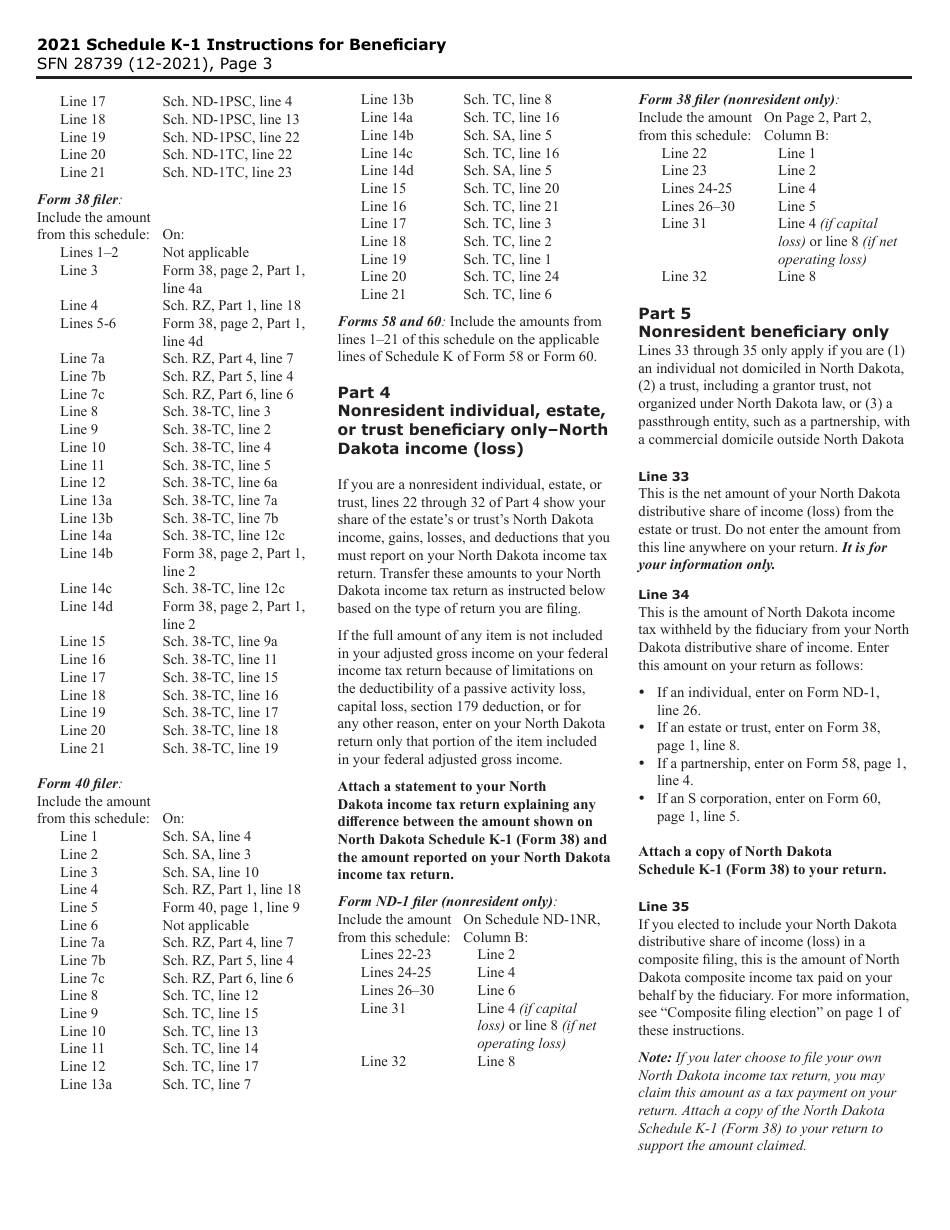

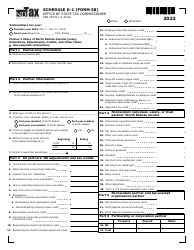

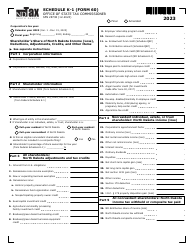

Form 38 (SFN28739) Schedule K-1 Beneficiary's Share of North Dakota Income (Loss), Deductions, Adjustments, Credits, and Other Items - North Dakota

What Is Form 38 (SFN28739) Schedule K-1?

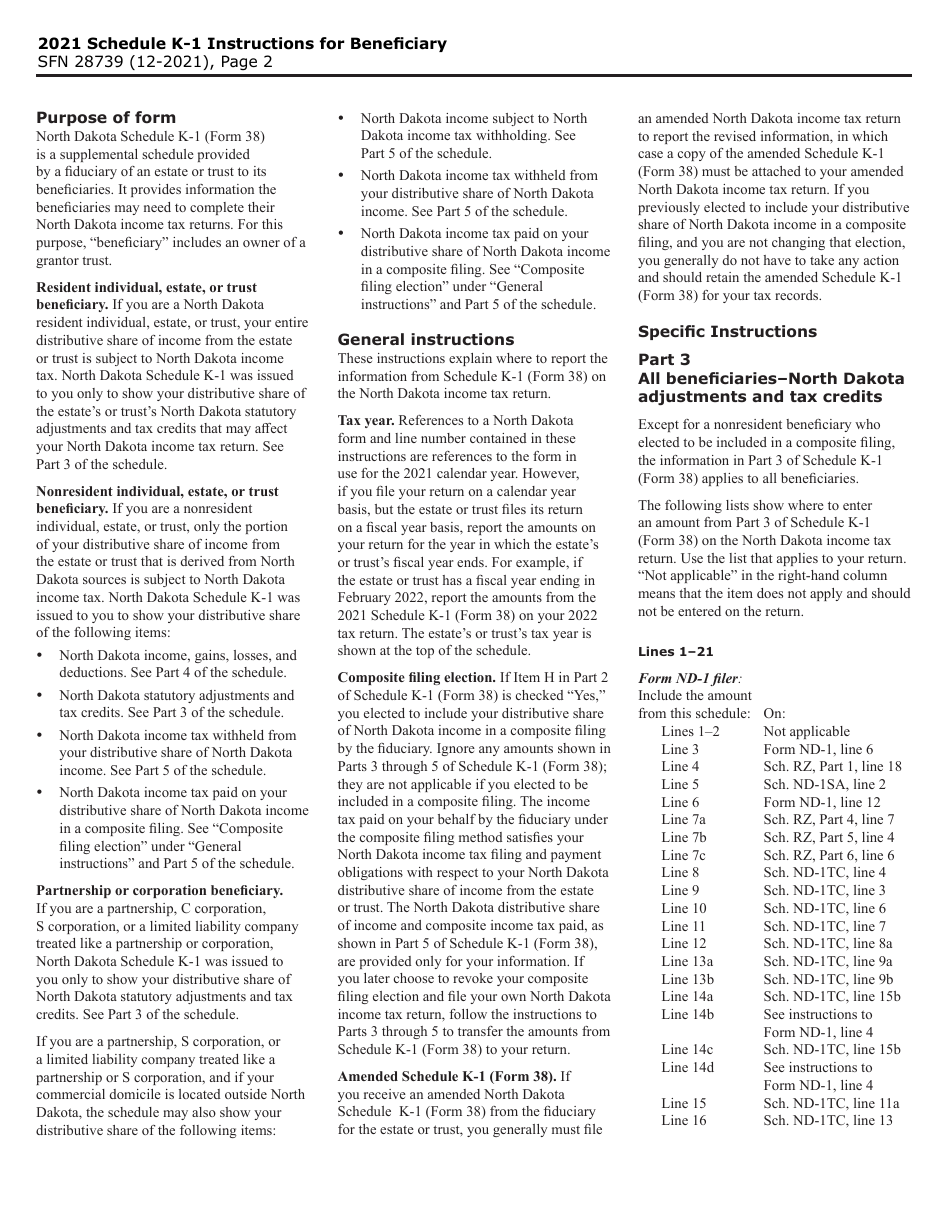

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38 (SFN28739)?

A: Form 38 (SFN28739) is Schedule K-1 Beneficiary's Share of North Dakota Income (Loss), Deductions, Adjustments, Credits, and Other Items for North Dakota.

Q: What does Schedule K-1 Beneficiary's Share of North Dakota Income (Loss) mean?

A: Schedule K-1 Beneficiary's Share of North Dakota Income (Loss) refers to the portion of income or loss that a beneficiary has earned or incurred in North Dakota.

Q: What are deductions, adjustments, credits, and other items on Form 38?

A: Deductions, adjustments, credits, and other items on Form 38 include various expenses, tax credits, and other financial transactions that may affect the beneficiary's income.

Q: Who needs to file Form 38?

A: Form 38 should be filed by beneficiaries who have received income or incurred losses in North Dakota and need to report their share of such items.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38 (SFN28739) Schedule K-1 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.