This version of the form is not currently in use and is provided for reference only. Download this version of

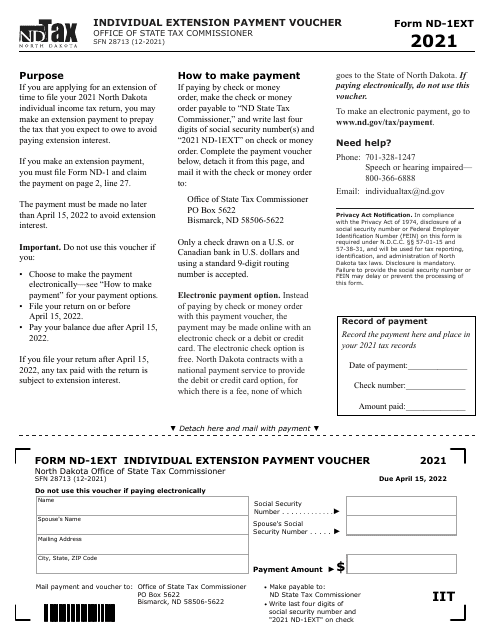

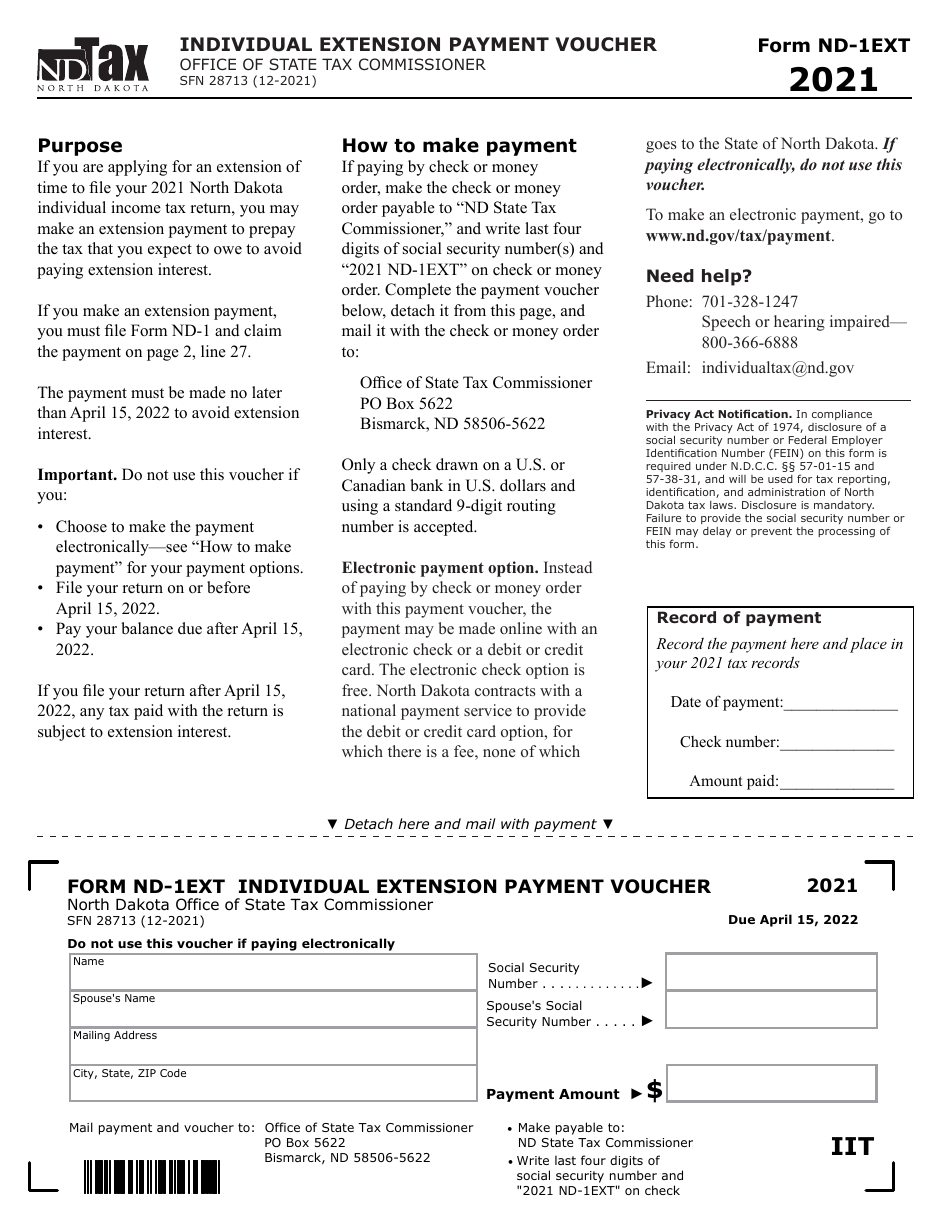

Form ND-1EXT (SFN28713)

for the current year.

Form ND-1EXT (SFN28713) Individual Extension Payment Voucher - North Dakota

What Is Form ND-1EXT (SFN28713)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1EXT?

A: Form ND-1EXT is the Individual Extension Payment Voucher for North Dakota.

Q: What is the purpose of Form ND-1EXT?

A: The purpose of Form ND-1EXT is to make a payment for an individual extension in North Dakota.

Q: When is Form ND-1EXT due?

A: Form ND-1EXT is due on the same date as your North Dakota individual income tax return, which is usually April 15th.

Q: Do I need to file Form ND-1EXT if I am not extending my tax return?

A: No, you only need to file Form ND-1EXT if you are making a payment for an individual extension.

Q: Can I file Form ND-1EXT electronically?

A: Yes, you can file Form ND-1EXT electronically if you are using an approved tax software or a tax professional.

Q: Is Form ND-1EXT only for North Dakota residents?

A: No, Form ND-1EXT is for both North Dakota residents and non-residents who are making an individual extension payment.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1EXT (SFN28713) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.