This version of the form is not currently in use and is provided for reference only. Download this version of

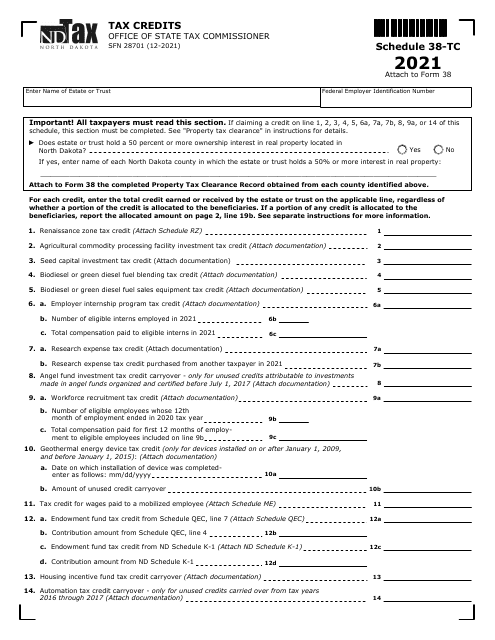

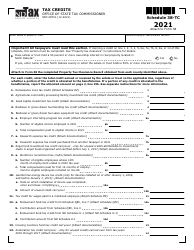

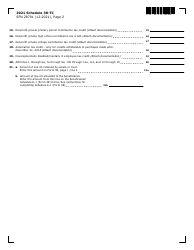

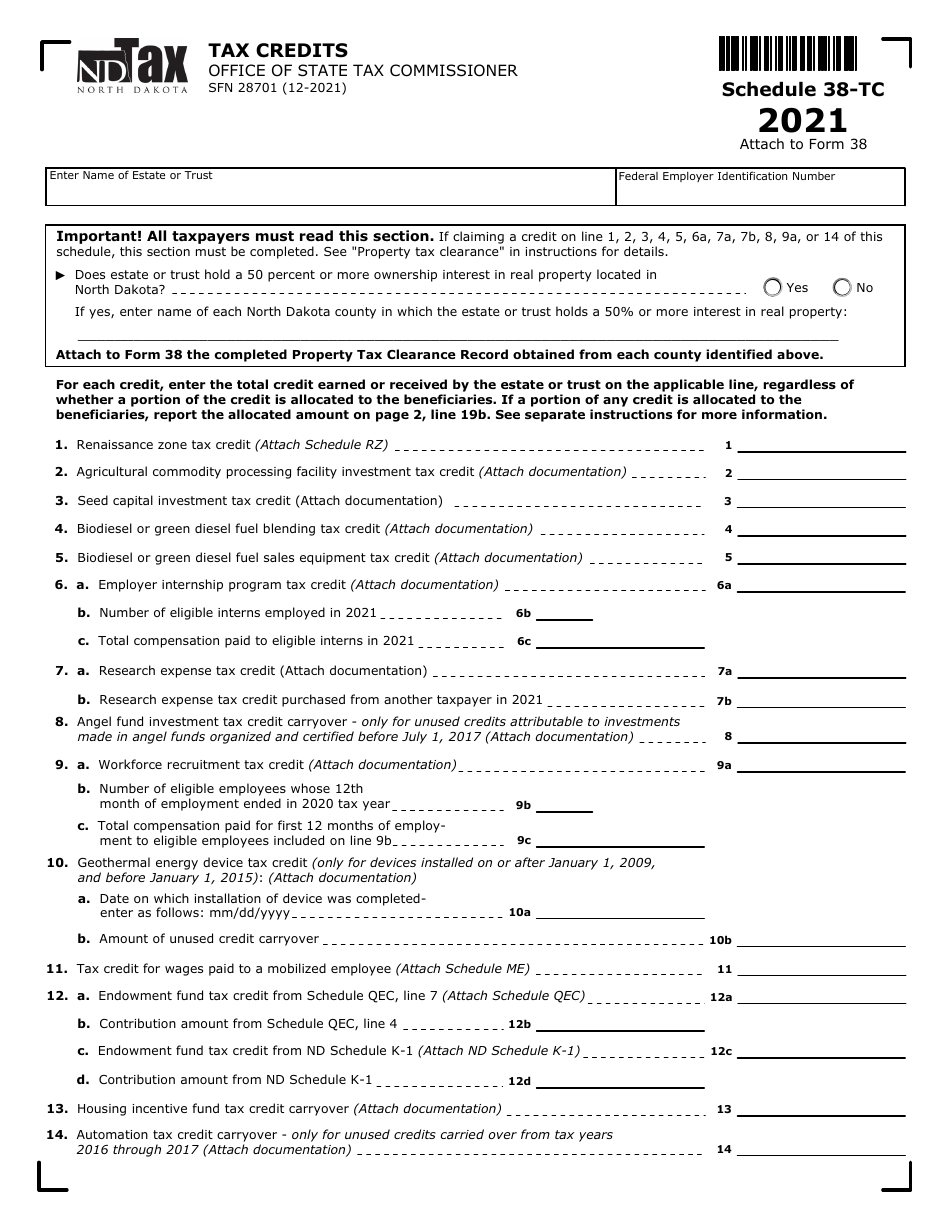

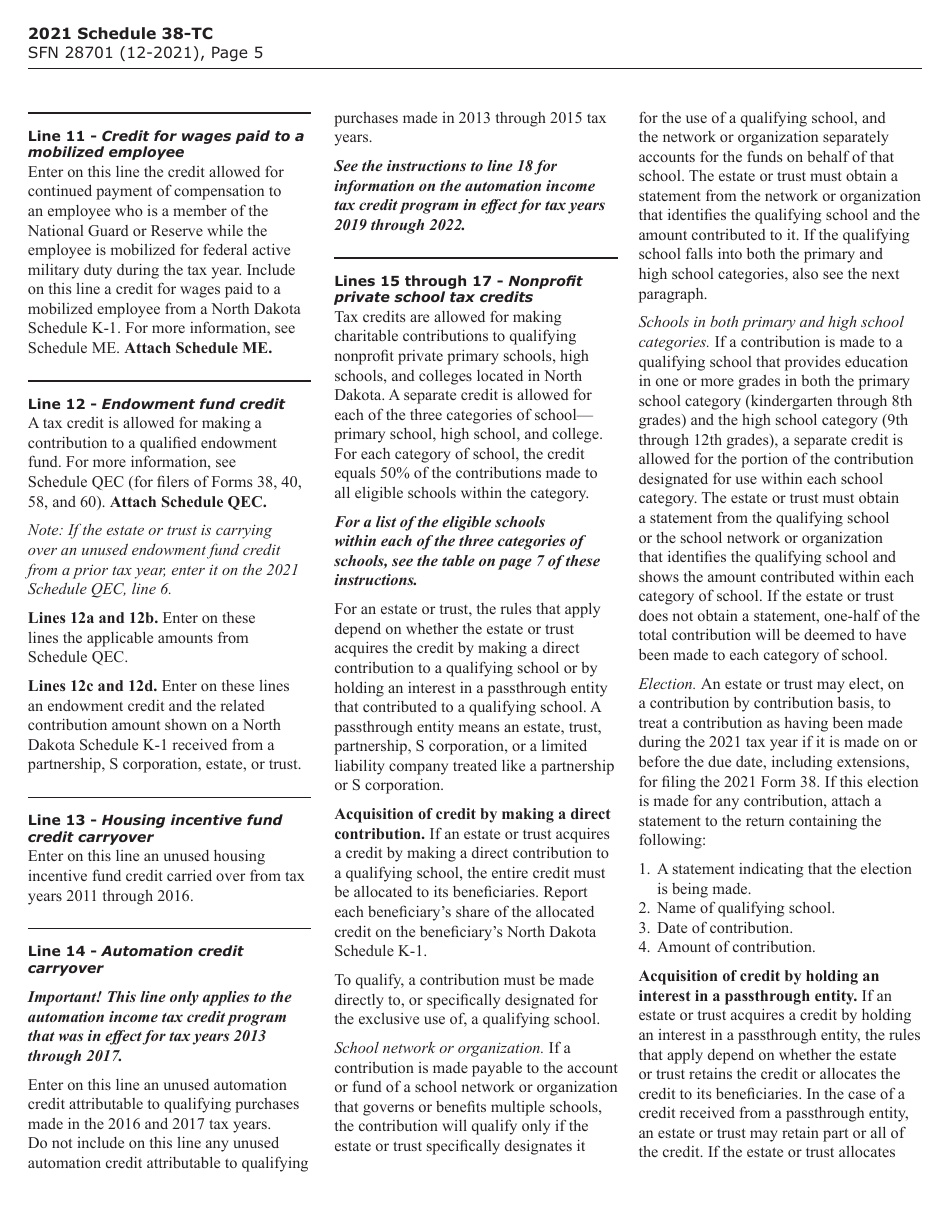

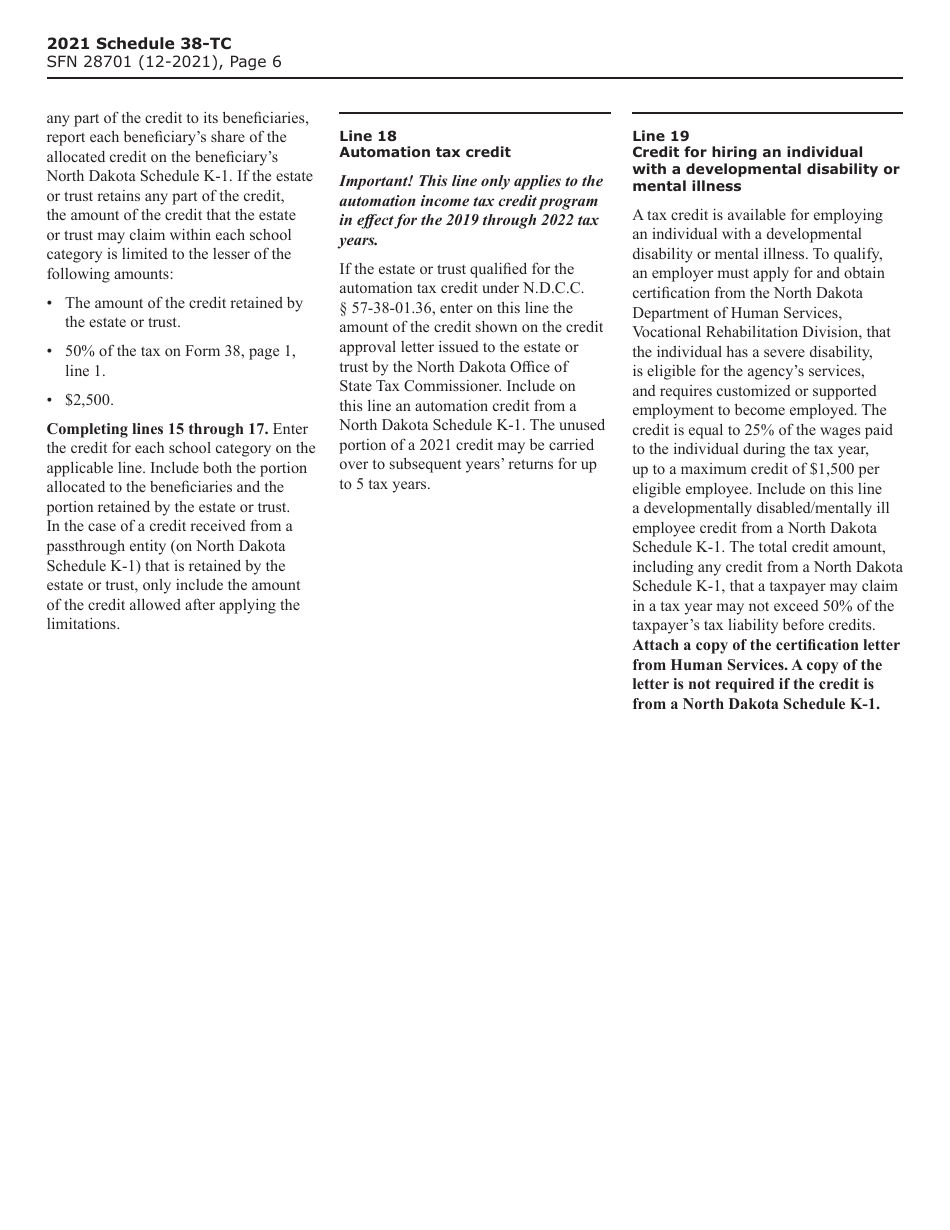

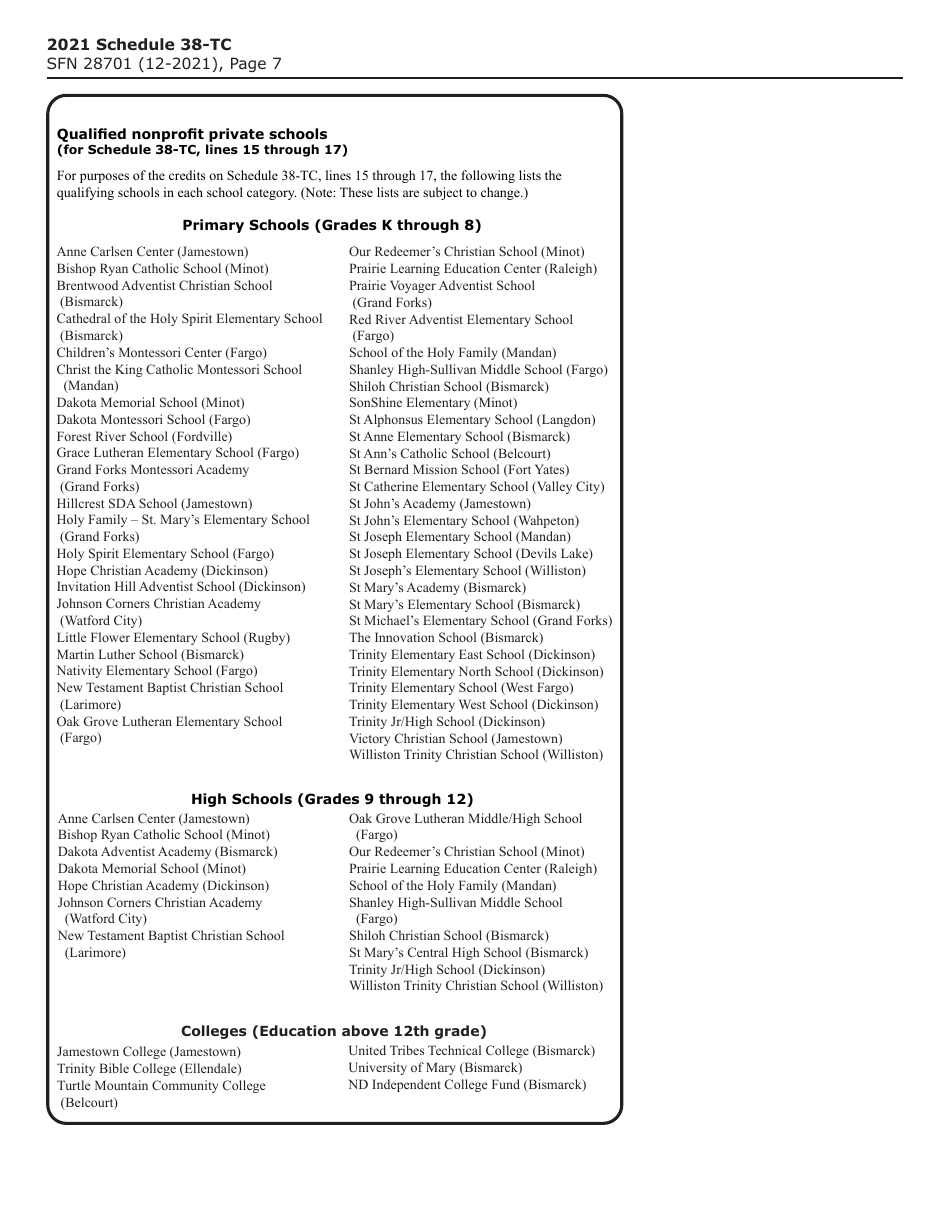

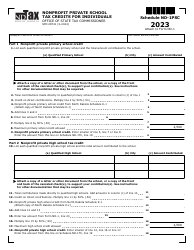

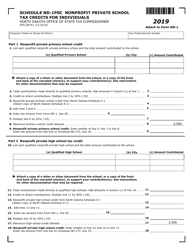

Form SFN28701 Schedule 38-TC

for the current year.

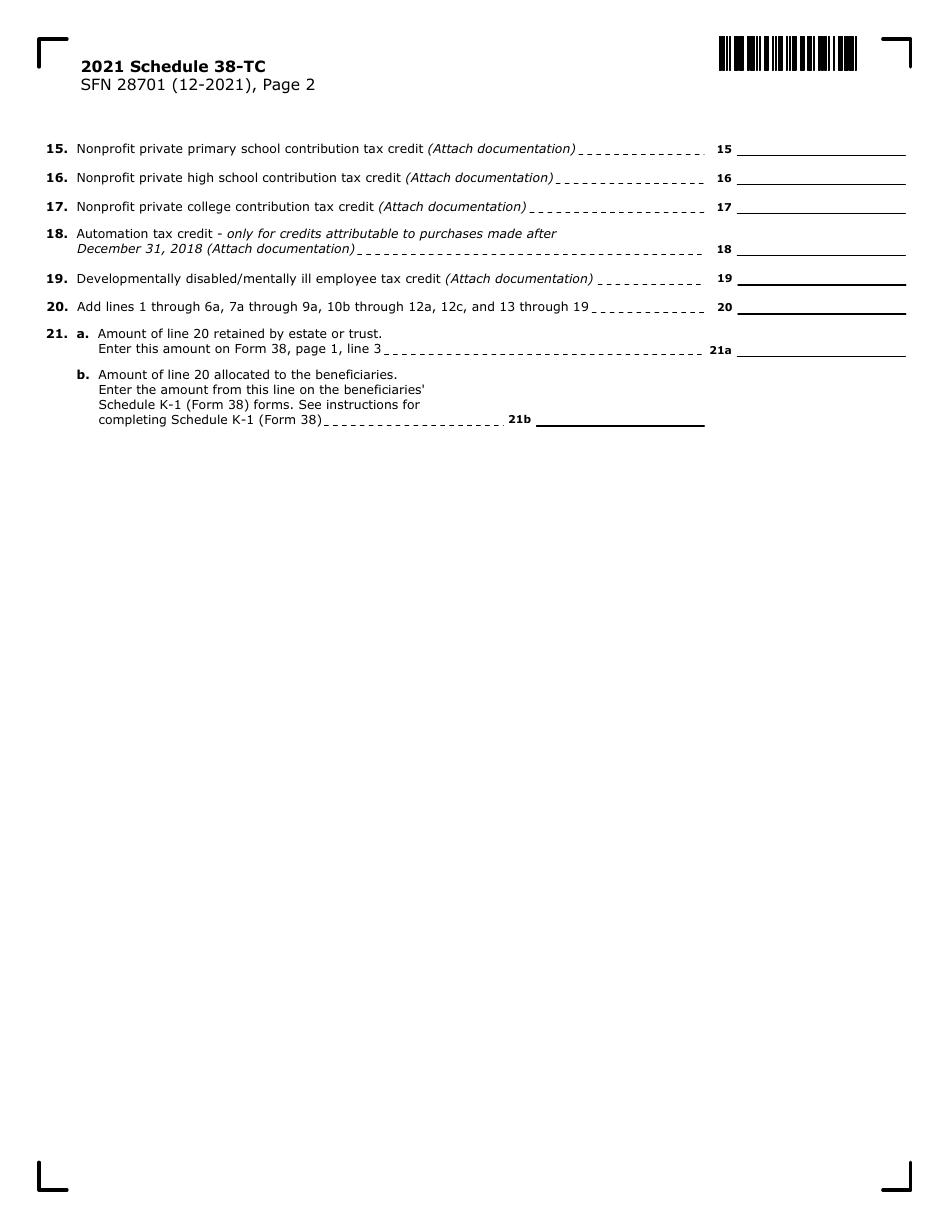

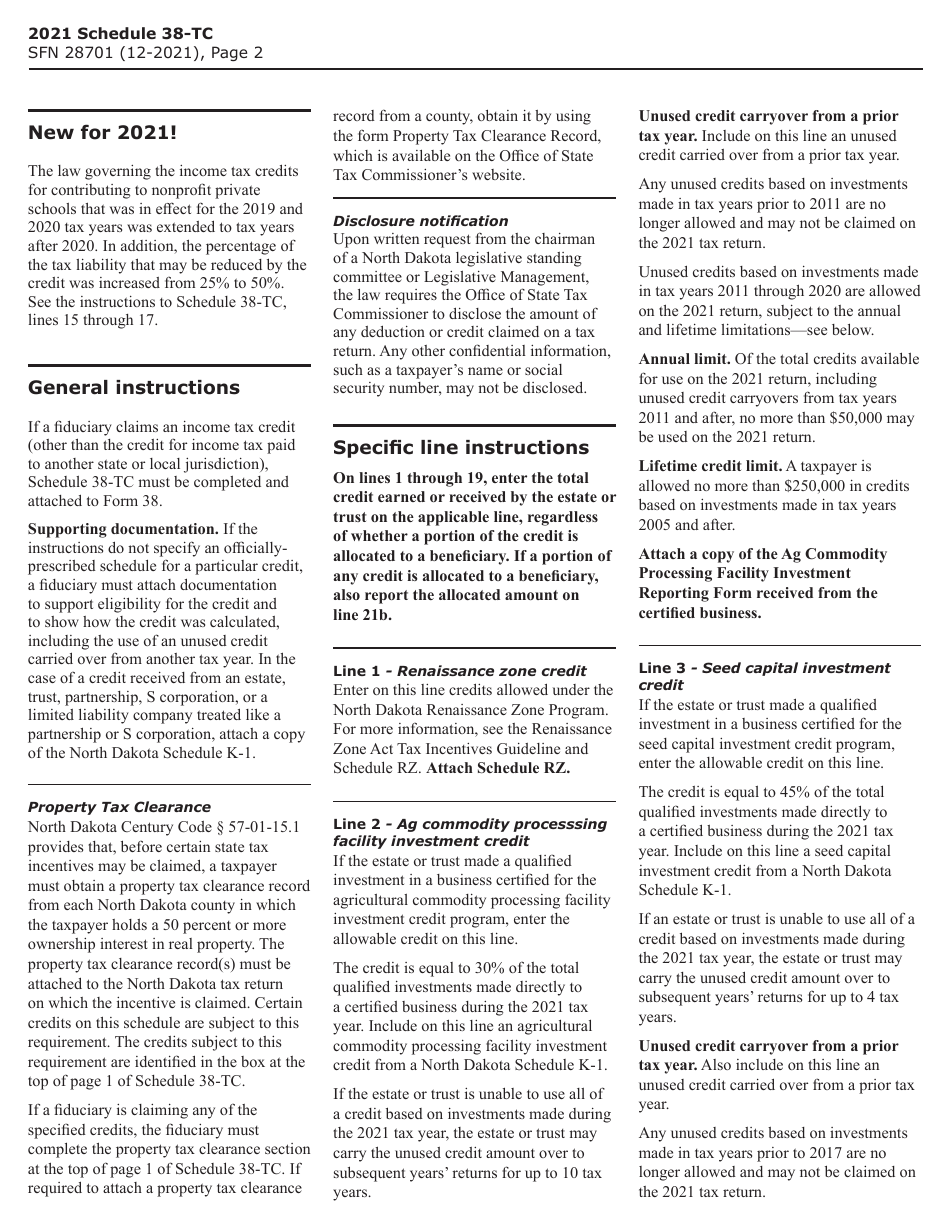

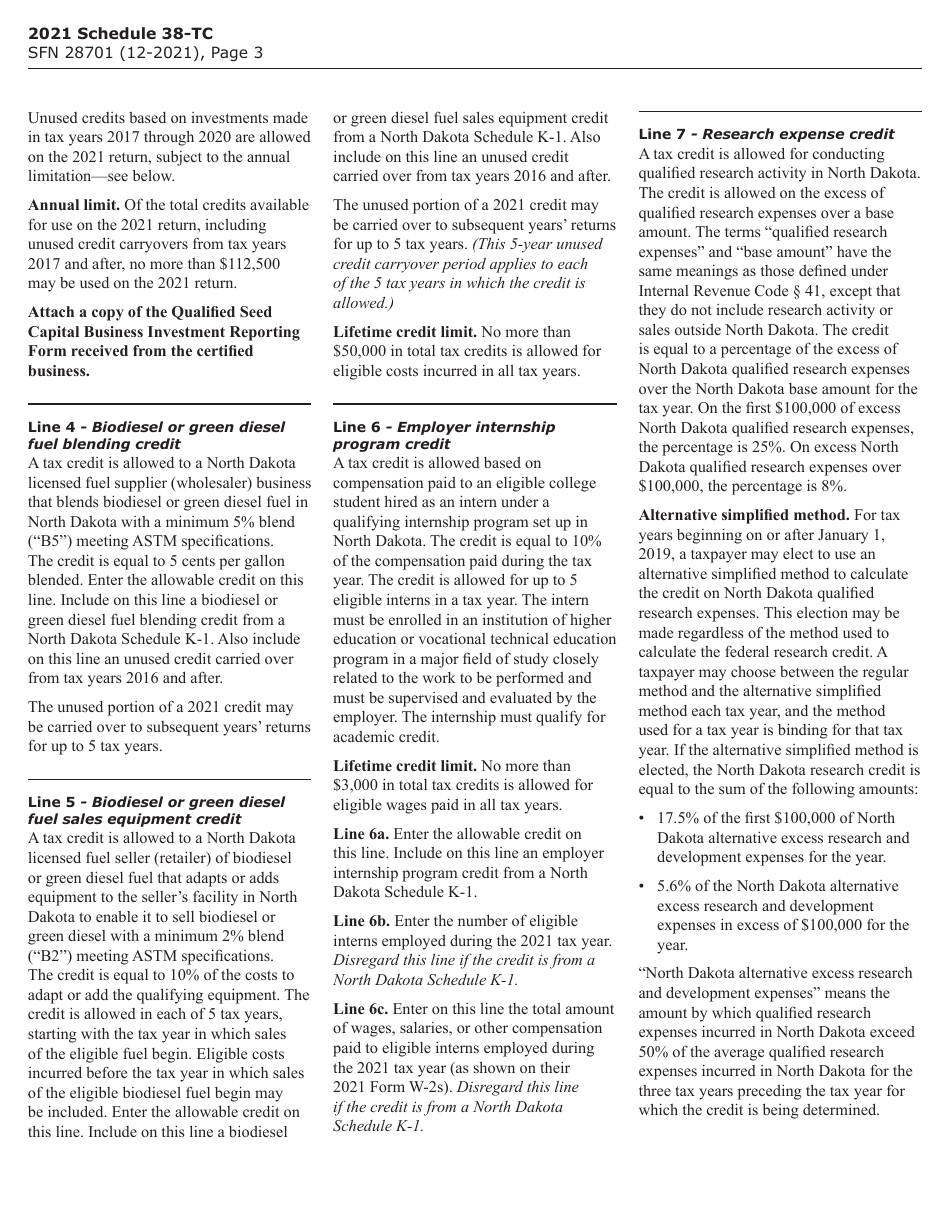

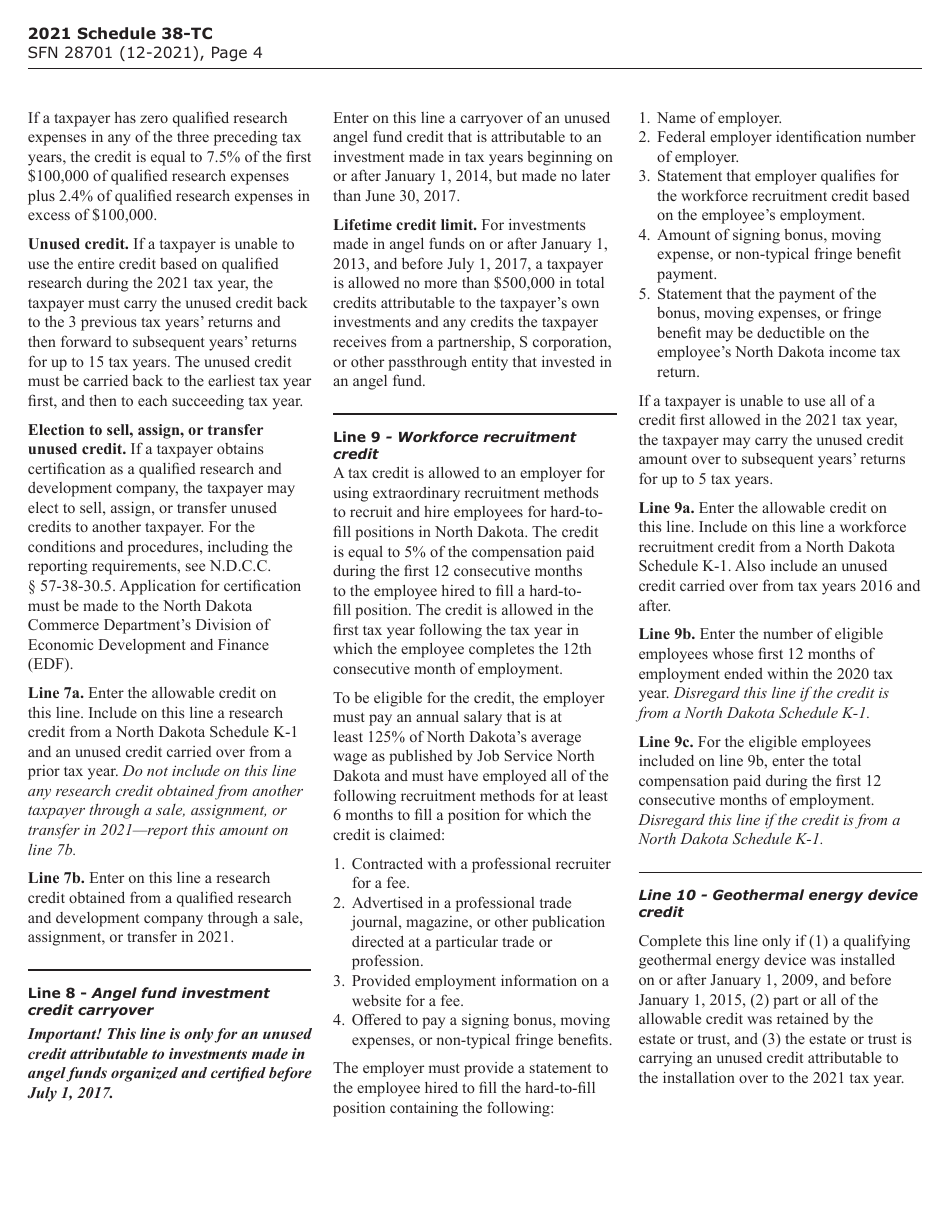

Form SFN28701 Schedule 38-TC Tax Credits - North Dakota

What Is Form SFN28701 Schedule 38-TC?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28701 Schedule 38-TC?

A: Form SFN28701 Schedule 38-TC is a tax form used for claiming tax credits in North Dakota.

Q: What are tax credits?

A: Tax credits are deductions from your tax liability that can reduce the amount of tax you owe.

Q: What is North Dakota?

A: North Dakota is a state in the United States located in the Midwest region.

Q: Who can use Form SFN28701 Schedule 38-TC?

A: Form SFN28701 Schedule 38-TC is for individuals and businesses in North Dakota who are eligible for tax credits.

Q: What information is required on Form SFN28701 Schedule 38-TC?

A: Form SFN28701 Schedule 38-TC requires information about the taxpayer and details of the tax credits being claimed.

Q: When is the deadline for filing Form SFN28701 Schedule 38-TC?

A: The deadline for filing Form SFN28701 Schedule 38-TC is usually April 15th, or the next business day if it falls on a weekend or holiday.

Q: Can I file Form SFN28701 Schedule 38-TC electronically?

A: Yes, you can file Form SFN28701 Schedule 38-TC electronically if you are using the North Dakota state e-file system or a compatible tax software.

Q: What happens if I don't file Form SFN28701 Schedule 38-TC?

A: If you are eligible for tax credits in North Dakota and fail to file Form SFN28701 Schedule 38-TC, you may miss out on potential tax savings.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28701 Schedule 38-TC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.