This version of the form is not currently in use and is provided for reference only. Download this version of

Form 38-ES (SFN28723)

for the current year.

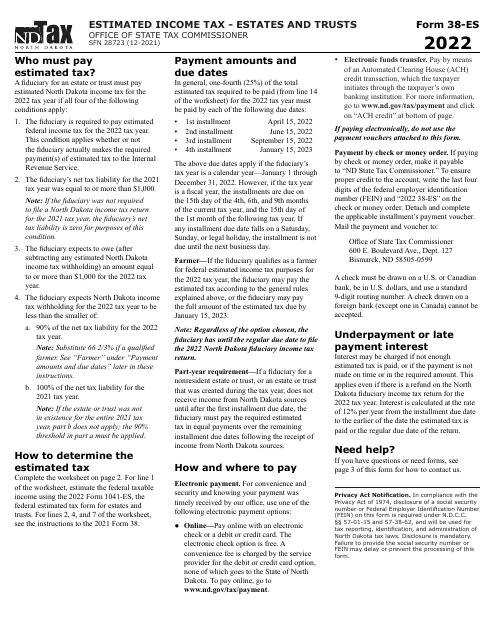

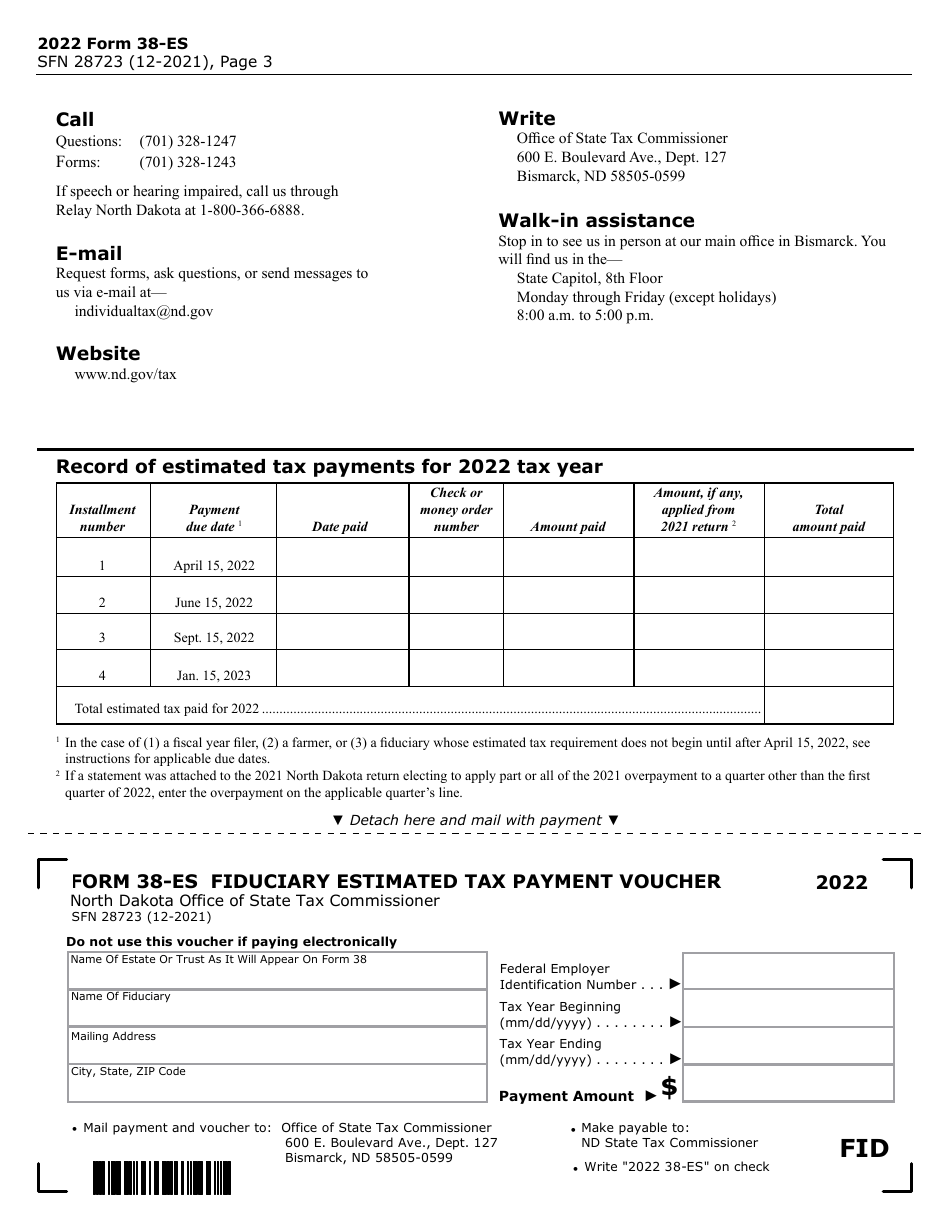

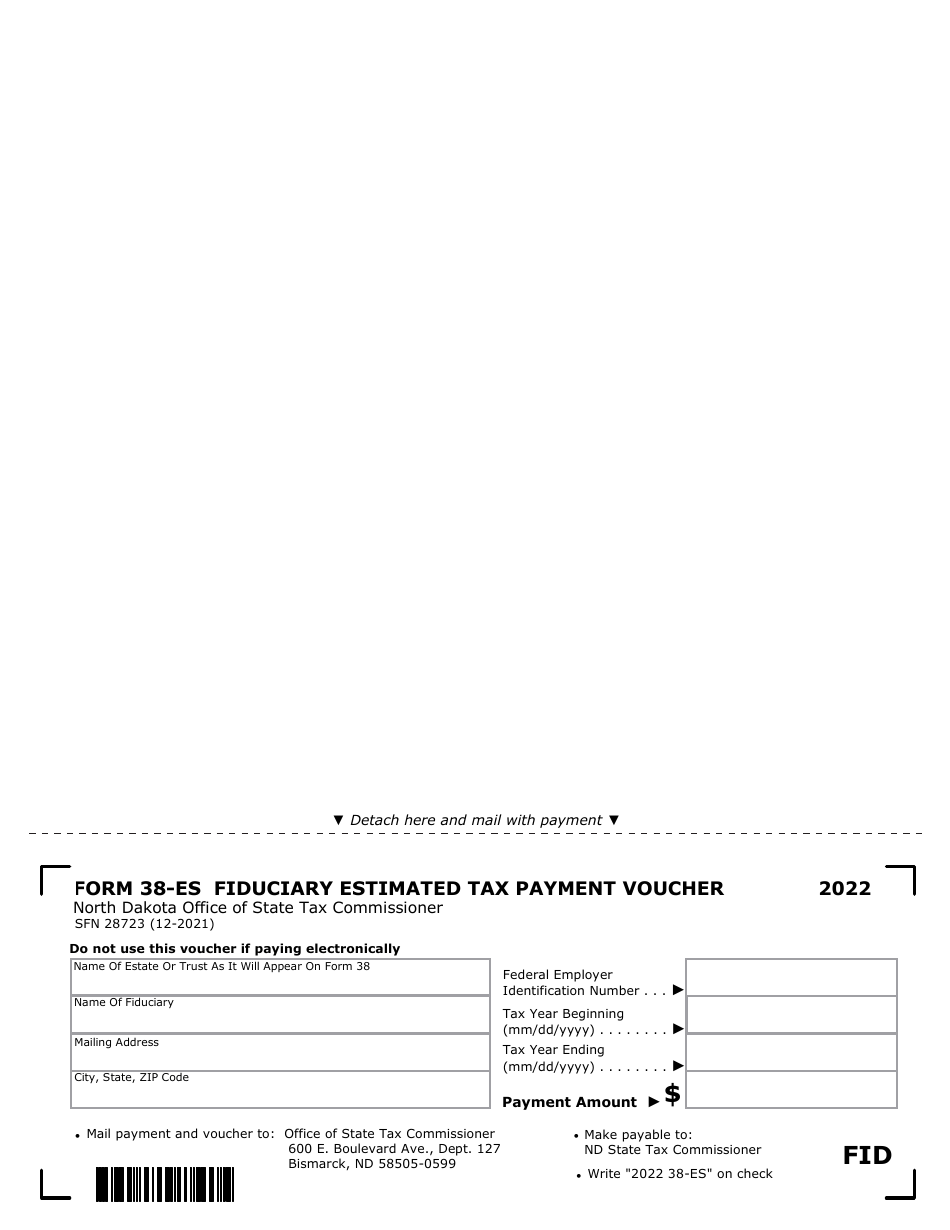

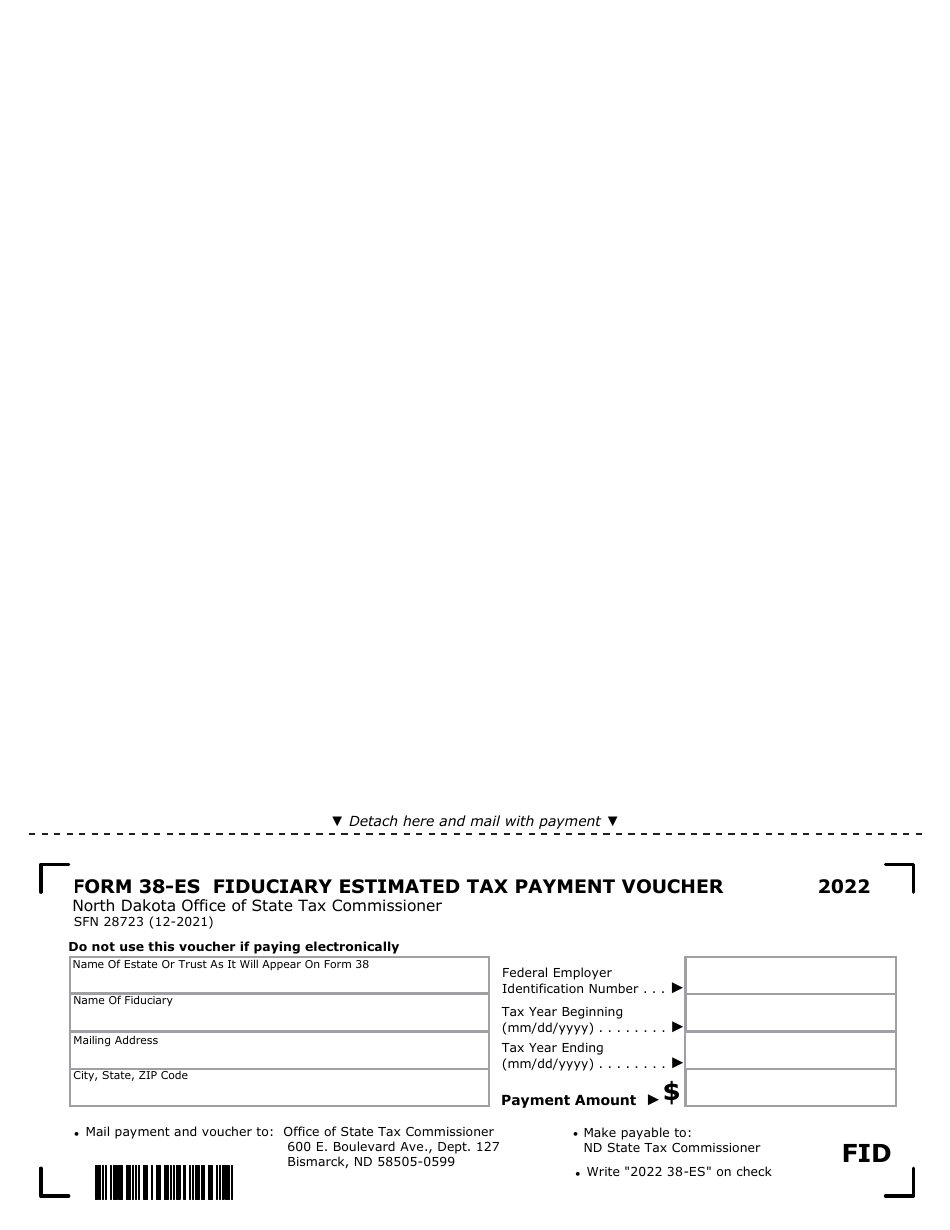

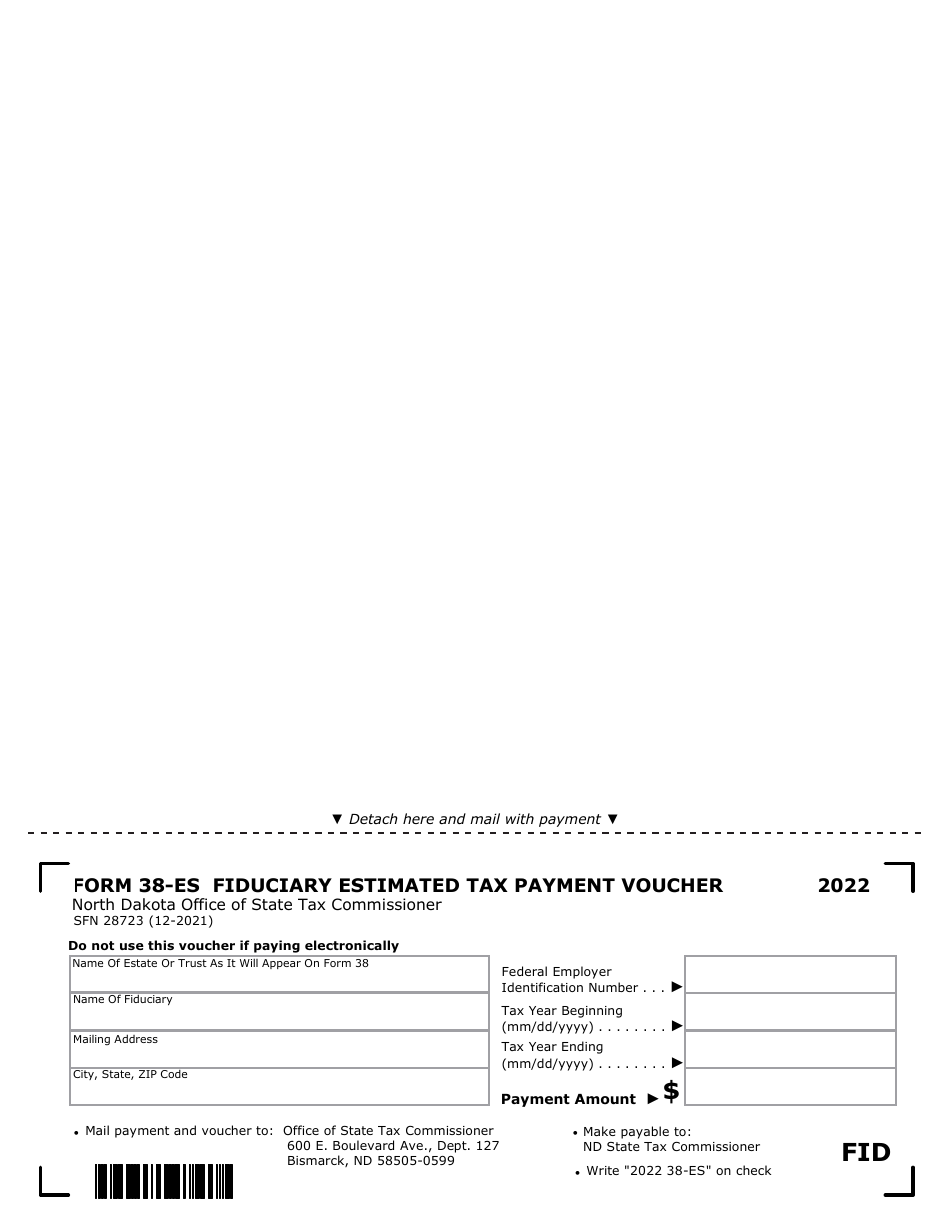

Form 38-ES (SFN28723) Fiduciary Estimated Tax Payment Voucher - North Dakota

What Is Form 38-ES (SFN28723)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

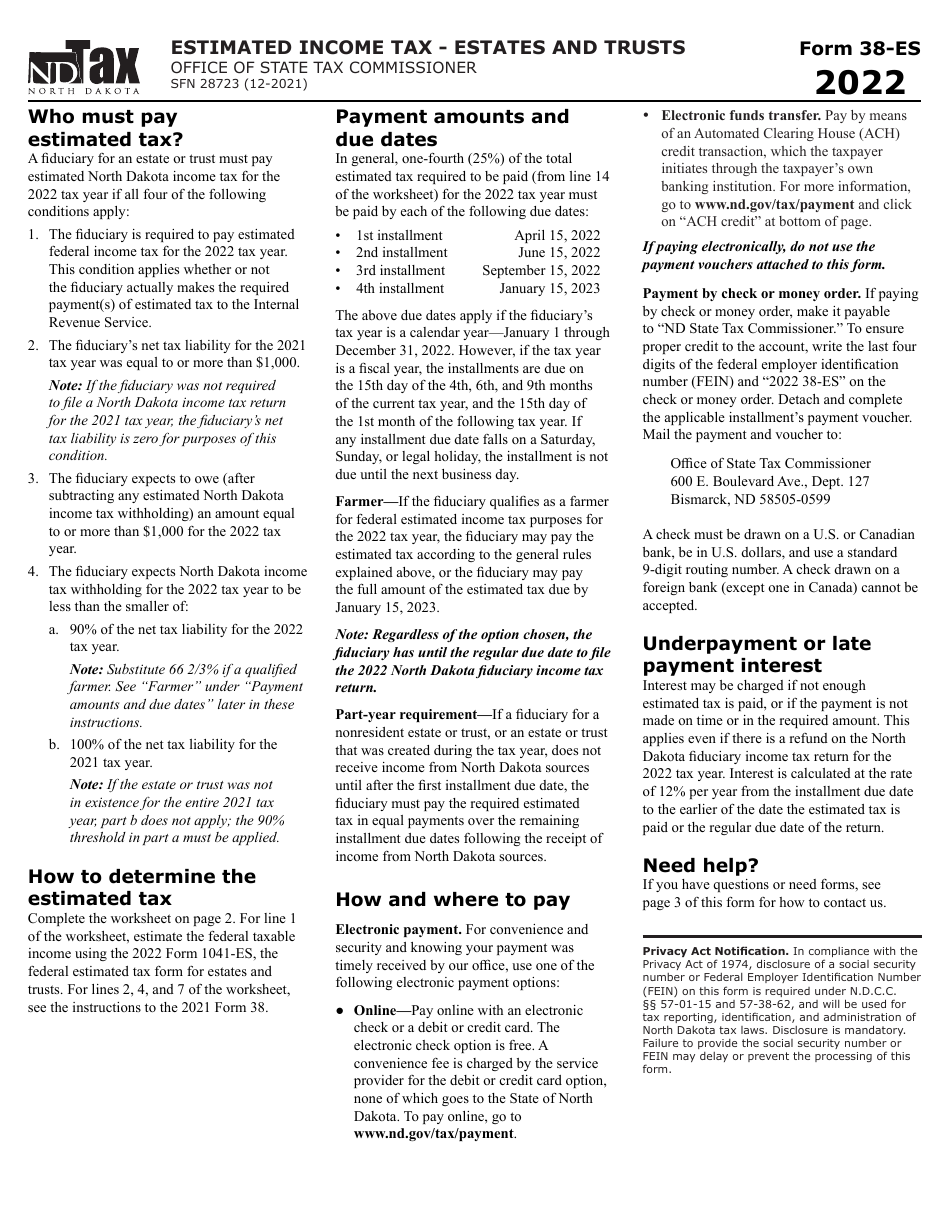

Q: What is Form 38-ES (SFN28723)?

A: Form 38-ES (SFN28723) is a Fiduciary Estimated Tax Payment Voucher specific to North Dakota.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that has a legal obligation to act in the best interest of another party, typically in a financial or legal matter.

Q: What is an estimated tax payment voucher?

A: An estimated tax payment voucher is a form used to submit estimated tax payments to the appropriate taxing authority.

Q: Who needs to use Form 38-ES (SFN28723)?

A: Individuals or entities acting as fiduciaries in North Dakota who need to make estimated tax payments should use this form.

Q: How often are estimated tax payments due?

A: Estimated tax payments are typically due quarterly, but it is important to check specific requirements and deadlines set by the tax authority.

Q: Can I file Form 38-ES (SFN28723) electronically?

A: Please consult the North Dakota Department of Revenue to determine if electronic filing is available for this form.

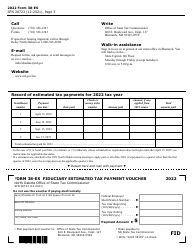

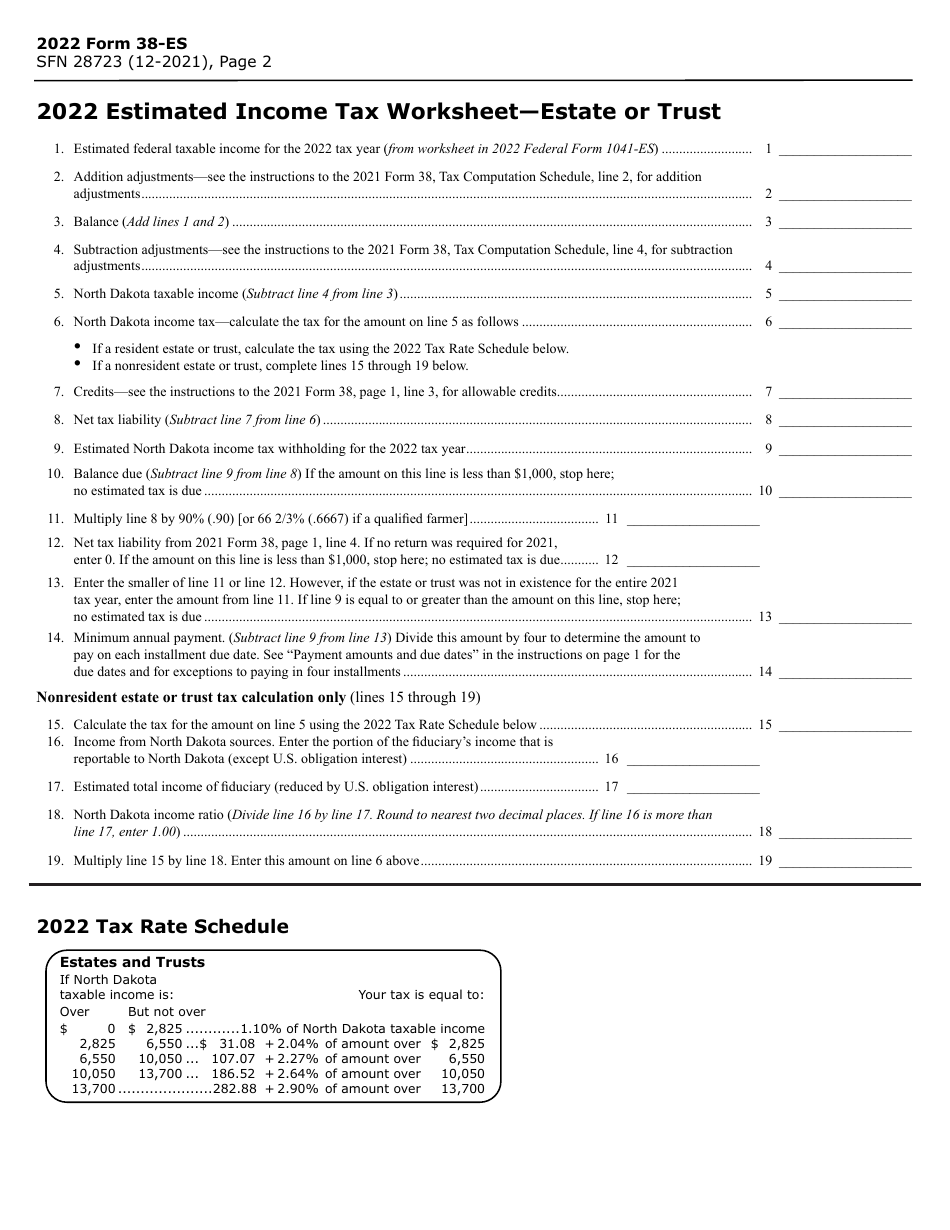

Q: What information do I need to complete Form 38-ES (SFN28723)?

A: You will need to provide your personal information, the fiduciary's information, estimated tax amounts, and other relevant details as specified on the form.

Q: What do I do after I complete Form 38-ES (SFN28723)?

A: After completing the form, you should review it for accuracy, attach any required documentation or payment, and submit it to the North Dakota Department of Revenue as instructed.

Q: Are there any penalties for not filing or paying estimated taxes?

A: Penalties may apply for failure to file or pay estimated taxes on time, so it is important to comply with the applicable deadlines and requirements.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38-ES (SFN28723) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.