This version of the form is not currently in use and is provided for reference only. Download this version of

Form 38-EXT (SFN28735)

for the current year.

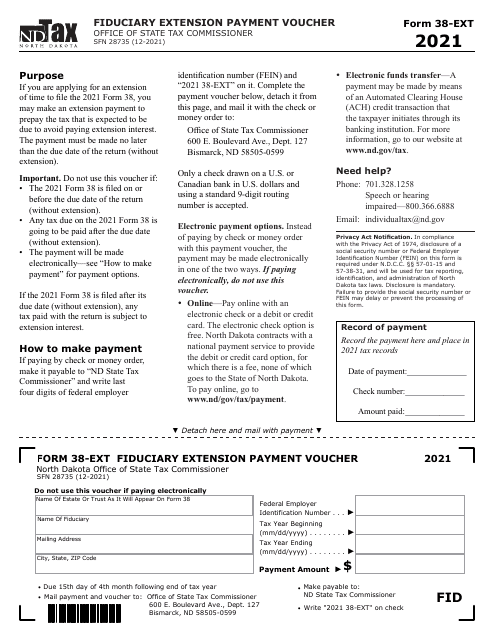

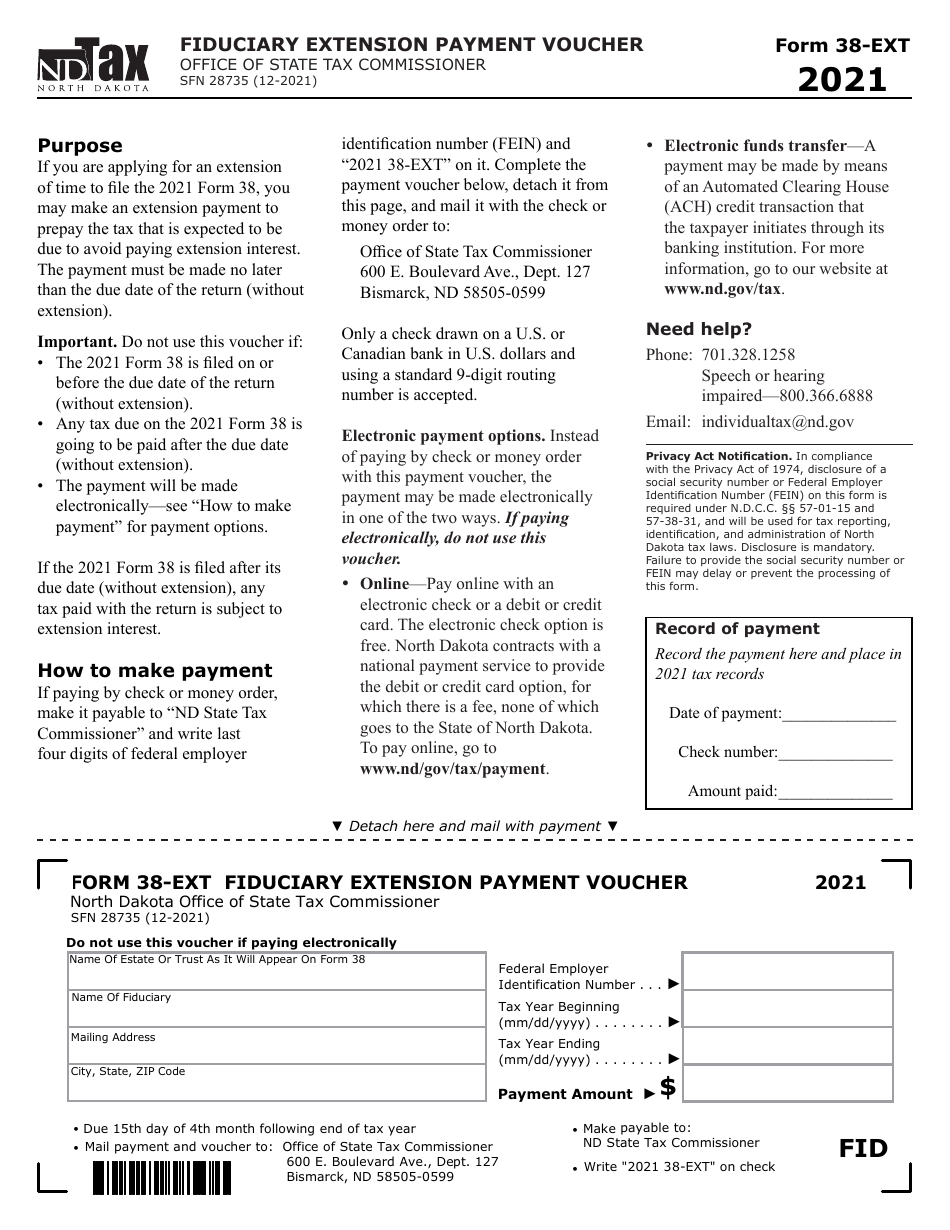

Form 38-EXT (SFN28735) Fiduciary Extension Payment Voucher - North Dakota

What Is Form 38-EXT (SFN28735)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38-EXT?

A: Form 38-EXT is the Fiduciary Extension Payment Voucher for North Dakota.

Q: What is the purpose of Form 38-EXT?

A: The purpose of Form 38-EXT is to make an extension payment for fiduciary taxes in North Dakota.

Q: What information is required on Form 38-EXT?

A: Form 38-EXT requires information such as the taxpayer's name, address, Social Security number or Employer Identification Number, tax year, and the amount of the extension payment.

Q: When is Form 38-EXT due?

A: Form 38-EXT must be filed and the extension payment must be made on or before the original due date of the fiduciary tax return.

Q: Are there any penalties for late filing of Form 38-EXT?

A: Yes, late filing of Form 38-EXT may result in penalties and interest.

Q: Can I file Form 38-EXT electronically?

A: Yes, North Dakota allows electronic filing of Form 38-EXT.

Q: Can I make the extension payment electronically?

A: Yes, North Dakota provides options for electronic payment of the extension amount.

Q: Are there any eligibility requirements to file Form 38-EXT?

A: Any taxpayer who needs an extension to file the fiduciary tax return in North Dakota can file Form 38-EXT.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38-EXT (SFN28735) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.