This version of the form is not currently in use and is provided for reference only. Download this version of

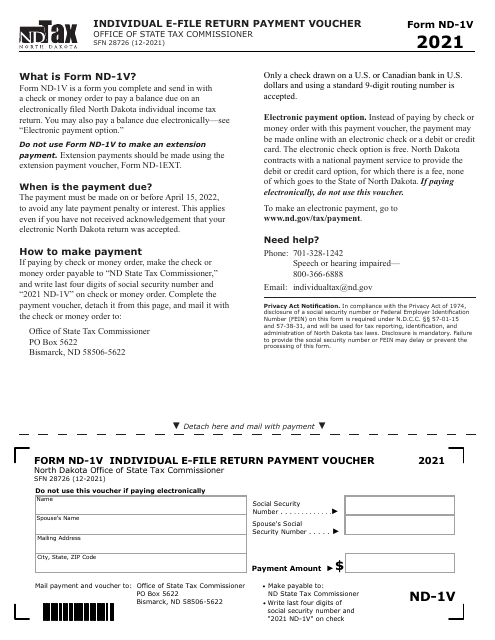

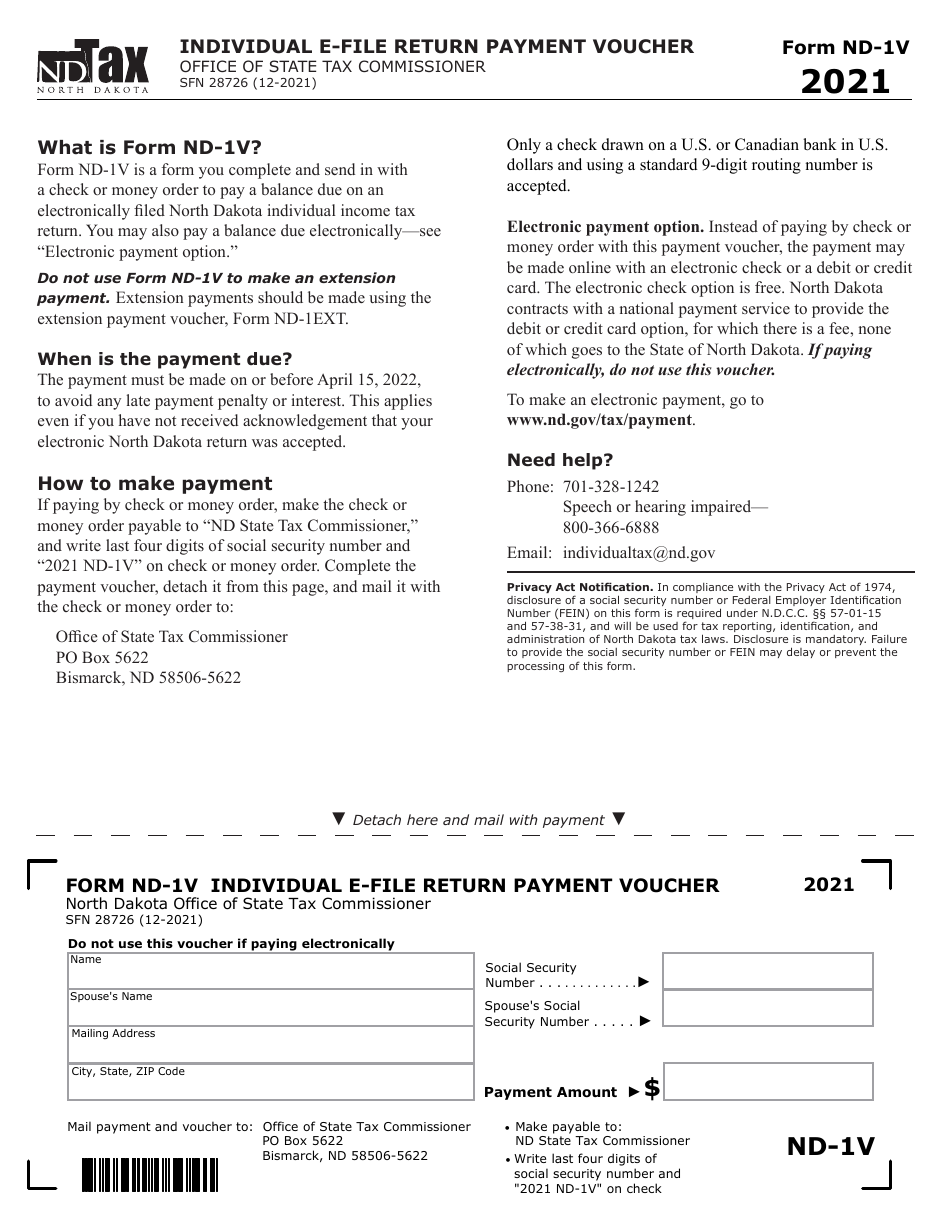

Form ND-1V (SFN28726)

for the current year.

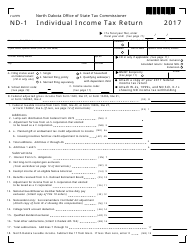

Form ND-1V (SFN28726) Individual E-File Return Payment Voucher - North Dakota

What Is Form ND-1V (SFN28726)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1V (SFN28726)?

A: Form ND-1V (SFN28726) is the Individual E-File Return Payment Voucher for North Dakota.

Q: What is the purpose of Form ND-1V?

A: Form ND-1V is used to make a payment for North Dakota individual income tax returns that are filed electronically.

Q: When is Form ND-1V due?

A: Form ND-1V is typically due on the same date as the individual income tax return.

Q: Can Form ND-1V be filed electronically?

A: No, Form ND-1V is used to make a payment for electronically filed individual income tax returns, but it cannot be filed electronically itself.

Q: What information is required on Form ND-1V?

A: Form ND-1V requires the taxpayer's name, address, Social Security number, tax year, payment amount, and payment method.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1V (SFN28726) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.