This version of the form is not currently in use and is provided for reference only. Download this version of

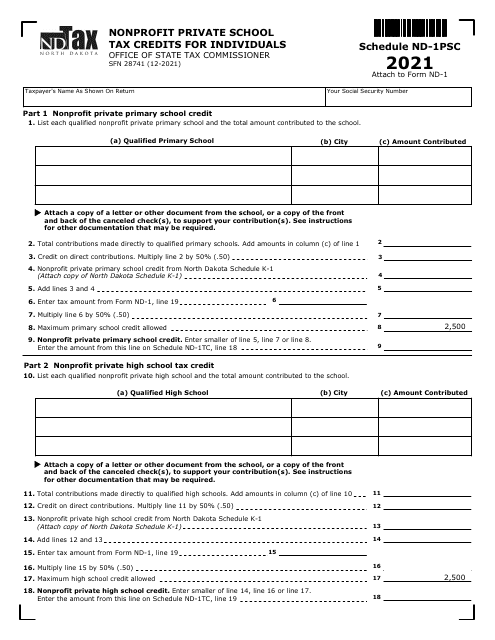

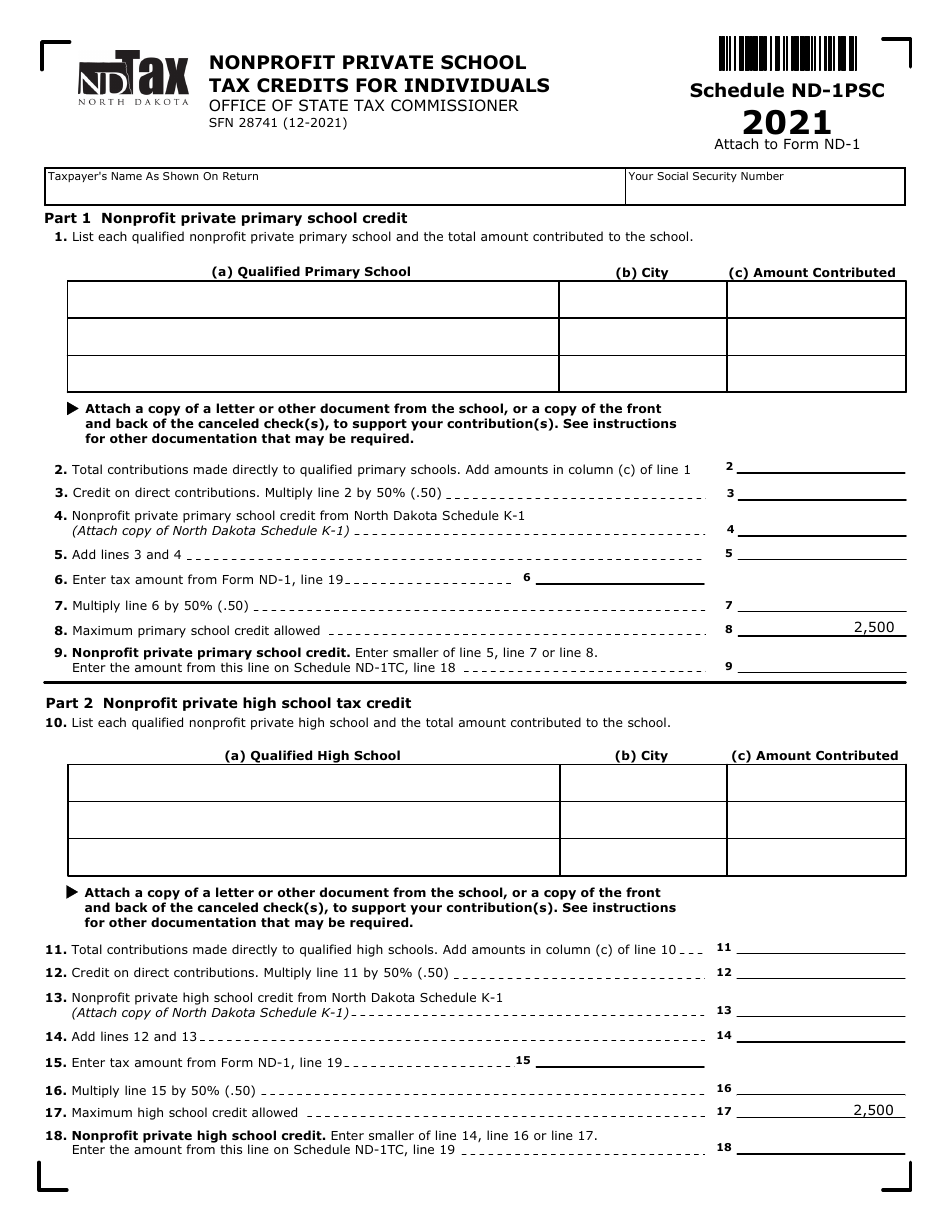

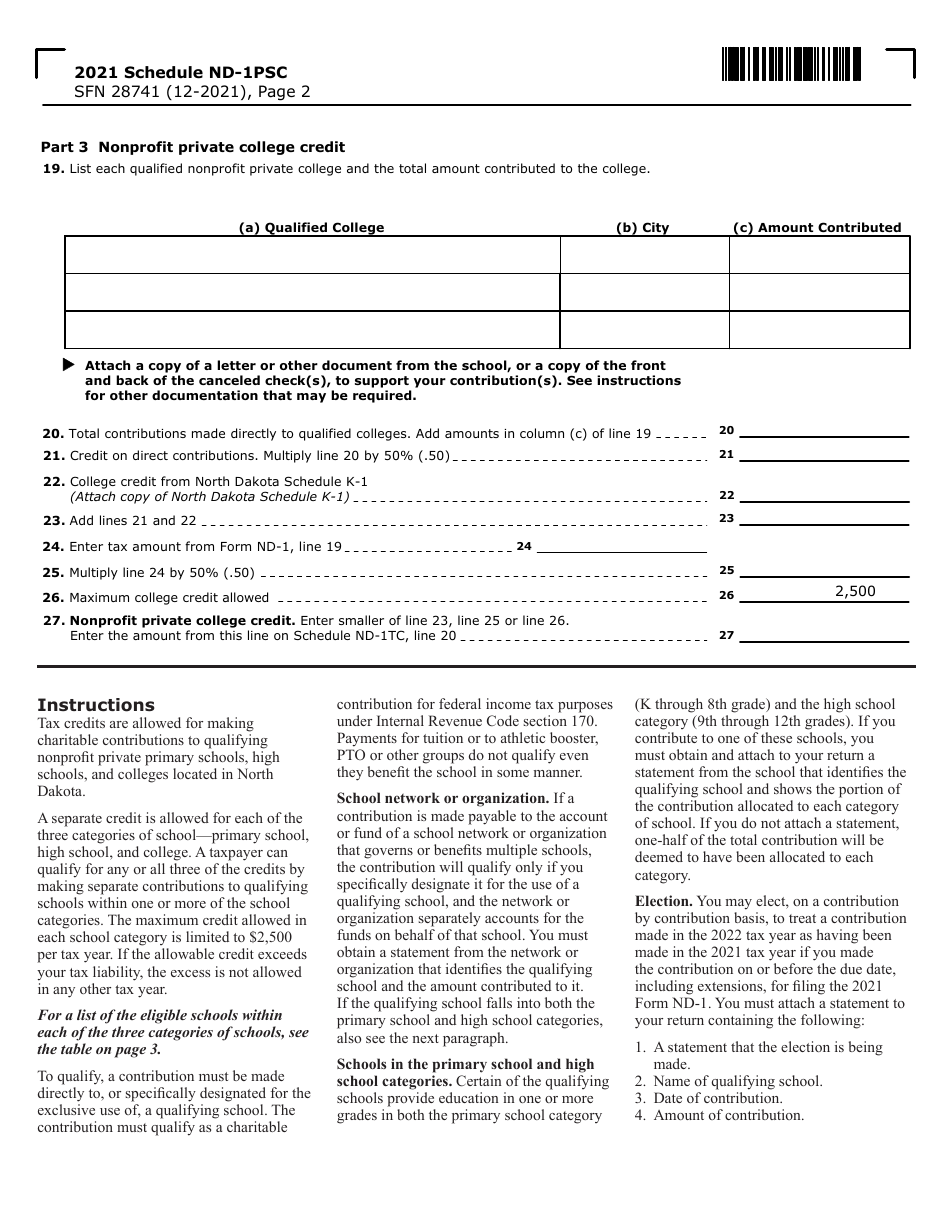

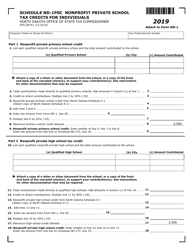

Form SFN28741 Schedule ND-1PSC

for the current year.

Form SFN28741 Schedule ND-1PSC Nonprofit Private School Tax Credits for Individuals - North Dakota

What Is Form SFN28741 Schedule ND-1PSC?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28741 Schedule ND-1PSC?

A: Form SFN28741 Schedule ND-1PSC is a tax form used by individuals in North Dakota to claim non-profit private school tax credits.

Q: Who can use Form SFN28741 Schedule ND-1PSC?

A: Individuals in North Dakota who have made donations to non-profit private schools can use Form SFN28741 Schedule ND-1PSC.

Q: What is the purpose of Form SFN28741 Schedule ND-1PSC?

A: The purpose of Form SFN28741 Schedule ND-1PSC is to allow individuals in North Dakota to claim tax credits for donations made to non-profit private schools.

Q: How do I fill out Form SFN28741 Schedule ND-1PSC?

A: You need to provide information about the non-profit private schools you made donations to, as well as the amounts of your donations.

Q: Is there a deadline to file Form SFN28741 Schedule ND-1PSC?

A: Yes, Form SFN28741 Schedule ND-1PSC must be filed by the deadline for filing your North Dakota individual income tax return.

Q: Are there any eligibility requirements to claim non-profit private school tax credits?

A: Yes, you need to meet certain requirements such as being a North Dakota resident and having made eligible donations to non-profit private schools.

Q: What is the benefit of claiming non-profit private school tax credits?

A: Claiming non-profit private school tax credits can help reduce your state income tax liability and support non-profit private schools in North Dakota.

Q: Can I claim non-profit private school tax credits if I made donations to public schools?

A: No, non-profit private school tax credits are specifically for donations made to non-profit private schools in North Dakota.

Q: Do I need to provide any documentation when filing Form SFN28741 Schedule ND-1PSC?

A: Yes, you may need to provide documentation such as receipts or acknowledgements from the non-profit private schools for your donations.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28741 Schedule ND-1PSC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.