This version of the form is not currently in use and is provided for reference only. Download this version of

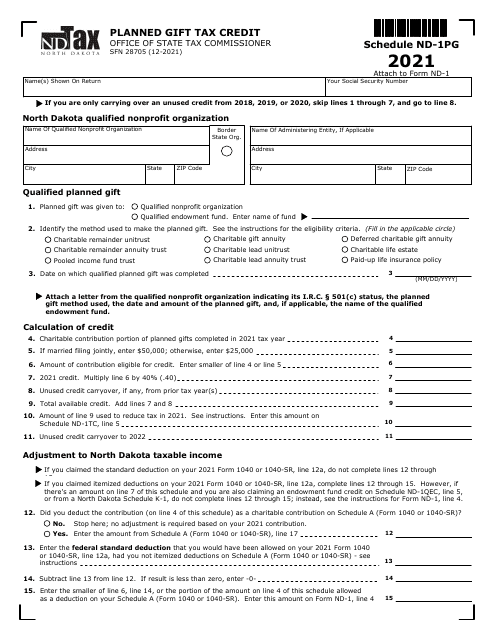

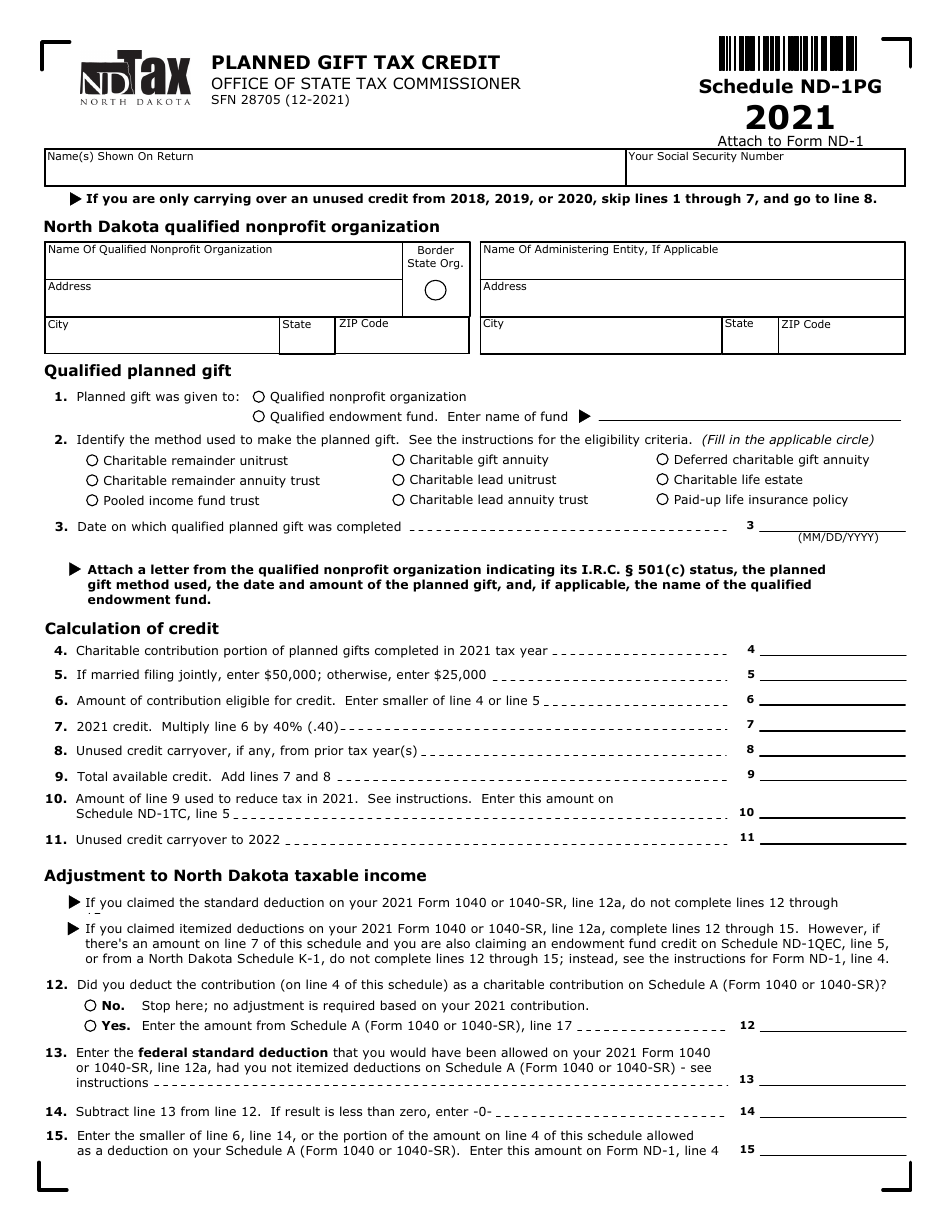

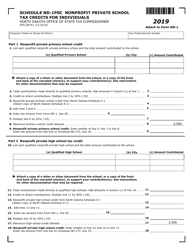

Form SFN28705 Schedule ND-1PG

for the current year.

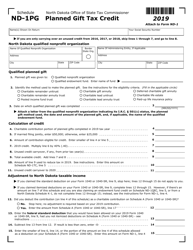

Form SFN28705 Schedule ND-1PG Planned Gift Tax Credit - North Dakota

What Is Form SFN28705 Schedule ND-1PG?

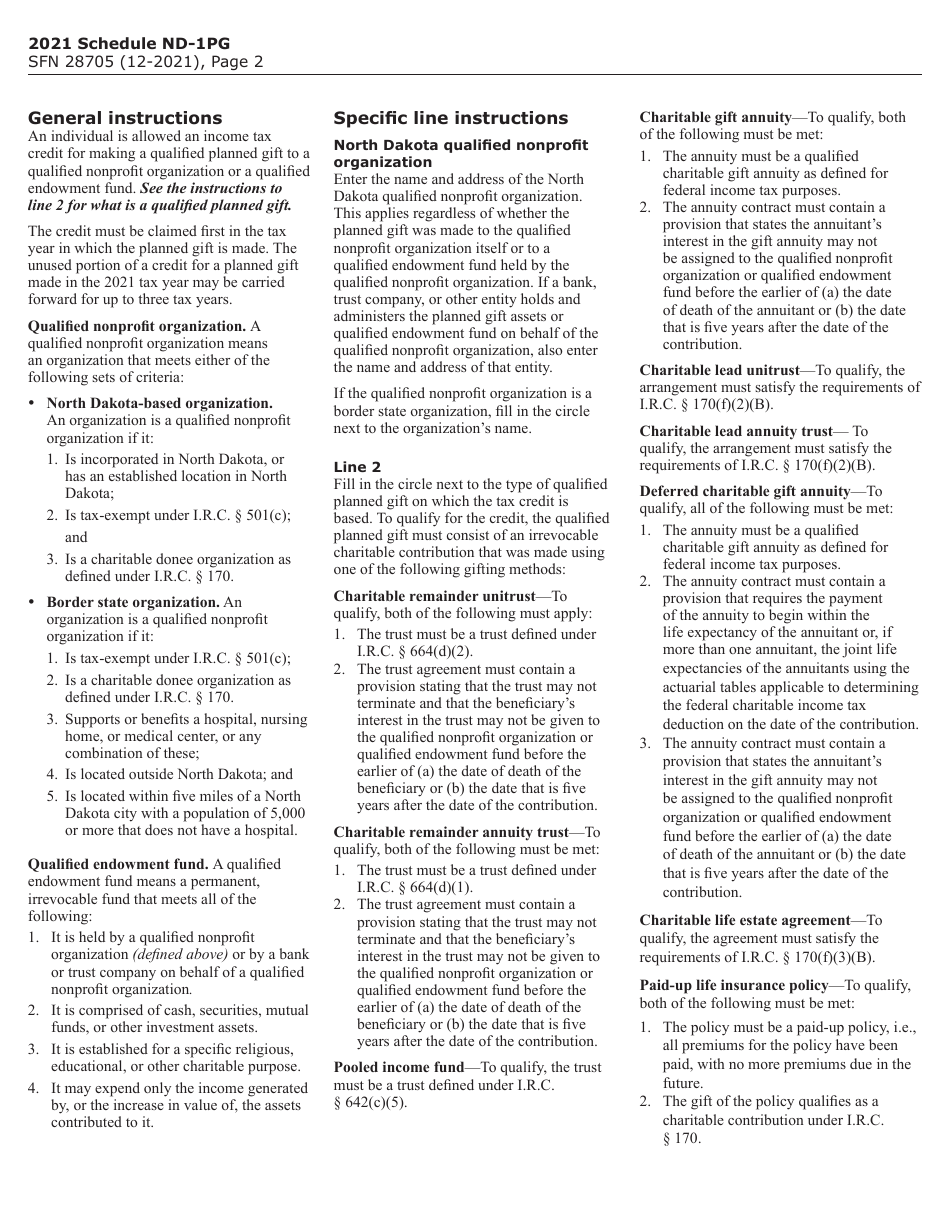

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28705 Schedule ND-1PG?

A: Form SFN28705 Schedule ND-1PG is a tax form used to claim the Planned Gift Tax Credit in North Dakota.

Q: What is the Planned Gift Tax Credit in North Dakota?

A: The Planned Gift Tax Credit in North Dakota is a tax credit available for individuals or corporations who make planned charitable contributions.

Q: Who can use Form SFN28705 Schedule ND-1PG?

A: Individuals or corporations in North Dakota who have made planned charitable contributions can use Form SFN28705 Schedule ND-1PG.

Q: How do I claim the Planned Gift Tax Credit in North Dakota?

A: To claim the Planned Gift Tax Credit in North Dakota, you need to complete Form SFN28705 Schedule ND-1PG and include it with your state tax return.

Q: What information do I need to complete Form SFN28705 Schedule ND-1PG?

A: To complete Form SFN28705 Schedule ND-1PG, you will need information about your planned charitable contributions, including the date, amount, and recipient of each gift.

Q: Is there a deadline to submit Form SFN28705 Schedule ND-1PG?

A: Yes, Form SFN28705 Schedule ND-1PG must be filed by the deadline for filing your North Dakota state tax return.

Q: Can I claim the Planned Gift Tax Credit if I made charitable contributions in other states?

A: No, the Planned Gift Tax Credit in North Dakota is only available for contributions made to qualifying charitable organizations in North Dakota.

Q: Are there any income limitations for claiming the Planned Gift Tax Credit?

A: No, there are no income limitations for claiming the Planned Gift Tax Credit in North Dakota.

Q: What is the maximum tax credit I can claim through Form SFN28705 Schedule ND-1PG?

A: The maximum tax credit you can claim through Form SFN28705 Schedule ND-1PG is determined by the amount of your planned charitable contributions and is subject to certain limitations. It is best to consult the instructions of the form or a tax professional for specific details.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28705 Schedule ND-1PG by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.