This version of the form is not currently in use and is provided for reference only. Download this version of

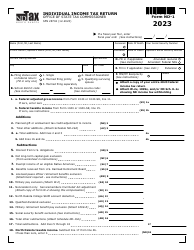

Form SFN28704 Schedule ND-1UT

for the current year.

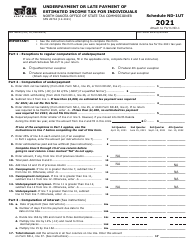

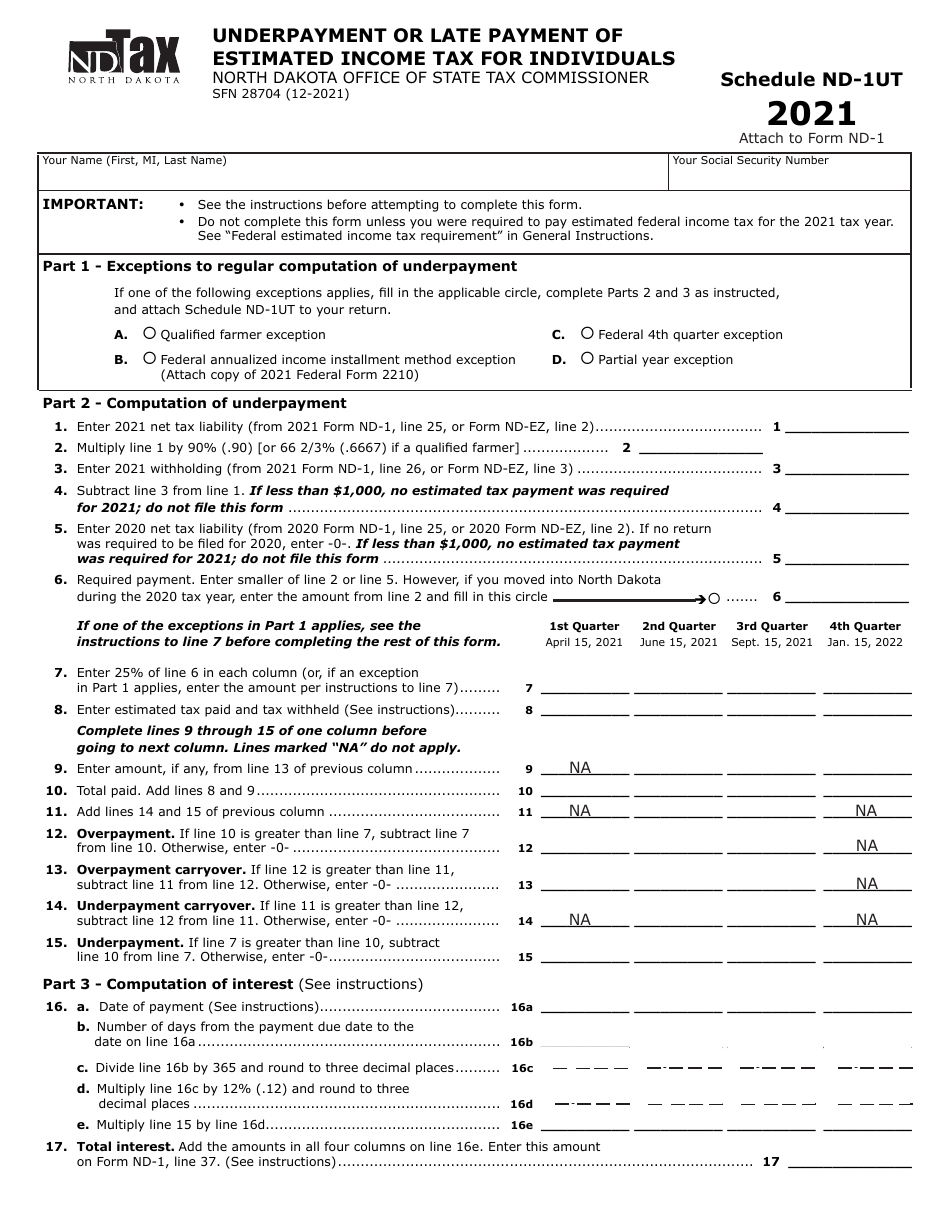

Form SFN28704 Schedule ND-1UT Underpayment or Late Payment of Estimated Income Tax for Individuals - North Dakota

What Is Form SFN28704 Schedule ND-1UT?

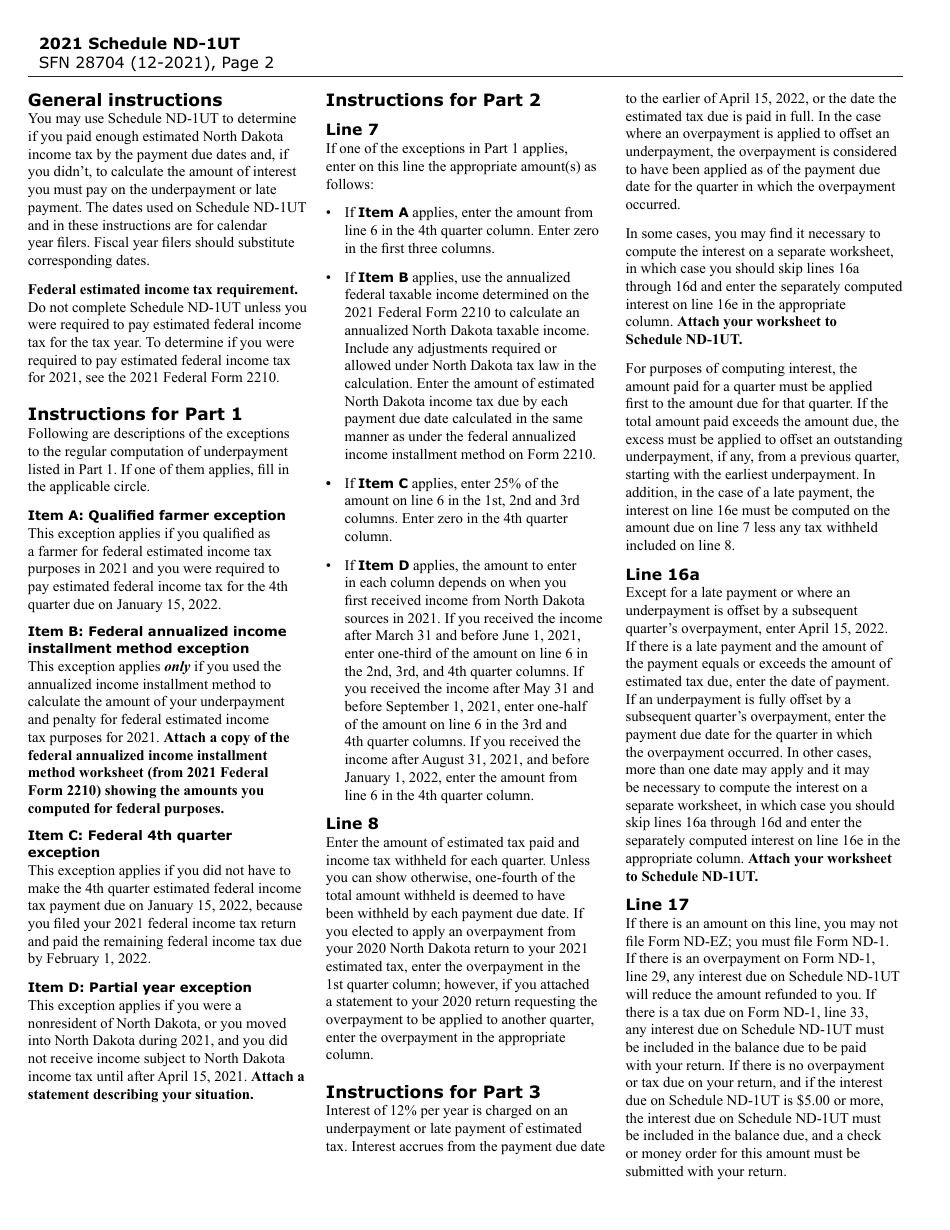

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

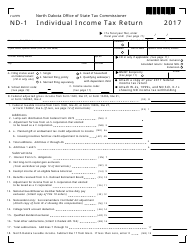

Q: What is SFN28704?

A: SFN28704 is the form for Schedule ND-1UT, which is used to report Underpayment or Late Payment of Estimated Income Tax for Individuals in North Dakota.

Q: Who needs to file SFN28704?

A: Individuals who have underpaid or paid their estimated income tax late in North Dakota need to file SFN28704.

Q: What is the purpose of Schedule ND-1UT?

A: The purpose of Schedule ND-1UT is to calculate and report any underpayment or late payment of estimated income tax by individuals in North Dakota.

Q: Is Schedule ND-1UT specific to North Dakota?

A: Yes, Schedule ND-1UT is specific to individuals residing in North Dakota.

Q: What information is required for Schedule ND-1UT?

A: Schedule ND-1UT requires information such as the taxpayer's name, Social Security number, estimated tax payments made, the dates of those payments, and any penalties or interest due.

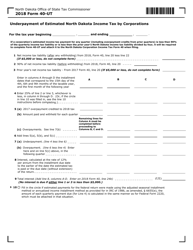

Q: When is the deadline to file Schedule ND-1UT?

A: The deadline to file Schedule ND-1UT is typically the same as the deadline for filing your annual state income tax return in North Dakota, which is usually April 15th.

Q: What happens if I fail to file Schedule ND-1UT?

A: If you fail to file Schedule ND-1UT or report underpayment or late payment of estimated income tax, you may be subject to penalties and interest charges.

Q: Can I use Schedule ND-1UT for business taxes?

A: No, Schedule ND-1UT is specifically designed for individuals and cannot be used for business taxes in North Dakota.

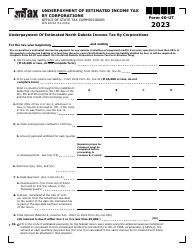

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28704 Schedule ND-1UT by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.