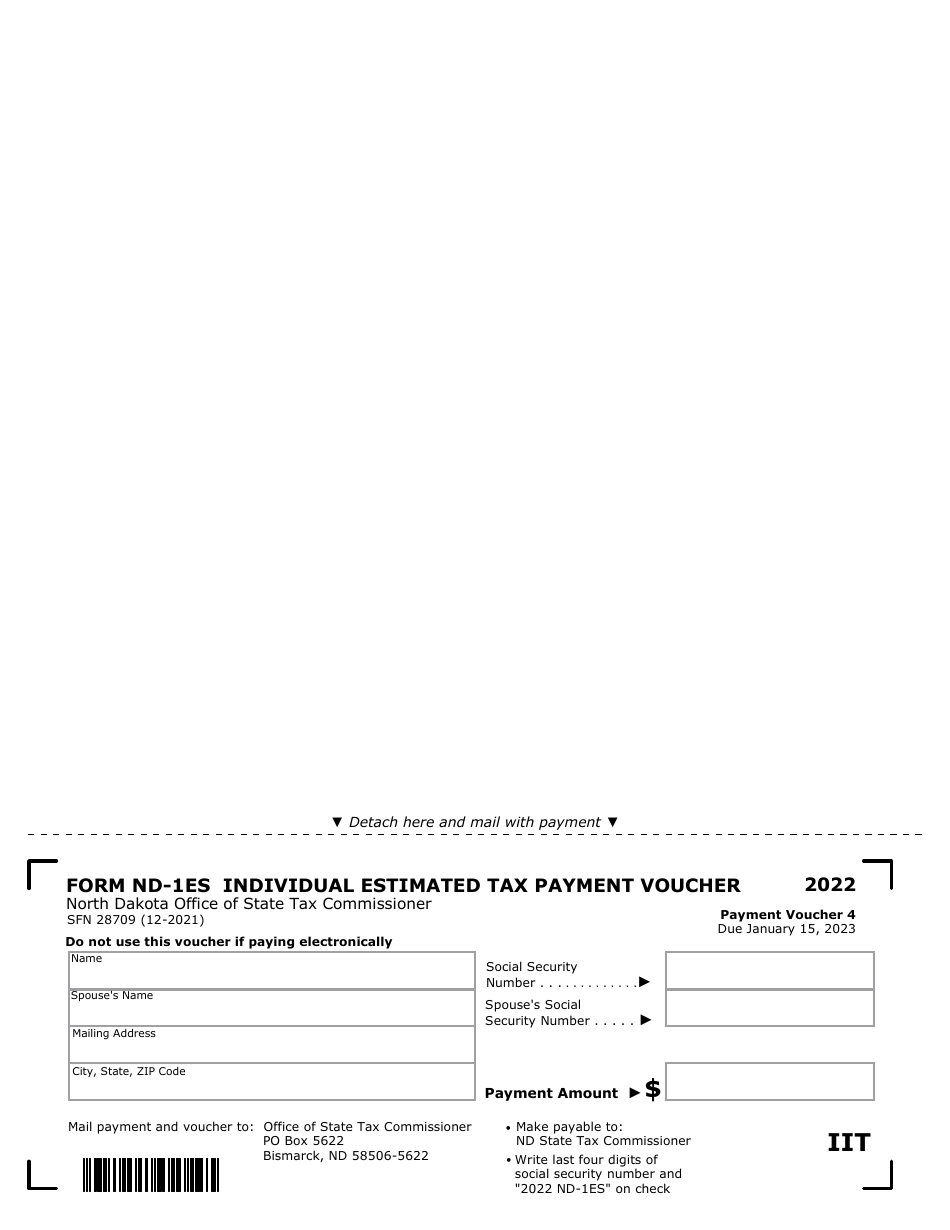

This version of the form is not currently in use and is provided for reference only. Download this version of

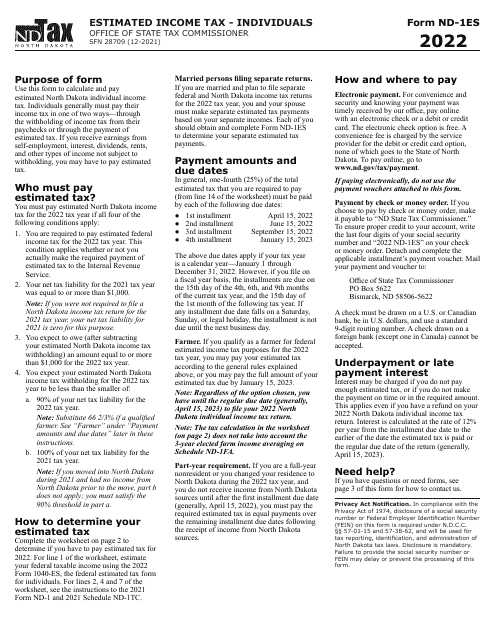

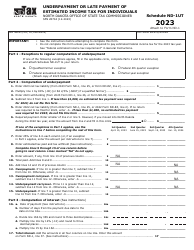

Form ND-1ES (SFN28709)

for the current year.

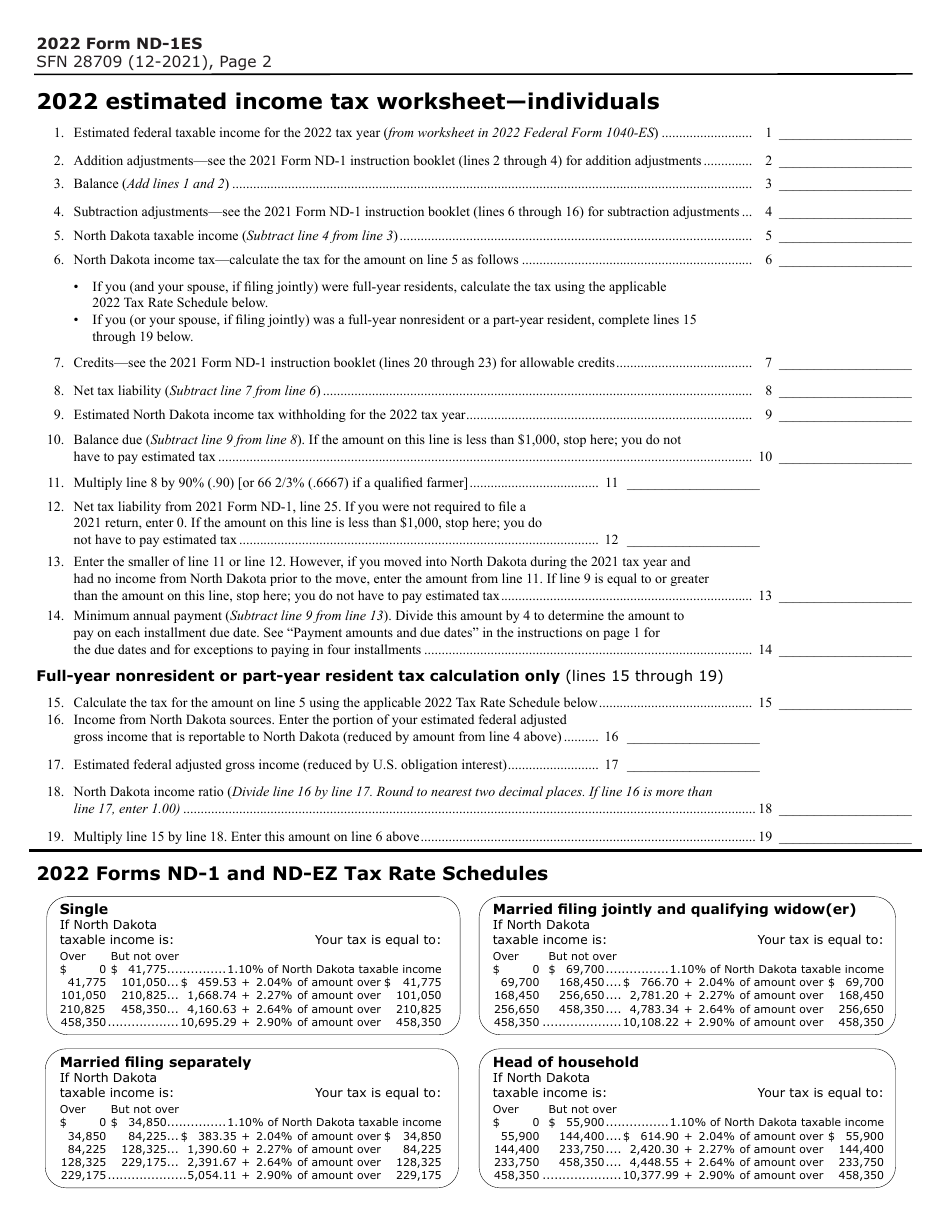

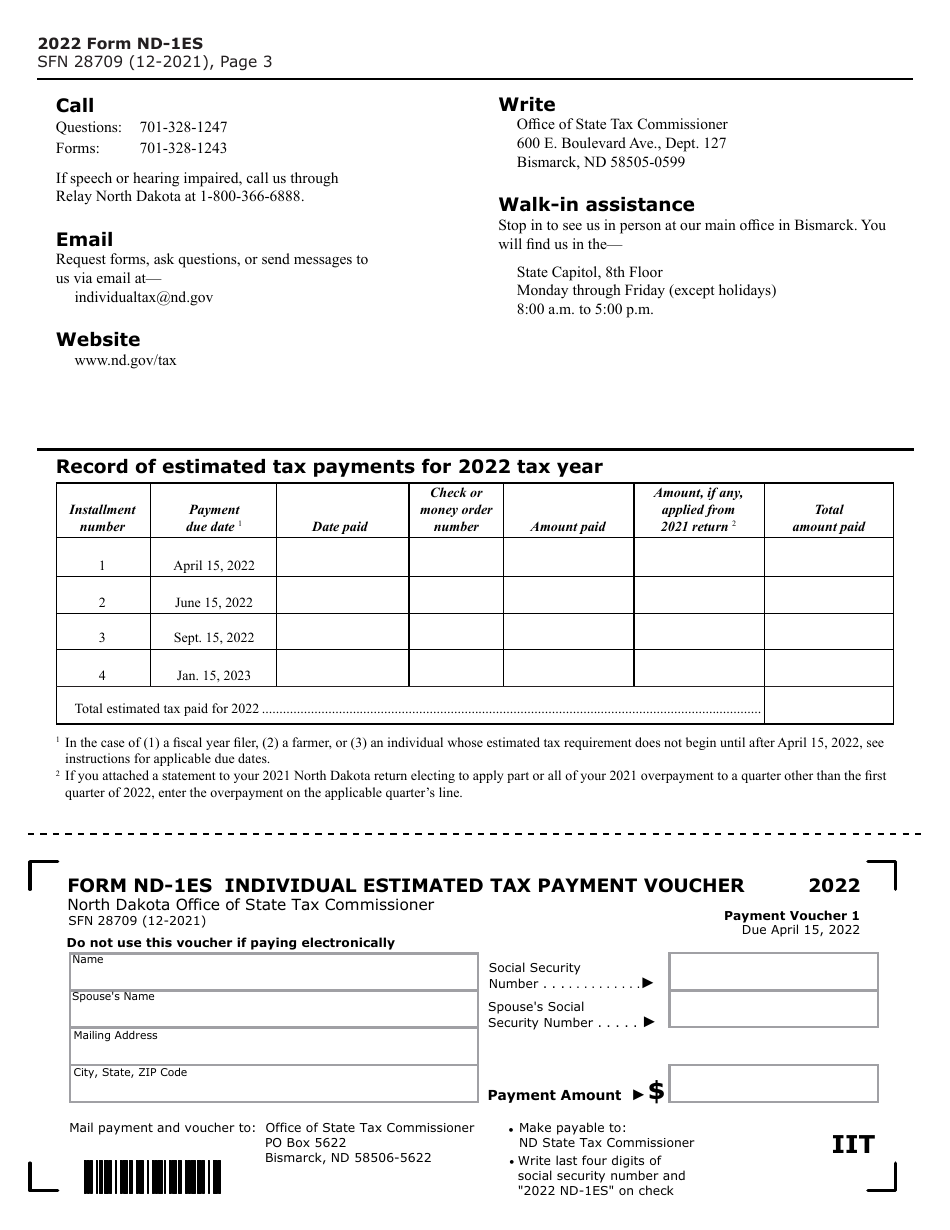

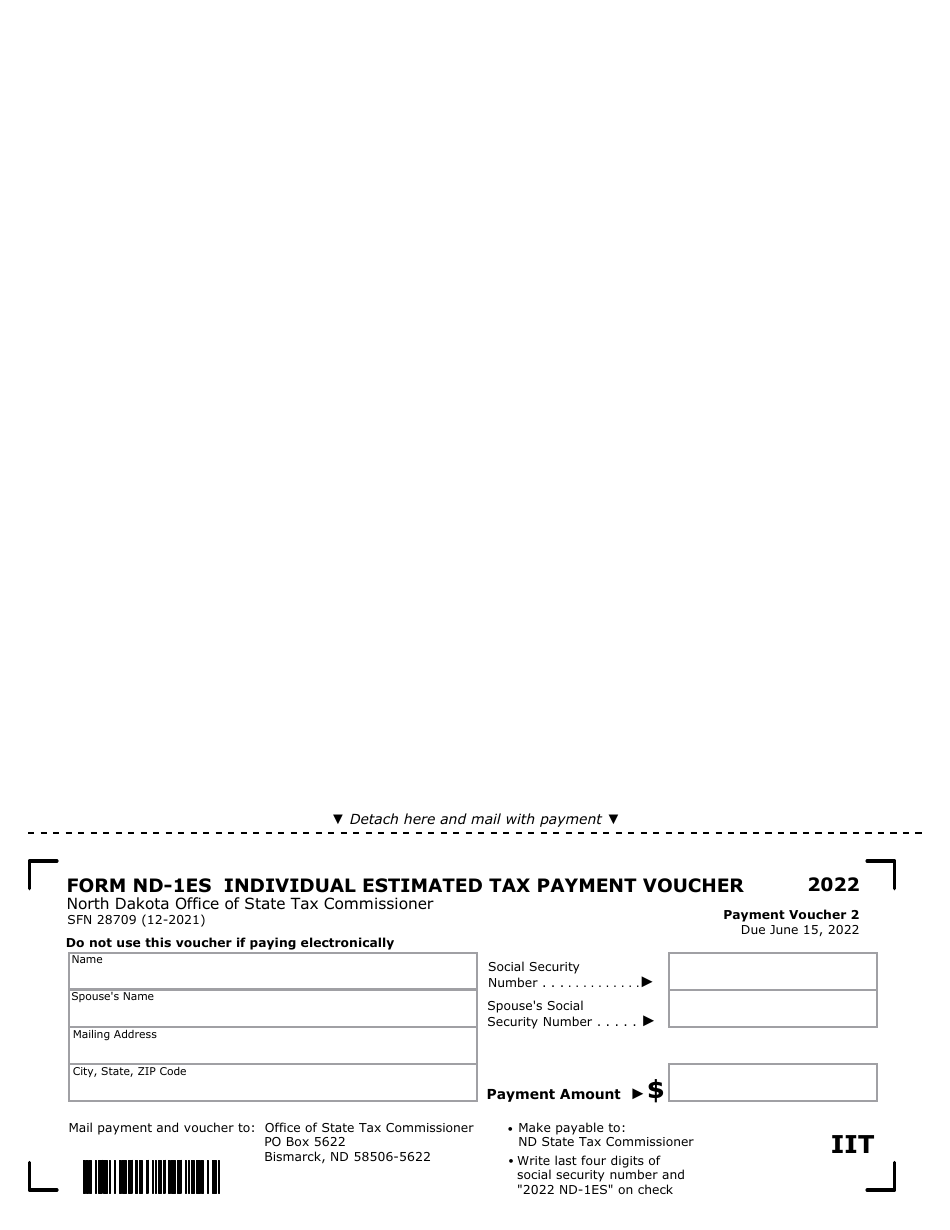

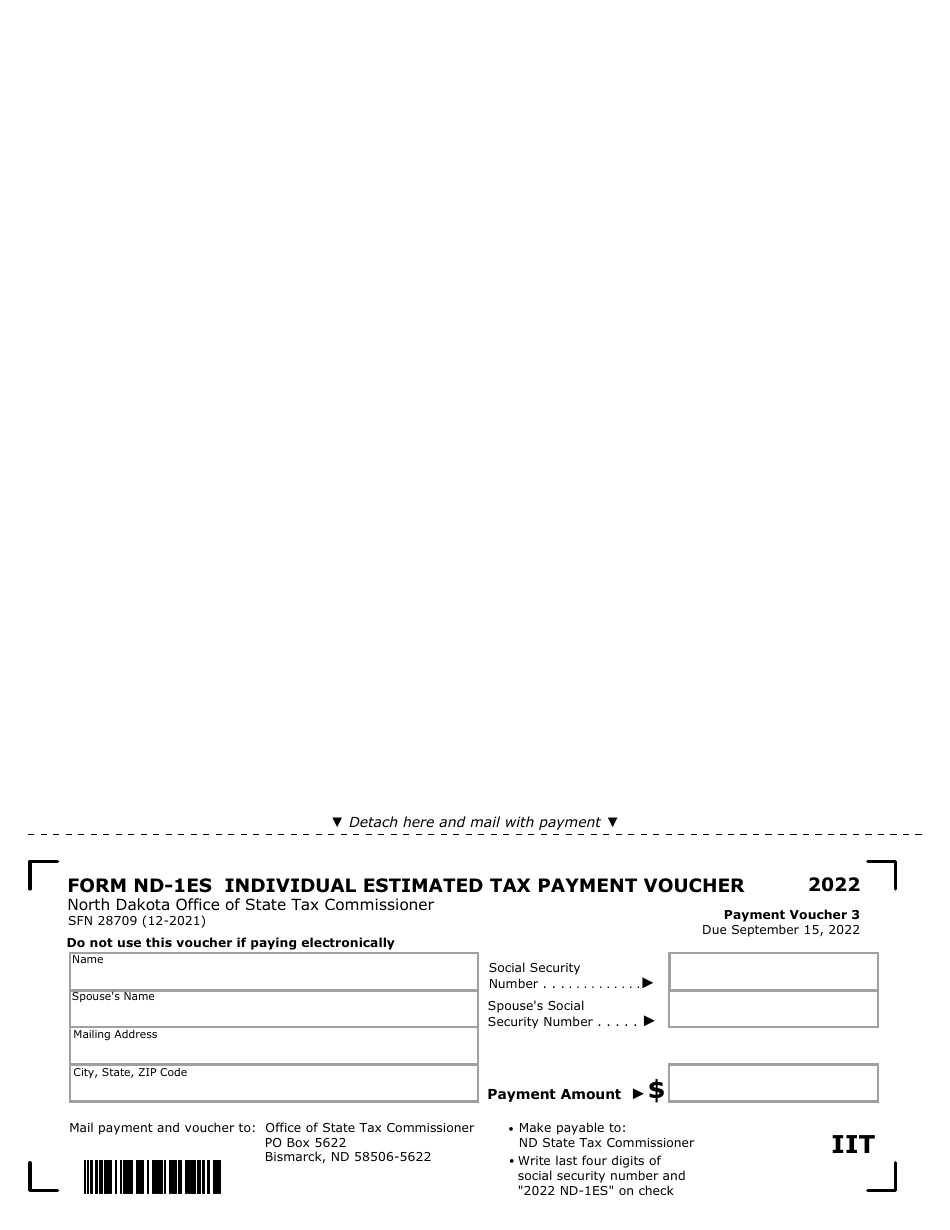

Form ND-1ES (SFN28709) Individual Estimated Tax Payment Voucher - North Dakota

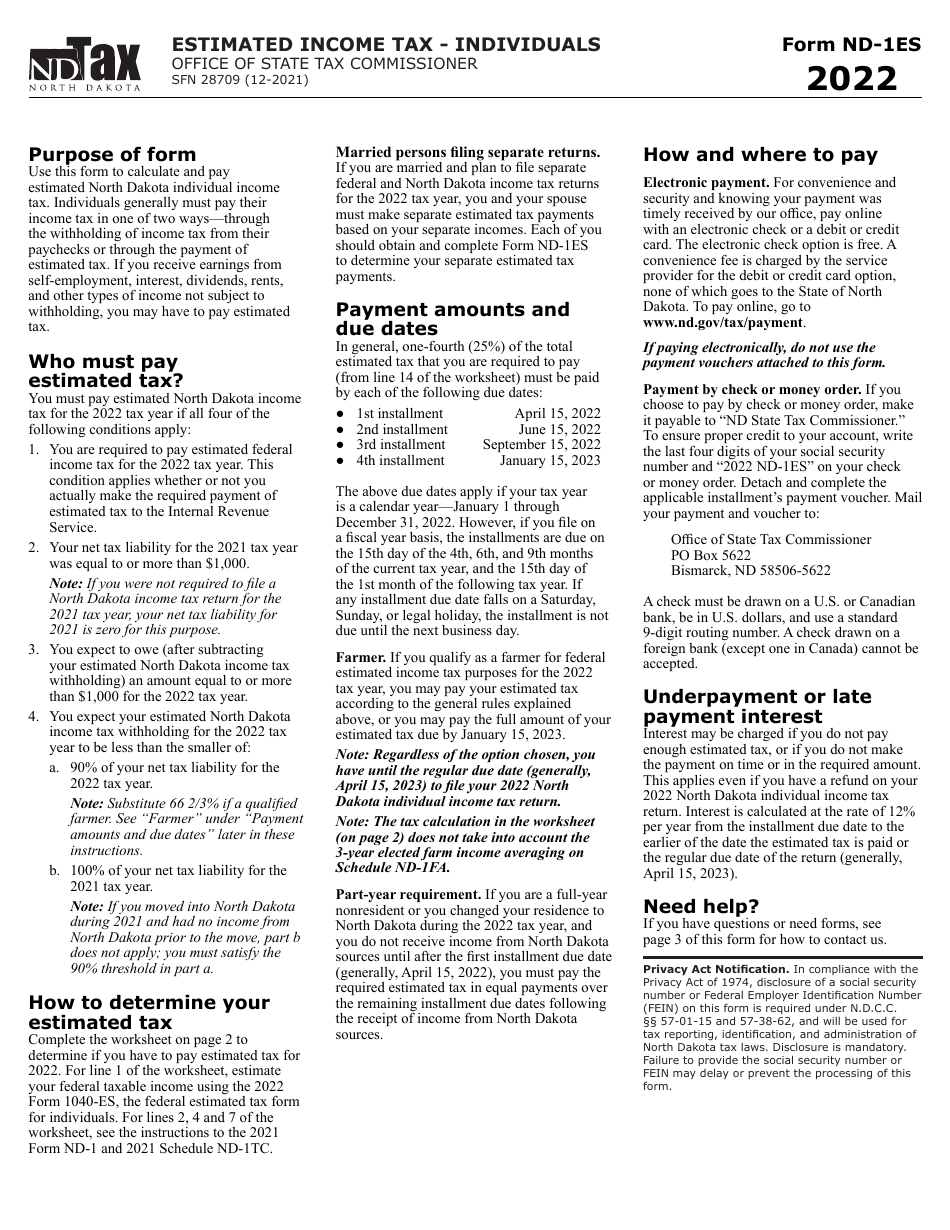

What Is Form ND-1ES (SFN28709)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1ES (SFN28709)?

A: Form ND-1ES (SFN28709) is the Individual Estimated Tax Payment Voucher for residents of North Dakota.

Q: Who needs to use Form ND-1ES (SFN28709)?

A: Residents of North Dakota who need to make estimated tax payments should use Form ND-1ES (SFN28709).

Q: What is an estimated tax payment?

A: An estimated tax payment is a payment made to the state government to cover your expected tax liability for the current tax year.

Q: Why do I need to make estimated tax payments?

A: If you expect to owe a certain amount in taxes for the current tax year, the state requires you to make estimated tax payments throughout the year to avoid penalties and interest.

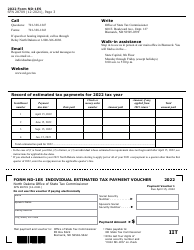

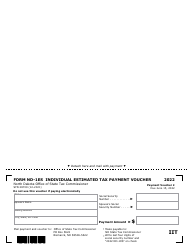

Q: How do I fill out Form ND-1ES (SFN28709)?

A: You will need to provide your personal information, estimate your taxable income and calculate your estimated tax liability, and indicate the amount you are paying with the voucher.

Q: When is the deadline for submitting Form ND-1ES (SFN28709)?

A: The deadline for submitting Form ND-1ES (SFN28709) is April 15th of the tax year, or the due date of your federal income tax return, whichever is later.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1ES (SFN28709) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.