This version of the form is not currently in use and is provided for reference only. Download this version of

Form 60-EXT (SFN28736)

for the current year.

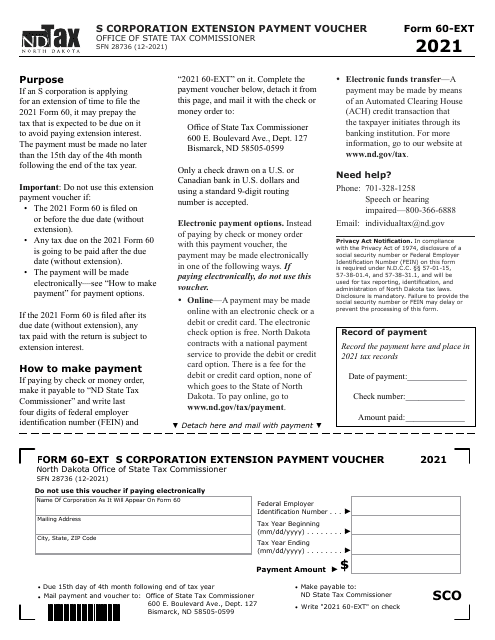

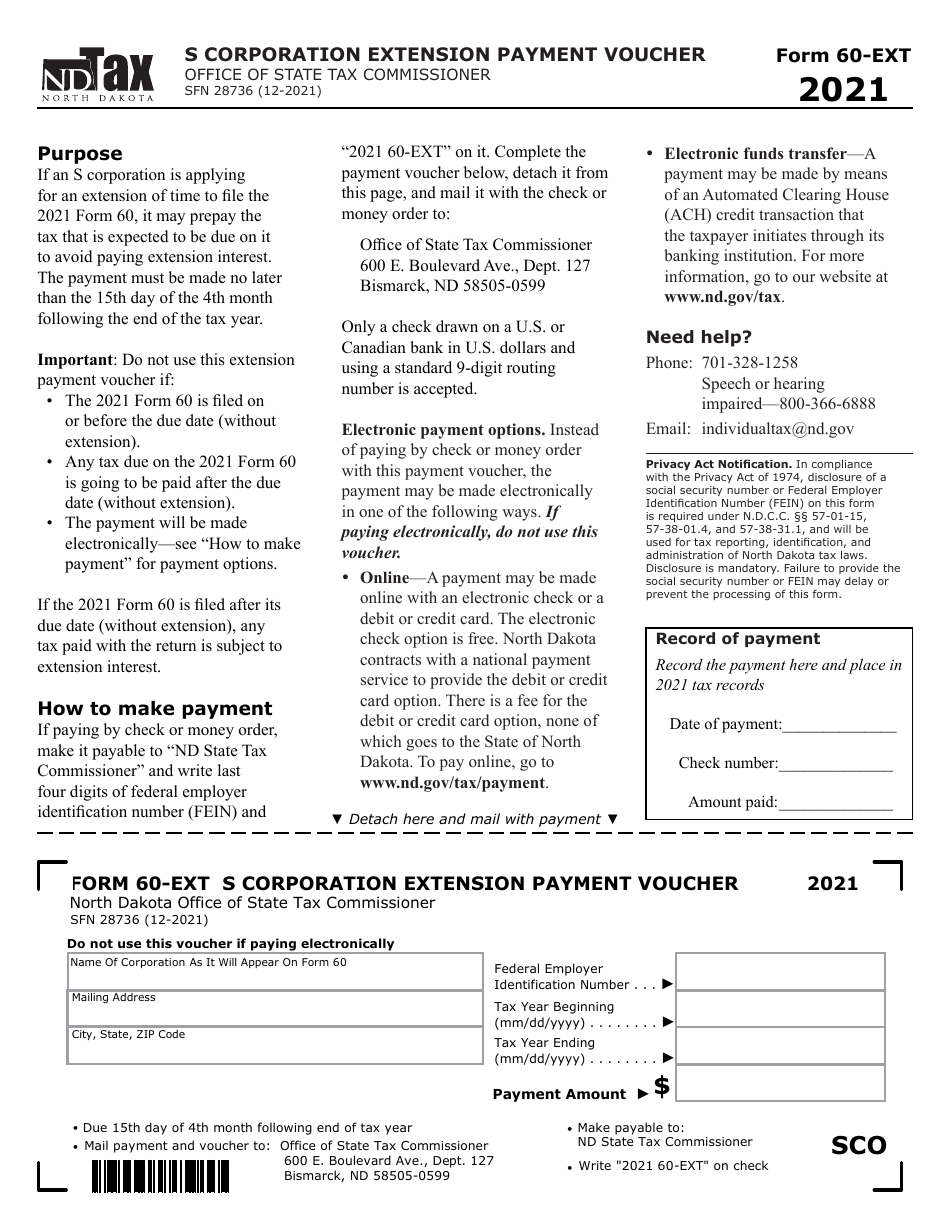

Form 60-EXT (SFN28736) S Corporation Extension Payment Voucher - North Dakota

What Is Form 60-EXT (SFN28736)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-EXT (SFN28736)?

A: Form 60-EXT (SFN28736) is a S Corporation Extension Payment Voucher for North Dakota.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that offers certain tax benefits to shareholders.

Q: What is an extension payment voucher?

A: An extension payment voucher is a form used to submit payment for a tax extension.

Q: What is the purpose of Form 60-EXT?

A: Form 60-EXT is used by S Corporations in North Dakota to request an extension of time to file their tax return and submit payment for any taxes owed.

Q: Do I need to file Form 60-EXT if I am not an S Corporation?

A: No, Form 60-EXT is specifically for S Corporations. If you are not an S Corporation, you may need to file a different extension form.

Q: What is the deadline for filing Form 60-EXT?

A: The deadline for filing Form 60-EXT is typically the same as the regular deadline for filing S Corporation tax returns, which is March 15th.

Q: Is there a penalty for filing Form 60-EXT late?

A: Yes, if you fail to file Form 60-EXT or pay the taxes due by the deadline, you may be subject to penalties and interest charges.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 60-EXT (SFN28736) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.