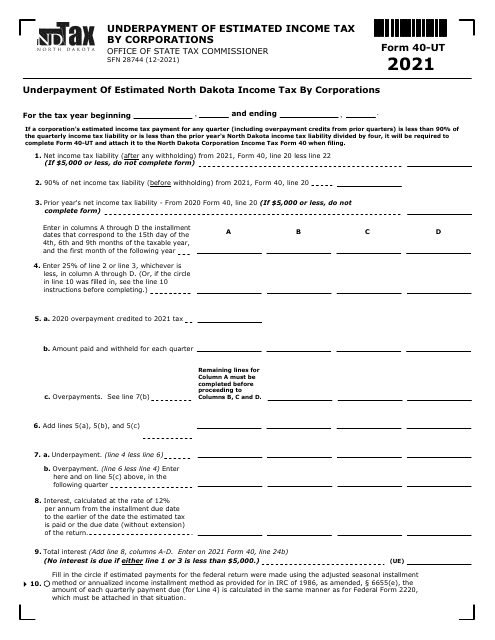

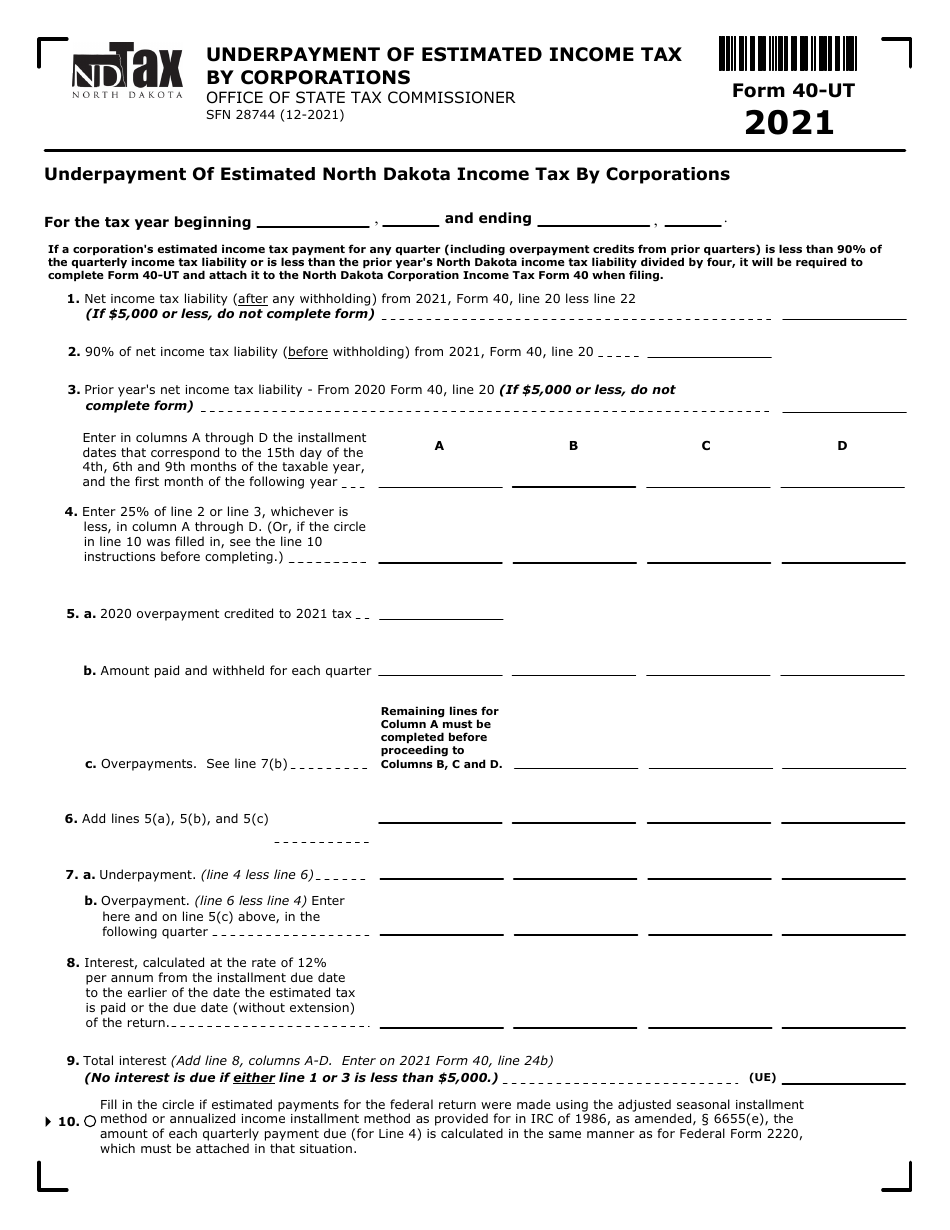

This version of the form is not currently in use and is provided for reference only. Download this version of

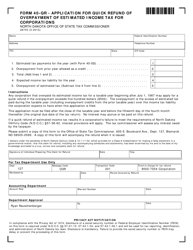

Form 40-UT (SFN28744)

for the current year.

Form 40-UT (SFN28744) Underpayment of Estimated Income Tax by Corporations - North Dakota

What Is Form 40-UT (SFN28744)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 40-UT?

A: Form 40-UT is the Underpayment of Estimated Income Tax by Corporations form for North Dakota.

Q: Who needs to file form 40-UT?

A: Corporations in North Dakota who have underpaid their estimated income tax need to file form 40-UT.

Q: What is the purpose of form 40-UT?

A: The purpose of form 40-UT is to calculate and report the underpayment of estimated income tax by corporations in North Dakota.

Q: When is form 40-UT due?

A: Form 40-UT is due on the same date as the North Dakota corporation income tax return, which is the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing form 40-UT?

A: Yes, there may be penalties for not filing form 40-UT or for underpaying estimated income tax. It is important to meet the filing and payment deadlines.

Q: Can form 40-UT be filed electronically?

A: No, as of now, form 40-UT cannot be filed electronically. It must be filed by mail.

Q: Is form 40-UT specific to North Dakota?

A: Yes, form 40-UT is specific to North Dakota and is used for reporting underpayment of estimated income tax by corporations in the state.

Q: Can I carry over underpayment from a previous year on form 40-UT?

A: No, form 40-UT does not allow for carrying over underpayment from a previous year. It is only used to report underpayment for the current tax year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-UT (SFN28744) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.