This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form SFN28706 Schedule RZ

for the current year.

Instructions for Form SFN28706 Schedule RZ Renaissance Zone Income Exemption and Tax Credits - North Dakota

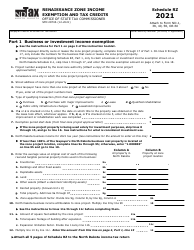

This document contains official instructions for Form SFN28706 Schedule RZ, Income Exemption and Tax Credits - a form released and collected by the North Dakota Office of State Tax Commissioner. An up-to-date fillable Form SFN28706 Schedule RZ is available for download through this link.

FAQ

Q: What is Form SFN28706 Schedule RZ?

A: Form SFN28706 Schedule RZ is a schedule that is used to claim Renaissance Zone Income Exemption and Tax Credits in North Dakota.

Q: What are Renaissance Zones?

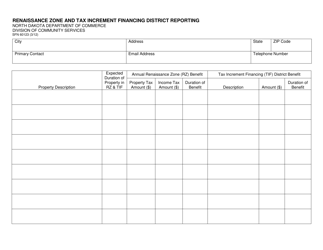

A: Renaissance Zones are designated areas in North Dakota that provide economic incentives and tax benefits to businesses and residents.

Q: Who is eligible to claim the Renaissance Zone Income Exemption and Tax Credits?

A: Businesses and individuals who have income from activities within a designated Renaissance Zone in North Dakota may be eligible to claim the exemption and tax credits.

Q: What is the purpose of the Renaissance Zone Income Exemption?

A: The purpose of the Renaissance Zone Income Exemption is to encourage investment and economic development in designated Renaissance Zones by exempting qualified income from North Dakota income tax.

Q: What are the tax credits available in the Renaissance Zones?

A: There are several tax credits available in the Renaissance Zones, including the Renaissance Zone Investment Tax Credit, Renaissance Zone Employment Tax Credit, Renaissance Zone Research Expense Credit, and Renaissance Zone Work Opportunity Tax Credit.

Q: How do I fill out Form SFN28706 Schedule RZ?

A: You will need to provide information about your income from activities within the designated Renaissance Zone, as well as any tax credits you are claiming. Follow the instructions on the form to fill it out correctly.

Q: When is the deadline to file Form SFN28706 Schedule RZ?

A: The deadline to file Form SFN28706 Schedule RZ is the same as the individual incometax filing deadline in North Dakota, which is typically April 15th.

Q: Can I claim the Renaissance Zone Income Exemption and Tax Credits if I don't live in a Renaissance Zone?

A: Yes, you may still be eligible to claim the exemption and tax credits if you have income from activities within a designated Renaissance Zone, even if you don't live there.

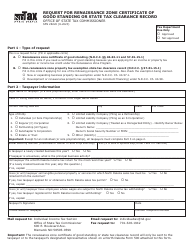

Q: What documentation do I need to include with Form SFN28706 Schedule RZ?

A: You may need to include supporting documentation such as income statements, investment receipts, and employment records to substantiate your claim for the Renaissance Zone Income Exemption and Tax Credits.

Instruction Details:

- This 14-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Dakota Office of State Tax Commissioner.