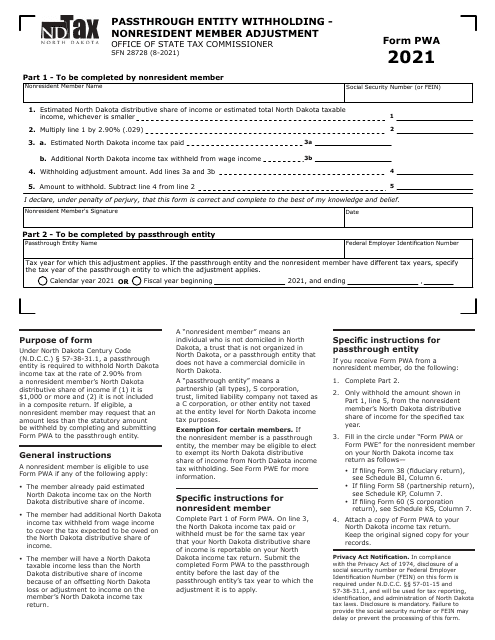

Form SFN28728 (PWA) Passthrough Entity Withholding - Nonresident Member Adjustment - North Dakota

What Is Form SFN28728 (PWA)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28728 (PWA)?

A: Form SFN28728 (PWA) is a tax form used for Passthrough Entity Withholding in North Dakota.

Q: What is Passthrough Entity Withholding?

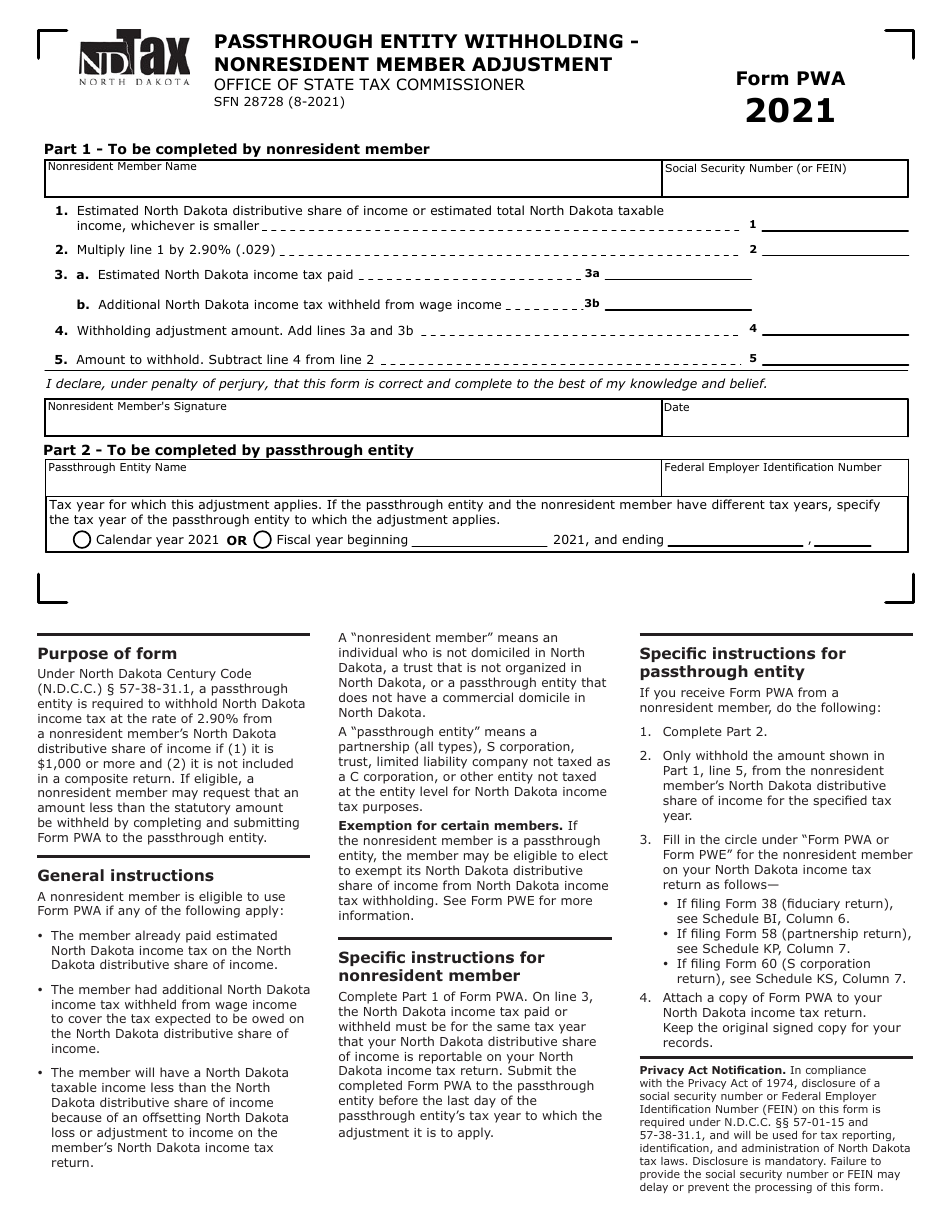

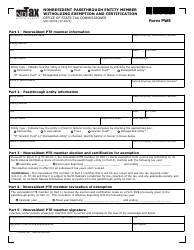

A: Passthrough Entity Withholding is a tax requirement in North Dakota where passthrough entities must withhold taxes on income distributed to nonresident members.

Q: Who needs to file Form SFN28728 (PWA)?

A: Passthrough entities in North Dakota who have nonresident members and are required to withhold taxes.

Q: What is a nonresident member?

A: A nonresident member refers to an individual or entity that is not a resident of North Dakota, but has ownership in a passthrough entity.

Q: What is Nonresident Member Adjustment?

A: Nonresident Member Adjustment is a provision in North Dakota tax law that allows nonresident members to adjust their withholding based on their individual tax situation.

Q: When is the deadline to file Form SFN28728 (PWA)?

A: The deadline to file Form SFN28728 (PWA) is generally on or before the due date of the passthrough entity's tax return.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFN28728 (PWA) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.