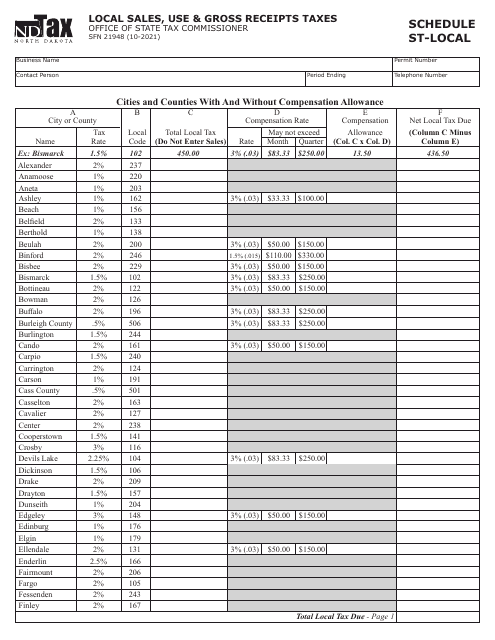

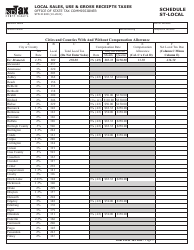

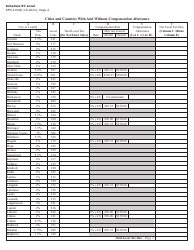

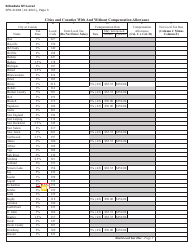

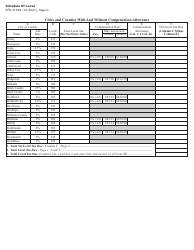

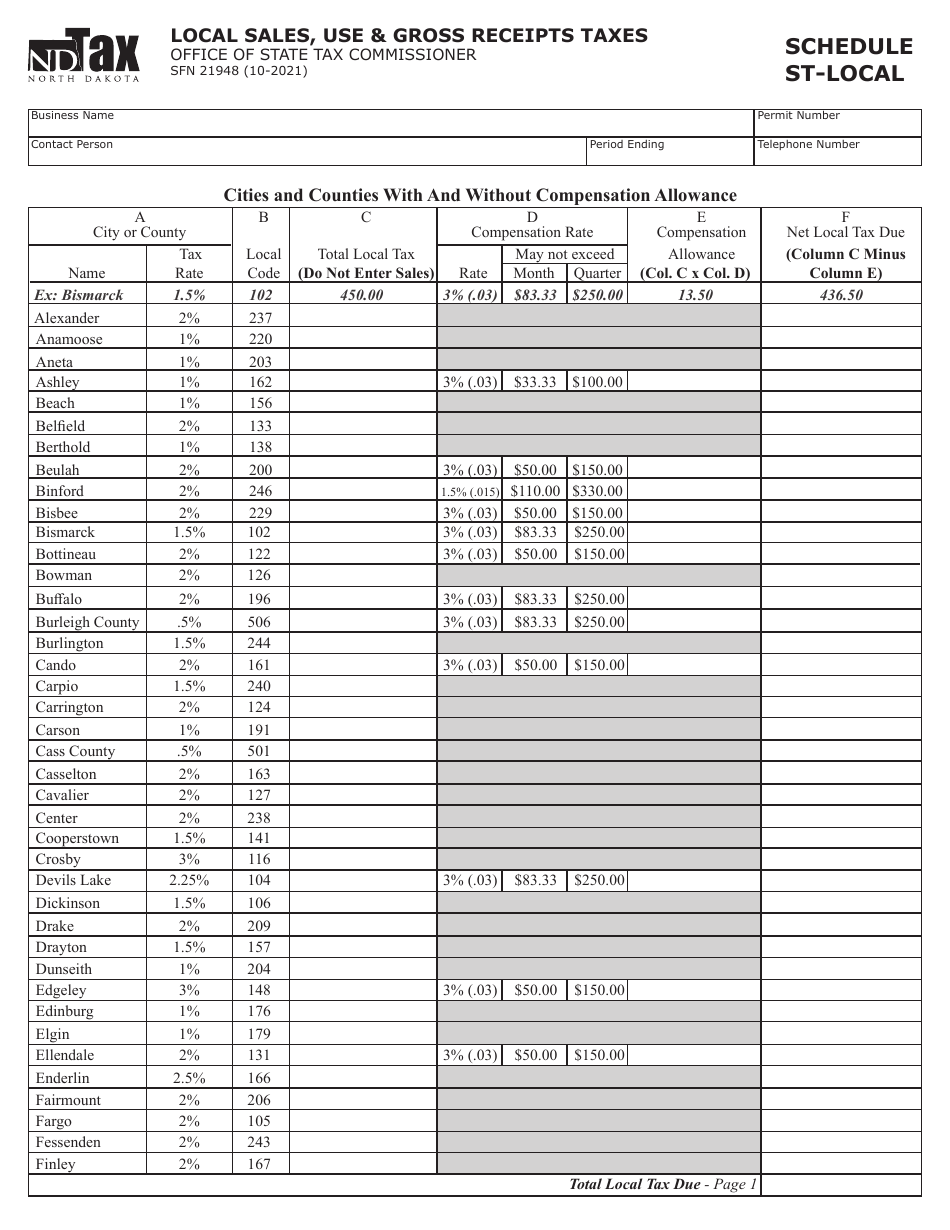

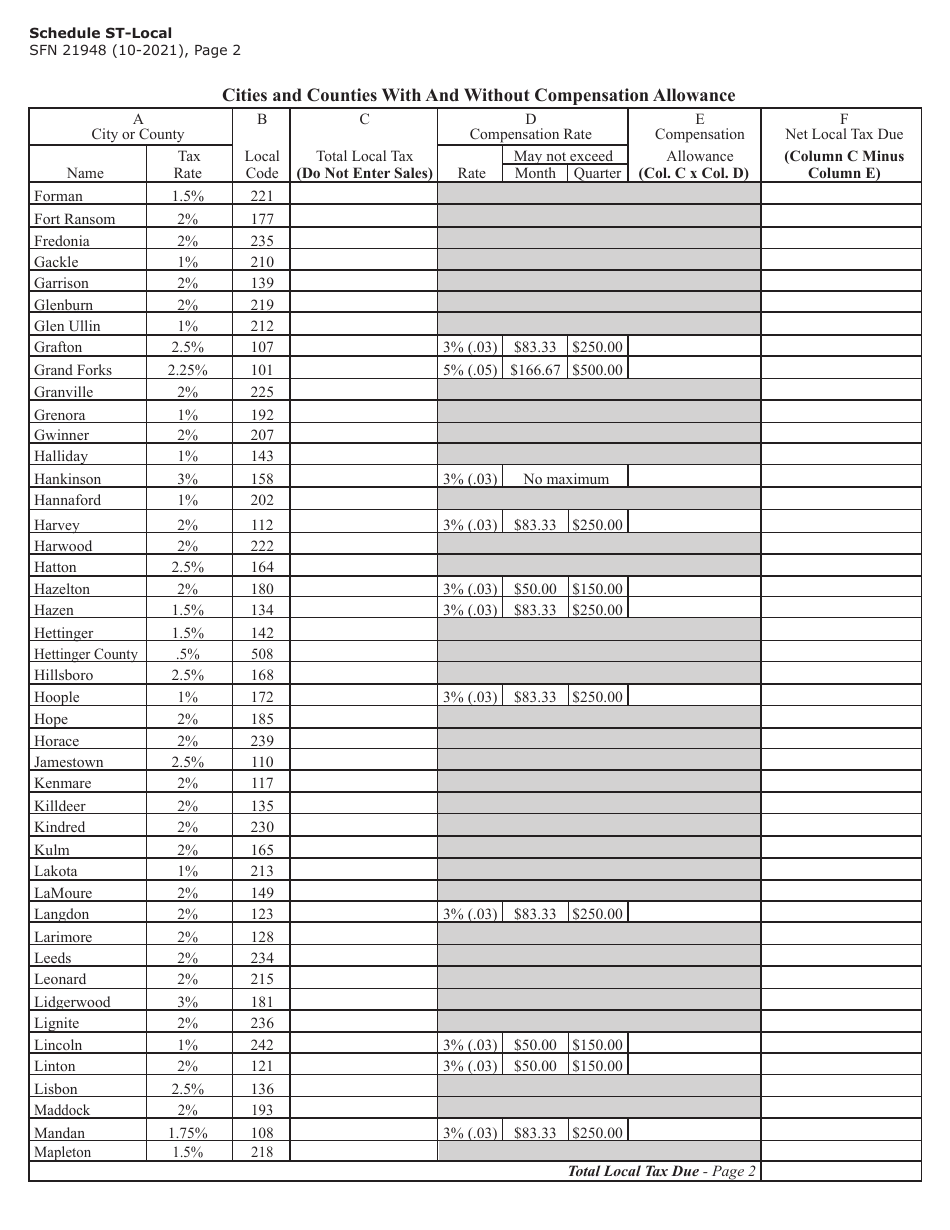

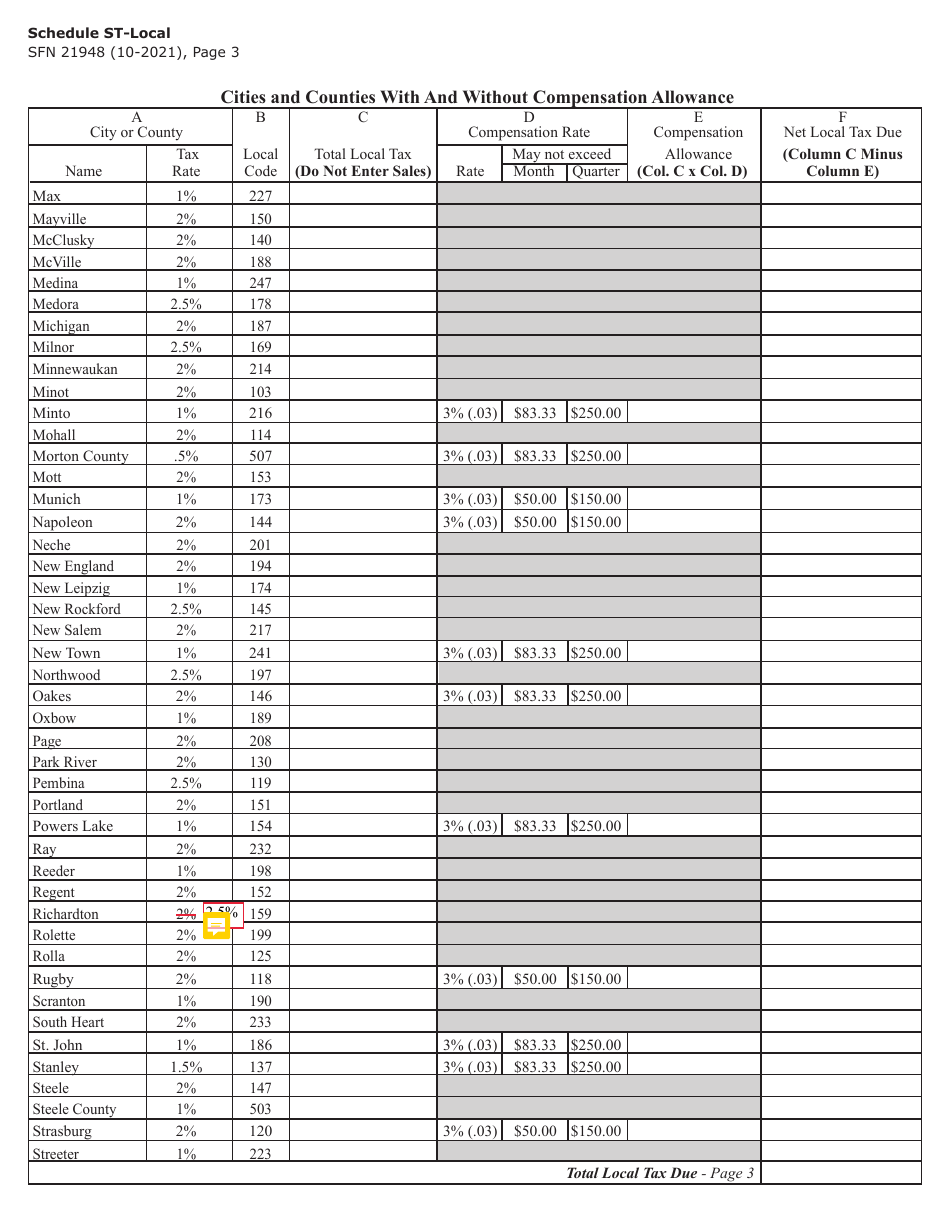

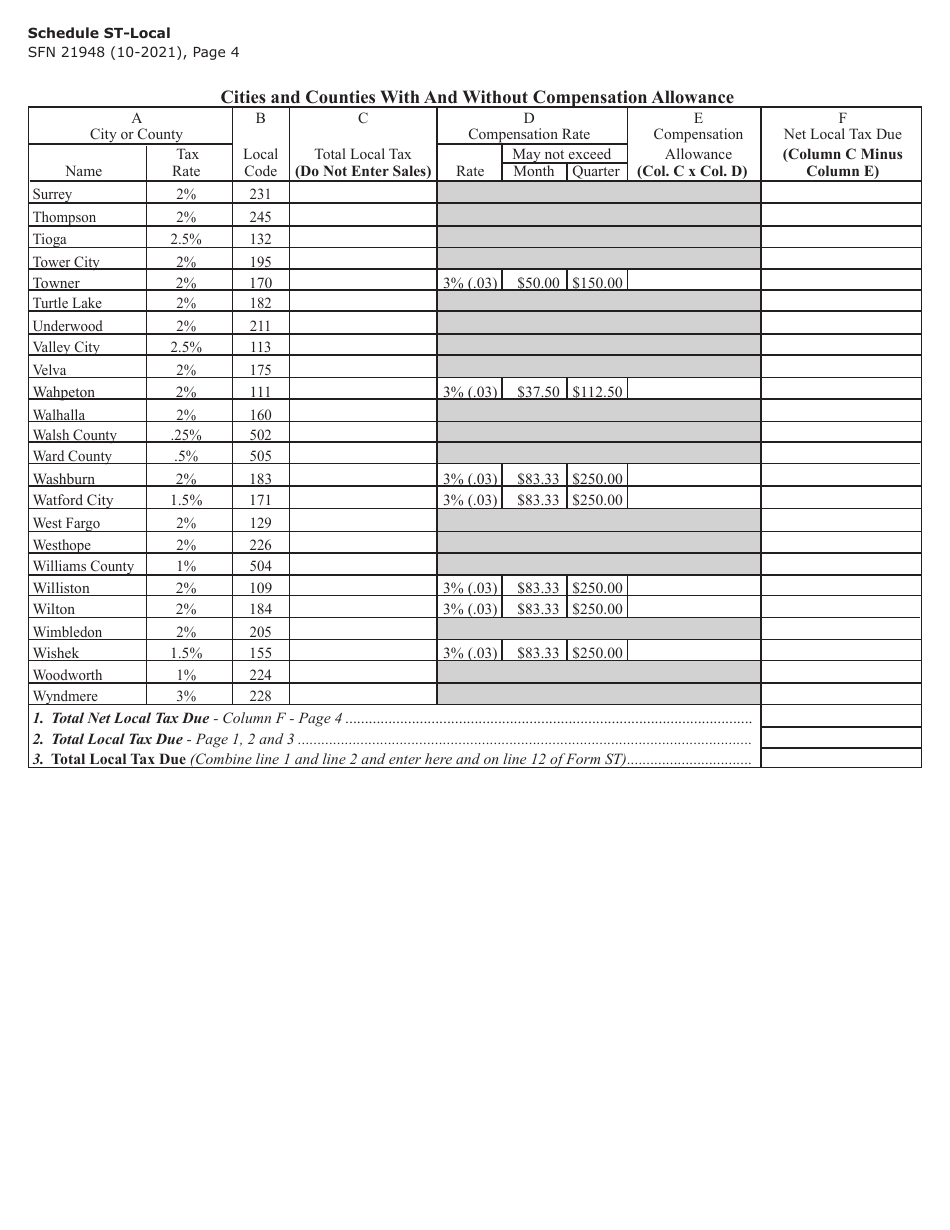

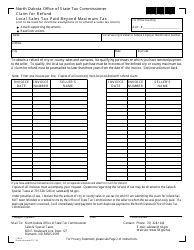

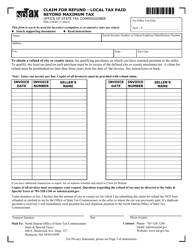

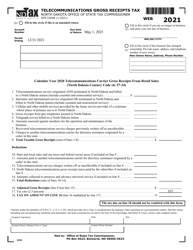

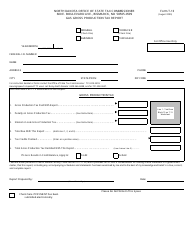

Form SFN21948 Schedule ST-LOCAL Local Sales, Use & Gross Receipts Taxes - North Dakota

What Is Form SFN21948 Schedule ST-LOCAL?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SFN21948 Schedule ST-LOCAL?

A: SFN21948 Schedule ST-LOCAL is a form used in North Dakota to report local sales, use, and gross receipts taxes.

Q: Who needs to file SFN21948 Schedule ST-LOCAL?

A: Any individual or business in North Dakota that is required to collect and remit local sales, use, and gross receipts taxes needs to file SFN21948 Schedule ST-LOCAL.

Q: What taxes are reported on SFN21948 Schedule ST-LOCAL?

A: SFN21948 Schedule ST-LOCAL is used to report local sales, use, and gross receipts taxes in North Dakota.

Q: How often do I need to file SFN21948 Schedule ST-LOCAL?

A: The frequency of filing SFN21948 Schedule ST-LOCAL depends on the individual or business's sales volume and tax liability. It could be filed monthly, quarterly, or annually.

Q: Are there any penalties for not filing SFN21948 Schedule ST-LOCAL?

A: Yes, there may be penalties for failure to file SFN21948 Schedule ST-LOCAL or for underreporting or late payment of taxes. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN21948 Schedule ST-LOCAL by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.