This version of the form is not currently in use and is provided for reference only. Download this version of

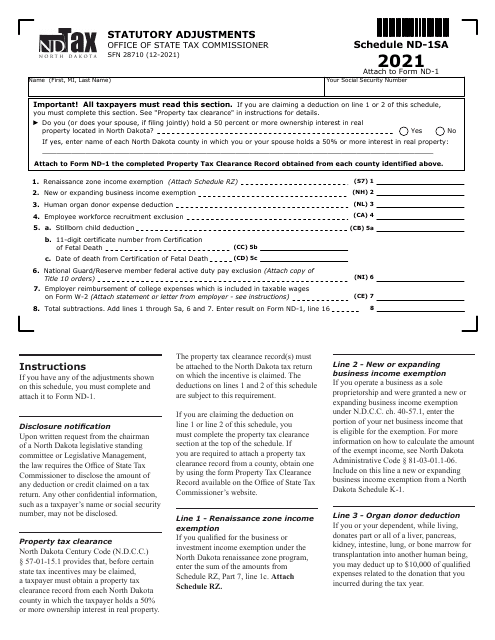

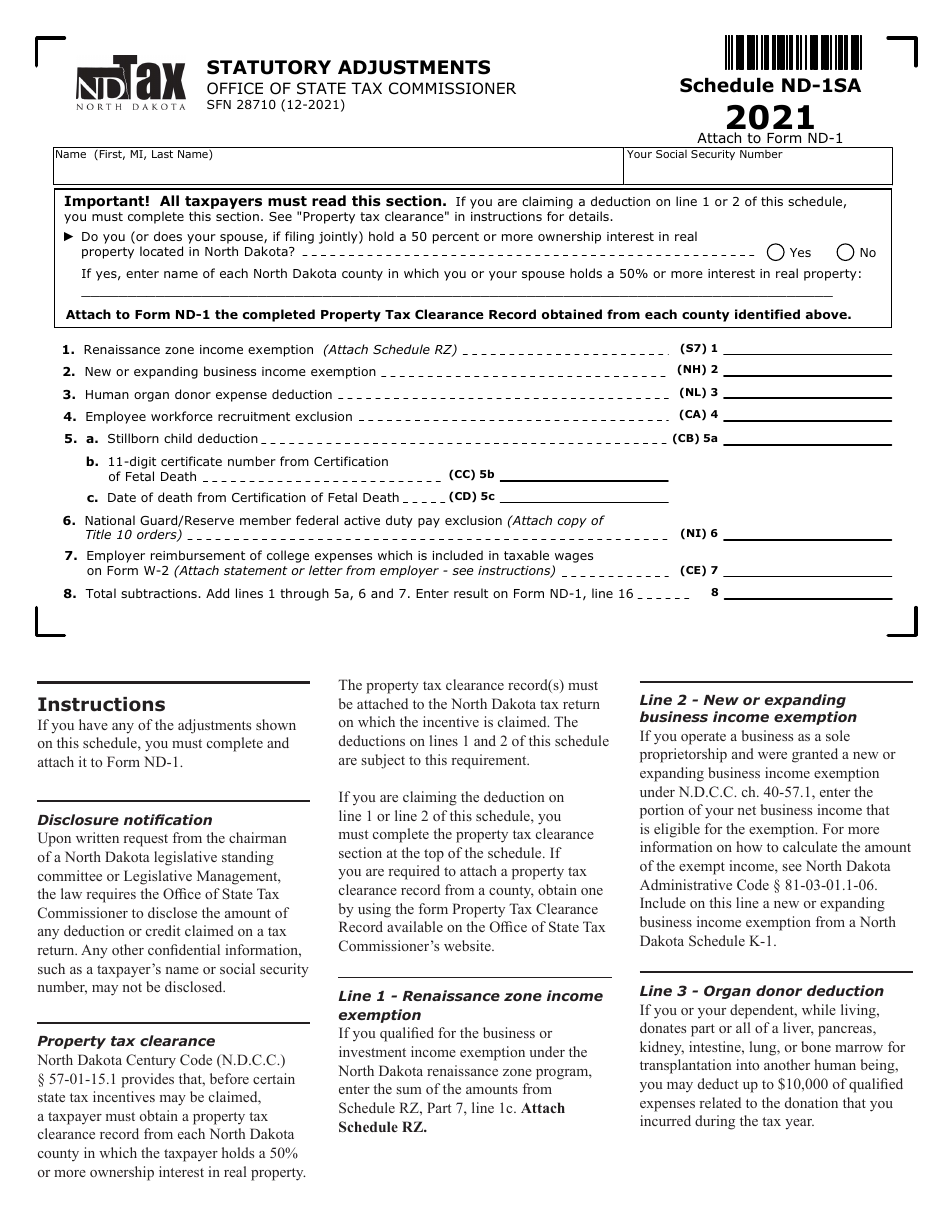

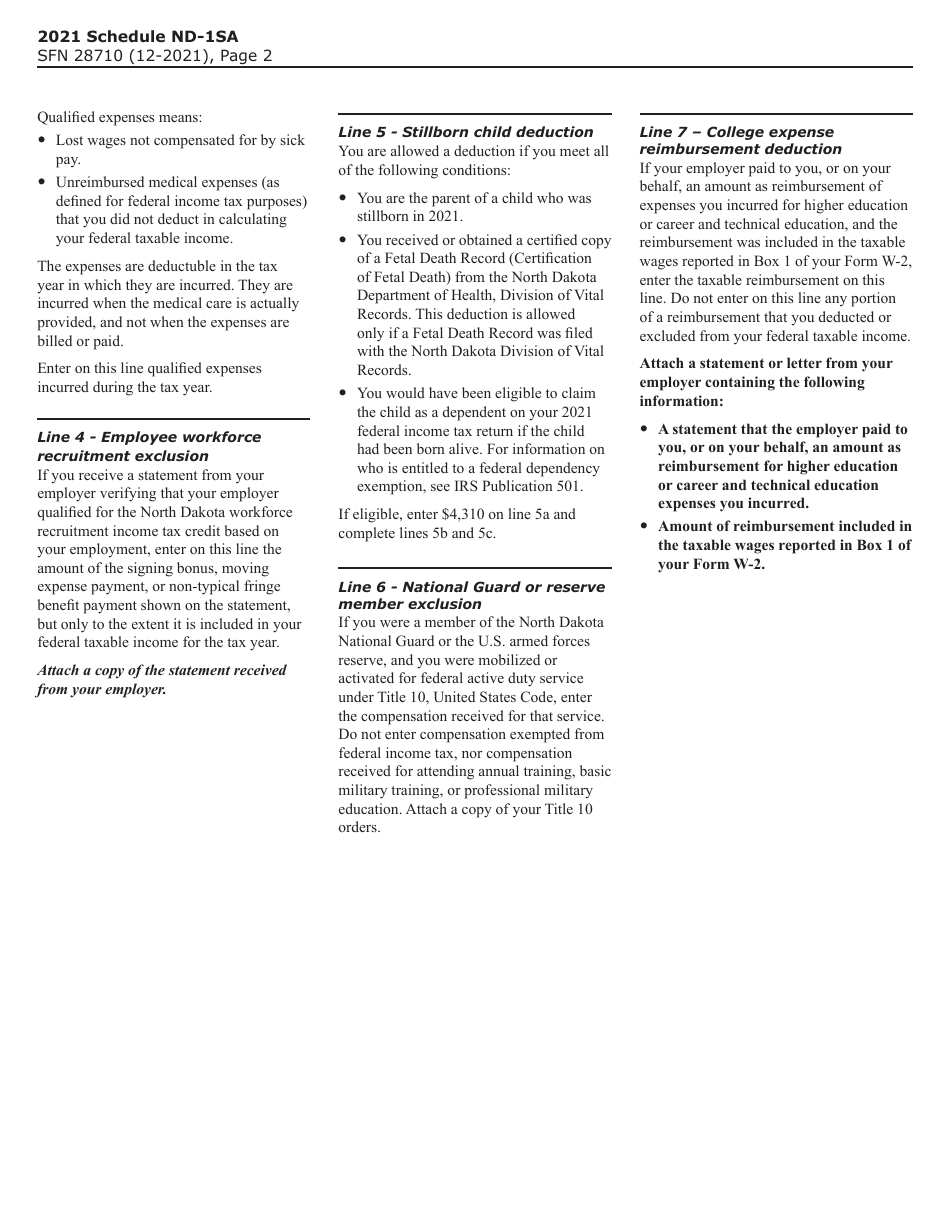

Form SFN28710 Schedule ND-1SA

for the current year.

Form SFN28710 Schedule ND-1SA Statutory Adjustments - North Dakota

What Is Form SFN28710 Schedule ND-1SA?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SFN28710 Schedule ND-1SA?

A: SFN28710 Schedule ND-1SA is a form used for calculating statutory adjustments in North Dakota.

Q: What are statutory adjustments?

A: Statutory adjustments are specific deductions or additions to taxable income that are mandated by law.

Q: Who needs to file SFN28710 Schedule ND-1SA?

A: North Dakota residents who have statutory adjustments to report on their state income tax return need to file SFN28710 Schedule ND-1SA.

Q: What should I include in SFN28710 Schedule ND-1SA?

A: You should include any statutory adjustments that apply to your situation, such as deductions or additions to your taxable income.

Q: Are there specific instructions for filling out SFN28710 Schedule ND-1SA?

A: Yes, the form comes with instructions that provide guidance on how to fill it out correctly.

Q: When is the deadline for filing SFN28710 Schedule ND-1SA?

A: The deadline for filing SFN28710 Schedule ND-1SA is the same as the deadline for your North Dakota state income tax return, which is typically April 15th.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28710 Schedule ND-1SA by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.