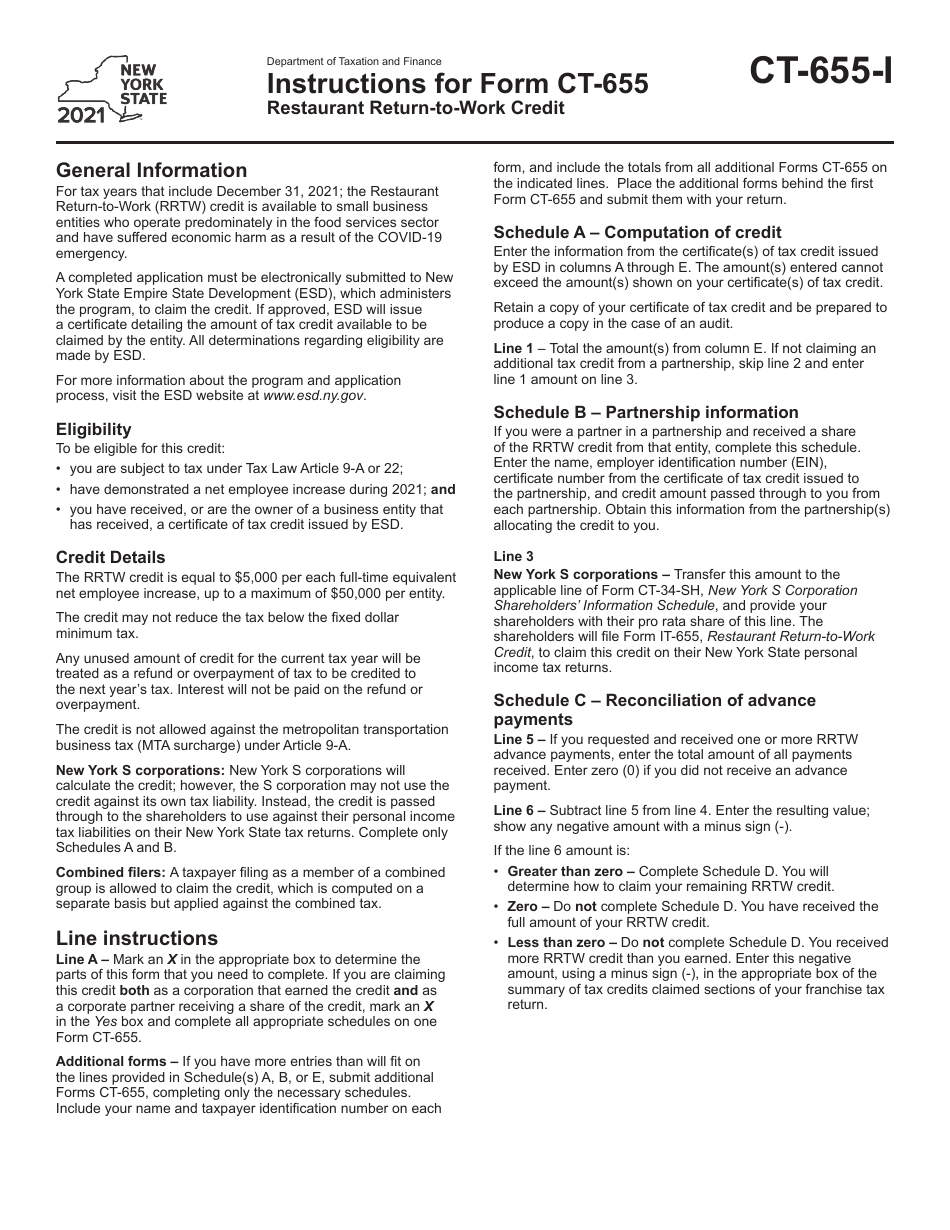

Instructions for Form CT-655 Restaurant Return-To-Work Credit - New York

This document contains official instructions for Form CT-655 , Restaurant Return-To-Work Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-655 is available for download through this link.

FAQ

Q: What is Form CT-655?

A: Form CT-655 is the Restaurant Return-To-Work Credit form in New York.

Q: What is the purpose of Form CT-655?

A: The purpose of Form CT-655 is to claim a tax credit for hiring qualified restaurant workers.

Q: Who is eligible to claim the Restaurant Return-To-Work Credit?

A: Qualified restaurants in New York that hire eligible employees are eligible to claim the credit.

Q: What is the credit amount?

A: The credit amount is $5,000 per eligible employee.

Q: What are the requirements for an eligible employee?

A: An eligible employee must be a resident of New York and must have been unemployed for at least 60 consecutive days before being hired.

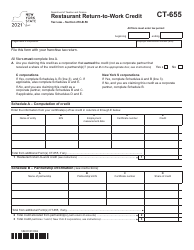

Q: How do I complete Form CT-655?

A: You need to provide information about your restaurant, the qualifying employees, and the total credit amount on the form.

Q: What supporting documentation is required?

A: You need to attach copies of the qualifying employees' employment records and unemployment documentation.

Q: When is the deadline to file Form CT-655?

A: The form must be filed by December 31 of the year following the year in which the qualified employees were hired.

Q: Can I e-file Form CT-655?

A: No, you cannot e-file Form CT-655. It must be filed by mail.

Instruction Details:

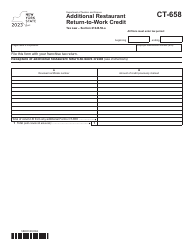

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.