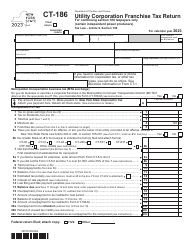

This version of the form is not currently in use and is provided for reference only. Download this version of

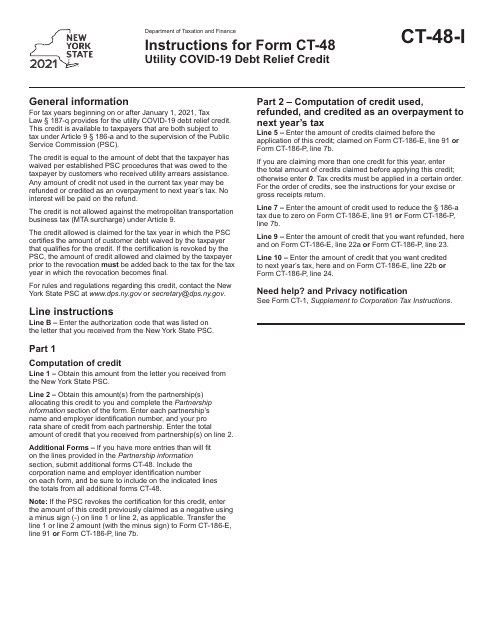

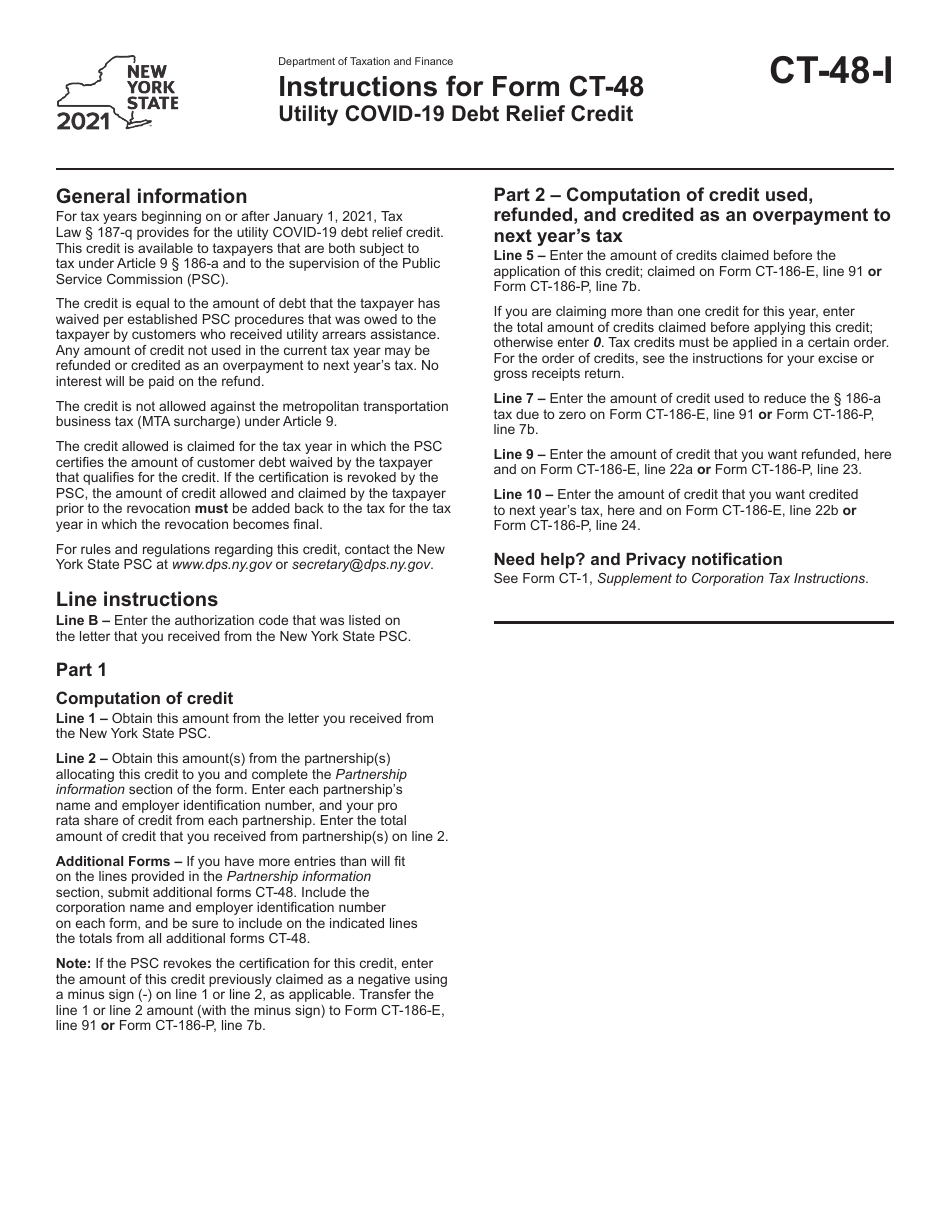

Instructions for Form CT-48

for the current year.

Instructions for Form CT-48 Utility Covid-19 Debt Relief Credit - New York

This document contains official instructions for Form CT-48 , Utility Covid-19 Debt Relief Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-48 is available for download through this link.

FAQ

Q: What is Form CT-48?

A: Form CT-48 is a tax form used in New York.

Q: What is the Utility Covid-19 Debt Relief Credit?

A: The Utility Covid-19 Debt Relief Credit is a credit available to eligible taxpayers in New York.

Q: Who is eligible for the Utility Covid-19 Debt Relief Credit?

A: Taxpayers who have unpaid utility bills incurred during the Covid-19 pandemic may be eligible for this credit.

Q: How do I fill out Form CT-48?

A: You should follow the instructions provided on Form CT-48 and fill out the required information accurately.

Q: Is there a deadline for filing Form CT-48?

A: Yes, the deadline for filing Form CT-48 is typically April 15th, unless an extension has been granted.

Q: How much is the Utility Covid-19 Debt Relief Credit?

A: The amount of the credit depends on the taxpayers' unpaid utility bills. Please refer to the instructions for more information.

Q: Can I claim the Utility Covid-19 Debt Relief Credit if I live in a different state?

A: No, the Utility Covid-19 Debt Relief Credit is specific to taxpayers in New York.

Q: What documentation do I need to include with Form CT-48?

A: You may need to include documentation such as utility bills and proof of Covid-19 impact. Please refer to the instructions for specific requirements.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.