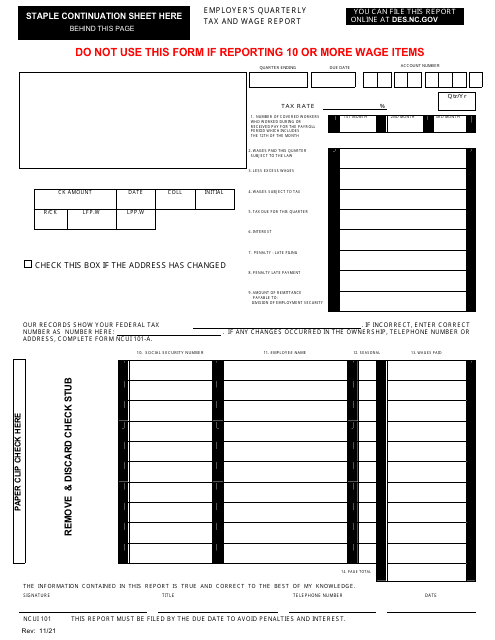

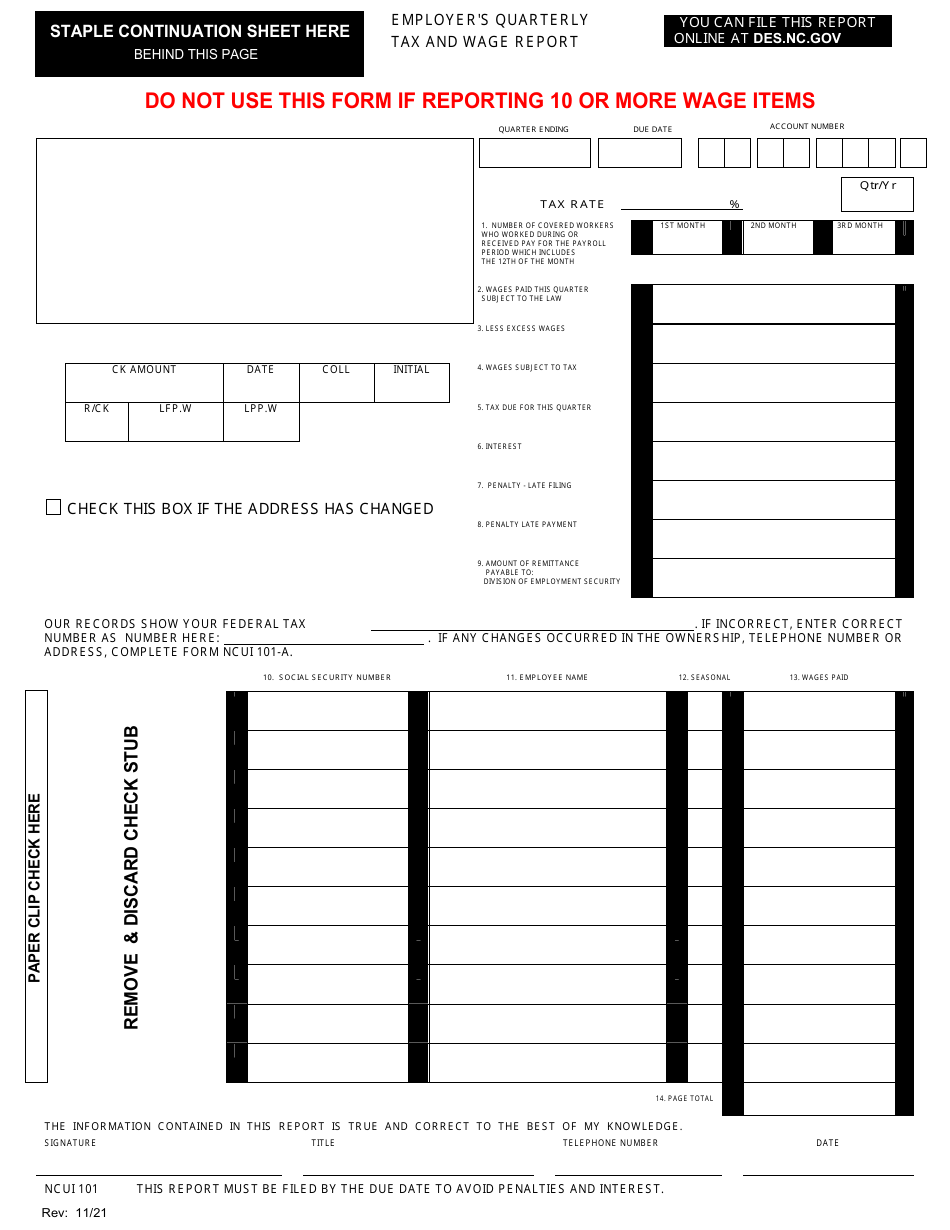

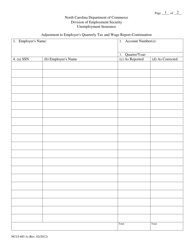

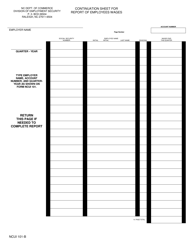

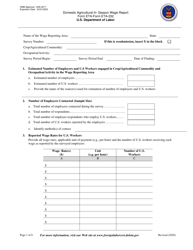

Form NCUI101 Employer's Quarterly Tax and Wage Report - North Carolina

What Is Form NCUI101?

This is a legal form that was released by the North Carolina Department of Commerce - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NCUI101 Employer's Quarterly Tax and Wage Report?

A: The NCUI101 Employer's Quarterly Tax and Wage Report is a form that employers in North Carolina use to report their quarterly tax and wage information.

Q: Who needs to file the NCUI101 form?

A: All employers in North Carolina who have paid wages to one or more employees during the quarter need to file the NCUI101 form.

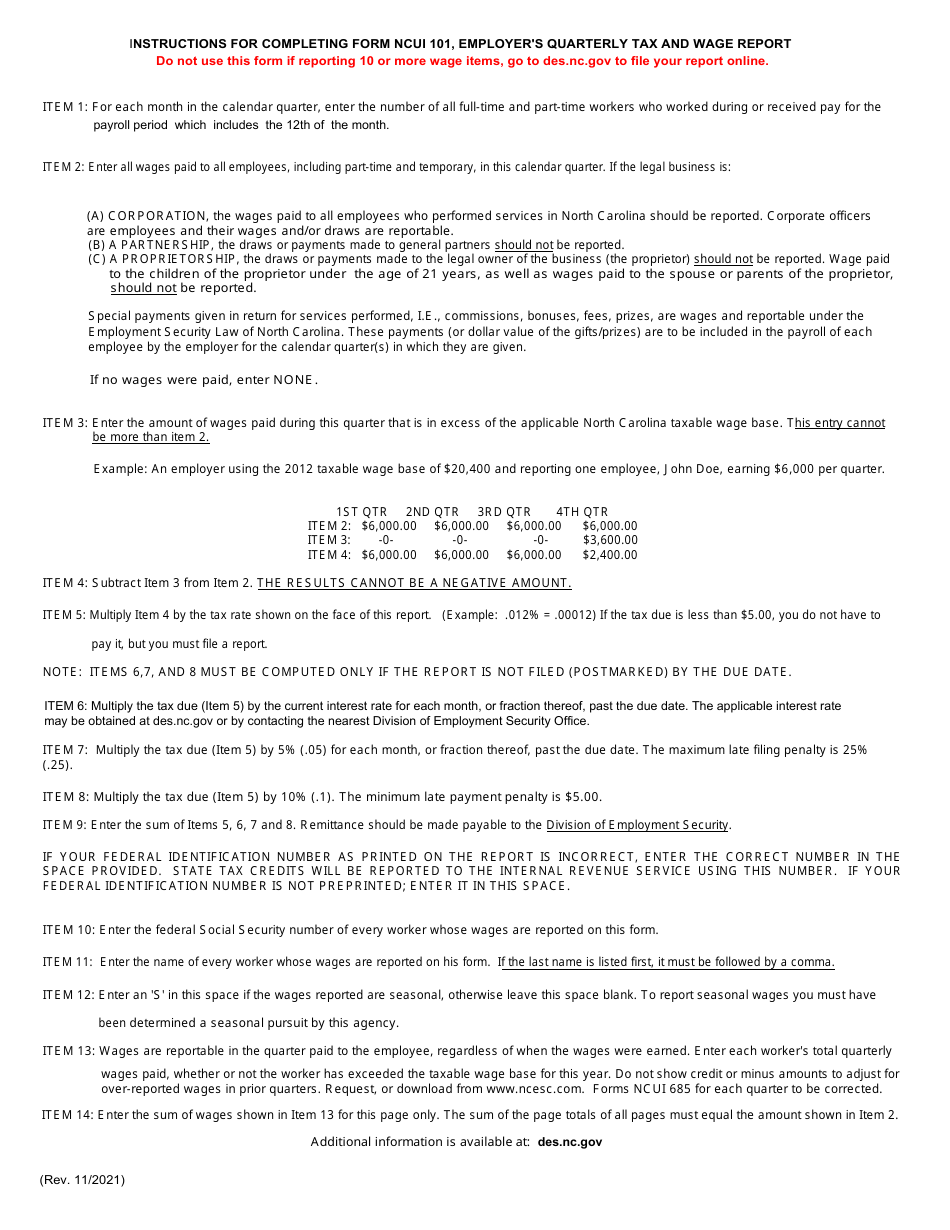

Q: What information is required on the NCUI101 form?

A: The NCUI101 form requires employers to provide information such as their employer account number, total wages paid during the quarter, number of employees, and unemployment contributions.

Q: When is the deadline to file the NCUI101 form?

A: The NCUI101 form must be filed by the last day of the month following the end of the quarter. For example, the form for the first quarter (January-March) is due by the end of April.

Q: Are there any penalties for not filing the NCUI101 form?

A: Yes, failure to file the NCUI101 form or filing it late can result in penalties and interest charges.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the North Carolina Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NCUI101 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Commerce.