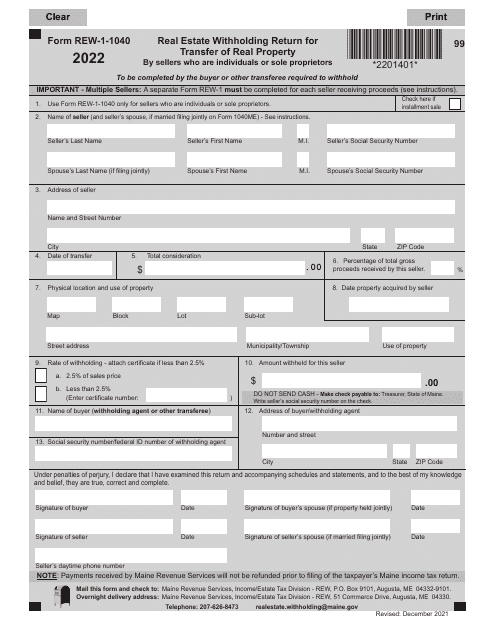

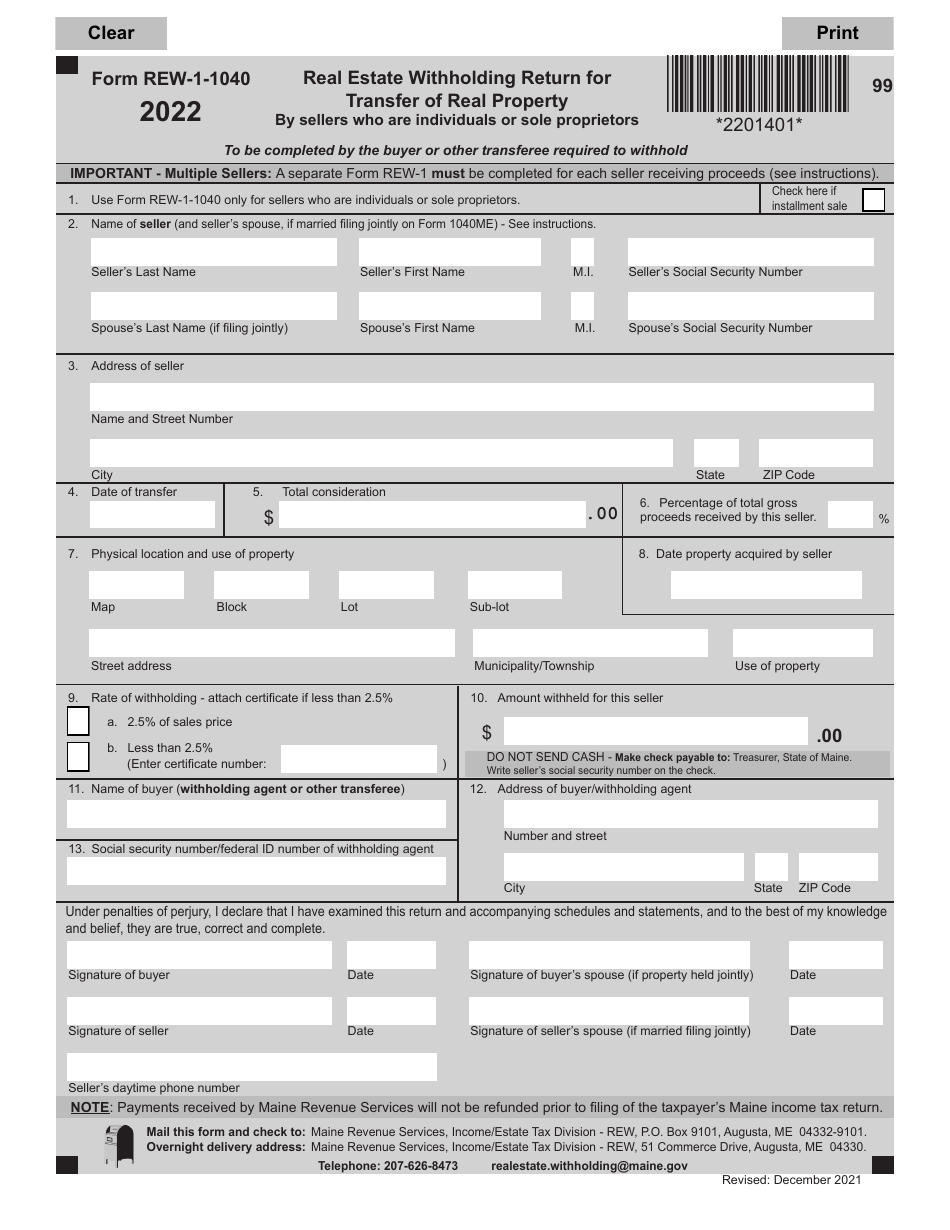

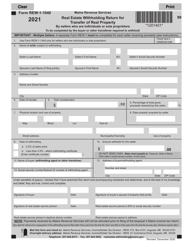

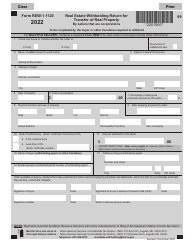

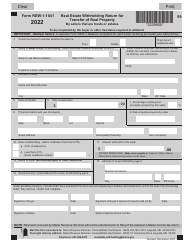

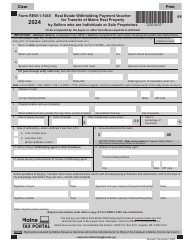

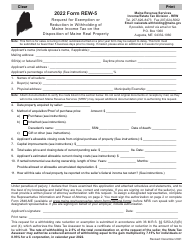

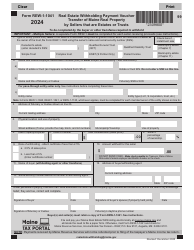

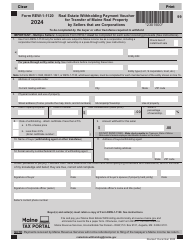

Form REW-1-140 Real Estate Withholding Return for Transfer of Real Property by Sellers Who Are Individuals or Sole Proprietors - Maine

What Is Form REW-1-140?

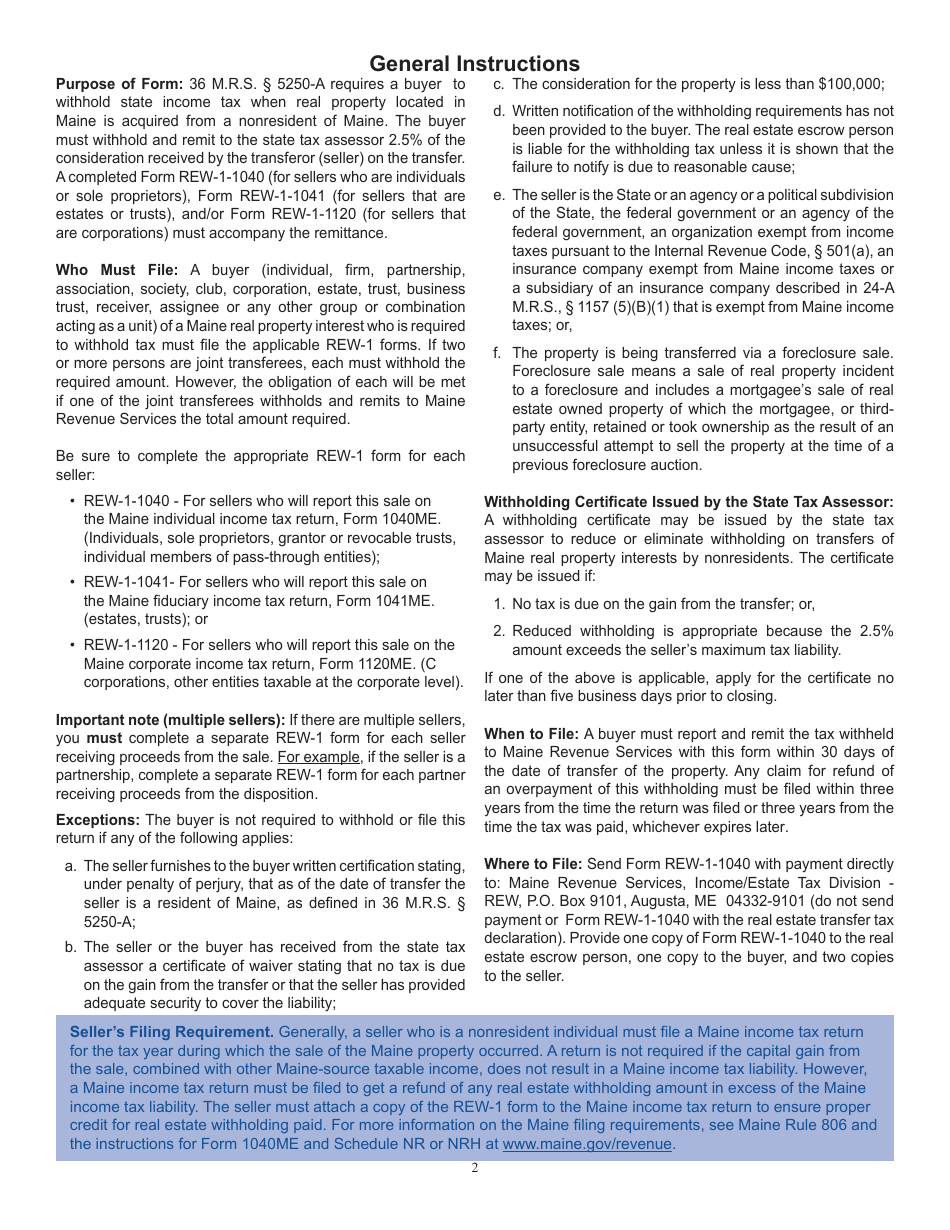

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REW-1-140?

A: The Form REW-1-140 is the Real Estate Withholding Return for Transfer of Real Property by Sellers Who Are Individuals or Sole Proprietors in Maine.

Q: Who should use the Form REW-1-140?

A: The Form REW-1-140 should be used by individuals or sole proprietors who are selling real property in Maine.

Q: What is the purpose of the Form REW-1-140?

A: The purpose of the Form REW-1-140 is to report and remit the real estate withholding tax on the transfer of real property by individuals or sole proprietors in Maine.

Q: When is the Form REW-1-140 due?

A: The Form REW-1-140 is due within 30 days from the date of transfer of real property.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the real estate withholding requirements in Maine. It is important to file the form and remit the tax on time to avoid penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-1-140 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.