This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-M4

for the current year.

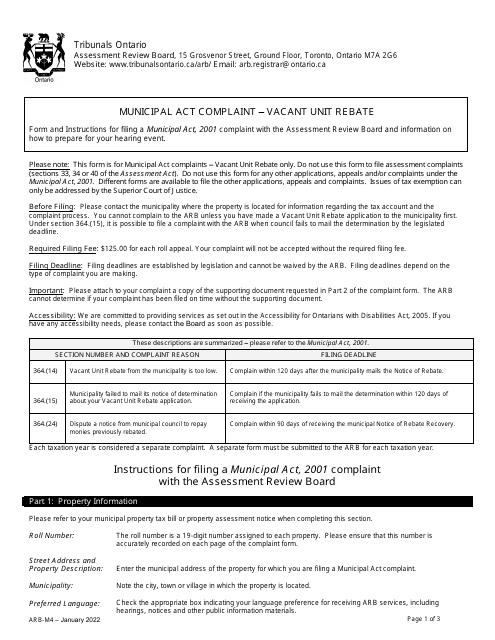

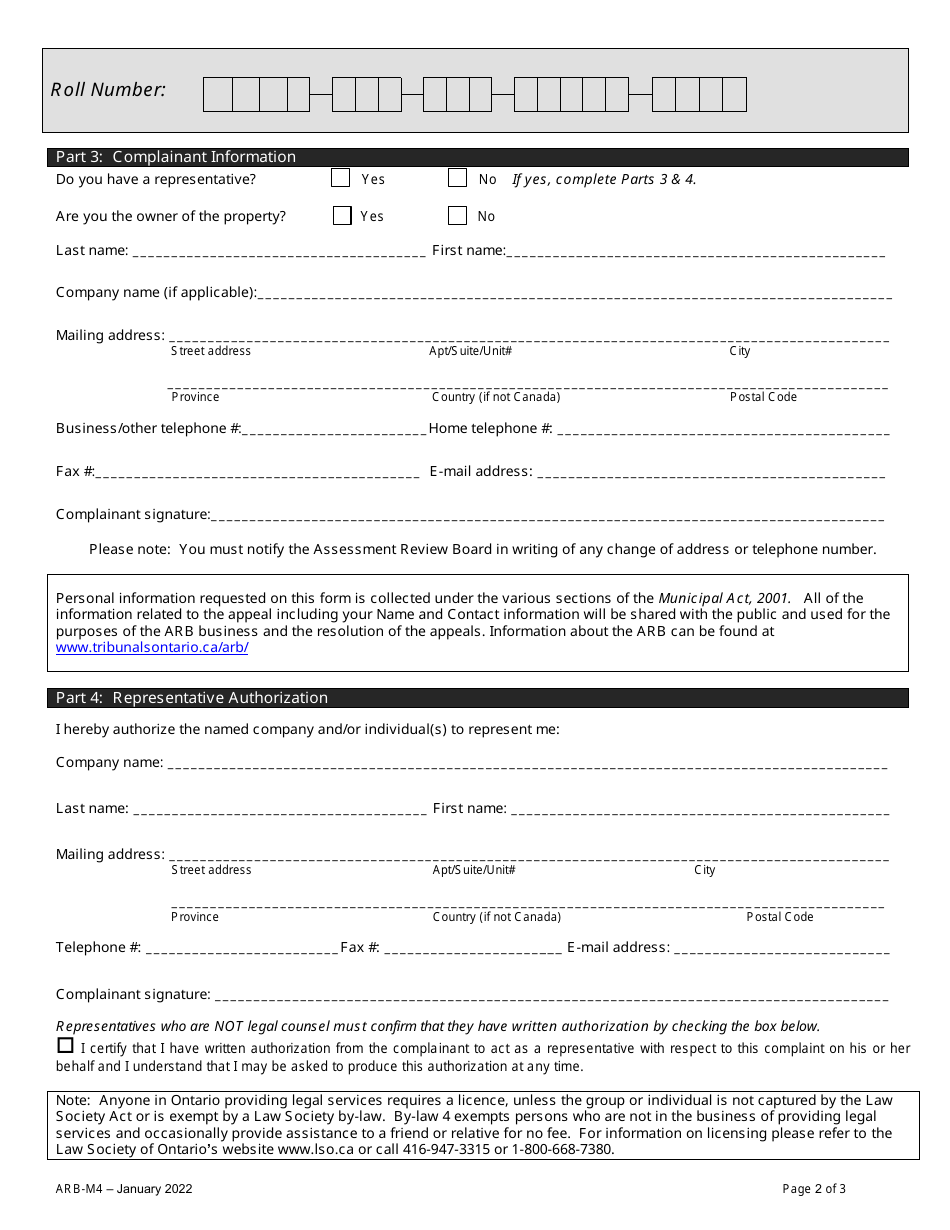

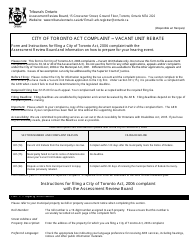

Form ARB-M4 Municipal Act Complaint - Vacant Unit Rebate - Ontario, Canada

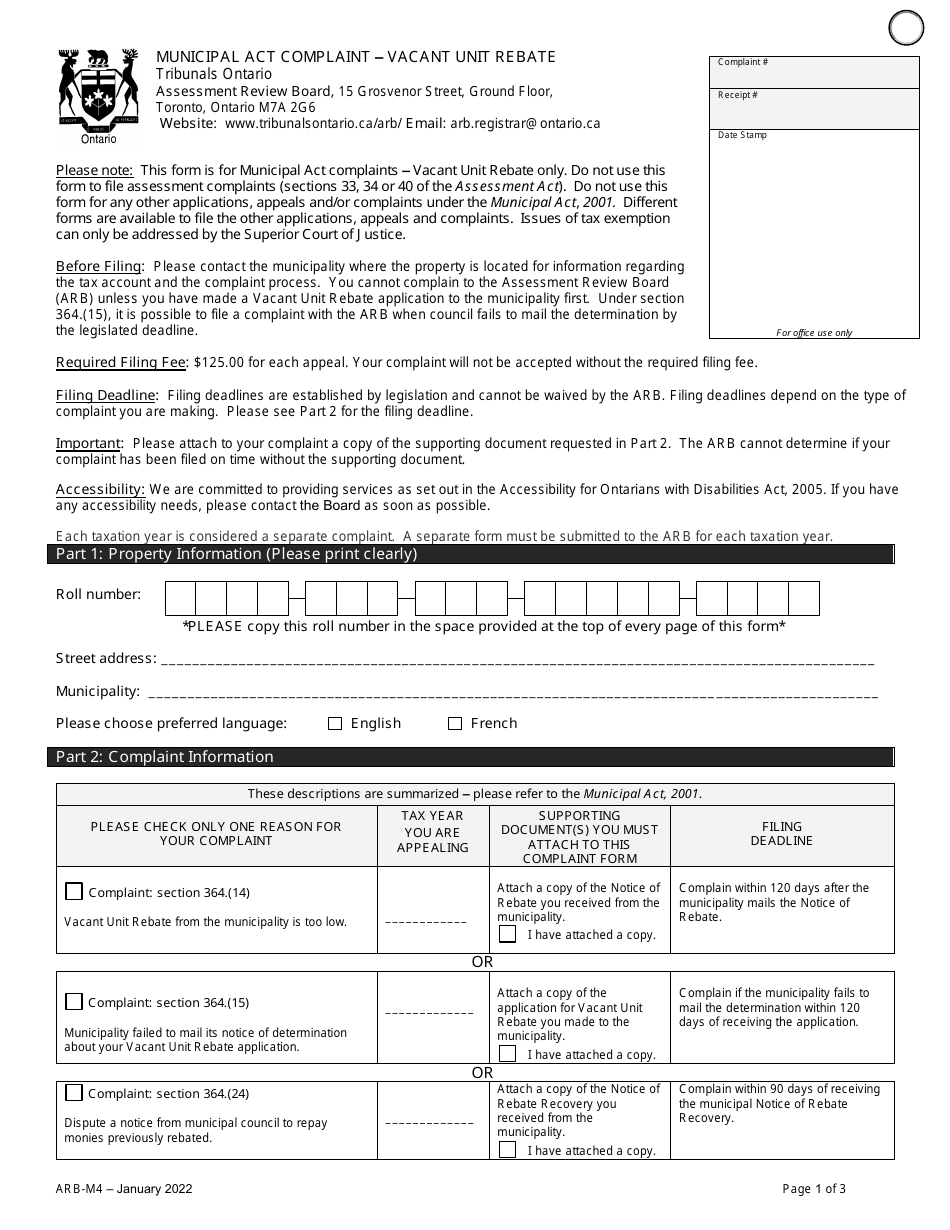

Form ARB-M4 Municipal Act Complaint - Vacant Unit Rebate is used for filing a complaint regarding the denial or reduction of a vacant unit rebate under the Municipal Act in Ontario, Canada. The form allows property owners to seek an adjustment or refund of property taxes if a unit has remained vacant for a specified period of time. It is a means to address grievances related to property tax rebates in Ontario.

The property owner or their authorized representative files the Form ARB-M4 Municipal Act Complaint - Vacant Unit Rebate in Ontario, Canada.

FAQ

Q: What is Form ARB-M4?

A: Form ARB-M4 is a form used for filing a complaint related to the Vacant Unit Rebate under the Municipal Act in Ontario, Canada.

Q: What is the Vacant Unit Rebate?

A: The Vacant Unit Rebate is a program under the Municipal Act in Ontario, Canada that provides rebates for property owners who have vacant commercial or industrial units.

Q: Who can file a complaint using Form ARB-M4?

A: Property owners who believe they are eligible for the Vacant Unit Rebate but have been denied can file a complaint using Form ARB-M4.

Q: How do I file a complaint using Form ARB-M4?

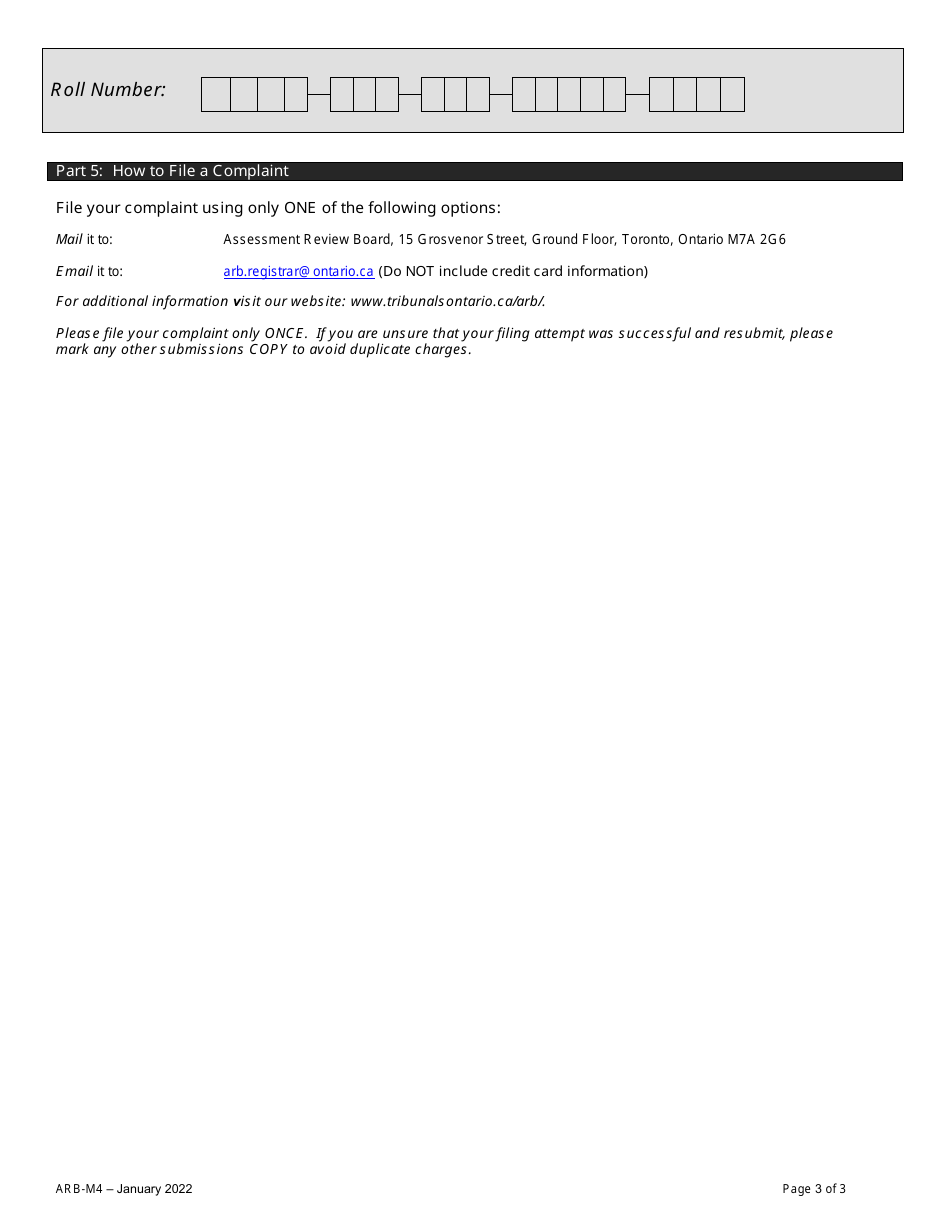

A: To file a complaint using Form ARB-M4, you need to complete the form with all the required information and submit it to the Assessment Review Board (ARB).

Q: What information do I need to provide on Form ARB-M4?

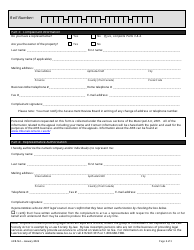

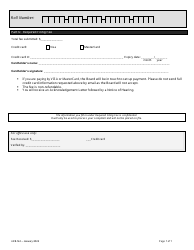

A: On Form ARB-M4, you will need to provide details about the property, the reasons for the complaint, and any supporting documentation or evidence.