This version of the form is not currently in use and is provided for reference only. Download this version of

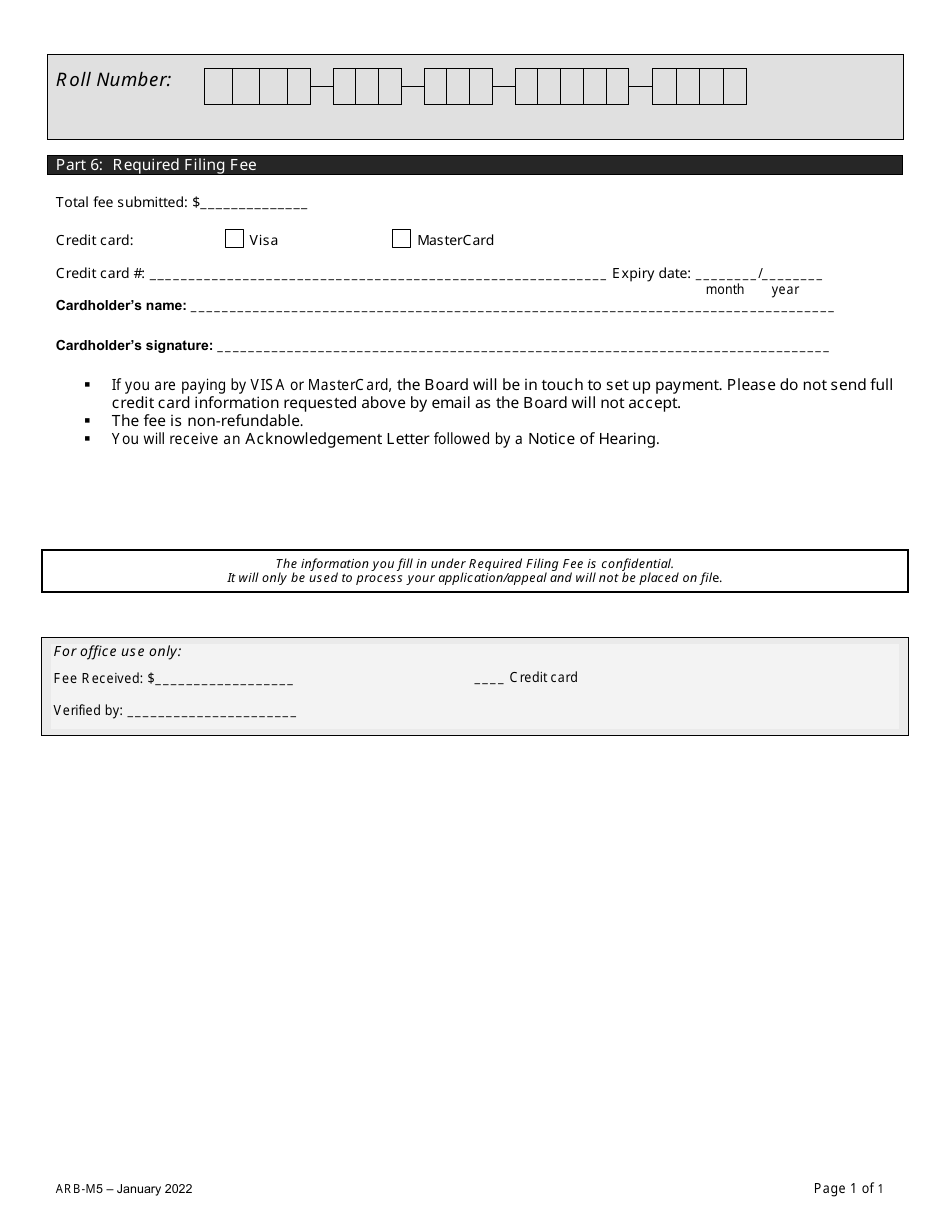

Form ARB-M5

for the current year.

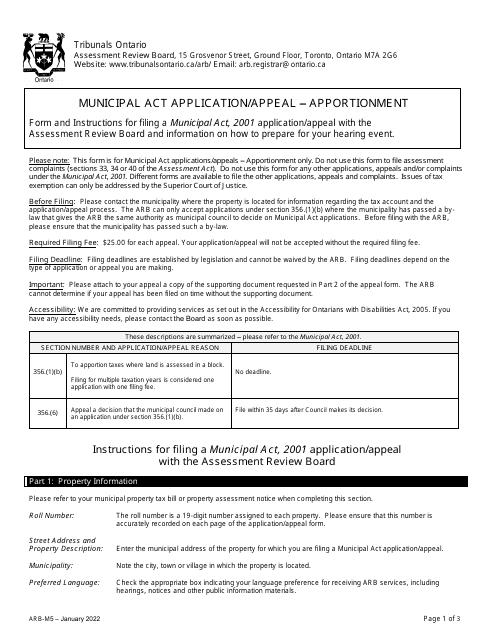

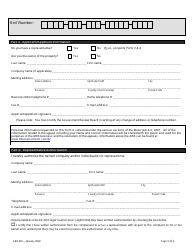

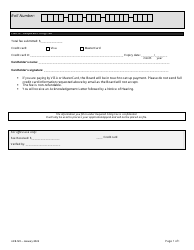

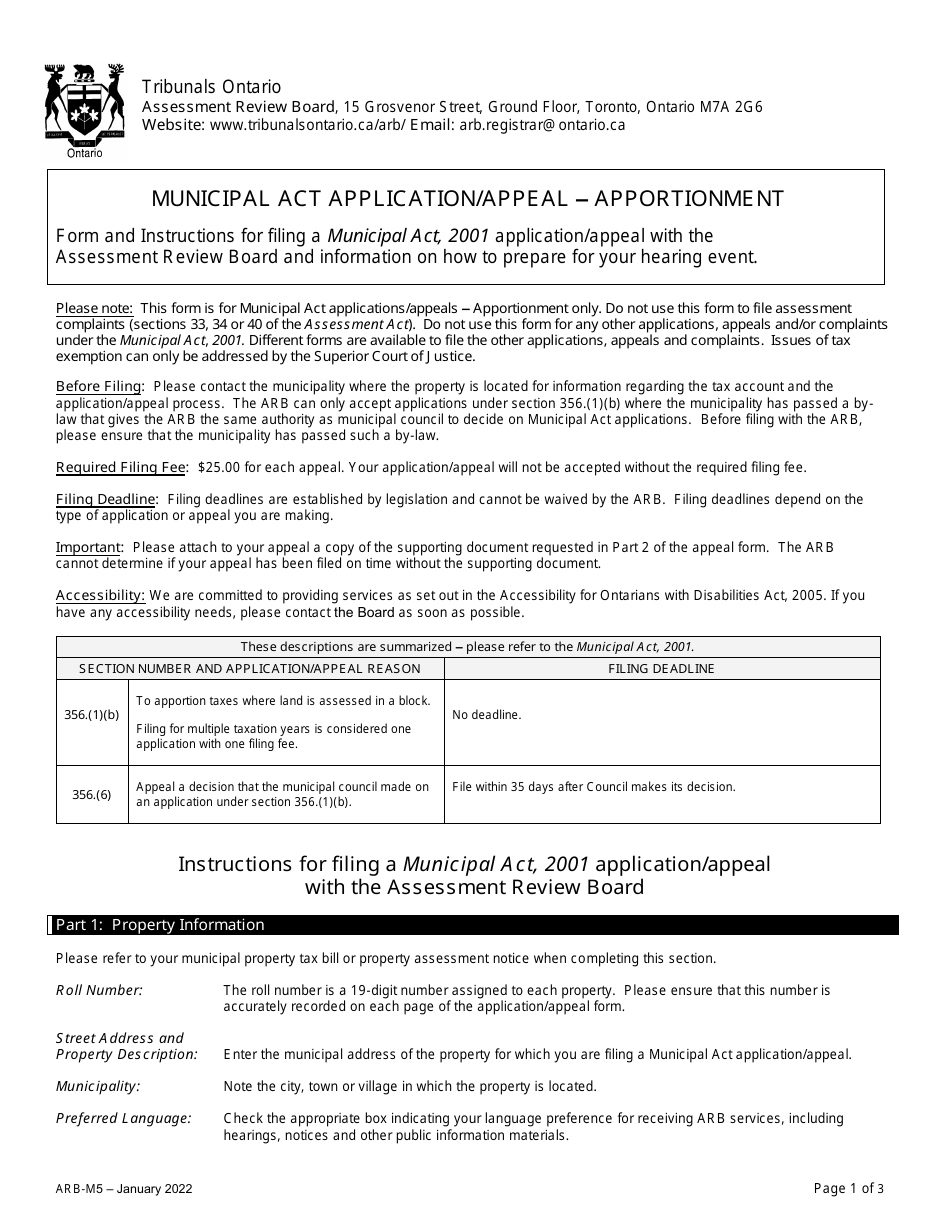

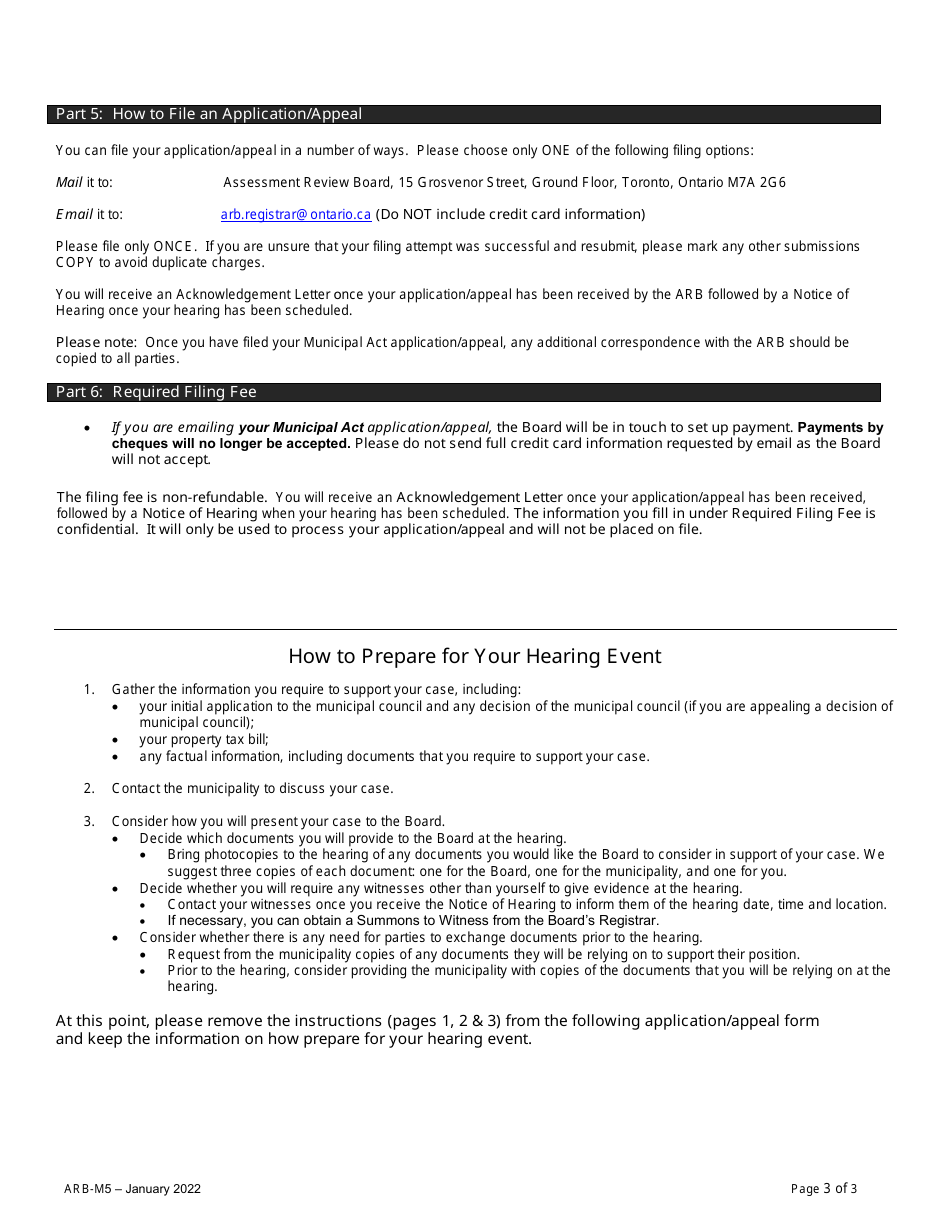

Form ARB-M5 Municipal Act Application / Appeal - Apportionment - Ontario, Canada

Form ARB-M5 Municipal Act Application/Appeal - Apportionment is used in Ontario, Canada for filing an application or appeal related to property tax apportionment. It is specifically related to the Municipal Act in Ontario.

The Form ARB-M5 Municipal Act Application/Appeal - Apportionment in Ontario, Canada is typically filed by property owners who want to appeal their property tax assessment.

FAQ

Q: What is the ARB-M5 Municipal Act Application/Appeal?

A: The ARB-M5 form is used for applying or appealing property tax apportionment decisions in Ontario, Canada.

Q: What does ARB stand for?

A: ARB stands for Assessment Review Board.

Q: What is the Municipal Act?

A: The Municipal Act is legislation that governs the operations of municipalities in Ontario, Canada.

Q: What is property tax apportionment?

A: Property tax apportionment is the process of determining how much property tax each property owner is responsible for.

Q: Who can use the ARB-M5 form?

A: Property owners in Ontario, Canada can use the ARB-M5 form to apply or appeal property tax apportionment decisions.

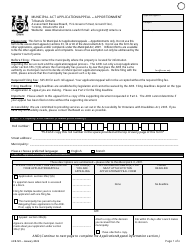

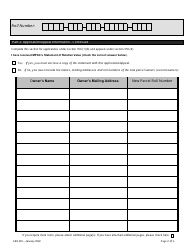

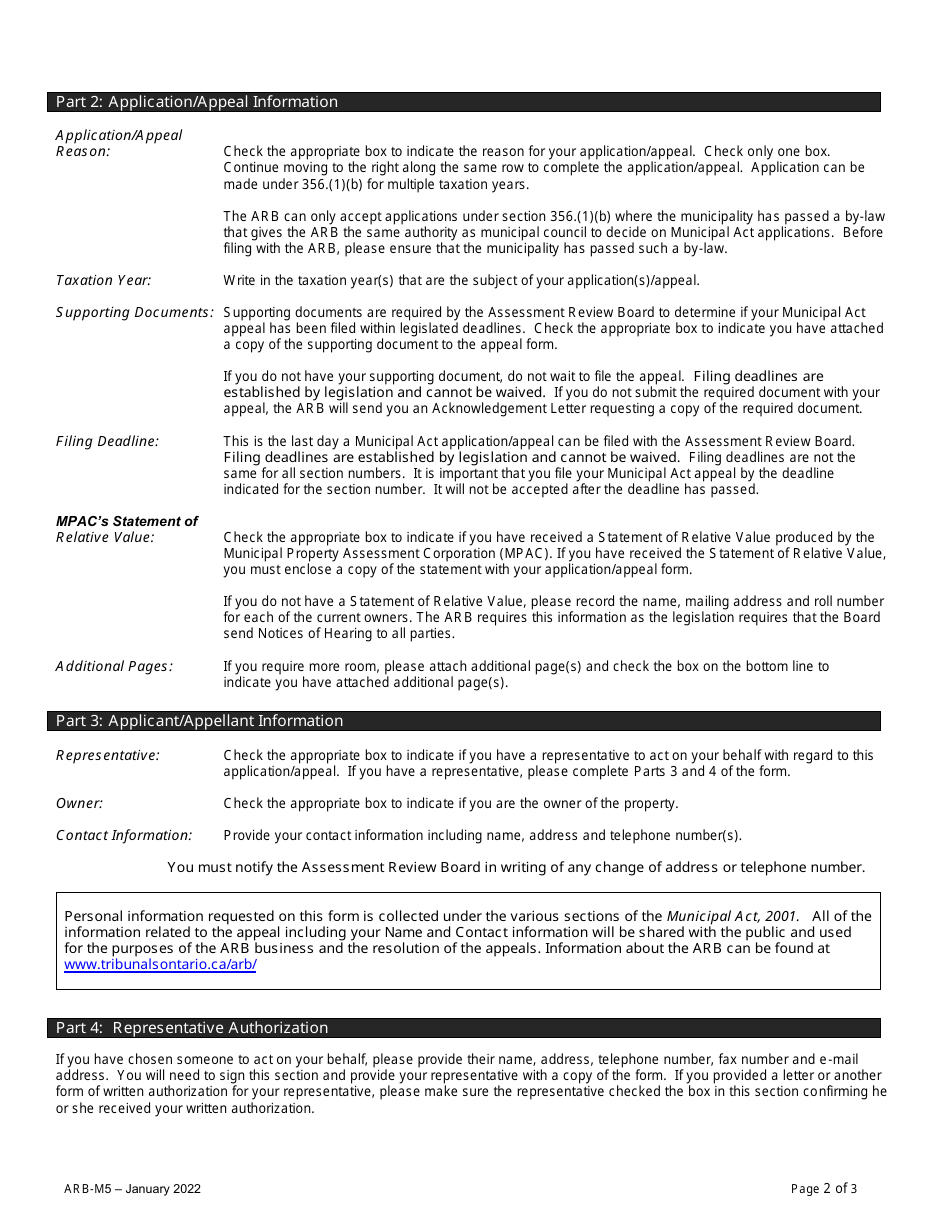

Q: What should I include in the ARB-M5 form?

A: The ARB-M5 form should include the necessary information about the property, details of the apportionment decision being appealed, and any supporting documents.

Q: What is the Assessment Review Board (ARB)

A: The Assessment Review Board (ARB) is an independent tribunal in Ontario, Canada that handles property assessment appeals and other municipal matters.

Q: Is the ARB-M5 form specific to Ontario?

A: Yes, the ARB-M5 form is specific to property tax apportionment appeals in Ontario, Canada.

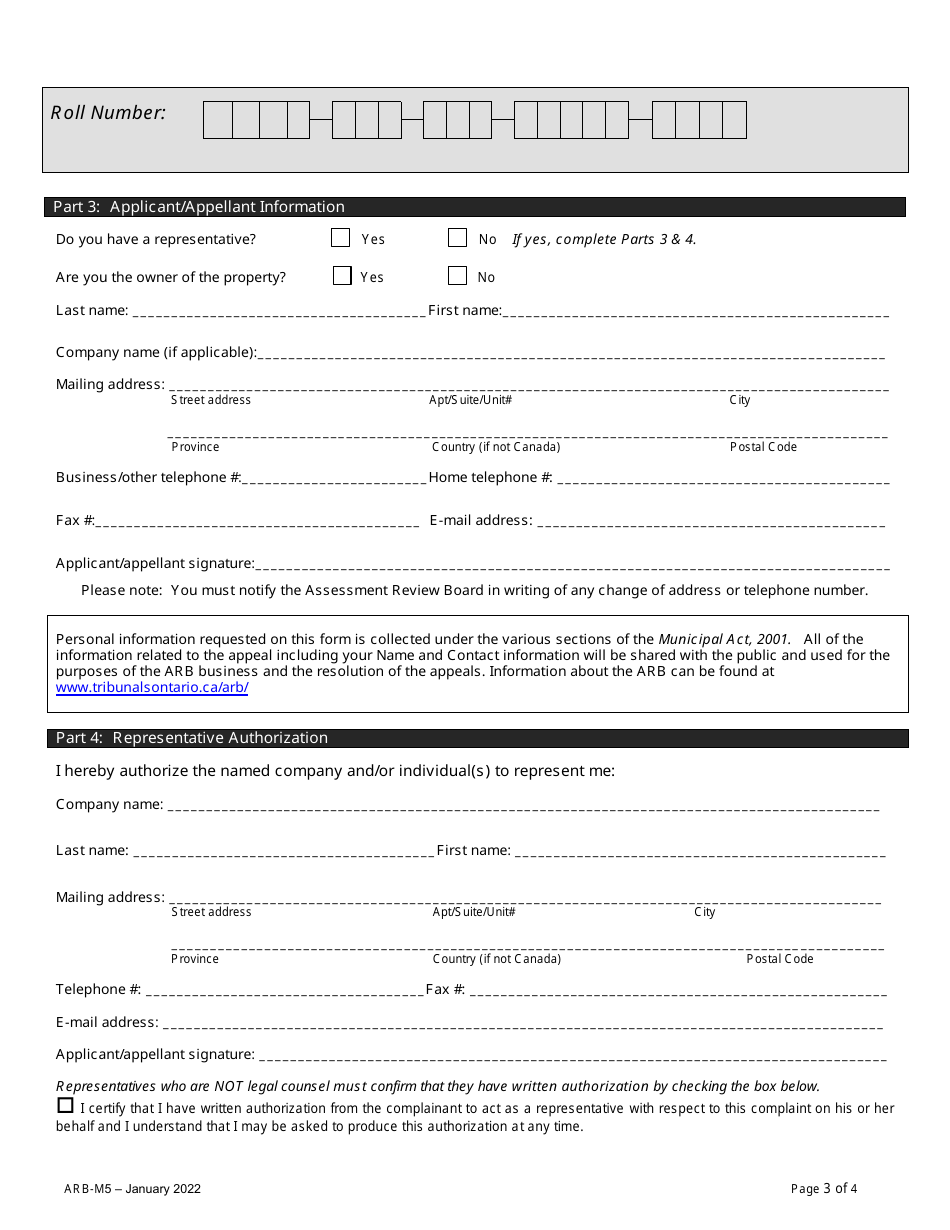

Q: What is the process after submitting the ARB-M5 form?

A: After submitting the ARB-M5 form, it will be reviewed by the Assessment Review Board (ARB), and a hearing may be scheduled to resolve the appeal.