This version of the form is not currently in use and is provided for reference only. Download this version of

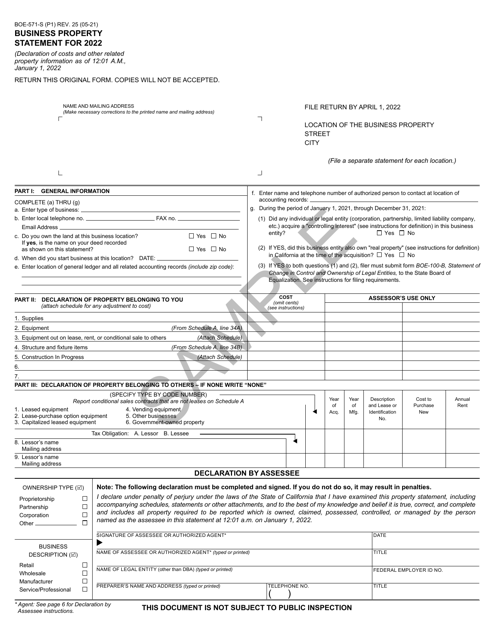

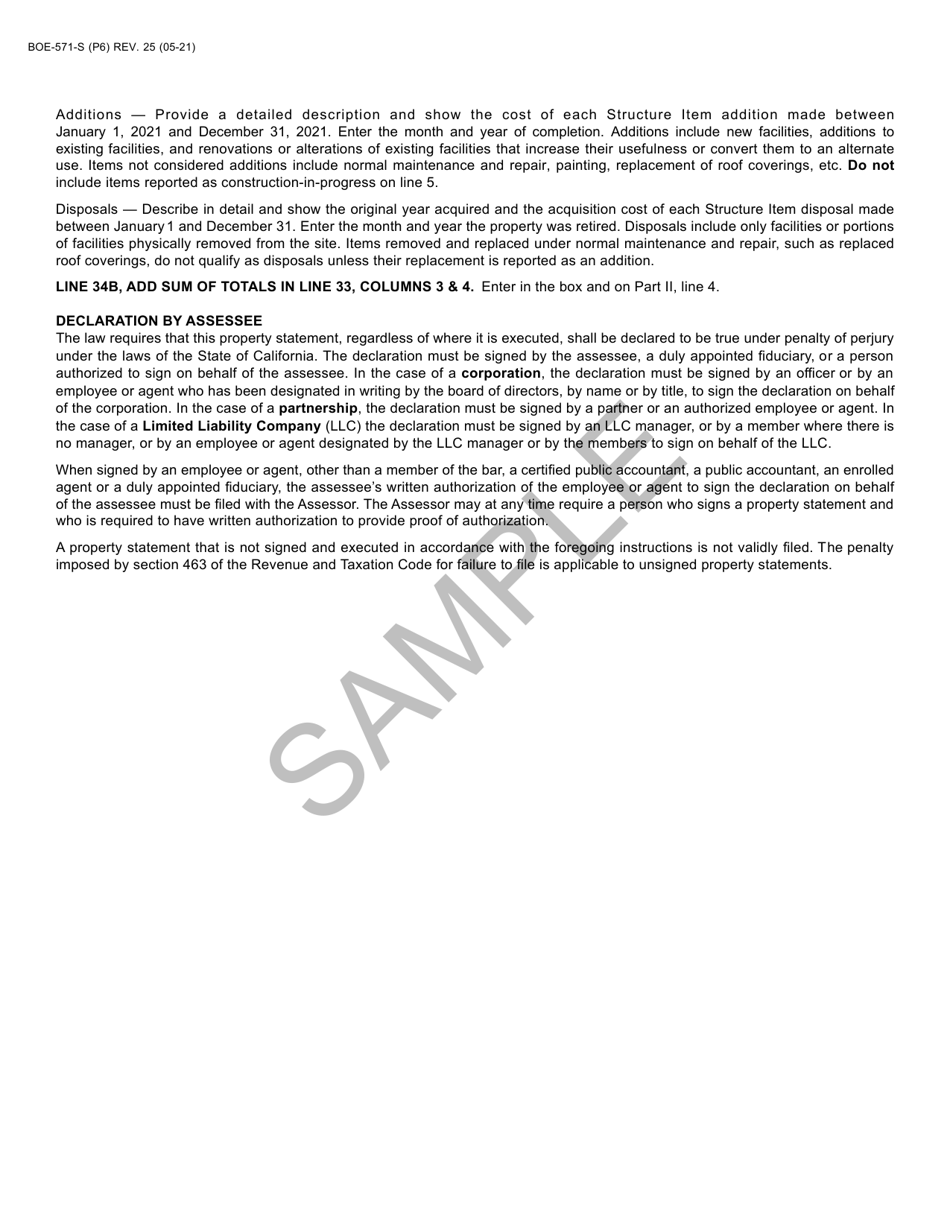

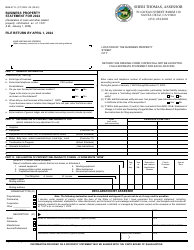

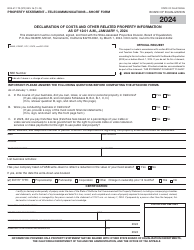

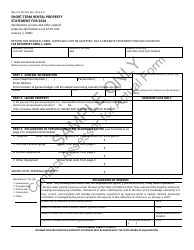

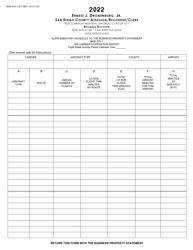

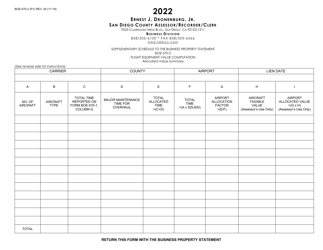

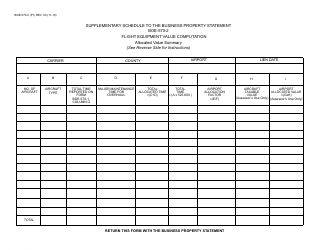

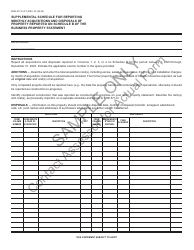

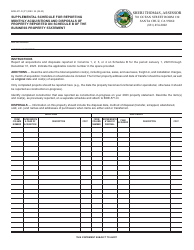

Form BOE-571-S

for the current year.

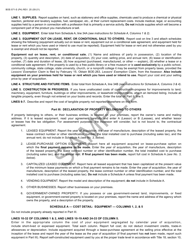

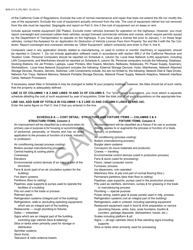

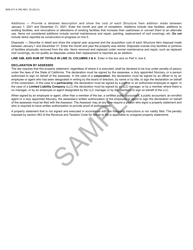

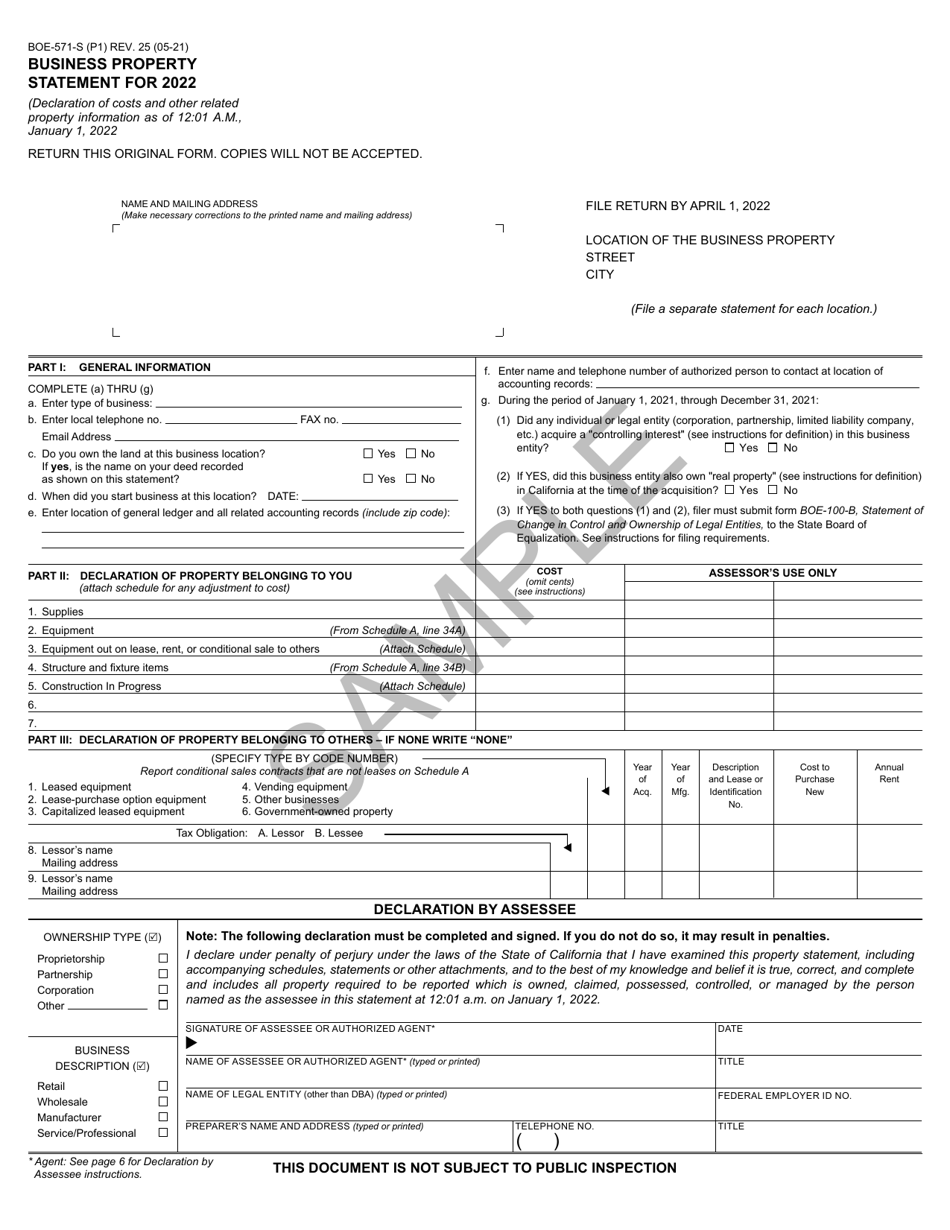

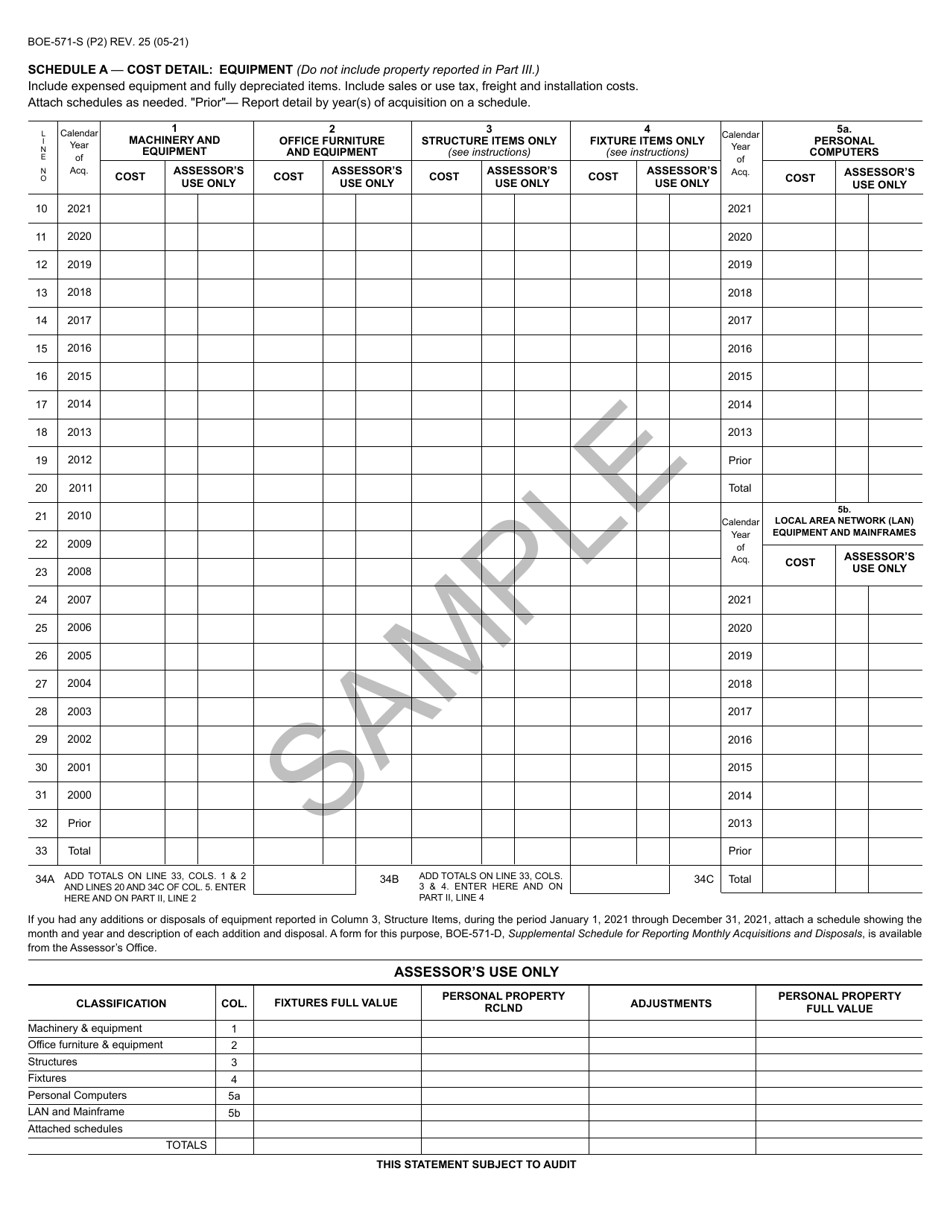

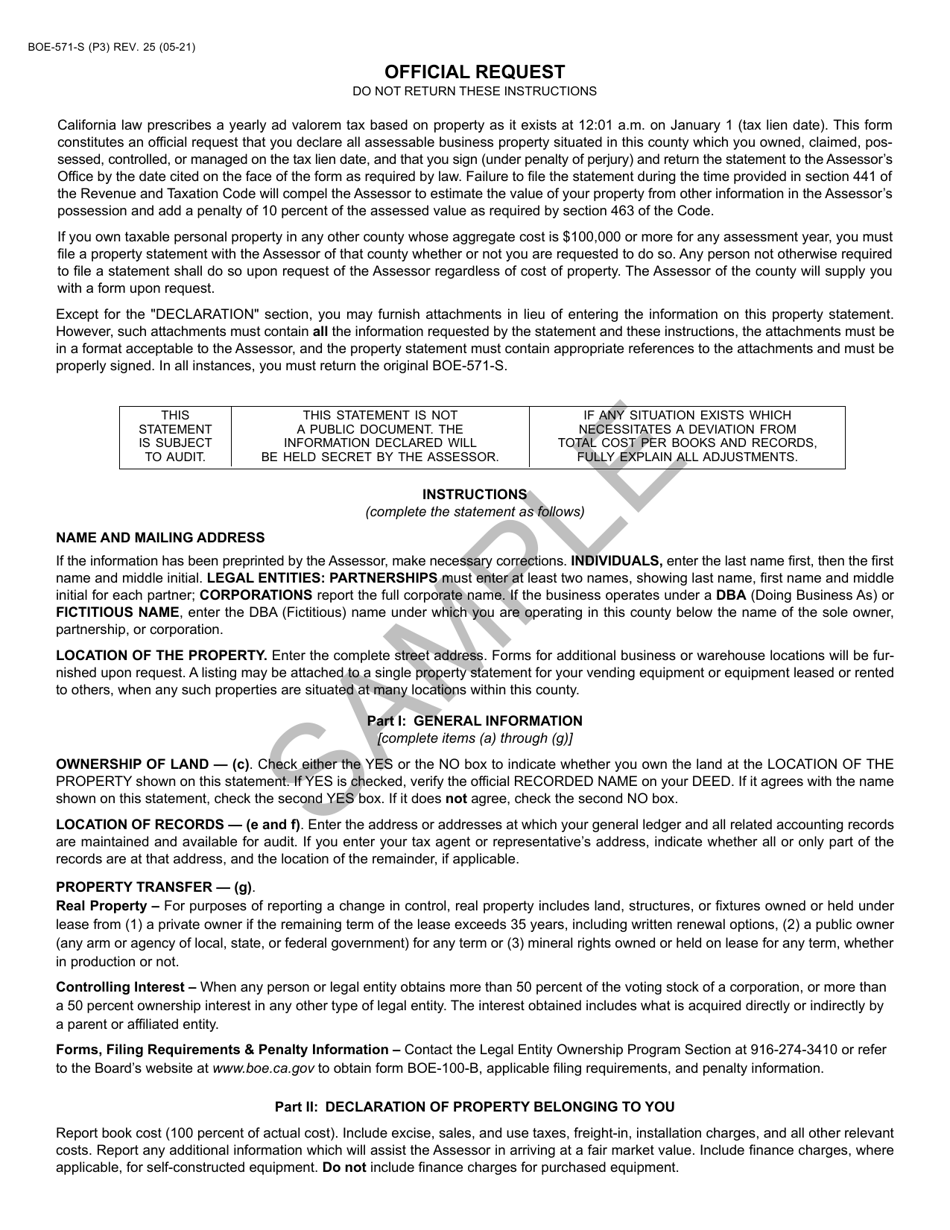

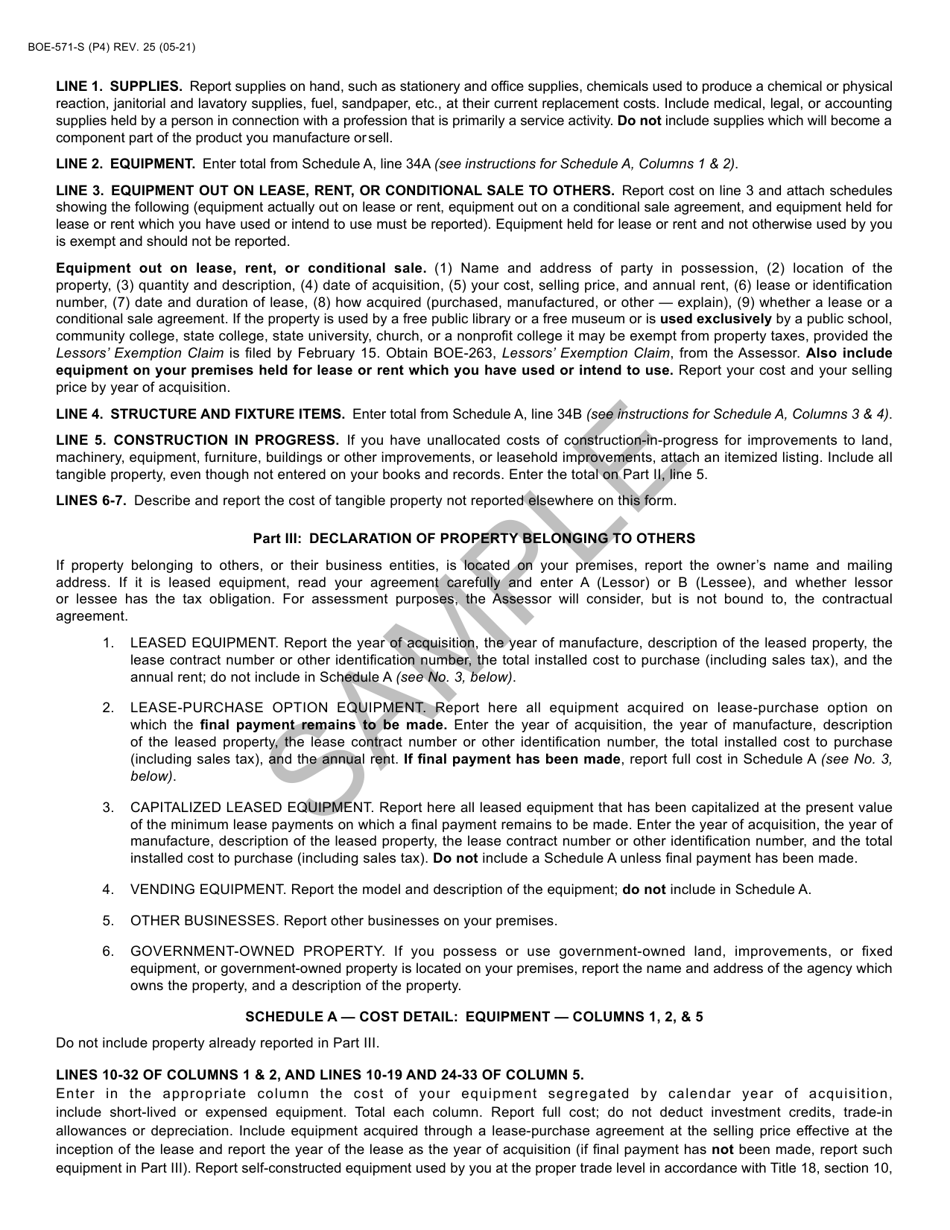

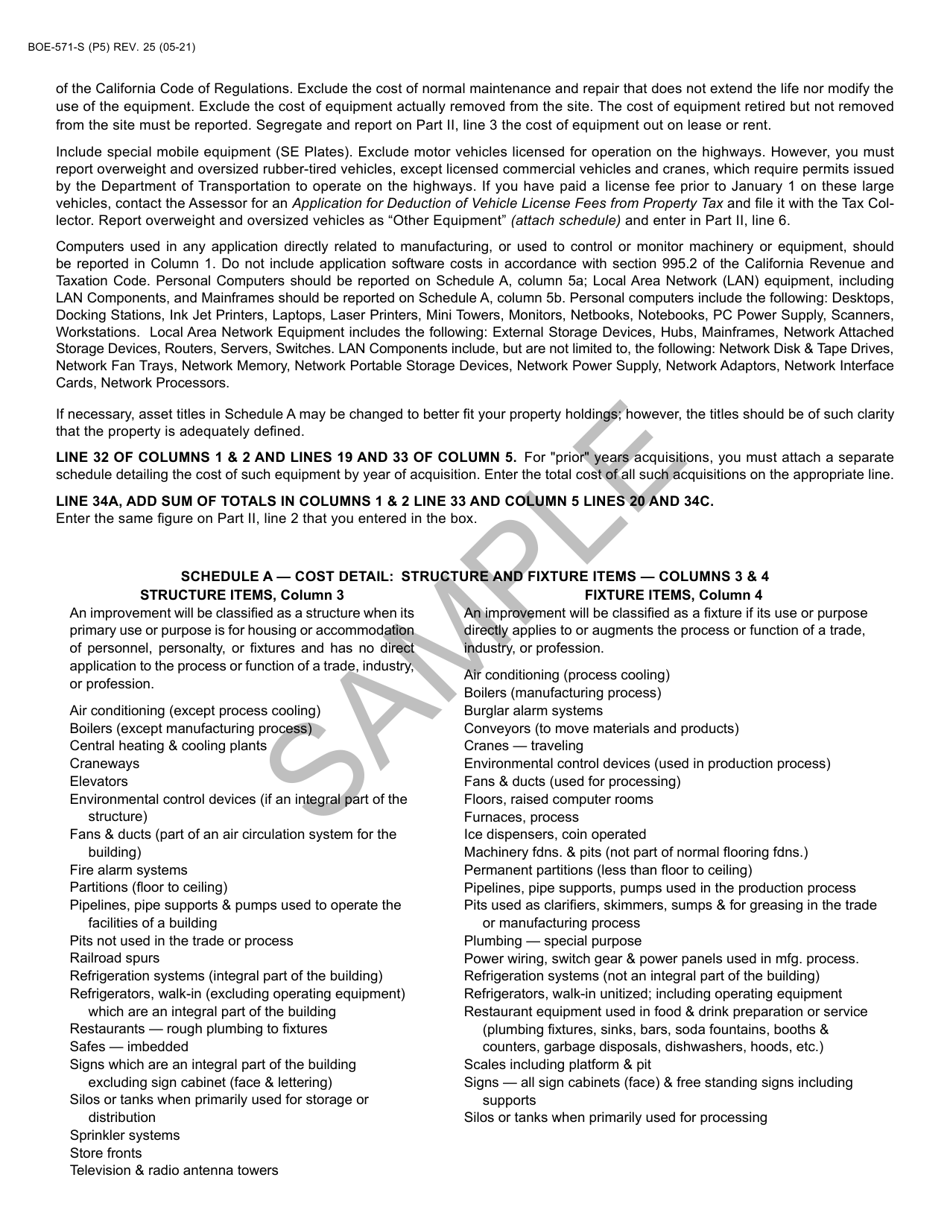

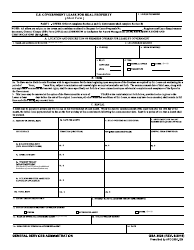

Form BOE-571-S Business Property Statement - Short Form - Sample - California

What Is Form BOE-571-S?

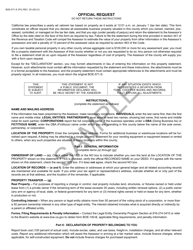

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form BOE-571-S Business Property Statement?

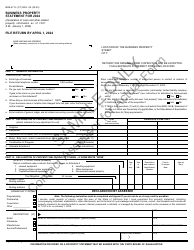

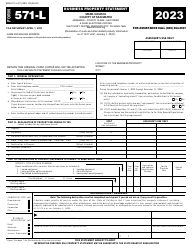

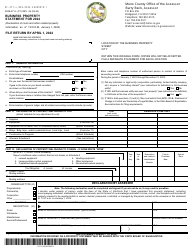

A: Form BOE-571-S is a short form used in California to report business property for taxation purposes.

Q: Who needs to file a Form BOE-571-S Business Property Statement?

A: Businesses in California that own or lease tangible personal property used for business purposes need to file this form.

Q: What is the purpose of filing a Form BOE-571-S Business Property Statement?

A: The purpose is to provide the county assessor with information about the value and nature of a business's property for property tax assessment.

Q: When is the deadline to file Form BOE-571-S?

A: The form must be filed annually by April 1st.

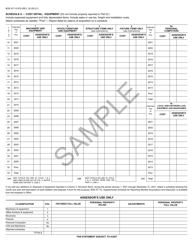

Q: What information is needed to complete Form BOE-571-S?

A: Information about the business's property, such as its description, date acquired, cost, and acquisition details, is required.

Q: Is there a penalty for not filing Form BOE-571-S?

A: Yes, failure to file the form may result in penalties and assessments.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-S by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.