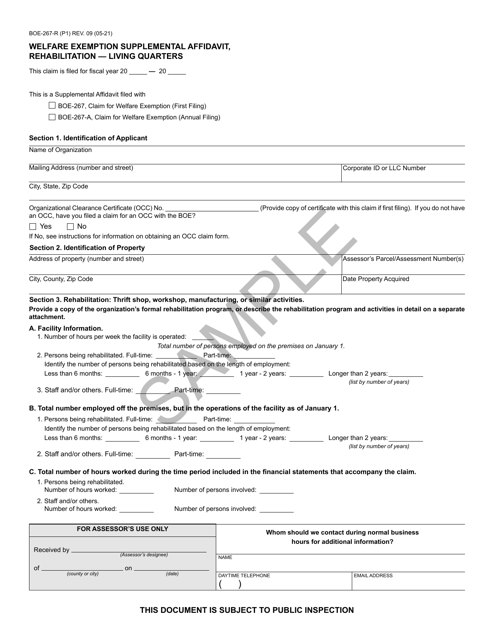

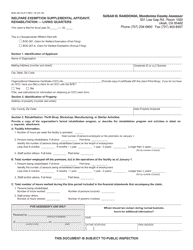

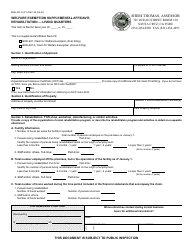

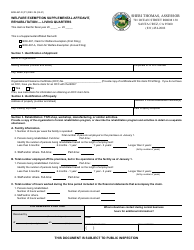

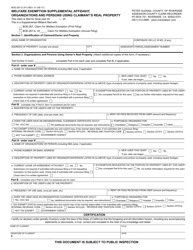

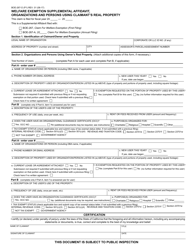

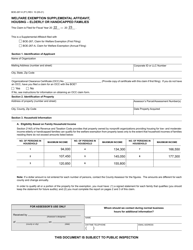

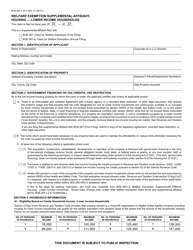

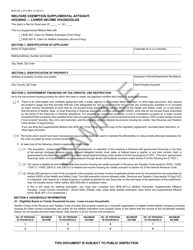

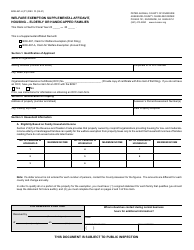

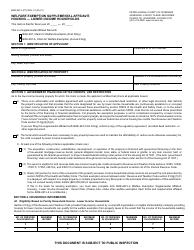

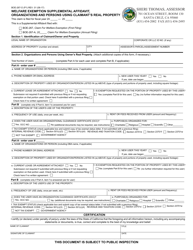

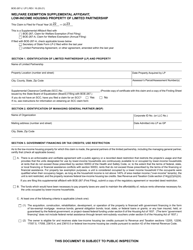

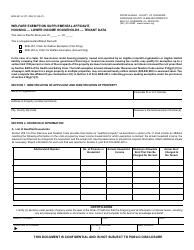

Form BOE-267-R Welfare Exemption Supplemental Affidavit, Rehabilitation - Living Quarters - Sample - California

What Is Form BOE-267-R?

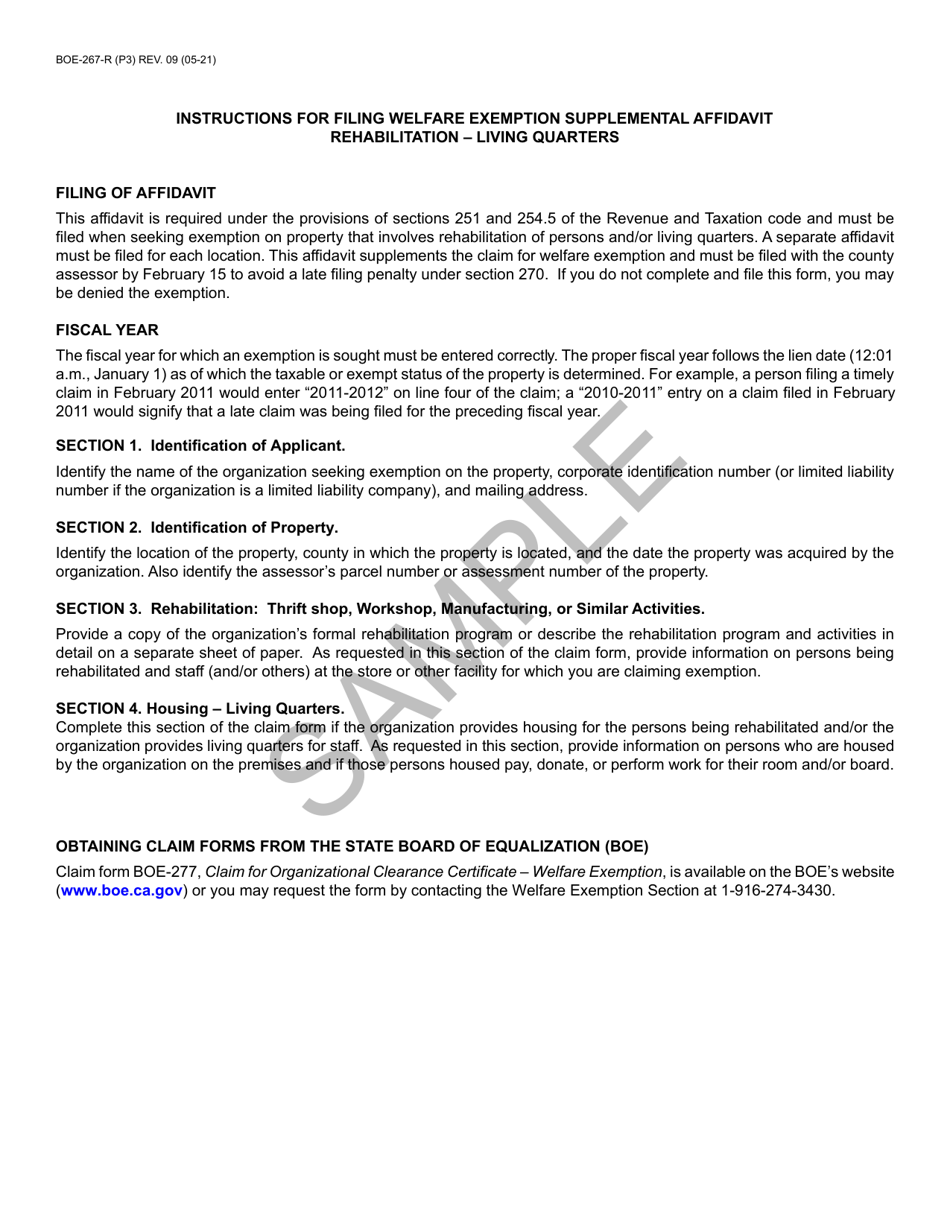

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-267-R?

A: BOE-267-R is a Welfare Exemption Supplemental Affidavit form used in California.

Q: What is the purpose of the BOE-267-R form?

A: The purpose of the BOE-267-R form is to apply for a welfare exemption for a property that is used for rehabilitation living quarters.

Q: What is a welfare exemption?

A: A welfare exemption is an exemption from property taxes for properties that provide certain benefits to the community, such as rehabilitation living quarters.

Q: Who can use the BOE-267-R form?

A: The BOE-267-R form can be used by property owners who meet the requirements for a welfare exemption for rehabilitation living quarters.

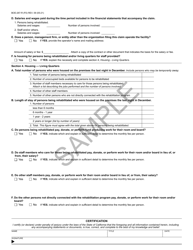

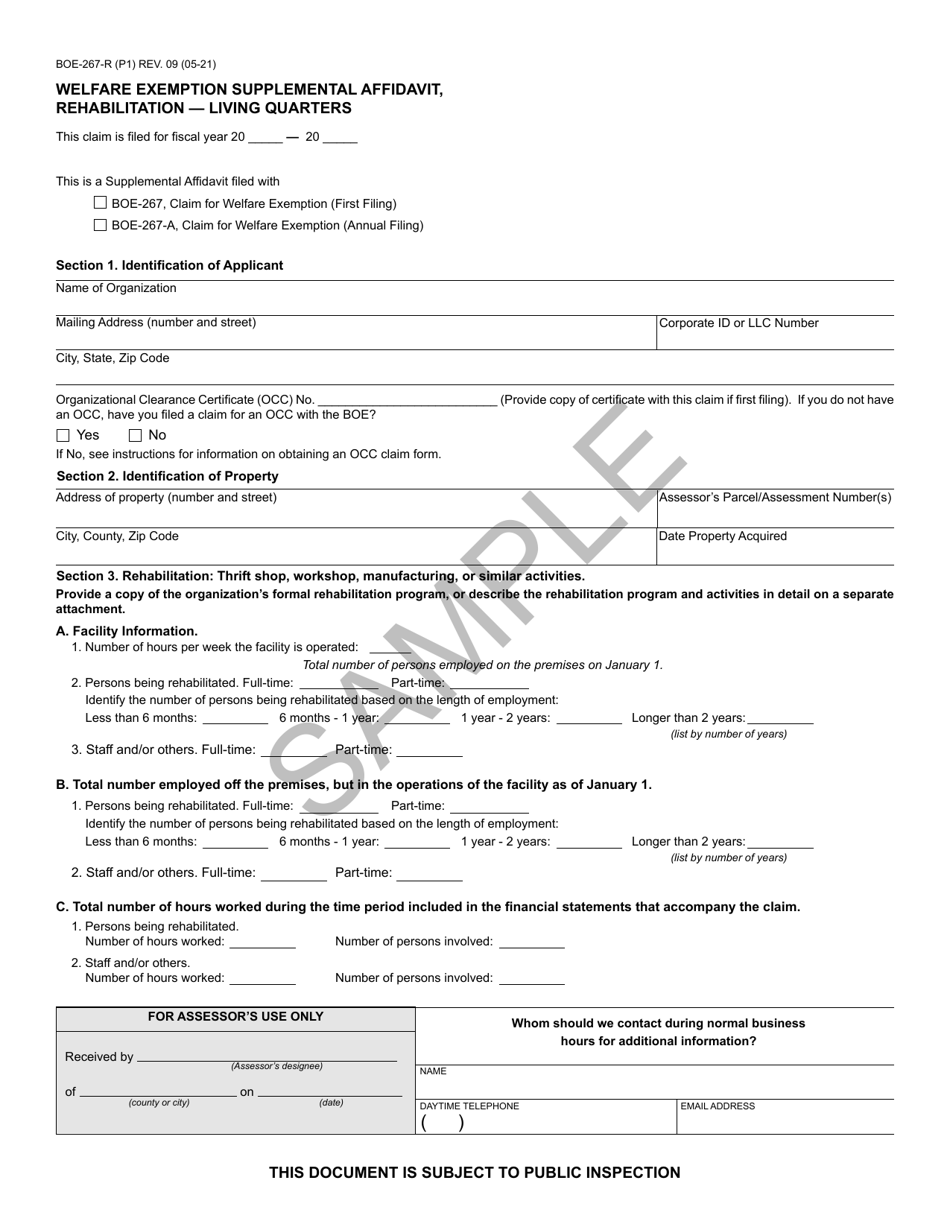

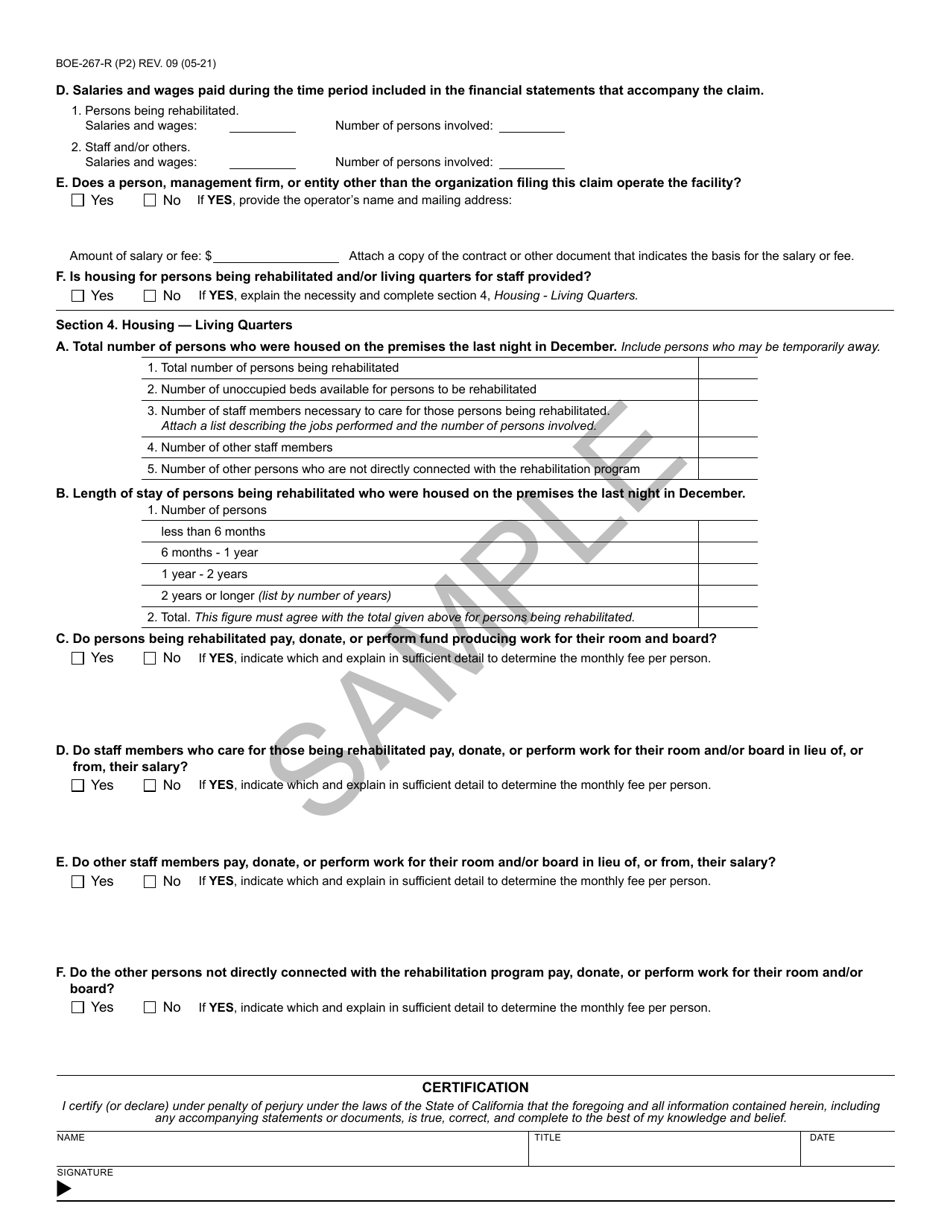

Q: What information is required on the BOE-267-R form?

A: The BOE-267-R form requires information about the property, its use, and the applicant, as well as supporting documentation.

Q: Is there a fee to file the BOE-267-R form?

A: There is no fee to file the BOE-267-R form.

Q: Are there any deadlines for filing the BOE-267-R form?

A: The BOE-267-R form must be filed annually with the county assessor's office by February 15th.

Q: What happens after I file the BOE-267-R form?

A: After filing the BOE-267-R form, the county assessor's office will review the application and determine if the property qualifies for a welfare exemption.

Q: Are there any income requirements for the welfare exemption?

A: Yes, the applicant's household income must not exceed a certain limit in order to qualify for the welfare exemption.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-267-R by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.