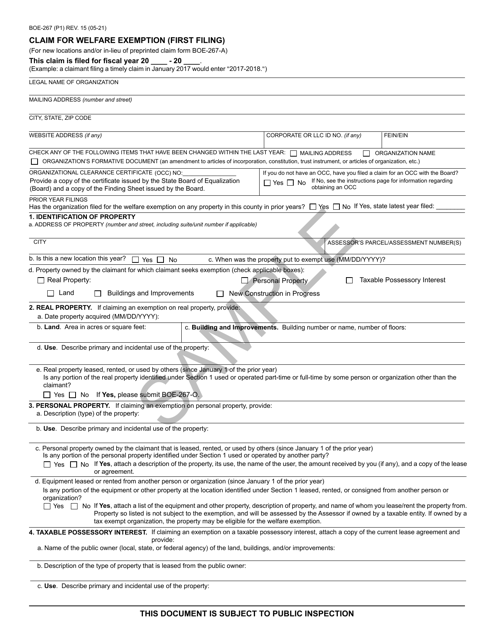

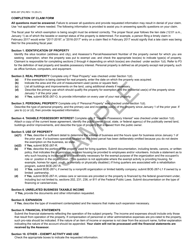

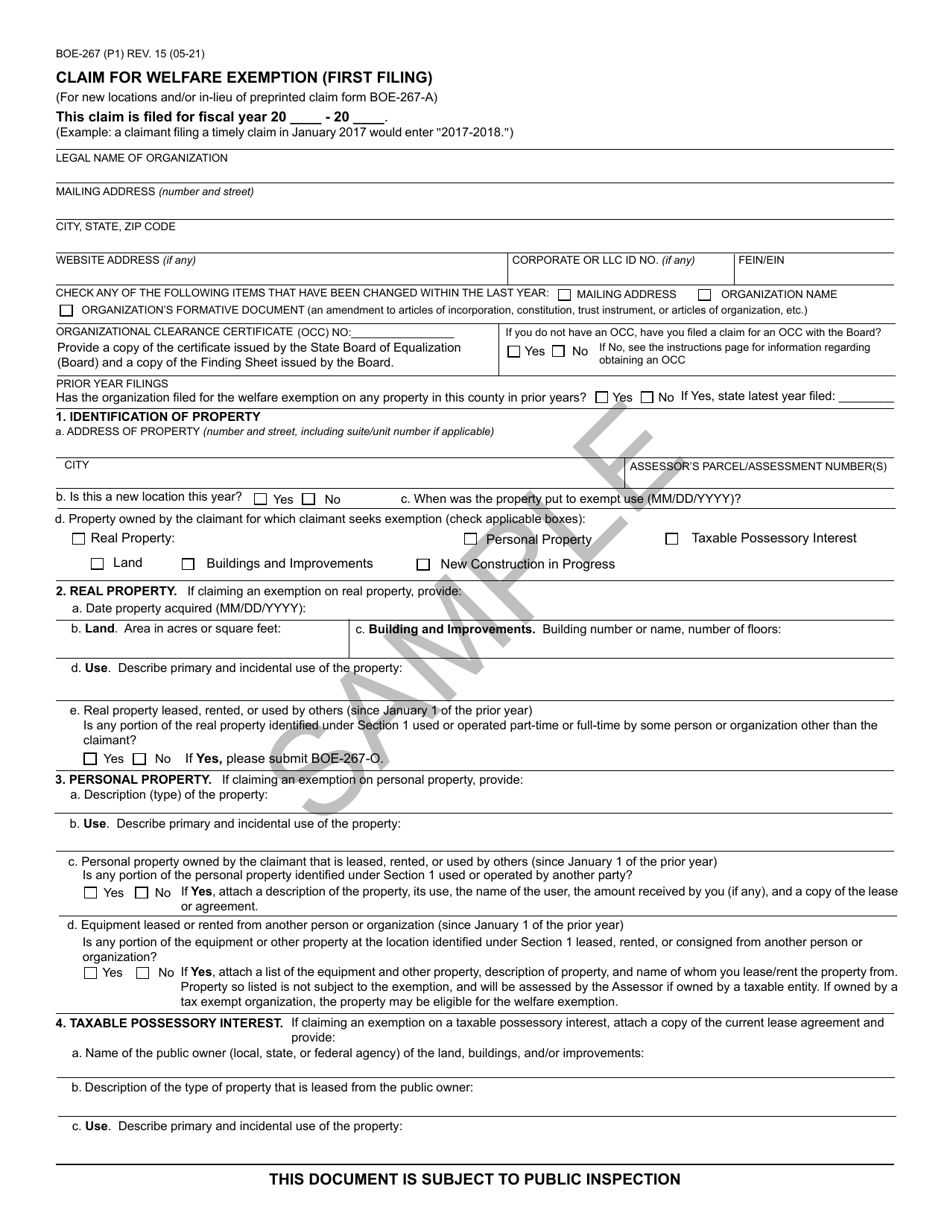

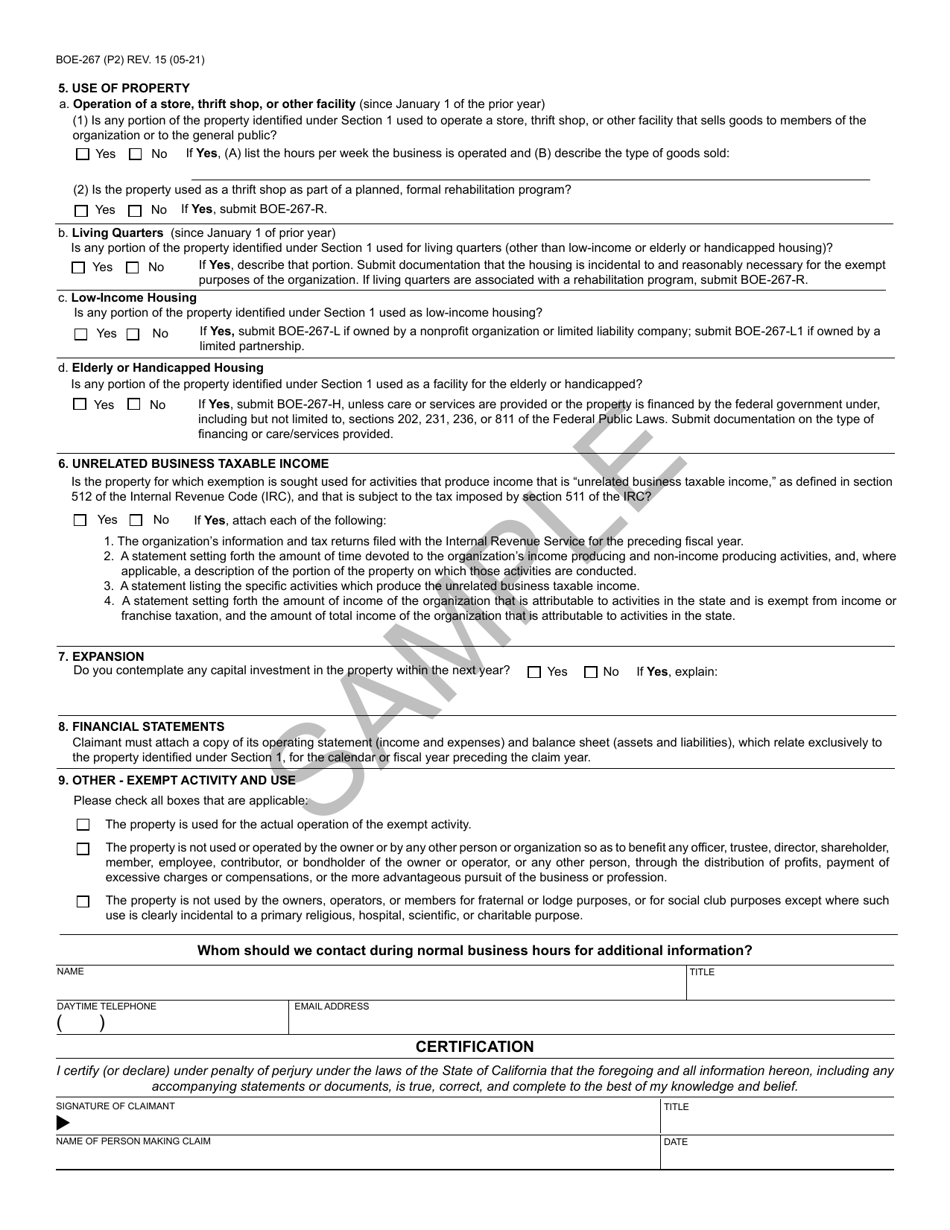

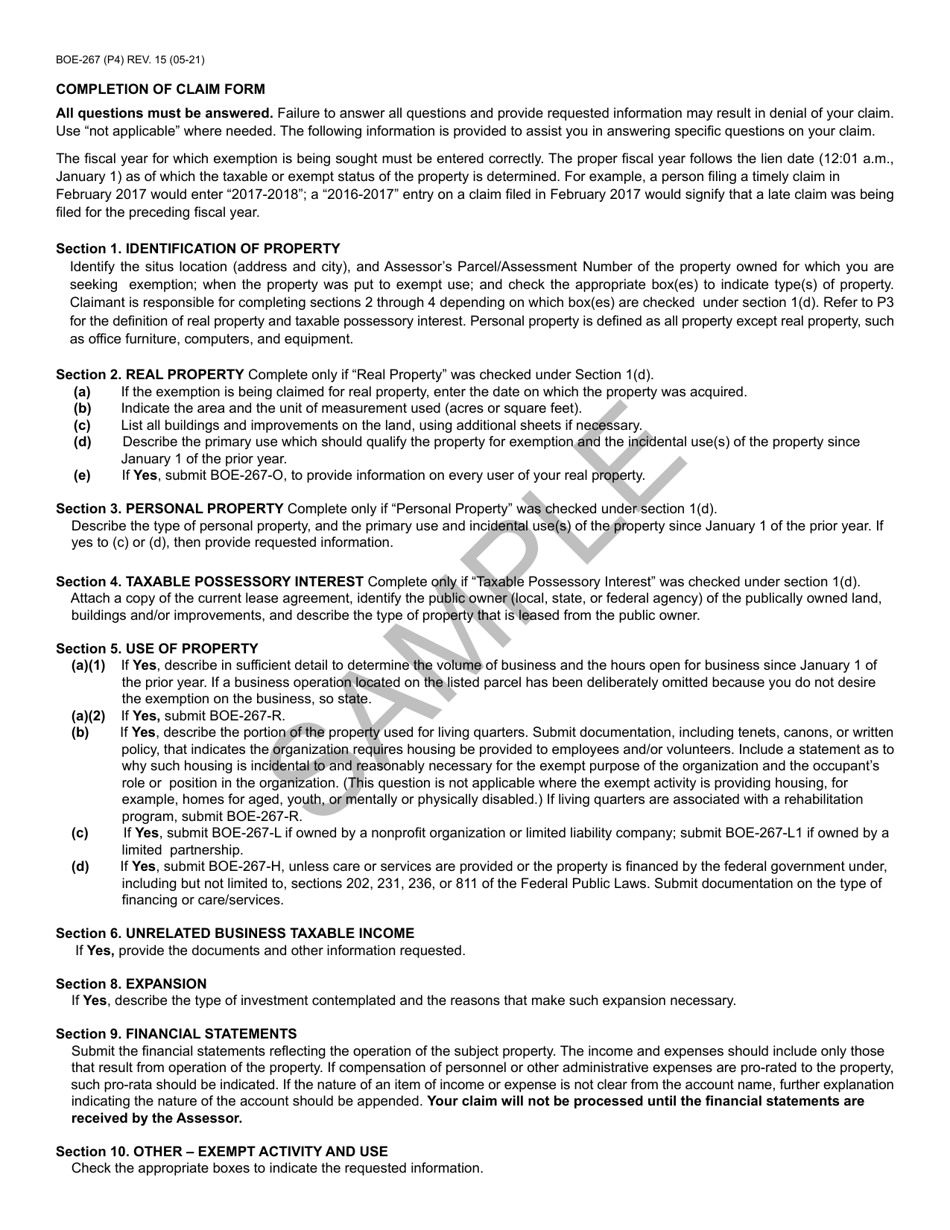

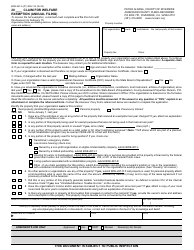

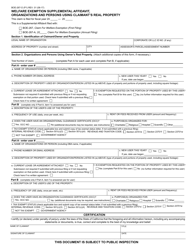

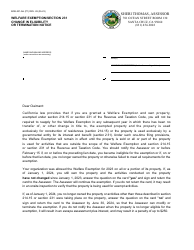

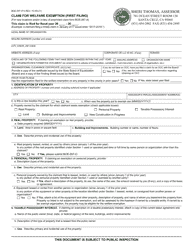

Form BOE-267 Claim for Welfare Exemption (First Filing) - Sample - California

What Is Form BOE-267?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

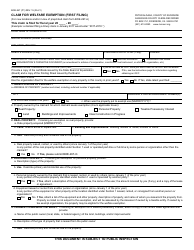

Q: What is Form BOE-267?

A: Form BOE-267 is a claim for welfare exemption for first filing in California.

Q: What is the purpose of Form BOE-267?

A: The purpose of Form BOE-267 is to apply for a welfare exemption from property taxes in California.

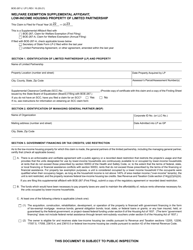

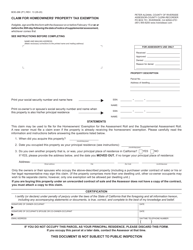

Q: Who needs to file Form BOE-267?

A: Nonprofit organizations seeking a welfare exemption for the first time in California need to file Form BOE-267.

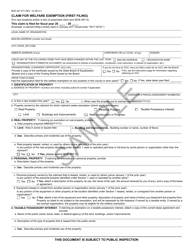

Q: What are the eligibility requirements for a welfare exemption?

A: To be eligible for a welfare exemption, an organization must be a nonprofit and use the property primarily for religious, hospital, scientific, or charitable purposes.

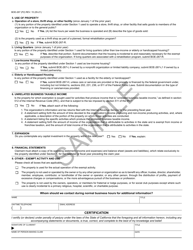

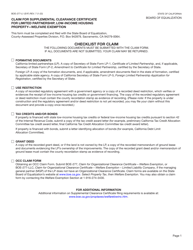

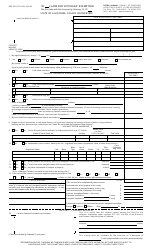

Q: What documents need to be submitted with Form BOE-267?

A: Depending on the type of organization, additional documents such as financial statements, articles of incorporation, and bylaws may need to be submitted with Form BOE-267.

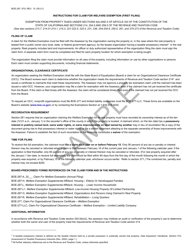

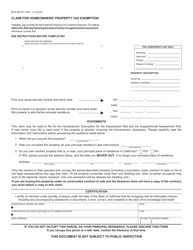

Q: When is the deadline to file Form BOE-267?

A: The deadline to file Form BOE-267 is normally February 15th of each year, but it may vary, so it is important to check the instructions on the form.

Q: Are there any filing fees for Form BOE-267?

A: No, there are no filing fees for Form BOE-267.

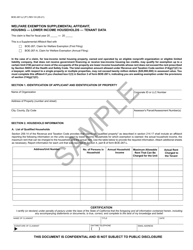

Q: What happens after filing Form BOE-267?

A: After filing Form BOE-267, the county assessor will review the claim and determine if the organization qualifies for the welfare exemption.

Q: Is the welfare exemption granted indefinitely?

A: No, the welfare exemption needs to be renewed on a regular basis, typically every four years.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-267 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.