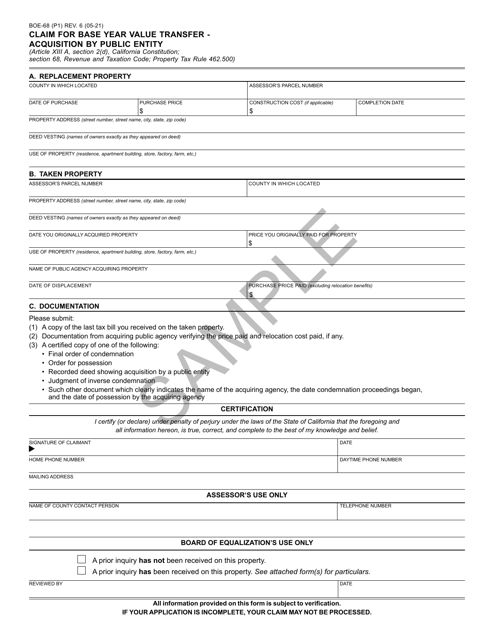

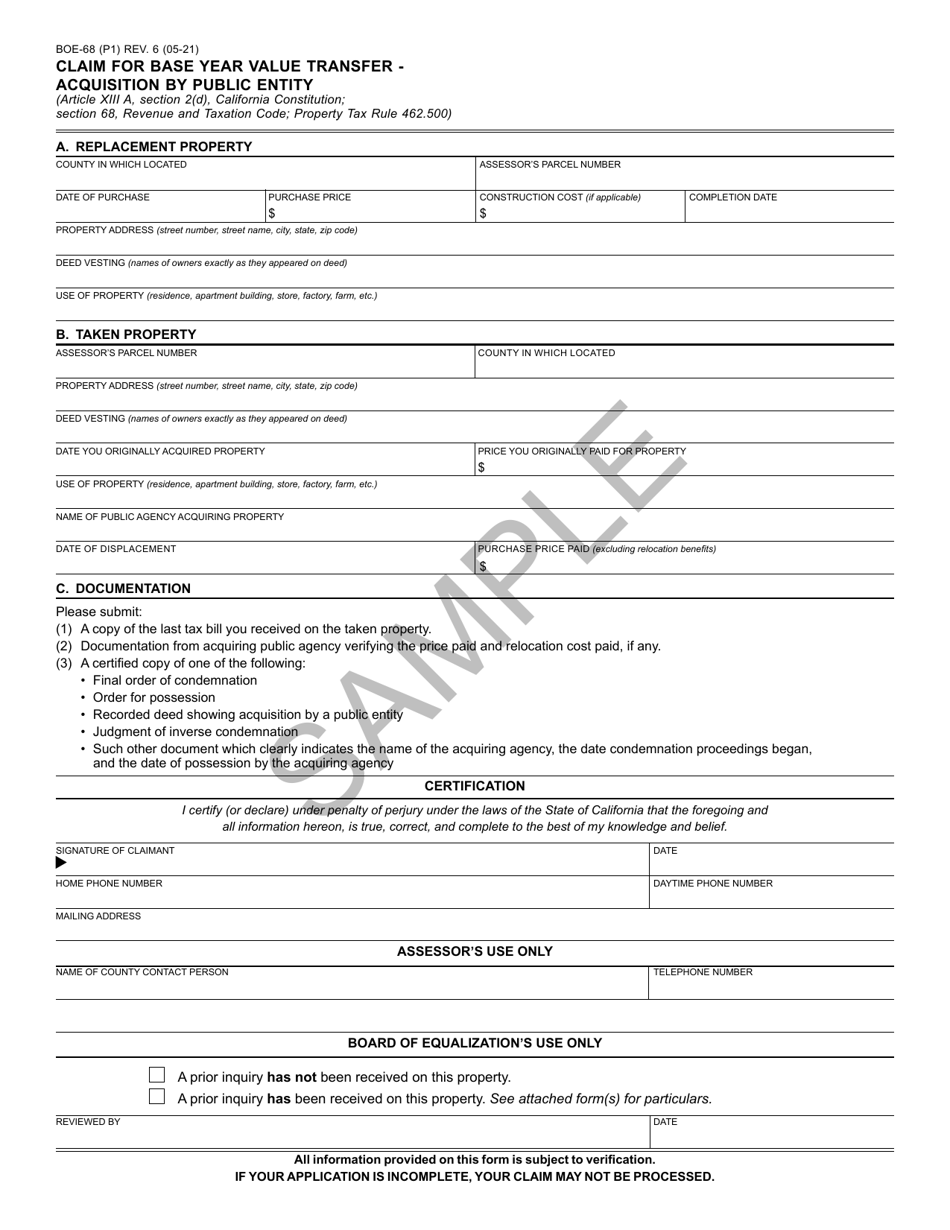

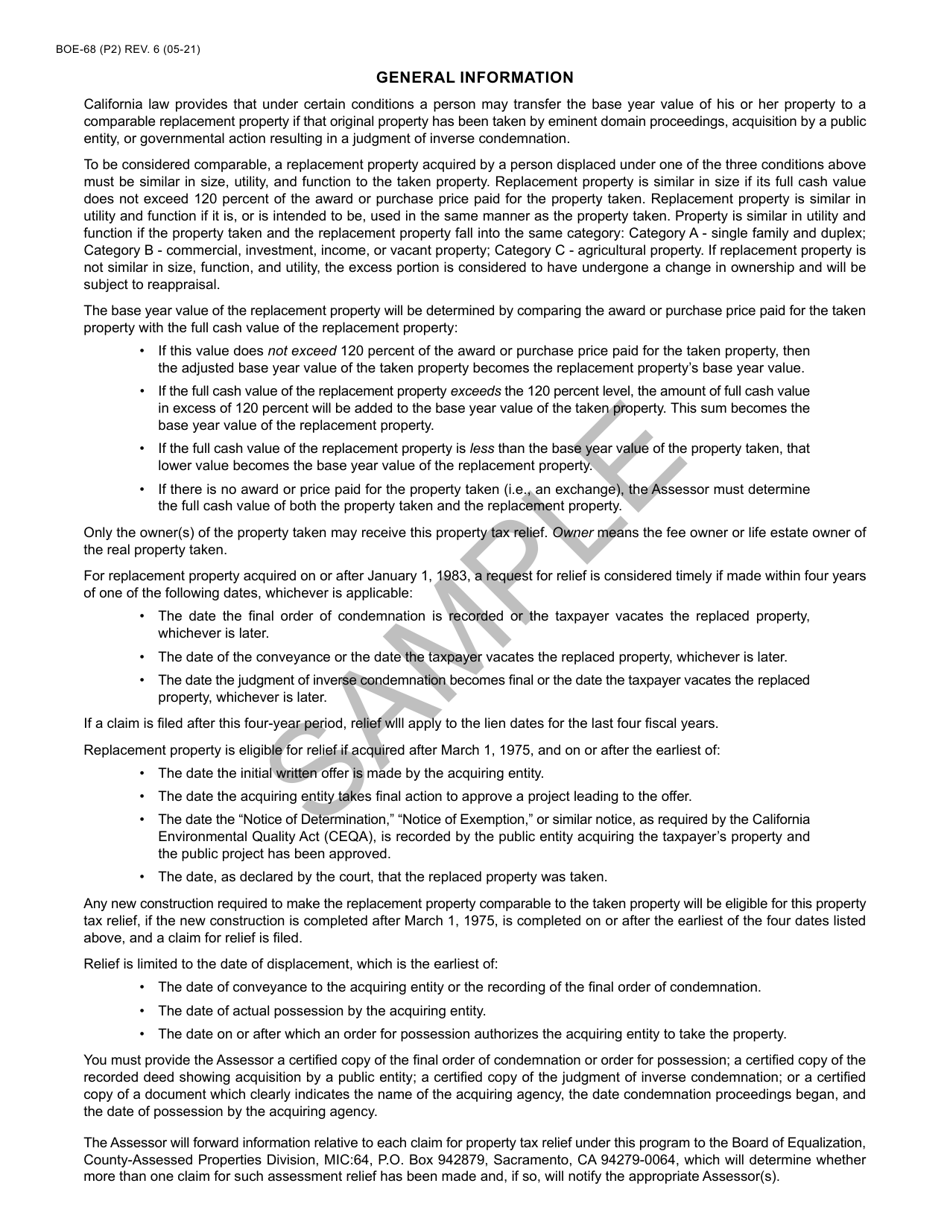

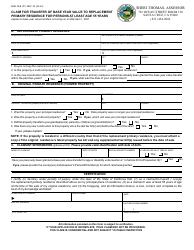

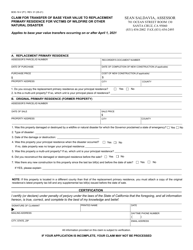

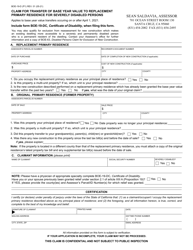

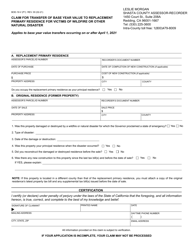

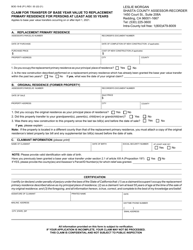

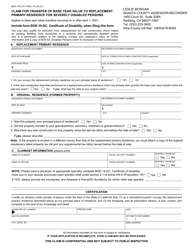

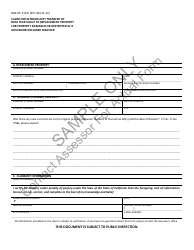

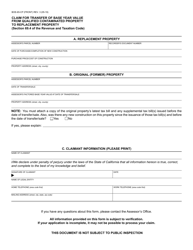

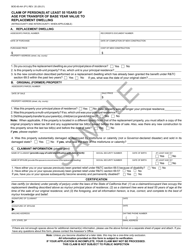

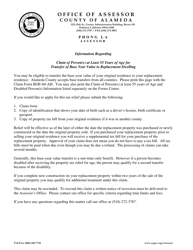

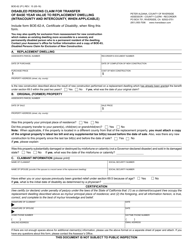

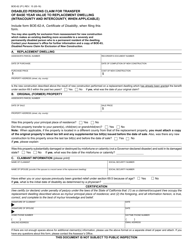

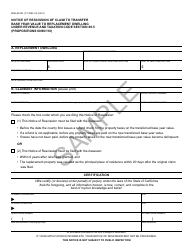

Form BOE-68 Claim for Base Year Value Transfer - Acquisition by Public Entity - Sample - California

What Is Form BOE-68?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-68?

A: BOE-68 is a claim form used to request base year value transfer for property acquisitions by public entities in California.

Q: Who can use form BOE-68?

A: Public entities in California can use form BOE-68 to claim base year value transfer for property acquisitions.

Q: What is base year value transfer?

A: Base year value transfer allows the assessed value of a property to be transferred to a replacement property when the original property is acquired by a public entity.

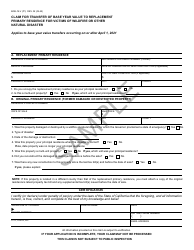

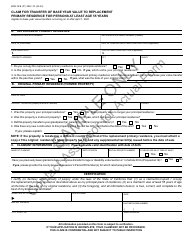

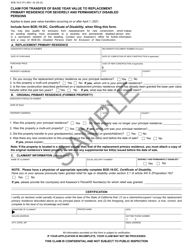

Q: What information is required on form BOE-68?

A: Form BOE-68 requires information about the property being acquired, the public entity acquiring the property, and supporting documentation for the claim.

Q: Is there a deadline for filing form BOE-68?

A: Yes, there is a deadline for filing form BOE-68. It must be filed within 3 years from the date of acquisition of the property by the public entity.

Q: What happens after filing form BOE-68?

A: After filing form BOE-68, the claim will be reviewed by the BOE to determine if the base year value transfer is eligible.

Q: Are there any fees associated with filing form BOE-68?

A: There are no fees associated with filing form BOE-68.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-68 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.