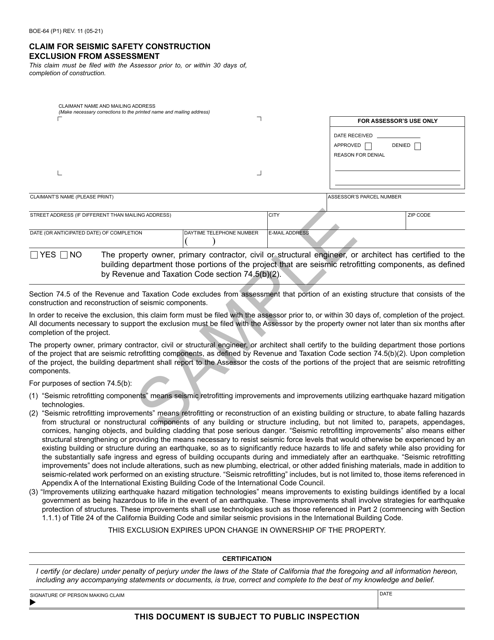

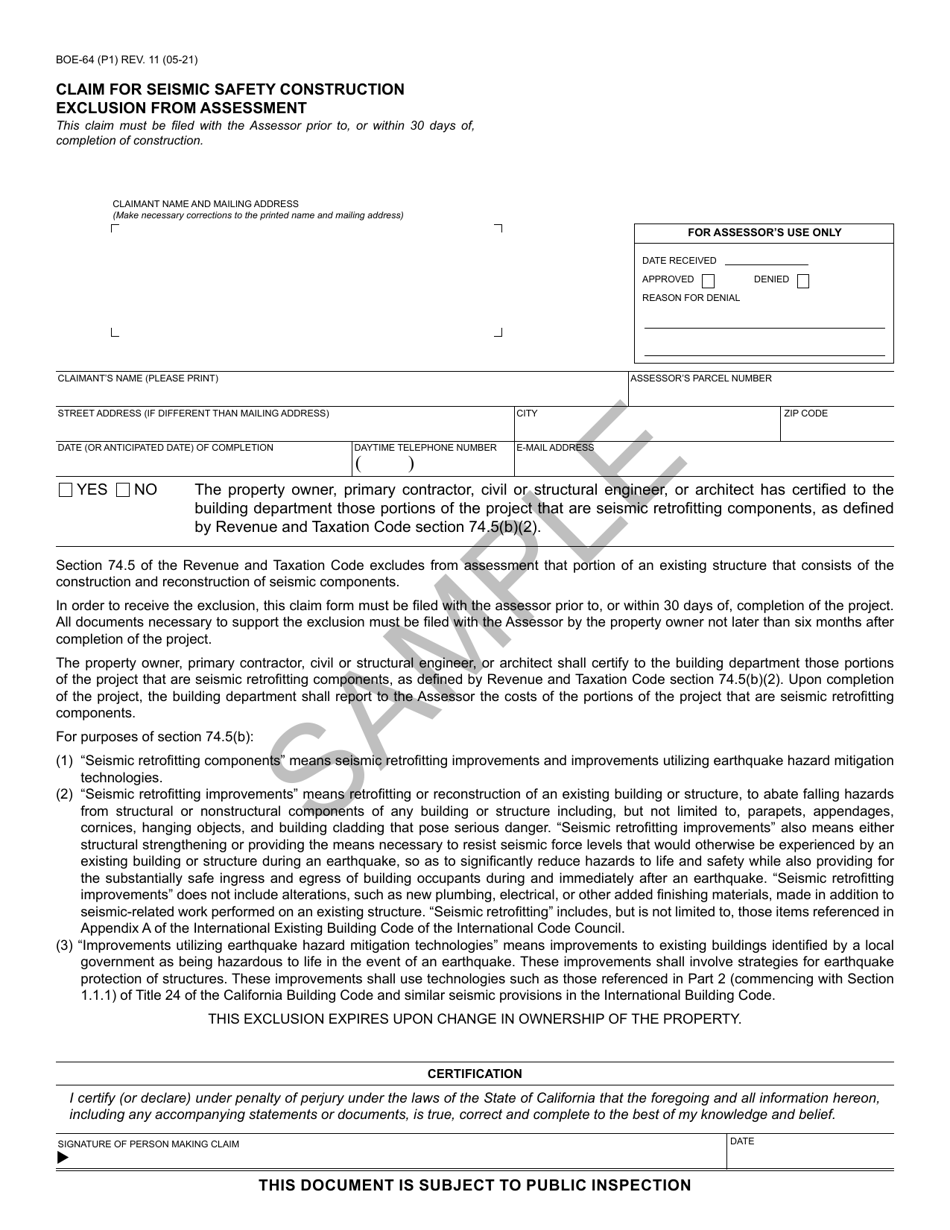

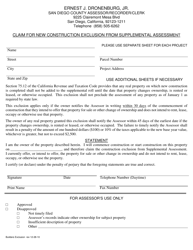

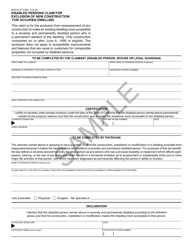

Form BOE-64 Claim for Seismic Safety Construction Exclusion From Assessment - Sample - California

What Is Form BOE-64?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

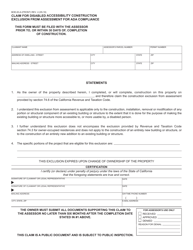

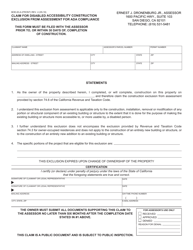

Q: What is Form BOE-64?

A: Form BOE-64 is a claim for seismic safety construction exclusion from assessment.

Q: What does Form BOE-64 exempt?

A: Form BOE-64 exempts certain seismic safety construction improvements from property tax assessment.

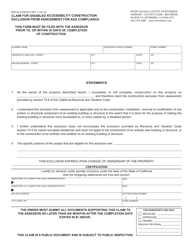

Q: Who is eligible to file Form BOE-64?

A: Property owners who have made seismic safety construction improvements on their property are eligible to file Form BOE-64.

Q: What is the purpose of Form BOE-64?

A: The purpose of Form BOE-64 is to provide a temporary reduction in property tax assessments for specified seismic safety construction improvements.

Q: What information is required to complete Form BOE-64?

A: To complete Form BOE-64, you will need to provide property information, details about the seismic safety construction improvements, and supporting documentation.

Q: Is there a deadline for filing Form BOE-64?

A: Yes, Form BOE-64 must be filed with the County Assessor's Office within 30 days of completion of the seismic safety construction improvements.

Q: How long does the tax exclusion last?

A: The tax exclusion provided by Form BOE-64 lasts for a period of 15 years from the date of completion of the seismic safety construction improvements.

Q: Can I file Form BOE-64 for retroactive tax exclusion?

A: No, Form BOE-64 cannot be filed for retroactive tax exclusion. It must be filed within 30 days of completion of the seismic safety construction improvements.

Q: What happens if the property is sold or the ownership changes?

A: If the property is sold or the ownership changes, the new owner must meet the eligibility requirements and file a new claim for the tax exclusion.

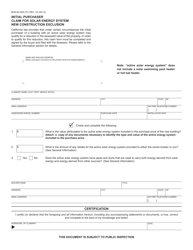

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-64 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.