This version of the form is not currently in use and is provided for reference only. Download this version of

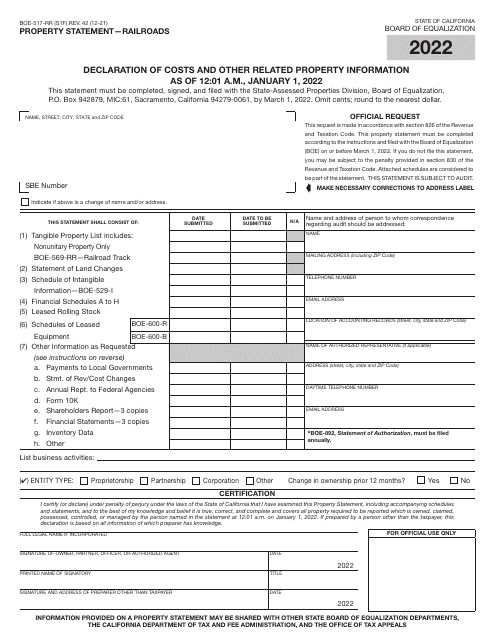

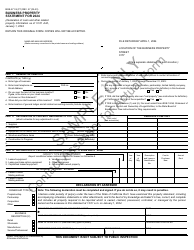

Form BOE-517-RR

for the current year.

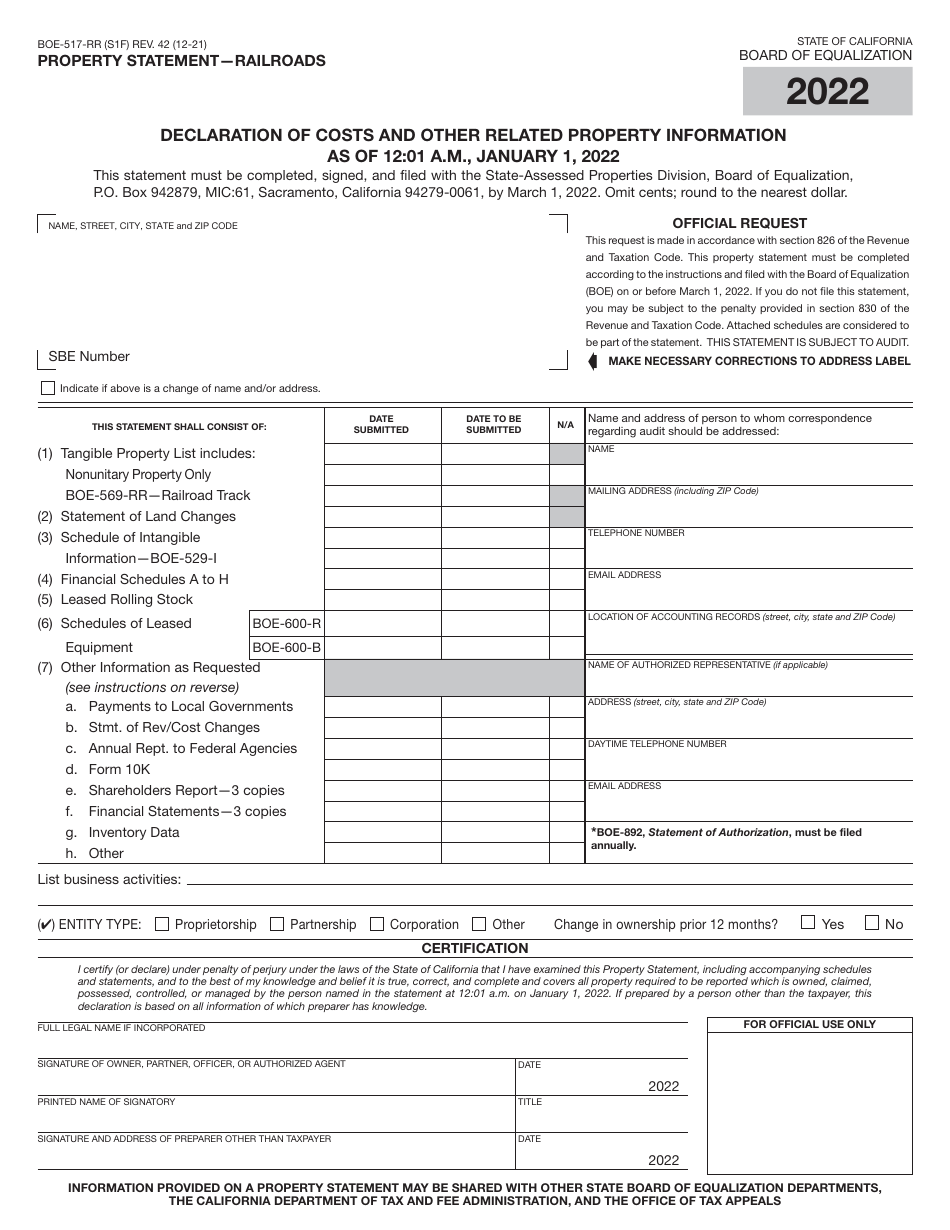

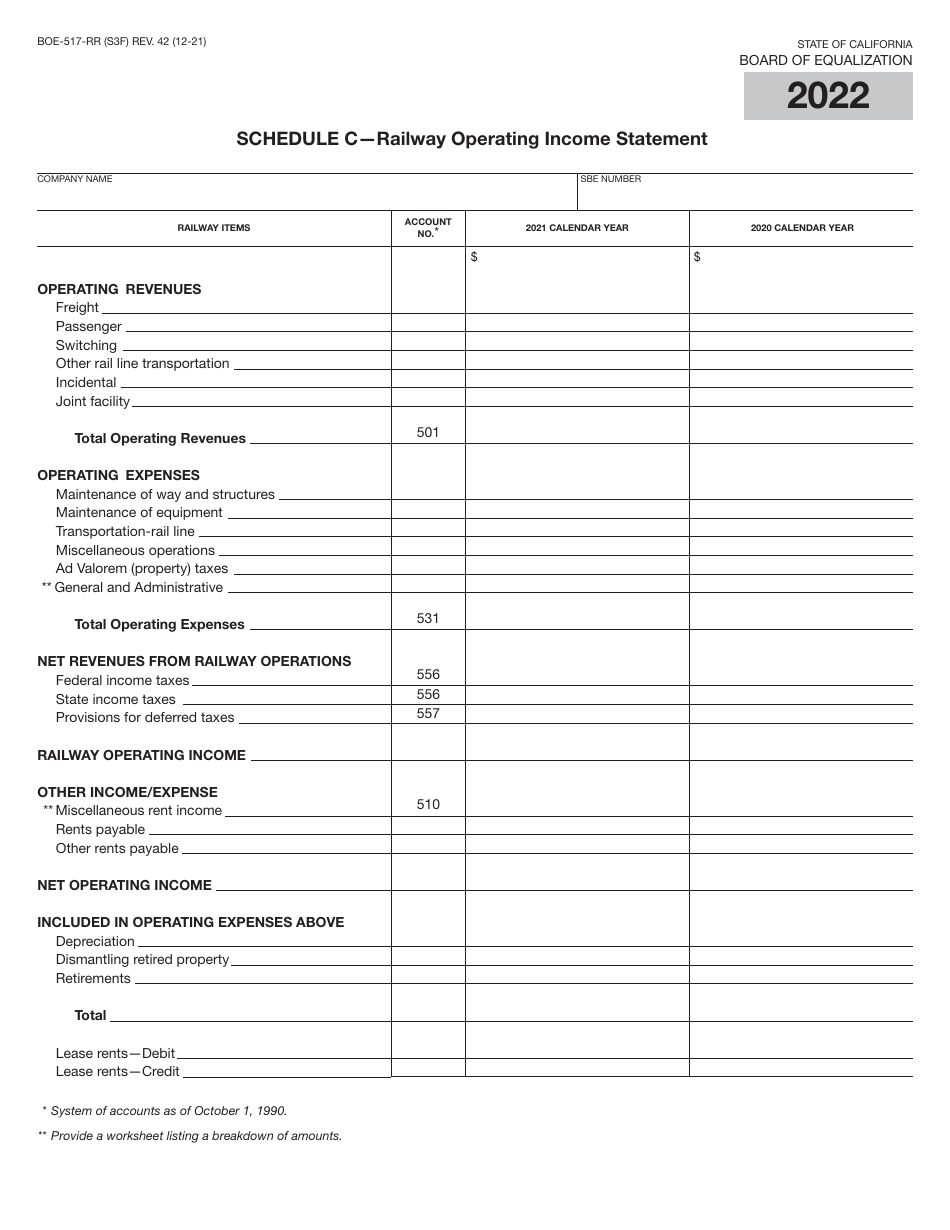

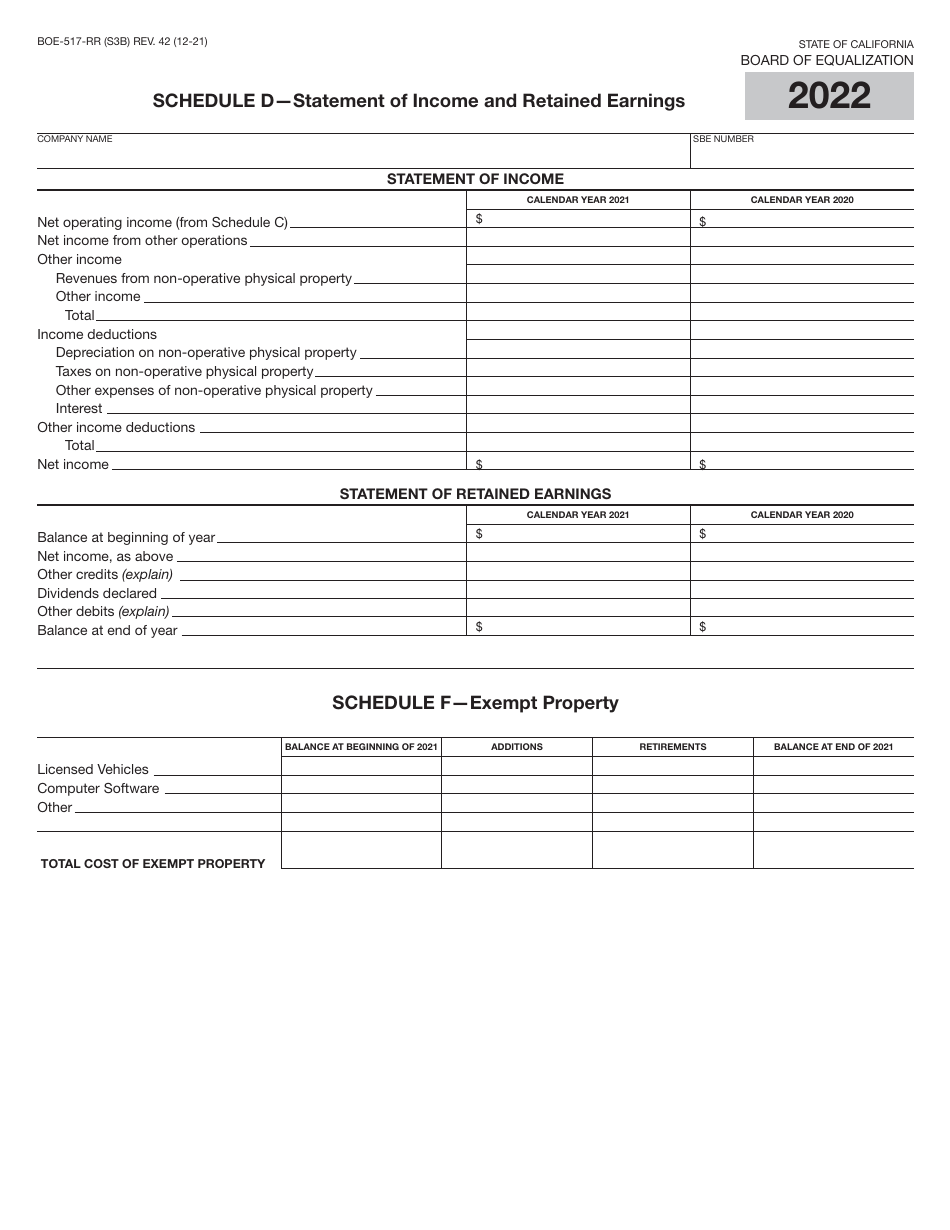

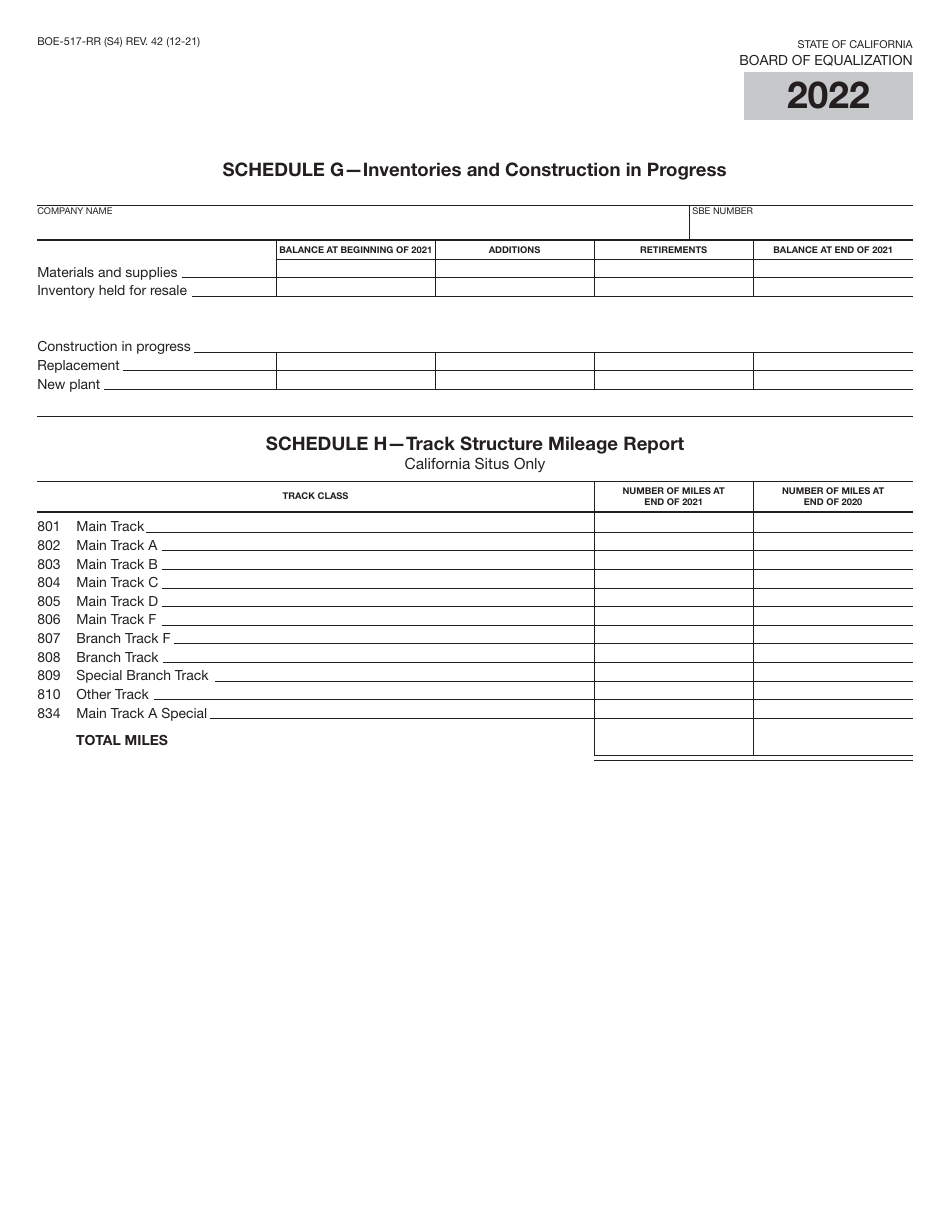

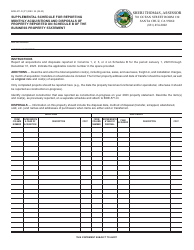

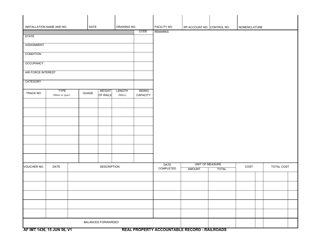

Form BOE-517-RR Property Statement - Railroads - California

What Is Form BOE-517-RR?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-517-RR?

A: BOE-517-RR is a property statement form specific to railroads in California.

Q: Who needs to file BOE-517-RR?

A: Railroad companies operating in California need to file BOE-517-RR.

Q: What is the purpose of BOE-517-RR?

A: The purpose of BOE-517-RR is to provide a detailed inventory of a railroad company's property in California for property tax assessment.

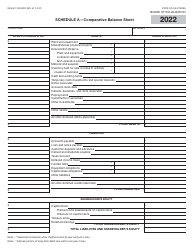

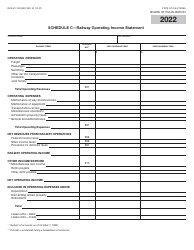

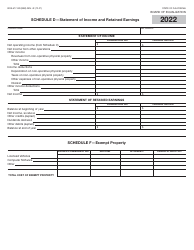

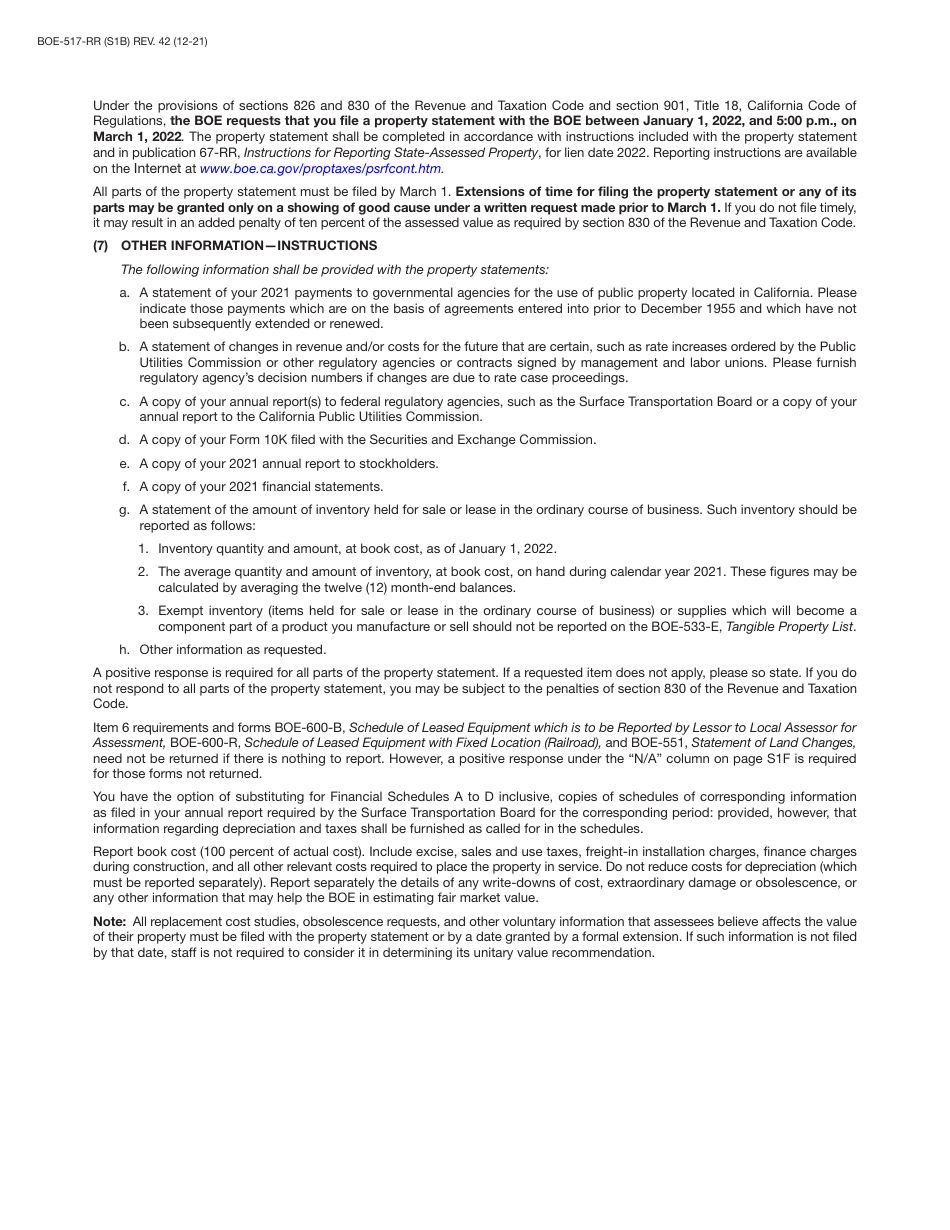

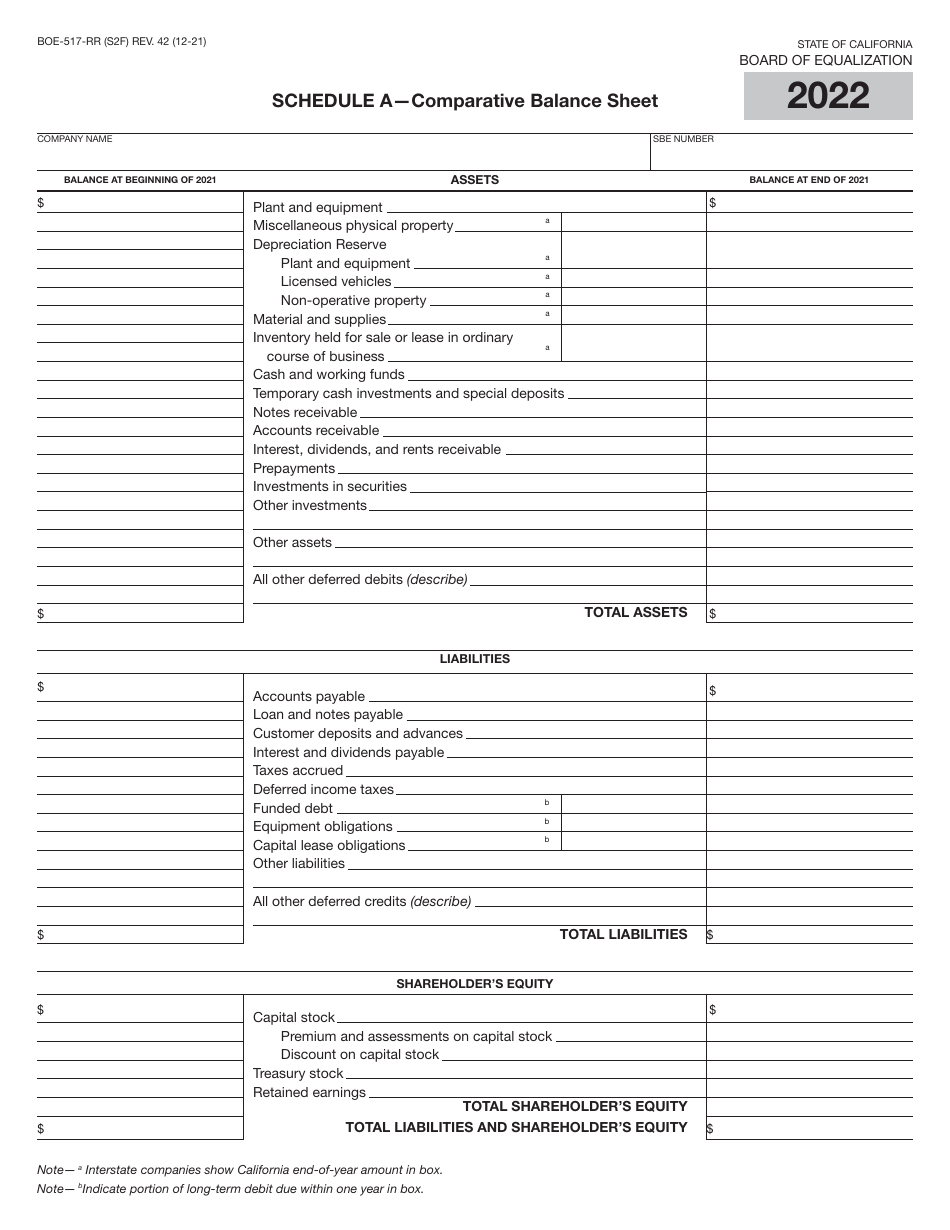

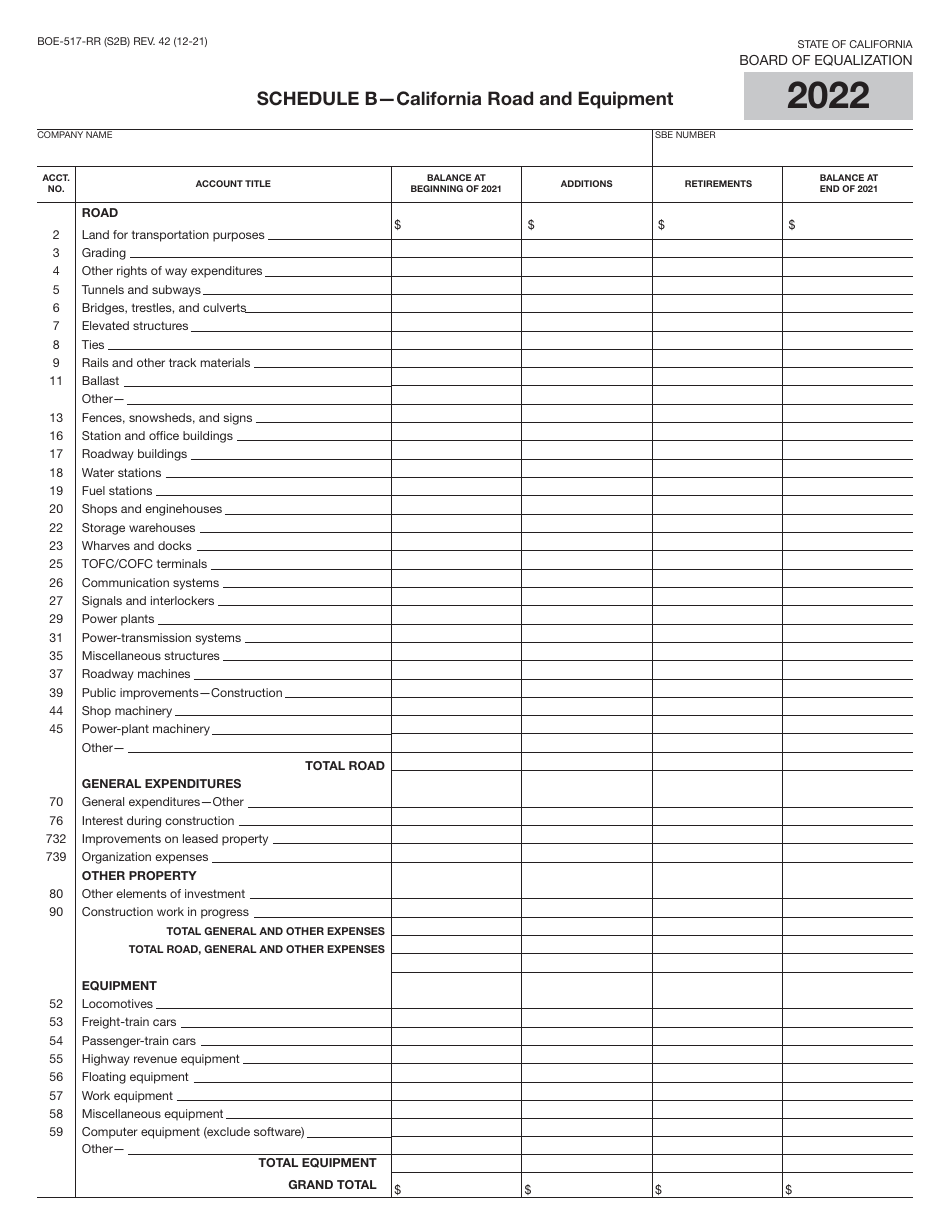

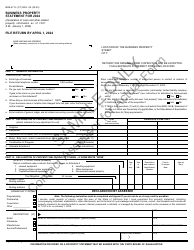

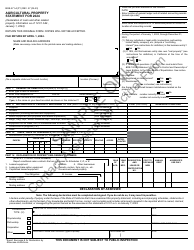

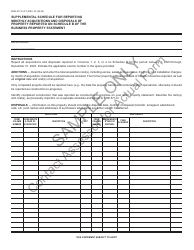

Q: What information is required in BOE-517-RR?

A: BOE-517-RR requires detailed information about the railroad company's property, including track mileage, rolling stock, structures, and other assets.

Q: When is the deadline for filing BOE-517-RR?

A: The deadline for filing BOE-517-RR is typically April 1st of each year.

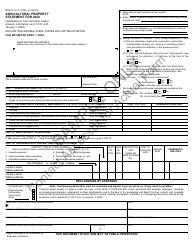

Q: Are there any penalties for not filing BOE-517-RR?

A: Yes, there can be penalties for not filing BOE-517-RR, including late filing fees and potential assessment of property taxes based on estimated values.

Q: Can I request an extension to file BOE-517-RR?

A: Yes, you may request an extension to file BOE-517-RR, but it must be done before the April 1st deadline.

Q: Do I need to file BOE-517-RR every year?

A: Yes, BOE-517-RR needs to be filed annually for each tax year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-517-RR by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.